For Fha Loans Opened On Or After June 3 2013

Most home buyers with newer FHA loans will have a harder time canceling their annual MIP payments. Thats because the FHA made annual MIP permanent for many borrowers starting in 2013.

Unless you put at least 10 percent down on your home much higher than the 3.5 percent minimum down payment required for most borrowers youre stuck with annual MIP payments until you pay off the loan.

If you put 10 percent or more down, your MIP will go away after youve made payments on your loan for 11 years.

If you put less than 10 percent down, youll likely need a mortgage refinance to eliminate these monthly premiums.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Three Ways To Remove Pmi

How you get rid of your mortgage insurance requirement depends on the type of loan you have, so its important to understand the rules in advance.

Removing PMI usually requires an increase in the propertys value or equity and/or paying the mortgage for a certain number of years, says Walda Yon, chief housing programs officer at the Latino Economic Development Center. For example, in some situations you may be required to have been paying the mortgage for two or five years before PMI can be dropped this is known as a seasoning period. You also have to be current with your mortgage payments and have a good payment history to be able to remove PMI.

Don’t Miss: How To Pay Off Mortgage In 5 Years Calculator

How Soon After Closing Can You Remove Pmi

PMI on a conventional loan does not have a set expiration date. Instead, its required until you pay the mortgage balance down to 80 percent of the homes value. You can reach this threshold sooner by making extra payments. An FHA loans MIP, which resembles conventional PMI, lasts until you pay off the home unless you put down 10 percent or more in which case MIP expires after 11 years.

Request Pmi Cancellation At 80% Ltv

If you werent able to put down 20% when you purchased the property, you can have PMI waived once youve built up enough equity over time.

But your lender isnt going to automatically cancel your PMI premium once youve reached 80% LTV. Youll have to reach out and request it. Your lender may require some form of appraisal to verify the property hasnt lost value, but thats not always the case.

To drop your PMI requirement, you may also be able to prove that the home has increased in value through appreciation or property improvements. In this case, you shouldnt just go and get an appraisal without communicating with your lender first, because when you waive PMI with a reappraisal a seasoning period is likely to apply. Call the loan servicer first and ask about getting the PMI removed, and theyll tell you what their process is, Dye says.

In most cases, the borrower will be responsible for the cost of the appraisal, which can easily be around $500. Dye recommends borrowers run the numbers to make sure they are actually saving.

Don’t Miss: Why Does My Mortgage Loan Keep Getting Transferred

Option : Refinance To Get Rid Of Pmi

When mortgage rates are low, you might consider refinancing your mortgage to save on interest costs or reduce your monthly payments. At the same time, refinancing might enable you to eliminate PMI if your new mortgage balance is below 80 percent of the home value. Its a double dose of savings.

The refinancing tactic works if your home has gained substantial value since the last time you got a mortgage. For example, if you bought your house four years ago with a 10 percent down payment, and the homes value has risen 15 percent since then, you now owe less than 80 percent of what the home is worth. Under these circumstances, you can refinance into a new loan without having to pay for PMI.

With any refinancing, youll want to weigh the closing costs of the transaction against your potential savings from the new loan terms and eliminating PMI.

Who this affects: This strategy works well in neighborhoods where home values are on the upswing. If your home value has declined, refinancing could have the opposite effect you might be required to add PMI if your home equity has dropped.

Refinancing to get rid of PMI typically doesnt work well for new homeowners. Many loans have a seasoning requirement that requires you to wait at least two years before you can refinance to get rid of PMI. So if your loan is less than two years old, you can ask for a PMI-cancelling refi, but youre not guaranteed to get approval.

What Is Fha Mortgage Insurance

An FHA mortgage insurance premium is an additional fee you pay to protect the lenders financial interests in case you default on your FHA loan. FHA borrowers are required to pay two mortgage insurance premiums: one upfront at closing, and another annually for as long as you repay the loan, in most cases.

By comparison, conventional loans with less than 20 percent down come with private mortgage insurance , charged every year until you have at least 20 percent equity in your home. This is different from FHA mortgage insurance, which doesnt have the same equity cutoff.

You might also encounter mortgage protection insurance , which is not a requirement for an FHA loan or any other kind of mortgage. MPI is similar to disability or life insurance in that it pays your mortgage if you become disabled, lose your job or pass away.

Read Also: What Would The Mortgage Be On A 200 000 House

Does Pmi Ever Get Automatically Terminated

There are two more ways to have PMI removed.

-

First, your servicer is required to automatically terminate PMI from your loan on the date that the principal balance is first scheduled to reach 78% of the original value based solely on the initial amortization schedule. Your loan must be current on the date of termination for the servicer to proceed with removal, otherwise, it will be removed on the first day of the month following the date you become current.

- NOTE: The automatic termination of PMI cannot be moved forward based on payments made to Principal. The date is determined when the loan is closed based on the initial amortization schedule.

Second, if your PMI has not been cancelled at the borrowers request or by the automatic termination process, the servicer must terminate PMI coverage by the first day following the date that is the midpoint of the loans amortization schedule. The loan must be current on the date of termination for the servicer to proceed with removal, otherwise, it will be removed on the first day of the month following the date you become current.

How Do I Get Rid Of Pmi

Fortunately, there are a few ways to eventually get rid of PMI if youâre required to pay it now. The first is consistently making payments until you have 20% equity in your homeâor an LTV of 80%âat which point the lender is required to cancel it. However, this doesnât happen automatically you should contact your lender and ensure that PMI is indeed canceled once you meet the qualifications.

Another situation in which you no longer need to pay PMI is if your home value increases and you now have more than 20% equity built up. In this situation, your LTV might reach 80% faster than you were originally required to pay PMI. If that happens, great. You should have your home reappraised, and if you owe less than 80% of the newly appraised value, itâs time to get in touch with your lender to have your PMI canceled. Keep in mind that you are responsible for the costs associated with having your home appraised in this situation.

Finally, if your cash flow has unexpectedly increased and you can afford to pay off your mortgage faster, you may consider doing soâat least for a few months. By making extra payments toward your loan, you can pay down the principal faster and reach an LTV of 80% sooner than originally planned.

Don’t Miss: Is It Worth It To Refinance To 15 Year Mortgage

Planning To Terminate Your Mortgage Insurance Early Dont Forget About Seasoning

It is important to note that some lenders have seasoning requirements that may not allow you to remove PMI until a certain amount of time has passed. If you plan on asking your current lender to do a new appraisal on your property after an upgrade, to determine if you are at or below 80% LTV, please make sure you ask if there is any seasoning first.

What To Know About Private Mortgage Insurance

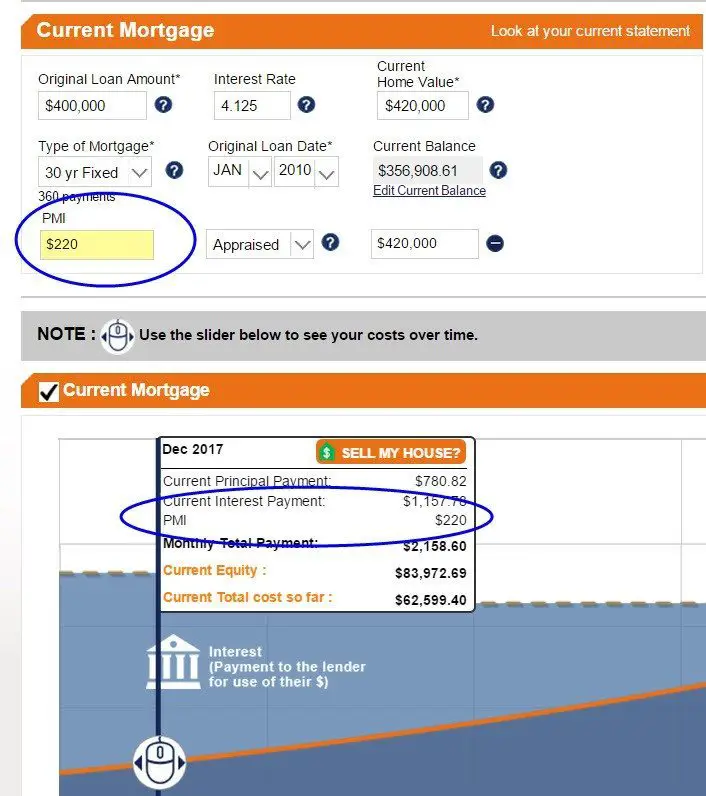

If you buy a home with a down payment of less than 20 percent, youll probably have to purchase some form of mortgage insurance. Private Mortgage Insurance or PMI is required for conventional loans exceeding 80 percent loan-to-value . Government-backed loans like FHA, VA and USDA mortgages have their own insurance programs.

You May Like: Does Your Mortgage Go Up When You Refinance

There Are Four Ways To Remove Pmi:

1. Let it cancel automatically

Approximately one in five mortgages in the U.S. have PMI*, and most of these homeowners will make monthly payments for about five years and then the insurance automatically ends because they will have built up 22% equity in their home. In this situation, you do not need to take any action. The monthly PMI costs will be automatically removed from your loan.

2. Requestearly cancellation

You can save money by removing the PMI sooner through early cancellation. Once you have 20% equity in your home, you can submit a written request to Caliber Home Loans, Inc. and ask that the PMI be canceled.

Login to your Caliber account and following these instructions:

- Click Mortgage Insurance.

- Click the MI Removal Eligibility button.

- Follow the instructions on the MI Removal Request form to submit the request to Caliber Home Loans, Inc.

If you are unable to process the request online, please contact us. Then we will review your loan account to make sure you meet the requirements for insurance removal.

3. Get a new appraisal

If property values are rising where you live you can request early cancellation based on the homes current value.Your home may also have increased in value if youve done anyhome improvements, such as upgrading the kitchen or adding a bedroom. Youll probably want to get a new appraisal to determine the homes new value.

4. Refinance your mortgage

*According to bankrate.com as of 2019.

How Long Will You Pay Fha Mip

While the law has changed more than once on this issue, current guidance states that borrowers who put down less than 10 percent on an FHA loan must pay for FHA mortgage insurance until the entire loan term is over. If you put down at least 10 percent, however, you can have FHA MIP removed after 11 years of payments.

The length of time that a borrower pays the monthly mortgage insurance premium varies depending upon the original loan terms, Boomer says.

PMI on a conventional loan, on the other hand, can typically be cancelled once a homeowner has 20 percent equity in their home.

Also Check: How To Pay Off Your Mortgage Quickly

Homebuyers Can Avoid Paying Pmi If Their Down Payment Is Large Enough

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

When you apply for a mortgage, the lender will typically require a down payment equal to 20% of the home’s purchase price. If a borrower can’t afford that amount, a lender will likely look at the loan as a riskier investment and require that the homebuyer take out PMI, also known as private mortgage insurance, as part of getting a mortgage.

PMI protects the lender in the event that you default on your primary mortgage and the home goes into foreclosure.

Fha Loans With Terms Longer Than 15 Years

| Loan amount |

| 55 | Entire loan term |

Upfront mortgage insurance premiums can be, and often are, financed into the loan amount, explains Peter Boomer, a mortgage executive with PNC Bank. Annual premiums are included in the borrowers monthly mortgage payment.

If you borrow $100,000 and roll the cost of FHA upfront MIP into your loan, your loan amount will increase to $101,750 . Naturally, that increases your monthly payment, as well. On a $101,750 30-year fixed-rate FHA loan at 4 percent, your monthly mortgage payment would be $485, compared to $477 without financing the MIP.

Tack on the annual premiums, too, and your monthly payment will rise further, adding another $72 per month, bringing the total to $557. Thats assuming you make a minimum down payment of 3.5 percent, in which case youll be charged an annual MIP rate of 0.85 percent.

Read Also: How Many Mortgages Can I Have

How To Dump Pmi Asap

If you bought a house with a down payment of less than 20%, your lender required you to buy mortgage insurance. The same goes if you refinanced with less than 20% equity.

Private mortgage insurance is expensive, and you can remove it after you have met some conditions.

How to get rid of PMI

To remove PMI, or private mortgage insurance, you must have at least 20% equity in the home. You may ask the lender to cancel PMI when you have paid down the mortgage balance to 80% of the home’s original appraised value. When the balance drops to 78%, the mortgage servicer is required to eliminate PMI.

Although you can cancel private mortgage insurance, you cannot cancel recent FHA insurance.

What mortgage insurance is for

Mortgage insurance reimburses the lender if you default on your home loan. You, the borrower, pay the premiums. When sold by a company, it’s known as private mortgage insurance, or PMI. The Federal Housing Administration, a government agency, sells mortgage insurance, too.

Canceling PMI sooner

Here are steps you can take to cancel mortgage insurance sooner or strengthen your negotiating position:

Know your rights

Mortgage servicers must give borrowers an annual statement that shows whom to call for information about canceling mortgage insurance.

Getting down to 80% or 78%

To calculate whether your loan balance has fallen to 80% or 78% of original value, divide the current loan balance by the original appraised value .

$171,600 / $220,000 = 0.78.

How To Remove Pmi: Key Takeaways

Can you get rid of PMI? The answer depends on your loan type and your current principal balance.

Remove conventional PMI:

- Conventional PMI goes away on its own when you have 22% home equity. You build equity as you pay down your mortgage and as your homes value increases

- You can request PMI cancellation when you have 20% home equity. Contact your loan servicer to request PMI cancellation

Remove FHA MIP:

- FHA mortgage insurance lasts the life of the loan unless you put down 10% or more

- To get rid of FHA mortgage insurance, you must refinance to a conventional loan

- Youll need a 620 credit score and 20% equity to get rid of your FHA mortgage insurance premium

With home values rising nationwide, many homeowners who are still paying for mortgage insurance will now have enough equity to cancel or refinance out of their mortgage insurance payments.

You may be able to do this with a new appraisal, but not all lenders will allow this. It usually needs to be based on the original loan terms and home value when you secured your loan. Otherwise, you need to refinance to get the new value considered, notes Jon Meyer, The Mortgage Reports loan expert and licensed MLO.

If you meet the requirements to get rid of PMI, you could start saving on your home loan immediately.

Also Check: What Is Loan Servicing In Mortgage

When Is Homeowners Insurance Required

Homeowners insurance typically is required for anyone who takes out a mortgage loan to buy a home. After you pay off your mortgage, youll probably want to continue to have a homeowners insurance policy. While your mortgage lender can no longer require you to carry home insurance after you pay off your mortgage, its up to you to protect your investment.