What Is The Average Monthly Mortgage Payment In The Us

The average monthly mortgage payment in the United States is $1029*.

This payment eats up 14.84% of the typical homeowners monthly income. That may seem low, but we are looking at homeowners specifically and homeowners tend to have much higher incomes than the general population, as we note later in this piece. When you add in other housing costs such as property taxes, association dues, utilities and maintenance costs, the median cost of housing jumps to $1,491 for homeowners with a mortgage.

On average, first-time homebuyers face higher monthly payments than the national average. According to research from the Urban Institute, in early 2018, first-time homebuyers bought houses worth $245,320 with an average down payment of $22,561, and an interest rate of 4.43%. Given these figures, first-time borrowers faced a mortgage payment of $1,235 21% more than the average homeowner.

Of course, a homeowners actual mortgage costs depend on a variety of factors, including when a homeowner purchased a home, where the home is located and the terms of the loan. Additionally, the affordability of a monthly mortgage payment depends the cost of the mortgage relative to a homeowners income.

Contact Us To Learn More

We know this example does not match everyones scenario. However, this simple calculation can give homebuyers a general idea of the average monthly mortgage payment in Texas. To learn more about particular home loans and get more specific scenarios, contact our expert team! Our Client Advisors are available 7 days week for any questions by phone at 855-4491 or by email at .

Jay Voorhees

Tips For Getting Out Of Debt

- When you have multiple loans and are trying to figure out how best to tackle them, you should usually prioritize paying them off in order of highest interest rate to lowest. The higher an interest rate you are paying on a loan the more expensive it in in the long term. So as a rule of thumb, it makes sense to prioritize debt from over student loan debt and then student loans over mortgages.

- Even as youre prioritizing certain debts, make sure to always pay the minimum monthly payment on all your loans. This will ensure you dont face any late payment penalties, further adding to your debt.

Also Check: How Much Is A Habitat For Humanity Mortgage

How Much Monthly Mortgage Payment Can You Afford

Weve looked at the median monthly mortgage payments, and youve even learned how one is calculated. But now the big question remains: How much mortgage can you afford?

Once youve set a ballpark housing budget, give Churchill Mortgage a call. Not only will they help you get a mortgage the smart way , but theyll also pay close attention to your budget and make sure you can actually afford it. Theyre real friendly folks. Get started with one of their loan specialists today! If youre wondering how much you can afford, dont sit around twiddling your thumbs. Get answers from a trustworthy lender now!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Borrowing Adds Up Fast

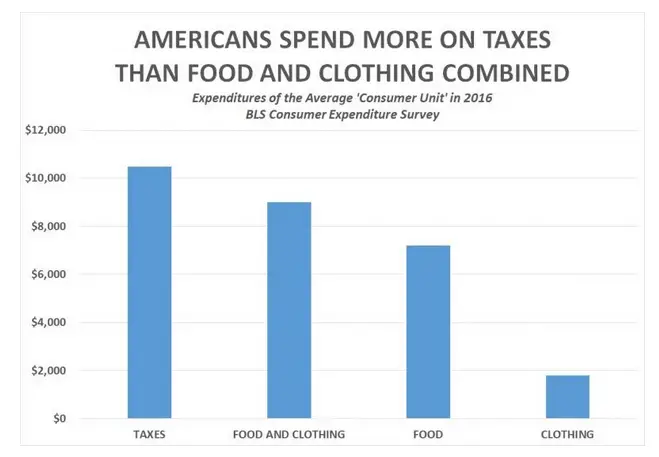

So, lets put it all together: If youre an average American family with a mortgage on a median-priced home, at least one car payment, an average student loan burden, and just one credit card with an average balance, you could be paying $8,037 or more just in interest each year.

Thats a whopping 14% of the median households income that might be going toward, wellnothing, really just the pricey privilege of purchasing on credit.

And thats just the basic stuff: If you finance other consumer goods like furniture, your smartphone, or a motorcycle or boat or if you owe money on personal loans or home equity loans, you could be signing off a whole lot more of your paycheck to the bank each year.

While borrowing money can make a lot of sense and even leave us better off in the long run its important to note how the interest we pay each month, and each year, adds up in a big way. Not only does the debt we take on leave us making payments for longer stretches of time, but it leads to higher interest payments over the course of our lives.

Check Your Personal Loan Rates

Answer a few questions to see which personal loans you pre-qualify for. Its quick and easy, and it will not impact your credit score.

with our trusted partners at Bankrate.com

You can also try sticking to cash when you can, or saving up a large down payment when you absolutely have to borrow money. The less money you can borrow over time, the better off youll be.

Keep Reading

Don’t Miss: How To Apply For A 2nd Mortgage

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Auto Loan Interest: $769 To $895

The average new car loan in the fourth quarter of 2016 worked out to $30,621, according to a recent Experian survey, while the average used car loan was $19,329. These loans extended for an average of 68 months and 63 months, respectively, with average interest rates of 4.74% and 8.50%.

Put all these figures together, and the average new car owner pays $4,356 in interest over the course of a 68-month loan, or $769 a year. The average used car buyer, on the other hand, despite borrowing less money, would pay $4,700 in interest all told, or $895 a year.

Don’t Miss: What Will Be My Mortgage

Consumers Increase Individual Mortgage Debt By 2%

In line with the past decade of overall growth, average individual consumer balances grew in 2020, rising to $208,185, according to Experian data. Unlike the rise in overall debt, individual balances increased at a rate of 2%, which is similar to the annual growth seen over the past decade. Even with the moderate growth, individual mortgage balances are still the highest they have ever been.

| Snapshot: Individual Mortgage Debt |

|---|

| +$4,889 |

As of 2020, approximately 44% of U.S. consumers have a mortgage. That’s unchanged since 2019, according to Experian data. While the slice of the population with a home loan didn’t change, average mortgage balances are up, which shows that consumers may be borrowing more than usual.

Historically low Federal Reserve rates helped ramp up competition in the housing market during the pandemic, and some homes have been sold above asking price as a result. In September 2020, according to data from homebuying website Zillow, 1 in 5 homes sold above their listing price. This indicates that competition and ample demand may have driven purchase prices up, and in combination with other factors, may explain why average mortgage balances are creeping up.

How Much Is A Typical Down Payment On A House

Lenders and underwriters will usually offer more competitive interest rates when your loan-to-value ratio is low. In other words when youve invested in a home with a larger down payment, lenders will release the mortgage insurance requirement. And with these larger-than-average down payments, you may be able to leverage a big financial benefit. Take a look at this chart that compares the homes overall price to the down payment, PMI interest rates and cost implications:

| Home Price |

|---|

Read Also: Can I Sell My House Back To The Mortgage Company

Costs Included In A Monthly Mortgage Payment

In the Census Bureau’s American Community Survey’s data, the monthly mortgage payment includes things like insurance and taxes. In part, it’s because that’s how mortgages actually work oftentimes, you pay for more than just the loan’s principal and interest in your monthly payment.

If your mortgage includes an escrow account, you’ll pay for two costs each month in your monthly mortgage payment:

- Property taxes: You’ll pay tax on your home to your state and local government, if necessary. This cost is included in your monthly payment if your mortgage includes escrow.

- Home insurance: To keep your home covered, you’ll need to purchase a homeowner’s insurance policy. The average cost of homeowners insurance is about $1,200 per year.

In addition, mortgage payments can also change based on several factors. Two different people could face very different homeownership costs for the same house, even. There are two big factors that change your monthly payment:

Another monthly cost to consider should be how much you’ll need to save for repairs. In general, the older your home is, the more you should keep on hand for repairs. Utilities like internet, garbage removal, and electricity will also add to your monthly costs of homeownership.

Why Use A Mortgage Payment Calculator

When planning to buy a home, it’s easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that you’ll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much you’ll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much you’ll be on the hook for in each scenario.

Also Check: Is A Timeshare Considered A Mortgage

Ways To Lower Your Mortgage

- Improve your credit score enough to qualify for a better interest rate

- Pay off debts or increase your income to lower your debt-to-income ratio

- Save 20% for a down payment, which will help you avoid paying private mortgage insurance

- Shop for a mortgage by getting quotes from multiple lenders.

- Buy in an area without an HOA

- Buy a home in a cheaper neighborhood

Refinance Your Mortgage If You Already Own A Home

If you’d like to bring your existing mortgage payment down, refinancing is a good solution â especially if you have great credit. When you refinance, you swap your current home loan for a new one with a lower rate. Imagine you’re currently paying 3.75% interest on a $200,000 mortgage, and you manage to lower your rate to 2.9%. Assuming you’re dealing with a 30-year loan, your monthly payment will go from $925 to $833 for principal and interest on that loan.

The lower your monthly mortgage payment is, the easier it will be for you to keep up with it, while ensuring you have income left over to cover your remaining bills. Of course, another good way to keep your payments low is to shop around with different lenders before signing a mortgage agreement. The more offers you get, the more likely you are to come away with a great deal, whether you’re buying a new home or refinancing in an attempt to lower your costs.

While it doesn’t influence our opinions of products, we do receive compensation from partners whose offers appear here. We’re on your side, always. See our full advertiser disclosurehere.

The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Offer from the Motley Fool:10 stocks we like better than Walmart

You May Like: What Does A Mortgage Payment Consist Of

How Much Home Can I Afford How We Calculate It

The average American household income is $73,298, assuming you have no monthly debt payments you can afford a home priced at $285,000 with a 3.5% down payment for $1,800 per month.

Our home affordability calculator takes several factors to determine what you qualify for. This calculator provides the best possible estimate of the maximum borrowing power you have based on these factors. It is not intended to be exact.

Income and debts First, we factor in your pre-tax salary and monthly debt payments. These monthly payments include car payments and credit card, or student loan debt.

Property taxes Taxes are included and are adjusted based on the state you are purchasing in.

One of the most significant factors in determining how much of a home you can afford is your credit rating. Your interest rate is directly tied to your FICO score. The higher your score, the lower your interest rate. You can adjust the mortgage calculator to factor in your credit score, which will adjust the interest rate accordingly.

Debt-to-income ratio The amount of your monthly obligations compared to your monthly income is called your DTI, or debt-to-income ratio. The maximum back-end DTI ratio most mortgages require is 41% and a front-end ratio of 31%. In the chart, you can adjust the DTI ratio to see how much house you can afford with different rates.

Front-end ratio The front-end DTI ratio does not include your mortgage payment into your monthly debt payments.

Benefits Of Making A Smallerthanaverage Down Payment On A House

Theres one clear benefit to beginning homeownership with a smaller down payment: You become a homeowner sooner.

In all but a few areas, youre likely to see your property grow in value each year. That means youre building home equity rather than paying rent youll never see returns on.

But what about PMI? Yes, youll likely resent every cent you pay out each month. But youre almost certain to be free of it soon enough.

Either you can prompt your lender to stop charging it when your loan balance reaches 80% of your homes market value, or you can refinance out of mortgage insurance on an FHA loan.

Don’t Miss: How To Get A Cheap Mortgage Rate

Average Monthly Mortgage Payments

See Mortgage Rate Quotes for Your Home

The median monthly mortgage payment for American homeowners was $1,030, according to the US Census Bureau’s 2015 American Housing Survey. The survey also reported aggregate monthly housing costs totaling $1,492 for homeowners with a mortgage. This figure typically includes property taxes, which vary based on state and city, and property insurance, which varies based on the homes cost. You can see how your potential mortgage payment compares by using the form above.

A Dream Of Homeownership Placed Out Of Reach

That midcentury scenario seems like a financial fantasia to young adults hoping to buy homes today. Finding enough money for a down payment in the face of rising rents and stagnant wages, qualifying for loans in a difficult regulatory environment, then finding an affordable home in expensive metro markets can seem like impossible tasks.

In 2016, millennials made up 32 percent of the homebuying market, the lowest percentage of young adults to achieve that milestone since 1987. Nearly two-thirds of renters say they cant afford a home.

Even worse, the market is only getting more challenging: The S& P CoreLogic Case-Shiller National Home Price Index rose 6.3 percent last year, according to an article in the Wall Street Journal. This is almost twice the rate of income growth and three times the rate of inflation. Realtor.com found that the supply of starter homes shrinks 17 percent every year.

Its not news that the homebuying market, and the economy, were very different 60 years ago. But its important to emphasize how the factors that created the homeownership boom in the 50swidespread government intervention that tipped the scales for single-family homes, more open land for development and starter-home construction, and racist housing laws and discriminatory practices that damaged neighborhoods and perpetuated povertyhave led to many of our current housing issues.

Don’t Miss: How Much Is A 180k Mortgage Per Month

Why The Average Mortgage Payment Is Declining

According to property data firm CoreLogic,the typical mortgage payment is down nearly 3% over May 2018, despite rising home prices.

Thats thanks to predicted low interest rates, which have hovered around threeyear lows for some time.

According to CoreLogics findings, rates should average about 0.7 percentage points lower on 30year, fixedrate loans compared to last year.

That should lead to even steeper declines in average mortgage payments moving forward.

How Much Are Average Mortgage Repayments

Asked by: Afton Rolfson MD

The average mortgage payment is $1,275 on 30-year fixed mortgage, and $1,751 on a 15-year fixed mortgage. However, a more accurate measure of what the typical American spends on their mortgage each month would be a median: $1,556 in 2018, according to the US Census Bureau.

$1,275 on a 30-year fixed mortgage£723£669below 28% of your pretax monthly income24 related questions found

You May Like: What To Look Out For With Mortgage Lenders

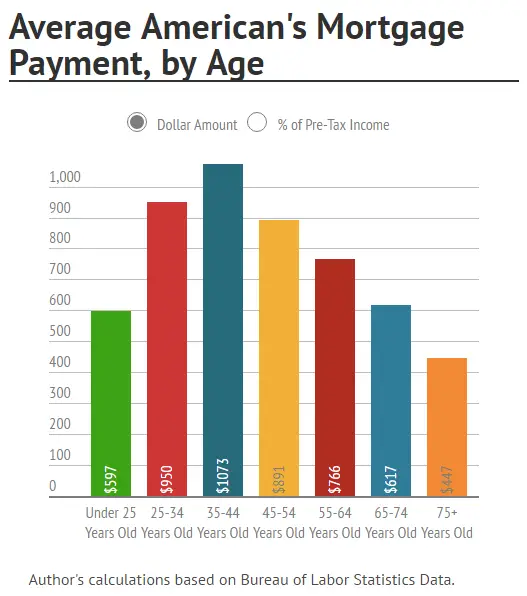

Average Balances Owed By Age

Americans in their prime owe the most in mortgage debt. These people, alongside Millennials and Gen X residents, are the most likely home buyers at the moment. Gen Z Americans are still too young to invest in homes. Boomers and the Silent Generation, in contrast, have already paid a significant share of their mortgages.

In the table below, you can find mortgage debt data for different generations. The table also compares how the average mortgage debt by age has changed between Q1 of 2019 and Q1 of 2020. You can also see which generations debt has increased the most.

Gen Z Americans noted the highest increase in average mortgage balance by age from $142,600 to $169,470 or 19%. There was an increase of 6% from $224,500 to $237,349 among Millennials/Gen Y. Baby Boomers and those from the Silent Generation noted average debt increases of minor 2% and 1%. GenXers meanwhile experienced a 4% rise during the reported period.

We want to highlight that regardless of the generation, theres been a notable increase in the total mortgage debt across all age groups. As you may know, the highest share of the average household debt of American families comes from mortgages. So, its essential not to overlook its YoY changes.

Below, you will find details on how the total mortgage balances increased YoY, and over the past five years. The data is represented in billions of US dollars.