How To Determine How Much Home You Can Afford

Buying a house is exciting, especially as you tour new places and eventually fall in love with a home. But how do you determine your price range? To set realistic expectations, consider your personal finances, borrowing options, and the total costs of buying.

Heres what well cover:

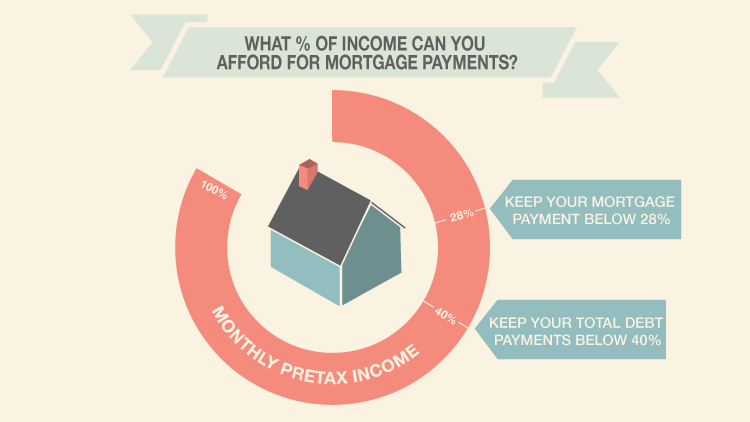

How Does The 28/36 Rule Of Thumb Work

So, how do mortgage lenders use the 28/36 rule of thumb to determine how much money to lend you?

Lets say you earn $6,000 a month, before taxes or other deductions from your paycheck. The rule of thumb states that your monthly mortgage payment shouldnt exceed $1,680 and that your total monthly debt payments, including housing, shouldnt exceed $2,160 .

A mortgage lender may use this guideline to gauge or predict that youll be able to take on a certain monthly mortgage payment for the foreseeable future, Andrina Valdes, COO of Cornerstone Home Lending in San Antonio, told The Balance by email. The 28/36 rule answers the question: How much house can you afford to buy?

The rule of thumb should be something you calculate before you start shopping for homes, as it gives you an accurate estimate of how much home you can afford.

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums, In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

What Percentage Of Income Should Go To My Mortgage

February 28th, 2021 by Hernandez |Posted in Blog |

How much house can you really afford? With rising rent prices, this can be a little bit of a hot-button topic. Financial gurus and thrifty spenders weigh in with many different opinions. But what matters is what the bank is willing to lend you and what you can swing, not just on paper but in real life.When you own a home, your mortgage includes four different components. When you rent, your monthly payments go a bit further and take care of everything from lawn care to maintenance. Homeowners are shelling out extra for these costs, but at the same time, they are building equity in their property.

What Should I Do If The Lender Refuses To Give Me A Big Enough Mortgage

If various lenders reject your application, its a sign that they dont think you can afford such a big mortgage. Should this be the case, its best to scale down your aspirations rather than desperately search for the one lender that will say yes.

This may be frustrating, but its in your best interest to ensure that youre not financially overstretched because you dont want to have your home repossessed in the future.

Related guides

Also Check: Rocket Mortgage Vs Bank

First How Much Do You Make

Before you can even begin to make an estimate of how much rent you can afford, you first need to know how much money you have to work with. While your annual salary might sound good on paper, thats your gross annual income, not your net monthly income.

For instance, someone with a taxable income of $50,000 a year might take home approximately:

- $50,000 taxable income 22% tax rate = $39,000 annual net income

When divided by 12, we arrive at $3,250 as the amount you have available to work with for your monthly budget. Keep this calculation in mind, as it is how you will determine the dollar amount from which you can deduct your monthly rent.

What Percentage Of Income Should Go To A Mortgage

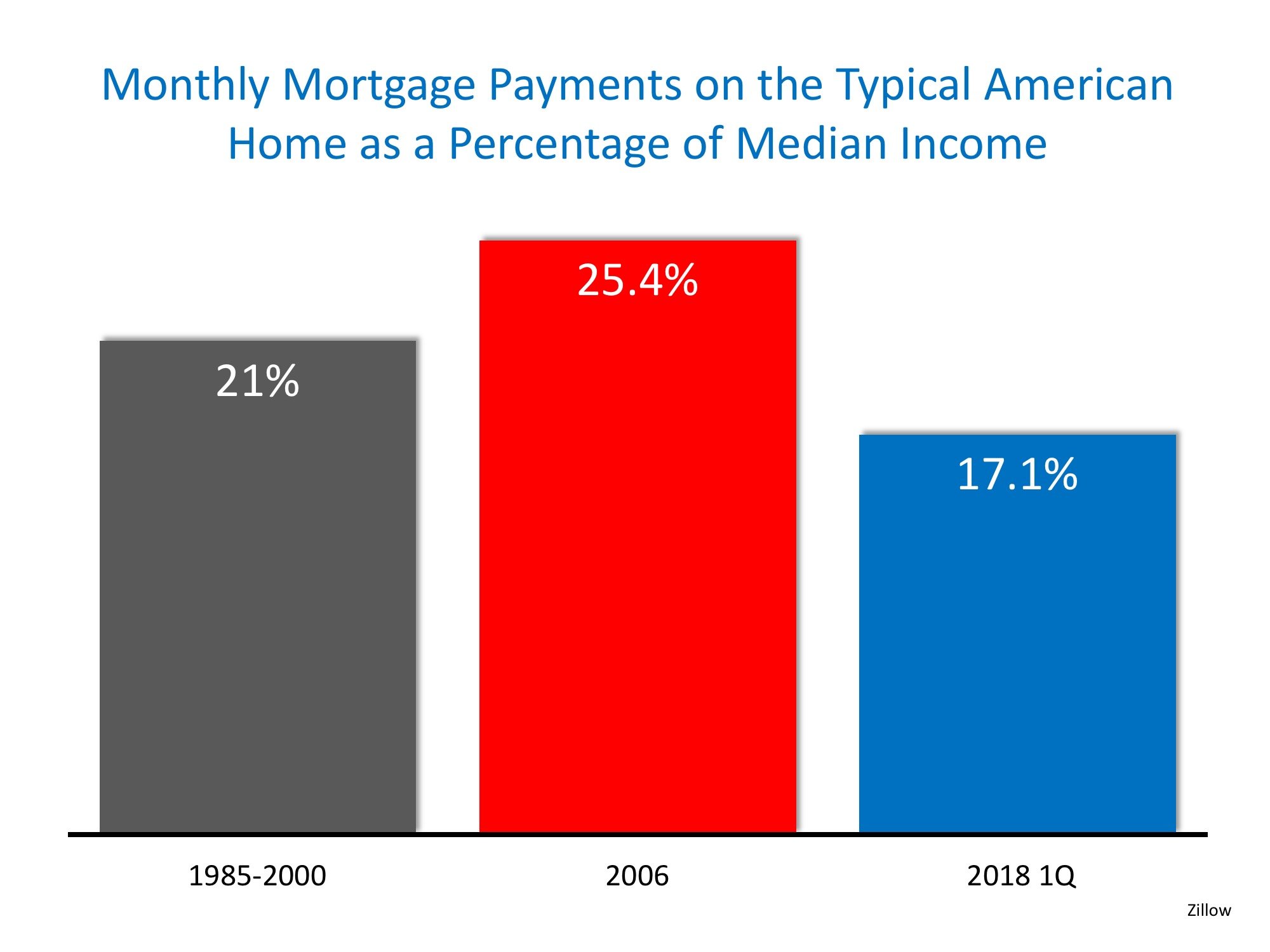

Every borrowers situation is different, but there are at least two schools of thought on how much of your income should be allocated to your mortgage: 28 percent and 36 percent.

The 28 percent rule, which specifies that no more than 28 percent of your income should be spent on your monthly mortgage payment, is a threshold most lenders adhere to, explains Corey Winograd, loan officer and managing director of East Coast Capital Corp., which has offices in New York and Florida.

Most lenders follow the guideline that a borrowers housing payment should not be higher than 28 percent of their pre-tax monthly gross income, says Winograd. Historically, borrowers who are within the 28 percent threshold generally have been able to comfortably make their monthly housing payments.

This 28 percent cap centers on whats known as the front-end ratio, or the borrowers total housing costs compared to their income.

The 36 percent model is another way to determine how much of your income should go towards your mortgage, and can be used in conjunction with the 28 percent rule. With this method, no more than 36 percent of your monthly income should be allocated to your debt, including your mortgage and other obligations like auto or student loans and credit card payments. This percentage is known as the back-end ratio or your debt-to-income ratio.

Most responsible lenders follow a 36 percent back-end DTI ratio model, unless there are compensating factors, Winograd says.

Recommended Reading: Chase Mortgage Recast Fee

How Much Can I Afford To Spend On My Mortgage

A mortgage payment can take a major bite out of your paycheck. To decide how much mortgage you can afford, you must look beyond the total income you and your partner earn each month. Most mortgage lenders will decide how much mortgage you can afford based on a percentage of your income, so you should start there as well.

TL DR

A good rule of thumb when considering how much of your income should go toward your mortgage is 28 percent of your gross income.

Improve Your Credit Score

Your credit score is directly tied to the interest rate you receive on a loanthe higher your score, the lower the rate, the lower your payment.

One of the quickest ways to improve your credit score is to pay down your credit card debt. Try to get your total balances below 15% of your credit limits.

Don’t Miss: Rocket Mortgage Conventional Loan

Calculate Your Monthly Income

The first thing you need to do is to calculate your monthly income. A mortgage broker will usually look at your gross monthly income, or your income before taxes. If you are self-employed or work on commission, a broker may look at your adjusted gross income based on your tax returns. When calculating your income, a broker will usually review your past two years of W-2s and determine the average earned over these two years.

Example:

2015 $90,0002016 $98,000

Most brokers would compute this as an income of $94,000 per year, or $7,833 a month.

Example : Jill And Joe New Parents

Finally, lets examine Jill and Joes living situation. These two mid-30s professionals live in Houston, Texas and are new parents. Jill works in marketing with an annual salary of $75,000, while Joe is a teacher who brings in about $55,000 each year. While they have healthy salaries for the Houston area, monthly daycare costs of $800 each month as well as Jills minimum $500 student loan payment eat up quite a bit of their monthly income.

The couple can afford to spend almost $1,700 on rent each month if they so choose. However, given that the average rent in Houston is about $1,340 a month for a two-bedroom apartment, the couple could easily find a place to live that costs less than their maximum housing budget and instead put the extra money toward paying off Jills debt, saving for a new house, or increasing their retirement nest egg.

Read Also: 10 Year Treasury Yield And Mortgage Rates

What Is Mortgage Affordability

Mortgage affordability refers to how much youâre able to borrow, based on your current income, debt, and living expenses. Itâs essentially your purchasing power when buying a home. The higher your mortgage affordability, the more expensive a home you can afford to purchase.

The term âaffordabilityâ is also used to describe overall housing affordability, which has more to do with the cost of living in a particular city. If the cost of housing relative to the average income in a city is high, it will be seen as a less affordable place to live. The two terms are related, but itâs important to understand the difference.

There are many factors that will affect the maximum mortgage you can afford to borrowincluding the household income of the applicants purchasing the home, the personal monthly expenses of those applicants , and the expenses associated with owning a home .

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you have a VA loan and pay the funding fee upfront.

You May Like: 10 Year Treasury Vs Mortgage Rates

How Much House Can You Afford The 28/36 Rule Will Help You Decide

You found your dream home, but can you safely afford it? Before you commit to the biggest financial decision of your life, consider the 28/36 rule.

The rule is used by lenders to determine what you can afford, according to Ramit Sethi, best-selling author of I Will Teach You to Be Rich.

Its used by lenders, but its also a really helpful tool for us as individuals to decide how much debt we can afford, Sethi tells NBC News.

The rule is simple. When considering a mortgage, make sure your:

- maximum household expenses wont exceed 28 percent of your gross monthly income

- total household debt doesnt exceed more than 36 percent of your gross monthly income .

In other words, if your maximum household expenses and total household debt are at or lower than 28/36, you should be able to safely afford the home.

Are You Ready To Buy A Home

Do you need help buying a home? Cadence Banks mortgage experts are happy to help. Contact us today to learn about our mortgages and the competitive rates we offer.

This article is provided as a free service to you and is for general informational purposes only. Cadence Bank makes no representations or warranties as to the accuracy, completeness or timeliness of the content in the article. The article is not intended to provide legal, accounting or tax advice and should not be relied upon for such purposes.

Read Also: Bofa Home Loan Navigator

How Much Should My Mortgage Be

The main thing you and your lender should care about isnt the total mortgage amount. Rather, you should focus on monthly mortgage payments and whether you can easily afford them.

Lenders use your debttoincome ratio as a measure of affordability. And they see a 36% DTI as an excellent one.

Ideally, that means your monthly debts including the mortgage payment arent more than 36% of your monthly income. But lenders can be flexible, so if your DTI is a little higher, dont worry.

The trick is finding the right loan amount and mortgage program for your situation. Heres how.

Poor Understanding Of The Costs Of Homeownership

More than the mortgage payment goes into buying a home. It’s a good idea to do research on future household expenses before moving forward with a home purchase so that you’re not surprised in a big way. Many expenses may cost more than you think they will, so the more you know going in, the better you can be prepared. Heres a list of expenses beyond the mortgage to think about:

Read Also: Chase Mortgage Recast

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Acknowledge Debts And Obligations

Not everyone can afford to pay a mortgage that takes up to 28 percent of their income. If you have a lot of debt or other financial obligations, this percentage may be lower than the norm. Credit cards, car payments, student loans, and personal loans can take a good chunk of your income. It is important to consider these debts when determining what percentage of income should go to mortgage. Debts, along with your total mortgage, should account for no more than 36 percent of your gross monthly income.

Don’t Miss: Reverse Mortgage Manufactured Home

Personal Approach To Debt

Some people are uncomfortable with debt and choose to carry minimal amounts and work hard to pay them off quickly. Other people are comparatively very comfortable with debt, seemingly having no problem carrying high balances on credit cards or maxing out home purchases at the top of their budget. How comfortable you are with debt and how much debt you currently have will determine how much home you can afford.

Rule : Consider Your Total Housing Payment Not Just The Mortgage

Most agree that your housing budget should encompass not only your mortgage payment , but also property taxes and all housing-related insurancehomeowners insurance and PMI. To find homeowners insurance, we recommend visiting . Theyre what we call an insurance aggregator, which means they compile all the best rates from around the online marketplace and present you with the best ones.

As for just how big a percentage of your income that housing budget should be? It all depends on whom you ask.

Read Also: How Much Is Mortgage On 1 Million

How Much Income Do I Need For A 400k Mortgage

Can I qualify for a 400k ns required for a 400k mortgage? The down payment on a $400,000 house is $55,600, that is 10 percent of the price. It is recommended that you have an income of at least $8200 and that your payments on your existing debts not exceed $981 per month if you are purchasing a home with a 30-year mortgage.

The Conservative Model: 25% Of After

On the flip side, debt-hating Dave Ramsey wants your housing payment to be no more than 25% of your take-home income.

Your mortgage payment should not be more than 25% of your take-home pay and you should get a 15-year or less, fixed-rate mortgage Now, you can probably qualify for a much larger loan than what 25% of your take-home pay would give you. But its really not wise to spend more on a house because then you will be what I call house poor. Too much of your income would be going out in payments, and it will put a strain on the rest of your budget so you wouldnt be saving and paying cash for furniture, cars, and education.

Notice that Ramsey says 25% of your take-home income while lenders are saying 35% of your pretax income. Thats a huge difference! Ramsey also recommends 15-year mortgages in a world where most buyers take 30-year mortgages. This is what Id call conservative.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

Figure Out 25% Of Your Take

Lets say you earn $5,000 a month . According to the 25% rule we mentioned earlier, that means your monthly house payment should be no more than $1,250.

Stick to that number and youll have plenty of room in your budget to tackle other financial goals like home maintenance and investing for retirement.

Formula For Buying A House

Your mortgage payment may consist of a few different factors:

- Principal and interest on your loan

- Property taxes

- Private mortgage insurance

- HOA fees

Say you’re buying a $250,000 home and are making a 20% down payment. Let’s also assume you’re getting a 30-year fixed mortgage at 3.7% interest. Your total monthly payment in that scenario will be $1,218, broken down as follows:

- Principal and interest – $920

- Property taxes – $210

- Homeowners insurance – $88

- Private mortgage insurance – $0

- HOA fees – $0

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.