What Is A Down Payment

A down payment is the cash you pay upfront to make a large purchase, such as a home. You use a loan to pay the rest of the purchase price over time. Down payments are usually shown as a percentage of the price. A 10% down payment on a $350,000 home would be $35,000.

When applying for a mortgage to buy a house, the down payment is your contribution toward the purchase and represents your initial ownership stake in the home. The mortgage lender provides the rest of the money to buy the property.

Lenders require a down payment for most mortgages. However, some types of loans backed by the federal government may not require down payments.

How To Calculate A Down Payment Amount

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Also Check: How Do You Get A Second Mortgage On Your House

How Much House Can I Afford With A Conventional Loan

Conventional loans are popular for borrowers with credit scores of at least 620 and DTI ratios of 45% or less. Some conventional loan programs allow down payments as low as 3%, but you can avoid mortgage insurance if you make at least a 20% down payment. Conventional lenders often assess mortgage insurance to cover their losses if you default, and its usually part of your monthly payment.

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Don’t Miss: Will I Get Approved For A Mortgage

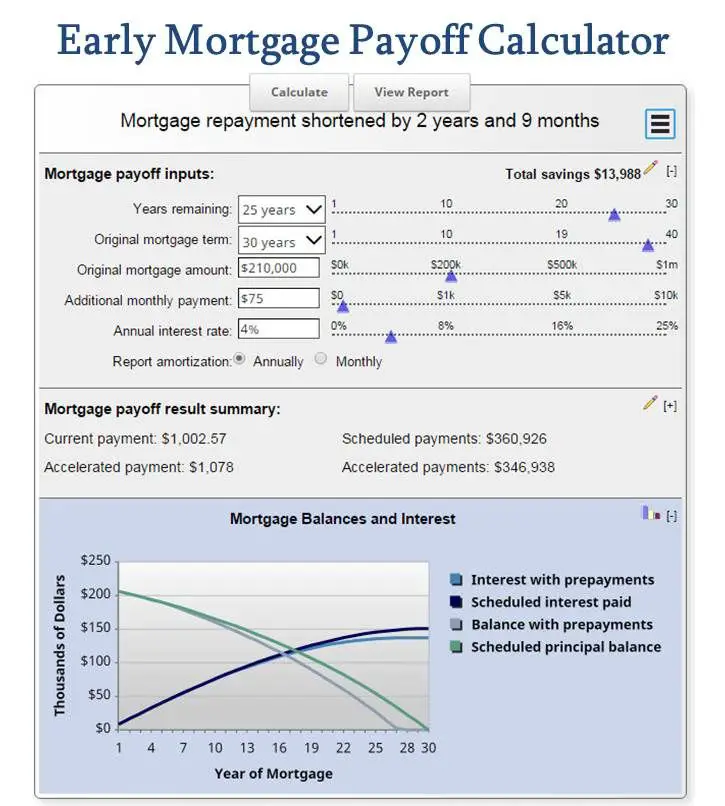

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

How Much Income Do I Need For A 500k Mortgage

The Income Needed To Qualify for A $500k Mortgage A good rule of thumb is that the maximum cost of your house should be no more than 2.5 to 3 times your total annual income. This means that if you wanted to purchase a $500K home or qualify for a $500K mortgage, your minimum salary should fall between $165K and $200K.

Also Check: What Is Buying Points On A Mortgage

Recommended Reading: What Age Can You Do A Reverse Mortgage

How To Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the maximum amount you can pay for a house, as well as your estimated monthly payment.

Should You Rent Or Buy A Home

Having the ability to buy something does not mean that one necessarily should. Owning a home is both a significant commitment and a serious lifestyle choice. Renting a home is a more flexible arrangement than buying. Here are some factors to consider beyond the above financial ratios.

Do you plan on living in the area for an extended period of time? Real estate transactions are typically large, leveraged, high-friction transactions. Between closing costs, real estate commissions & other related fees, many home buyers may spend about eight or nine percent of the home’s price between buying and selling it. If you live in a place for a significant period of time the home appreciation can more than offset any costs, but if you only live there a couple years before moving again it is likely to cost you as the first few years of a loan’s payments go primarily toward interest.

How secure is your source of income? If your job may require you to move then owning a home may harm your career flexibility. If you are in a field with high employee churn then renting may be a better option.

Will you be adding to your family in the near future? If you buy a house & quickly outgrow it, there’s no guarantee that it will be easy to simulaneously sell your current home and buy a larger one.

Also Check: What Is Mortgage Rate Vs Apr

What Can You Afford

To start, youll need a good grasp of your finances, specifically the total income youre bringing in each month and the monthly payments for any debts you owe .

Generally speaking, no more than 25% to 28% of your monthly income should go toward your mortgage payment, according to Freddie Mac. You can plug these numbers into a mortgage calculator to break down the monthly payment you can afford and your desired home price.

Keep in mind that this is only a rough estimate. You should also take into account the consistency of your income. If your income fluctuates or is unpredictable, you may want to aim for a lower monthly payment to relieve some financial pressure.

See if youre a good candidate to take out a mortgage right now by answering a few quick questions.

Remember, costs also may vary by location, so youll also want to take that into account when determining which town or city youre looking to buy in.

How Much Can You Spend On A Mortgage

Rather than looking at the total amount of money you can borrow for a house, its better to look at how affordable your monthly payment might be. Thats because this is what youll be paying each month, so you want to make sure it fits into your budget.

One of the best ways to measure that is the debt-to-income or DTI ratio. Its broadly calculated by dividing your debt payments by your income. More specifically, it can be measured in two ways:

- Front-end DTI ratio: This measures your monthly mortgage payment as a percentage of your total gross monthly income. For example, if your salary is $54,000 per year and your mortgage payment is $1,000, then your front-end DTI ratio is 22% .

- Back-end DTI ratio: This measures your total monthly debt payments, including your mortgage, as a percentage of your total gross monthly income. If you also pay $250 per month for student loans and $200 per month for your credit cards, for example, your back-end DTI ratio would be 33% .

Lenders use these ratios to figure out the maximum monthly mortgage payment you might qualify for. For example, Freddie Mac and Fannie Mae guidelines state that for a conventional mortgage, your back-end DTI ratio shouldnt exceed 36%. In other words, your debt payments combined shouldnt be more than 36% of your before-tax income each month.

Lenders look at other factors when deciding whether to approve you for a mortgage too, such as your and how stable your job is.

Read Also: Can You Write Off Mortgage Payments

Start With The 28/36 Rule

So how much of your salary should you be spending on housing costs? Historically, the 28/36 rule has been a guideline that many lenders use to help understand a borrowers ability to repay a mortgage and other debts. The rule advises spending no more than 28 percent of your income on housing expenses, and no more than 36 percent of your income on total debt payments, including housing.

If youre making $75,000 each year, your monthly earnings come out to $6,250. To meet the 28 piece of the 28/36 rule, that means your monthly mortgage payment should not exceed $1,750. And for the 36 part, your total monthly debts should not come to more than $2,250.

Of course, buying a home is more complicated than just following a simple rule. Bankrates new-home calculator can help you crunch all the numbers to get a deeper, more detailed understanding of how much house you can comfortably afford.

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Also Check: What Does Refinancing Your Mortgage Mean

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratiothat lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

Loan Deposit And Credit Records

Most borrowers that qualify for financing save substantial funds for deposit. They also have a good credit history showing on-time payments without large outstanding balances. In the fourth quarter of 2020, only 0.37% of mortgages from borrowers with impaired credit history were approved by lenders.

What is Loan-to-value Ratio?

LTV stands for loan-to-value. Its a ratio that compares the size of the loan against the value of the dwelling.

For example, if you saved a £50,000 deposit for a £200,000 home, your loan amount would be £150,000. To calculate the LTV ratio, divide £150,000 by £200,000. In this example, the LTV ratio is 75%.

In the fourth quarter of 2020, a tiny 0.16% of gross advances went to loans with an LTV over 95%. Meanwhile, 1.06% went to loans with an LTV between 90% and 95%. An estimated 38.76% of advances were granted to loans between 75% and 90% LTV, while 60.02% of gross advances went to loans with an LTV below 75%.

Lenders prefer to extend credit to borrowers with relatively low LTV values. If a borrower obtained funding at 100% LTV, any weakness in the local property market could expose the lender to outright potential losses. For this reason, borrowers in the highest LTV quartile may pay 1% APR higher than borrowers in the lower half of the market.

Also Check: What Do They Look At For Mortgage Approval

How To Calculate Your Required Income

To use the Mortgage Income Calculator, fill in these fields:

-

Mortgage interest rate.

-

Recurring debt payments. Heres where you list all your monthly payments on loans and credit cards. If you dont know your total monthly debts, click No and the calculator will ask you to enter monthly bill amounts for:

-

Car loan or lease.

-

Minimum credit card payment.

-

Personal loan, child support and other regular payments.

Monthly property tax .

Monthly homeowners insurance .

Monthly homeowners association fee .

How To Calculate How Much House You Can Afford

To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages. Generally speaking, and depending upon your location, they will typoically range from about 0.5% to about 2.5% for Taxes, and 0.5% to 1% or so for Insurance.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all your regular obligations . The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%.

Read Also: Does It Make Sense To Pay Points On A Mortgage

Your Mortgage And Your Overall Budget

The question isn’t how much you could borrow but how much you should borrow. These home affordability calculator results are based on your debt-to-income ratio . Industry standards suggest your total debt should be 36% of your income and your monthly mortgage payment should be 28% of your gross monthly income.

Assessing Your Mortgage Eligibility

After the 2008 UK financial crisis, lenders began employing strict measures before approving mortgages. By 2014, the Financial Conduct Authority required lenders to perform thorough affordability assessments before granting loans. The evaluation considers your personal and living expenses, as well as the level of monthly payments you can afford. It includes a stress test which simulates how consistently you can pay your mortgage under drastic financial changes. To determine the loan amount, lenders specifically consider your credit score and history, debt-to-income ratio , size of the deposit, and the price of the property you are buying.

Expect lenders to scrutinise your employment records, how long youve held your current job, and your present address. They also check the length and history of your bank accounts, together with other debt obligations you must fulfil. To do this, they review your also known as your credit report, which is used to determine your credit score. This gives insight into your ability to make mortgage payments. Ultimately, your records must prove youre a reliable debtor who always pays on time.

Mortgage Affordability Assessment Factors

To prepare for your mortgage application, be sure to gather the following documents:

If you are self-employed, expect lenders to ask for additional documentation. They require proof of income, such as a statement from your accountant covering 2 to 3 years of your accounts.

| Income |

|---|

| £211,600 | £306,600 |

You May Like: How To Check Credit Score For Mortgage

What Home Can I Buy With My Income

A quick recap of the guidelines that we outlined to help you figure out how much house you can afford:

- The first is the 36% debt-to-income rule: Your total debt payments, including your housing payment, should never be more than 36% of your income.

- The second is your down payment and cash reserves: You should aim for a 20% down payment and always try to keep at least three monthsâ worth of payments in the bank in case of an emergency.

Let’s take a look at a few hypothetical homebuyers and houses to see who can afford what.