The Bottom Line: Should You Get A Reverse Mortgage

If you can avoid getting a reverse mortgage, you should. The alternative ways to fund your retirement that weâve outlined will leave you more financially stable and with a larger estate to leave to your family when you die. Additionally, losing the equity in your home increases your financial risk if the housing market were to crash, or if something were to happen that forces you to sell.

That being said, if you fully understand the product, have spoken to a financial advisor and your family, and are confident about your decision, a reverse mortgage can be a good way to fund a more dignified retirement. Just be sure to go in with your eyes open.

Also read:

The Reverse Mortgage Concierge

Now that we have determined what this means to you, the next step is to decide who will guide you through this brave new world. Investing a little more time upfront here can save you a lot down the road.

I act as your Reverse Mortgage concierge. Assisting you with one on one consultations and how your situation will best fit with this product.

Find a Mortgage Agent who works with all Reverse Mortgage providers and can advise you of the borrowing alternatives as well for your best mortgage made easy.

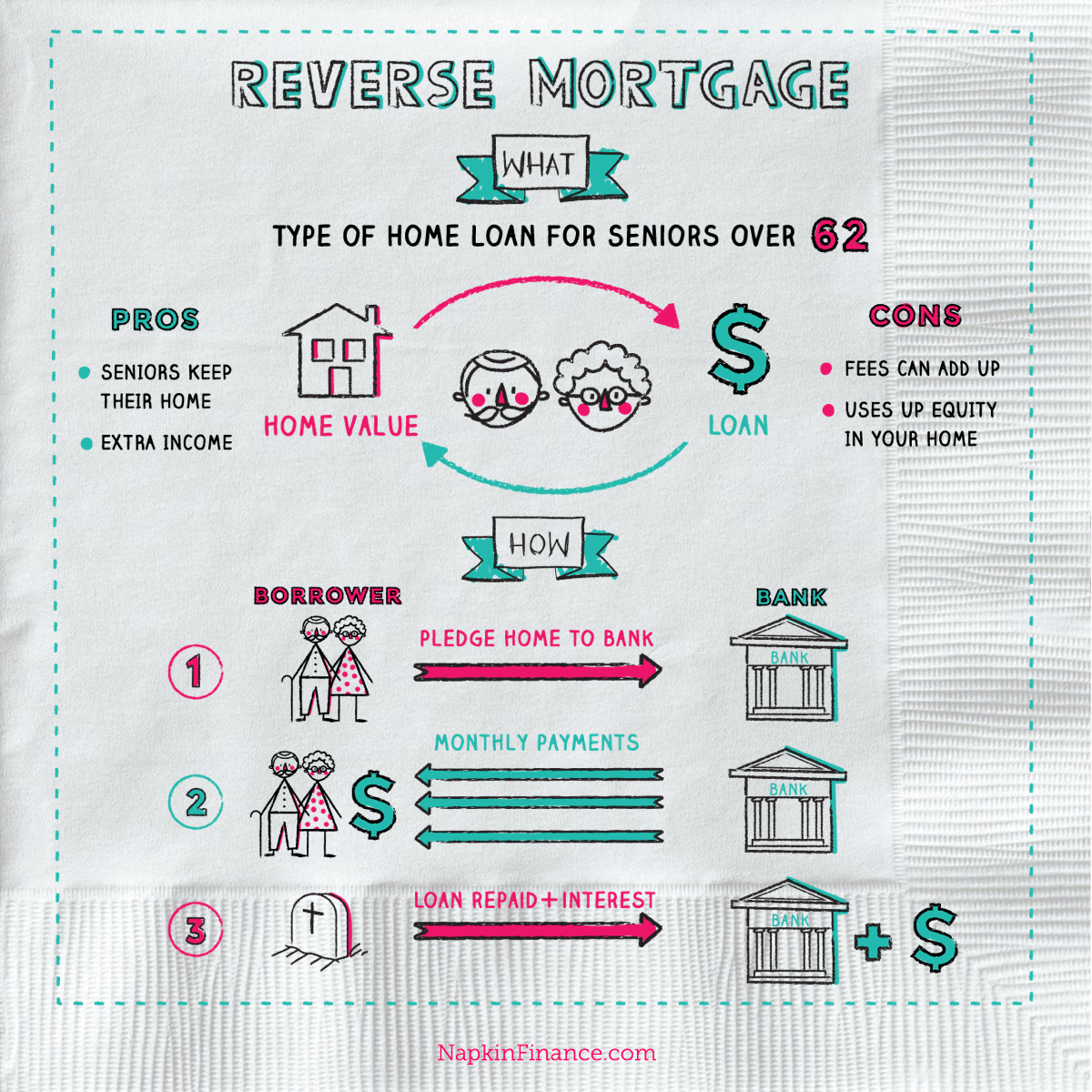

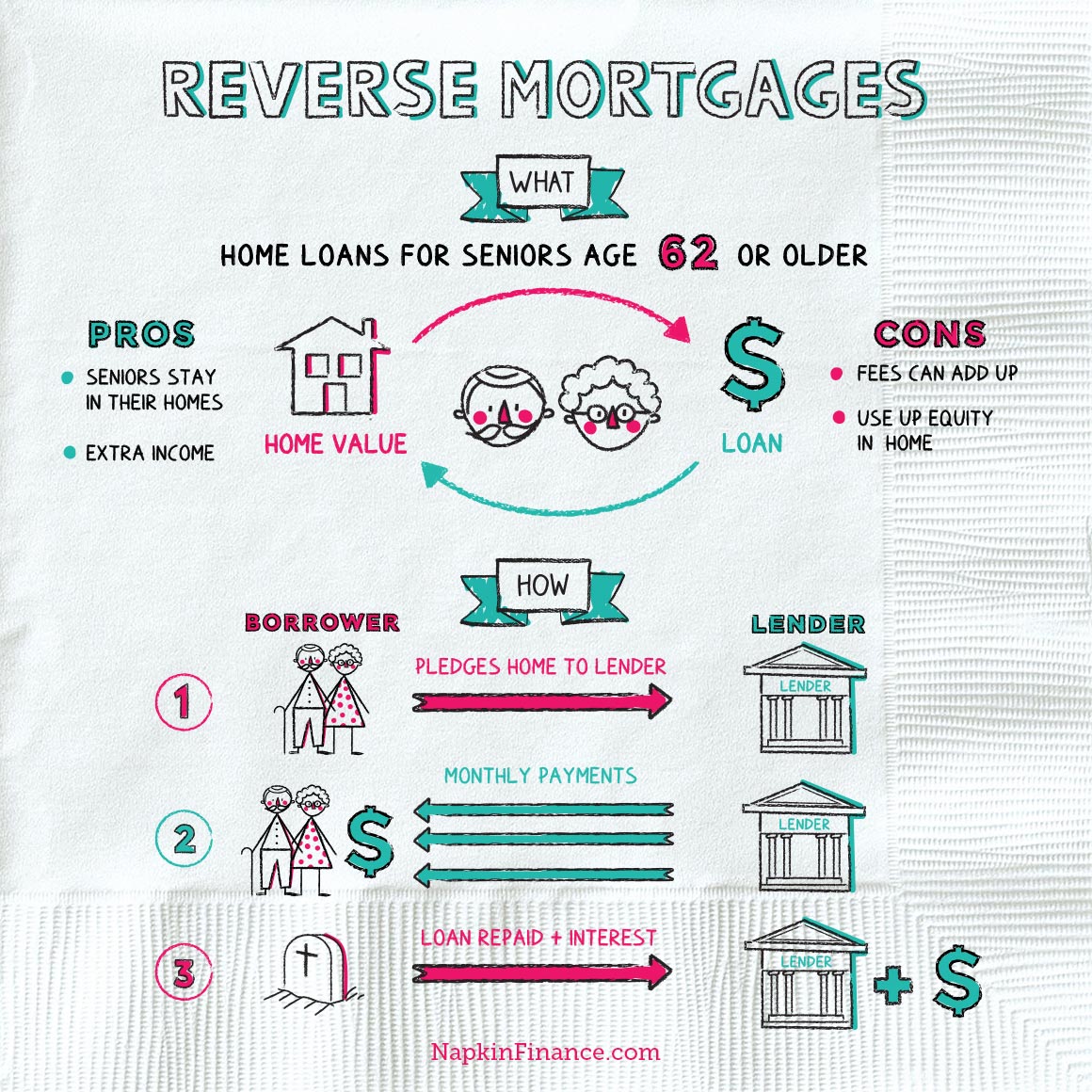

What Is A Reverse Mortgage And What Does It Mean To Me

TheStreet

Reverse mortgages are a unique financial tool for unique financial needs. Can they work for you?

A reverse mortgage is an increasingly attractive proposition for older Americans who may be low on cash, need to supplement retirement income, and want to use their home equity to remain in the house they own.

Reverse mortgages are loans that enable U.S. homeowners over the age of 62 to cash in on the equity built up in their home, via a reverse mortgage lender.

That’s a tempting opportunity in an age where millions of U.S. seniors are struggling to save enough money for retirement. Data from Northwest Mutual shows that 67% of Americans believe they will outlive their retirement savings and 21% of American have saved zero dollars for retirement.

Even so, there are some risks involved in cutting a deal on a reverse mortgage Such mortgages are supervised by the U.S. Federal Housing Administration, an arm of the Department of Housing and Urban Development, so there is some level of regulatory scrutiny.

A closer look at reverse mortgages may provide some answers for Americans approaching their golden years, but lack adequate retirement savings. Let’s kick some tires on reverse mortgages and see if there is a scenario in which this financial product makes sense for you.

Also Check: Rocket Mortgage Conventional Loan

Work An Application Process That Suits You

The reverse mortgage application is a long application and requires many borrower signatures. One of the recent innovations though, is the ability for borrowers to use electronic signatures if they prefer rather than having to hand-sign every document. This allows a lender to send you a package over the email that you can receive, review and click for your acceptance but it does not replace your need to review the documents carefully.

Some borrowers find it easier because they can increase the size of the font as large as needed to easily read. Some have a tougher time reading documents on the computer.

If you like reading the documents on the computer, electronic signatures are much easier and you can store the signed documents on the computer, print them if you wish in your home or ask the lender to send them to you if you do not have the ability to print a large package of loan documents.

If you cannot print and do not wish to sign electronically, be sure to let your lender know you still want an application package printed on paper for your review and signature. Sign all required signature lines and return all required documents to the lender . Here is a hint, if you cannot take copies, you can take pictures with a smart phone and send them if you can get a clear picture of the entire document.

Supplement Social Security Benefits

As the government raises the retirement age in the United States, workers with strenuous or unpleasant jobs may want out early. Retiring at 62 won’t get you the maximum Social Security benefit, but with enough home equity, a reverse mortgage can boost that monthly check and get you out of the rat race.

Don’t Miss: 70000 Mortgage Over 30 Years

What Responsibilities Come With A Reverse Mortgage

Its important to remember that a reverse mortgage is still a loan and, as the homeowner, you still have responsibilities tied to the loan and the home. Youll need to:

- Continue to pay property taxes and homeowners insurance.

- Keep the home in good condition complete repairs and maintenance.

- Live in the home for more than half the year as the primary residence.

If you do not stay current on your taxes and homeowners insurance, fail to maintain the house or live in the home for less than 6 months of the year, your loan may come due.

However, if you uphold the loan obligations listed above, your reverse mortgage will not come due until the last borrower moves out of the home or passes away. When this happens, the home is sold, and the proceeds of the sale are used to pay the loan balance in full. If heirs wish to keep the home, they can refinance the reverse mortgage into a traditional loan. They will need to pay either the loan balance or 95% of the appraised value, whichever is lower.

A reverse mortgage is a nonrecourse loan. That means if the home sells for less than what is due on the loan, this insurance covers the difference so you wont end up underwater or with negative equity on your loan and the lender doesnt lose money on their investment. Depending on the type of reverse mortgage you get, the FHA or the lender will cover the difference and absorb the cost.

Who Is Eligible For A Reverse Mortgage Loan

To be eligible for a reverse mortgage, you must meet the following criteria, at a minimum:

- You must be 62 years or older.

- You must have enough equity in your home usually about 50%, but the required amount varies by lender.

- Depending on the type of reverse mortgage you get, you may need to attend a counseling session from a Department of Housing and Urban Development-approved counselor to learn more about the loan and your options.

- You must go through a financial assessment to ensure youre in the best position to be successful with your loan. This will also depend on the type of loan you receive.

Along with these requirements, your home also needs to qualify for the loan. Here are a few basic requirements:

- The home must be your primary residence.

- The home must be in good condition and meet FHA standards .

- The home cannot be a mobile or, in most cases, a manufactured home.

- If the home is a condo, it must be on the HUD/FHA approved condo list. You may still be eligible for a proprietary reverse mortgage if it is not.

Don’t Miss: How Does The 10 Year Treasury Affect Mortgage Rates

Who Is Eligible For A Reverse Mortgage

To be eligible for a reverse mortgage, you must be:

- a homeowner

- at least 55 years old

On your reverse mortgage application, you must include all the individuals listed on your homes title. All these individuals must be at least 55 years old to be eligible.

Your lender may also ask you and the other individuals to get independent legal advice. They may ask for proof that you received this advice.

When you apply for a reverse mortgage, your lender will consider:

- your age, and the age of other individuals registered on the title of your home

- where you live

- your homes condition, type and appraised value

The home youre using to secure a reverse mortgage must also be your primary residence. This usually means you live in the home for at least six months a year.

What Does A Reverse Mortgage Mean To Me

We all want a better/more certain tomorrow. Understanding what a Reverse Mortgage means to you will help determine whether this is the train to get on or not.

What a Reverse Mortgage means to many Ontarians is a reversal of time. Instead of time being your enemy as you see the sand in your hourglass slipping through, we can now look at it differently.

The idea of a Reverse Mortgage can be: I can now begin living again knowing that my best life will bless my loved ones.

You May Like: Can You Do A Reverse Mortgage On A Condo

Reverse Mortgage Interest Rates

Only the lump sum reverse mortgage, which gives you all of the proceeds at once when your loan closes, has a fixed interest rate. The other five options have adjustable interest rates, which makes sense since youre borrowing money over many years, not all at once, and interest rates are always changing. Variable-rate reverse mortgages are tied to the London Interbank Offered Rate .

In addition to one of the base rates, the lender adds a margin of one to three percentage points. So if the LIBOR is 2.5% and the lenders margin is 2%, then your reverse mortgage interest rate will be 4.5%. As of January 2020, lenders margins ranged from 1.5% to 2.5%. Interest compounds over the life of the reverse mortgage, and your does not affect your reverse mortgage rate or your ability to qualify.

Is A Reverse Mortgage Right For You

If you have considered getting a reverse mortgage on your home, but arent sure if its a good fit for you, consider the following points:

- Access a large amount of cash or a steady source of income in retirement

- Flexibility in how you receive the money. Options include a lump sum upfront, an annuity, a line of credit or a combination of the three

- You or your heirs don’t need to make any payments on the loan until you move out, sell the house or pass away

- HECMs are non-recourse loans, so you will only owe what you borrowed even if your house loses value

- You do not pay income tax on money you receive from a reverse mortgage

- You have the right to change your mind for any reason and cancel the reverse mortgage within three business days of closing on the loan

- If one spouse should pass away, the surviving spouse will be able to stay in the house if they are a co-borrower

Keep in mind that, depending on the kind of reverse mortgage you choose, there may be limits placed on how you can use the money.

For single-purpose reverse mortgages, the moneys purpose needs to be reviewed and approved by the lending agency.

In the case of HECM mortgages, the house has to comply with HUDs minimum property standards to qualify. Furthermore, you may be required to use some of the loan proceeds for home improvements if your home doesnt meet HUD standards.

In order to qualify for a reverse mortgage loan, you must meet the following requirements:

Read Also: How Much Is Mortgage On 1 Million

How Is Hud Involved In Reverse Mortgages

There are two parties involved in every mortgage transaction a lender and a borrower. That is also true with a reverse mortgage. But in addition to a reverse mortgage lender, the government is involved in every transaction because HUD will insure the loan and so there are steps the lender must follow to be certain that the loan meets HUD requirements. To be a lender for a HECM loan, the lender must be approved by HUD.

That does not mean though that the originator is necessarily a HUD-approved entity. Some originators, like mortgage loan brokers, are not HUD-approved but must take the loan to a HUD-approved lender to be underwritten and closed. The loan is the same HUD HECM loan either way, but there may be additional or higher costs with more people in the mix.

Borrowers are encouraged to be good shoppers and compare different lenders. Not all lenders are priced well and not all brokers are priced higher, but it is prudent to compare. After all, if you are getting the same loan with the same parameters and the same insurance no matter where you go, you might as well get the best terms for yourself and your family. HUD is involved in every loan completed no matter who the originator is.

In fact, lenders may not give approvals to borrowers under the terms of the program until after they have received appraisal clearance through the HUD EAD. Then the lender will deliver certain documents to HUD for insuring the loan after the loan closes.

Eligibility For A Reverse Mortgage

To be eligible for a reverse mortgage, the Federal Housing Administration requires that the youngest borrower on the title is at least age 62. If the home is not owned free and clear, then any existing mortgage must be paid off using the proceeds from the reverse mortgage loan at the closing. In addition, you must meet financial eligibility criteria as established by HUD.

You May Like: What Does Gmfs Mortgage Stand For

I Understand Therefore I Go

So now we have a better understanding of what a Reverse Mortgage is.

Whats next? Dont be left standing on the platform not knowing if another train is coming.

I can picture you through the window of the train. Youve settled in, sipping on a hot tea, a smile on the edge of your lips as you know you are moving towards a better tomorrow.

Rather than simply reading about it, why not experience my concierge service today. Contact me by filling out the easy form below. Your information is secure and confidential.

Distribution Of Money From A Reverse Mortgage

There are several ways to receive the proceeds from a reverse mortgage:

- Lump sum a lump sum of cash at closing.

- Tenure equal monthly payments as long as the homeowner lives in the home.

- Term equal monthly payments for a fixed period of time.

- Line of Credit draw any amount at any time until the line of credit is exhausted.

- Any combination of those listed above

Recommended Reading: Reverse Mortgage For Mobile Homes

Accounting For Interest Taxes Insurance And Fees

Its important to note: a reverse mortgage is not free money. Reverse refers to your loan balance. While you remain the owner of your home and receive payments, monthly interest is added to the loan balance, increasing your debt throughout the life of the loan unless you decide to make payments.

Even if you don’t make payments, you won’t be able to defer all payments on your house. You will still be required to pay:

- Closing costs

- Home maintenance

These are important obligations to remember, because you could lose your home to foreclosure if you fall behind on property taxes or insurance or let your home deteriorate.

Reverse Mortgages In Canada: The Pros And Cons

Thereâs been a lot of talk about reverse mortgages over the past few years, with supporters and opponents both being very vocal. Reverse mortgages are used by older Canadians to provide a source of retirement funds, and with more than 60% of Canadians concerned theyâll outlive their retirement savings, itâs no surprise reverse mortgages are a talking point .

However, there are pros and cons to getting a reverse mortgage. Hereâs everything you need to know about reverse mortgages in Canada.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

How And When To Repay A Reverse Mortgage

Most people who take out reverse mortgages do not intend to ever repay them in full. In fact, if you think you may plan to repay your loan in full, then you may be better off avoiding reverse mortgages altogether.

However, generally speaking, reverse mortgages must be repaid when the borrower dies, moves, or sells their home. At that time, the borrowers can either repay the loan and keep the property or sell the home and use the proceeds to repay the loan, with the sellers keeping any proceeds that remain after the loan is repaid.

You may need to repay a mortgage either with cash or by selling the home if:

- You have to move into an assisted living facility or have to move in with a family member to help take care of you

- You have family who lives with you who want to keep your property, and you have the money to pay back the loan

Eligibility Factors For Reverse Mortgages

- You are 62 years of age, or older.

- You own your home and live on the premises

- Your home is a single-family home, a multi-family home , or select condominiums.

- You either have paid off your mortgage loan outright and own your own home, or you are close to doing so.

- Your property is in solid condition

Read Also: Can I Get A Reverse Mortgage On A Condo

How Much Does A Reverse Mortgage Cost

The closing costs for a reverse mortgage arent cheap, but the majority of HECM mortgages allow homeowners to roll the costs into the loan so you dont have to shell out the money upfront. Doing this, however, reduces the amount of funds available to you through the loan.

Heres a breakdown of HECM fees and charges, according to HUD:

- Mortgage insurance premiums There is a 2 percent initial MIP at closing, as well as an annual MIP equal to 0.5 percent of the outstanding loan balance. The MIP can be financed into the loan.

- Origination fee To process your HECM loan, lenders charge the greater of $2,500 or 2 percent of the first $200,000 of your homes value, plus 1 percent of the amount over $200,000. The fee is capped at $6,000.

- Servicing fees Lenders can charge a monthly fee to maintain and monitor your HECM for the life of the loan. Monthly servicing fees cannot exceed $30 for loans with a fixed rate or an annually adjusting rate, or $35 if the rate adjusts monthly.

- Third-party fees Third parties may charge their own fees, as well, such as for the appraisal and home inspection, a credit check, title search and title insurance, or a recording fee.

Keep in mind that the interest rate for reverse mortgages tends to be higher, which can also add to your costs. Rates can vary depending on the lender, your credit score and other factors.