About Our Broker Partner Service

Advice is provided by London & Country Mortgages Ltd who are authorised and regulated by the Financial Conduct Authority . L& C are not part of BGL Group Limited of which Compare the Market Limited forms part.

Compare the Market receive a % of the commission our partner London and Country earns through customers who use this service. All applications are subject to lending and eligibility criteria. L& C will not charge you a broker fee should you decide to proceed with a mortgage.

Mortgage Rates Forecast Into 2023

Even as mortgage rates have spiked throughout this year, there have been some extreme fluctuations in recent months: the average 30-year, fixed-rate mortgage climbed up to 5.81% mid-June before dropping to 4.99% on August 4.

Since then, mortgage rates have resumed their climb, due partly to the Federal Reserves aggressive actions in raising its federal funds rate five times so far this year in an attempt to control inflation. And that trend is likely to continue, potentially pushing mortgage rates higher into the start of 2023.

Next weeks Federal Reserve announcement is sure to move markets, as will the October jobs report that will arrive two days later, said Zillow Senior Economist Matthew Speakman in an emailed statement. Any indications that the Fed plans to maintain, or even accelerate its previously stated plans for tightening monetary policy would almost certainly send mortgage rates higher once again.

Related:Mortgage Rates Forecast For 2022

The Fed has already signaled plans to raise interest rates further. The Fed meets again November 2, when many economists expect another rate hike.

While the Feds actions dont directly impact mortgage rates, it has a meaningful influence. Thats because the bond market, which directly impacts mortgage rates, responds to Fed rate movements.

How To Get A First

First-time buyers face many challenges on their journey to becoming a homeowner. First-time buyers will need to navigate their way through understanding how much they can afford to borrow, how much lenders will be prepared to give them, the different types of mortgages available, how mortgage interest and fees work, who is involved in the house buying and mortgaging process and the raft of acronyms involved in mortgage products. Thats alongside saving for a deposit and understanding the Government schemes and help available to make your home ownership dream a reality.

Don’t Miss: What Is Reverse Mortgage Meaning

How Do I Choose The Best Mortgage Lender

You should always compare several different lenders when shopping for a home loan. Not only will the rates and fees vary, but the quality of service as well. Regardless of what lender you end up working with, its important to find someone that can help your individual challenges. For example, if youre a military veteran getting a VA loan, youll want to work with someone who has experience with those types of loans.

To find a trusted lender, you can look at online reviews, or even better, ask around. Your real estate agent and friends who recently purchased a home are great sources for mortgage lender recommendations. Try comparing a variety of different mortgage lenders. The best mortgage lender for you may be a bank, credit union, mortgage broker, or an online mortgage lender, depending on your situation.

Freddie Mac Home Possible Loan

- Minimum credit score: 660

- Minimum down payment: 3%

- Other requirements: Income cannot be higher than 80% of area median income

This conventional loan is not backed by the federal government but offers benefits for first-time homebuyers. The Freddie Mac Home Possible loan program only requires a 3% down payment but does require a minimum credit score of 660. To qualify, your home must be located in an underserved area or your income must be no greater than 80% of the median income for that area.

PMI is required if your down payment is under 20%. This can be canceled when you reach 20% equity in your home.

Read Also: Which Mortgage Lenders Use Transunion

What Is A Discount Point

Discount points are fees you pay the lender upfront in exchange for a lower interest rate. Buying down the rate with discount points can save you money if youre planning on keeping your home for a long time. But if youre going to sell or refinance before the full loan term is up, paying more fees upfront may not make sense.

Discount points can be part of a good deal, but you need to make sure you know when they are being added to your loan. When youre comparing mortgage offers, be sure to ask if the interest rate includes discount points.

Can I Get A Mortgage With Bad Credit

- Poor: 579 or less

- Very good: 740 to 799

- Exceptional: 800 or more

To qualify for a conventional loan one thats not backed by any government agency youll usually need a fair credit score of at least 620. But its possible to qualify for FHA loans, which are insured by the Federal Housing Administration, with a poor credit score as low as 500.

And Veterans Administration loans, which are for veterans, active-duty service members, and their spouses, have no minimum credit score requirements. USDA loans, which help very low-income Americans buy in certain rural areas, also have no minimum credit score requirements.

If youre trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. Hes been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.

Also Check: How To Know How Much Mortgage I Can Afford

How To Get Started

The first step in the homebuying process is to get a mortgage preapproval.

The pre-approval process involves filling out a mortgage application and providing financial documents including things like your recent bank statements and tax returns.

Once the lender has verified your financial information, it can pre-approve you for a home loan. Youll have a better idea of which mortgage product you qualify for, how much you can borrow, your down payment options, and how much your upfront costs and lender fees are likely to be.

Luckily, most lenders offer online applications these days. So you can check your eligibility relatively quickly and easily.

Crosscountry Mortgage Low Interest Rates Unique Loan Options

Younger home buyers often want to do everything online. But plenty would welcome a human touch when it comes to buying their first home. And CrossCountry encourages borrowers to build strong relationships with its loan officers.

If you like the idea of a friendly, knowledgeable, easily accessible guide through the loan process, this lender might suit you.

CrossCountry scored a near-perfect 4.9 in online customer reviews. So plenty of people like the personal touch. And that can only be helped by its fast service: CrossCountry says it closes most loans within 21 days.

But one of CrossCountrys strongest points is its low average mortgage rates, based on 2020 official data. Only one lender on our list had lower mortgage rates.

Of course, rates vary a lot by customer. But if you want to save on your home loan, its worth getting a quote to see what CrossCountry can offer you.

You May Like: How To Become A Certified Mortgage Underwriter

Other Ways Of Getting A Mortgage If You Are A First

Guarantor mortgages

Someone else can guarantee your mortgage, this is known as a guarantor mortgage and means a parent, guardian or close relative agrees to be responsible for paying the mortgage if you cant.

Guarantor mortgages are legally binding and your guarantor needs to be able to afford to pay your mortgage if you cannot afford it.

You may need to go to a mortgage broker to find out more about which lenders offer guarantor mortgages.

Help to Buy

This is a government scheme which helps with the cost of a deposit and anyone who is buying their one and only main residence can use the scheme.

Best Mortgage Rates Faq

What is the best mortgage rate available right now?

Mortgage rates spiked to start 2022 and hit a peak on June 23 at 5.81 percent, according to Freddie Mac. Since then, the lowest mortgage rate was just under 5 percent at 4.99 for a 30-year fixed-rate mortgage. Keep in mind that these figures are averages and borrowers with excellent credit can often get rates substantially lower.

What bank has the best mortgage rates?

We compared 30-year mortgage rates from the 30 biggest lenders in 2021 . In our study, Freedom Mortgage had the lowest mortgage rates overall while Rocket Mortgage had the best mortgage rates for a conventional loan. Keep in mind that rates vary a lot from one person to the next and you need to compare lenders to find your best rate. The cheapest lender on average wont necessarily be your best bet.

What type of loan has the lowest mortgage rates?

VA loans and USDA loans typically have the lowest mortgage rates of any program, but there are special requirements to qualify. Conforming loans often have very competitive rates for borrowers with great credit. And an FHA loan will likely offer the best rates if your credit score is on the lower end of the scale.

Is 4.25 a good mortgage rate? Do adjustable-rate mortgages have better rates? Do 15-year mortgages have lower rates?What affects my mortgage rate? What is the lowest 30-year mortgage rate ever?Are interest rates going down? Should I lock a mortgage rate in 2022?

Don’t Miss: How Do I Shop For Mortgage Rates

So What About Mortgage Rates

The housing and mortgage sector has been especially affected, with lenders pulling hundreds of mortgage deals or pricing them at a much higher level after sovereign bond yields and Bank of England rate expectations both surged. This pushed up costs for borrowers as the BOE’s base rate helps price all sorts of loans and mortgages in Britain.

According to Moneyfacts data, the average rate for a 2-year fixed mortgage surpassed 6% this week up from 2.25% just a year ago. This could go up even further, Nicholas Mendes, a technical mortgage manager at mortgage broker and advisor John Charcol, believes.

“With lenders costs increasing, volatile economic outlook, and factoring in service levels and future rate rises expect, we could be seeing average rate of 7% in the new year,” he said.

Many borrowers and soon-to-be borrowers are already concerned that they will not be able to afford their mortgage payments, which are set to more than double in thousands of cases. Research and expert advice are therefore key for anyone looking for a mortgage deal right now, Gill explains.

“Make sure your credit score is accurately reflected, make sure they speak to an independent broker, consider fixing for a period {] and consider any Early Repayment Charges,” he suggests.

“Speaking to someone who can expertly analyse their situation is key. Really, really consider if the rates are this high in 2/3 years, whether the mortgage is affordable,” he adds.

Is It Easier To Qualify As A First

A mortgage lender wont waive its rules for you just because you qualify as a first-time home buyer. Lenders still need to verify you can afford your monthly payments.

That means youll go through the full underwriting process verifying your credit, income, savings, and other personal finance information just like any other home buyer would. Loan programs dont offer easier requirements for first-time buyers.

But thats in your interest as much as the lenders. Who wants to be saddled with a home loan amount they cant afford?

The application process will ensure youre getting a house within your means and a reasonable monthly mortgage payment.

Also Check: What Is A Mortgage Contingency Date

Recommended Reading: What’s The Best Mortgage Loan To Get

Summary Of Current Mortgage Rates

Mortgage rates were higher this week

- The current rate for a 30-year fixed-rate mortgage is 5.89% with 0.7 points paid, an increase of 0.23 percentage points from a week ago. This week last year, the 30-year rate averaged 2.88%.

- The current rate for a 15-year fixed-rate mortgage is 5.16% with 0.8 points paid, 0.18 percentage points higher week-over-week. The 15-year rate averaged 2.19% a year ago this week.

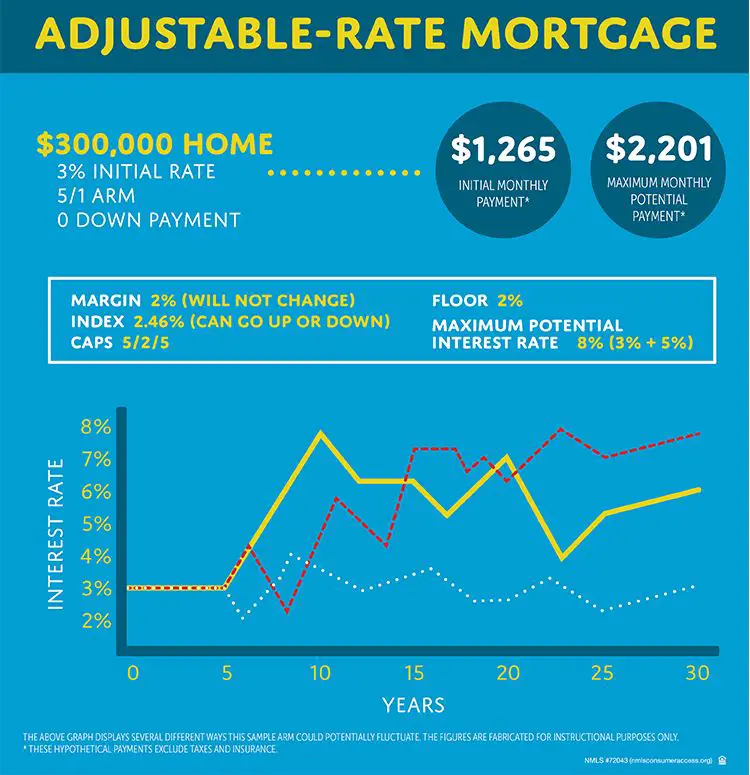

- The current rate on a 5/1 adjustable-rate mortgage is 4.64% with 0.4 points paid, up by 0.13 percentage points from a week ago. The average rate on a 5/1 ARM was 2.42% this week a year ago.

How To Get The Best Mortgage Rate

Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower’s personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:

Don’t Miss: How Long Are Home Mortgages

How Much Will I Need For A Down Payment

The minimum youll need to put down will depend on the type of mortgage. Many lenders require a minimum of 5% to 20%, whereas others like government-backed ones require at least 3.5%. The VA loan is the exception with no down payment requirements.

Generally, the higher your down payment, the lower your rate may be. Homeowners who put down at least 20 percent will be able to save the most.

Ryan Fuchs Financial Planner

@RyanFuchs07/10/15 This answer was first published on 07/10/15. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

There are too many factors involved to provide a concrete answer. It can depend on a lot of factors, such as: amount of loan , loan program , whether you pay points, borrowers’ credit score, etc.My suggestion would be to get quotes from multiple lenders and figure out which overall loan package is best for your situation.For example, you may get one quote that has a 3.75% rate for 30-years versus a quote that has a 3.5% rate for 30-years but requires you to pay 1 point to get the lower rate. Depending on how long you plan to stay in the home and taking into account other factors, paying the points for the lower rate may be the better way to go, or the 3.75% with no points might be better. Essentially, you cannot simply look at the rate alone. You must consider all other aspects of the loan to figure out what loan will suit you best.That being said, if you were locking in a rate today with excellent credit, independent of some other factors, you could probably expect to find rates somewhere between 3.75% and 4.25% for a 30-year fixed rate loan and probably around 3.0% to 3.25% for a 15-year fixed rate loan.Hope this helps and best of luck.

Don’t Miss: How To Select A Mortgage Lender

Which Option Is Better

For the last 10-or-so years, fixed-rate mortgages have been the most popular. This is because interest rates have been historically low with little room for movement, and with rates likely to increase over the next few years, many borrowers are trying to secure their interest rate with a fixed-rate mortgage.

On the other hand, trackers were popular when rates were higher. This is because there was room for a drop in rates. If interest rates increase to significantly higher levels shortly, tracker mortgages will likely grow in popularity.

Dont Miss: How Long Does A Mortgage Refinance Take

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

You May Like: Does Property Tax Included In Mortgage

Best Mortgage Rates By Loan Type

Mortgage rates vary a lot by lender. But they also depend on your loan type. And some lenders are more competitive for one type of mortgage than another.

For instance, some lenders focused on VA mortgages might not be as competitive for conventional loans, and vice-versa.

The lists below show the best mortgage rates for the four main types of home loans: conventional, FHA, VA, and USDA. Again, use these lists as a starting point but note that the rates shown are averages from 2021 and do not reflect current mortgage rates.

‘make Improvements’ To Your Credit Score

As you may know, the higher your credit score, the lower the interest rate you can qualify for on a variety of loans, including mortgages. Home buyers with lower credit scores may pay almost $104,000 more over the life of a 30-year fixed-rate mortgage than someone with an excellent score , according to a Zillow analysis.

“Look at your current credit score and see if you need to make improvements,” Higgins said.

Generally speaking, a score of 740 or higher yields the best mortgage rates. However, be aware that the scores you see for free online so-called educational scores such as VantageScore are typically not what lenders use in the approval process.

Look at your current credit score and see if you need to make improvements.Sandy HigginsSenior wealth advisor with Capstone Financial Advisors

While mortgage lenders pull your score from the three big credit-reporting firms Equifax, Experian and TransUnion it is a specific FICO score that is used and can be different from an educational score.

Regardless, financial habits like paying your bills on time and getting rid of high credit card debt can help your score head higher.

Recommended Reading: Can A Second Mortgage Foreclose On Your Home