How Do I Know If My Mortgage Will Be Approved

There are a whole multitude of different variables considered when you apply for a mortgage. The outcome of your mortgage application depends on proof of income, your financial commitments, and your credit rating/credit history.

A broker can help assess whether your mortgage request is likely to be approved by lenders. They will also be able to make a recommendation of the type of mortgage products that might be best for you. Finally, they can also give you a mortgage in principle.

Why Is It Important To Get Pre

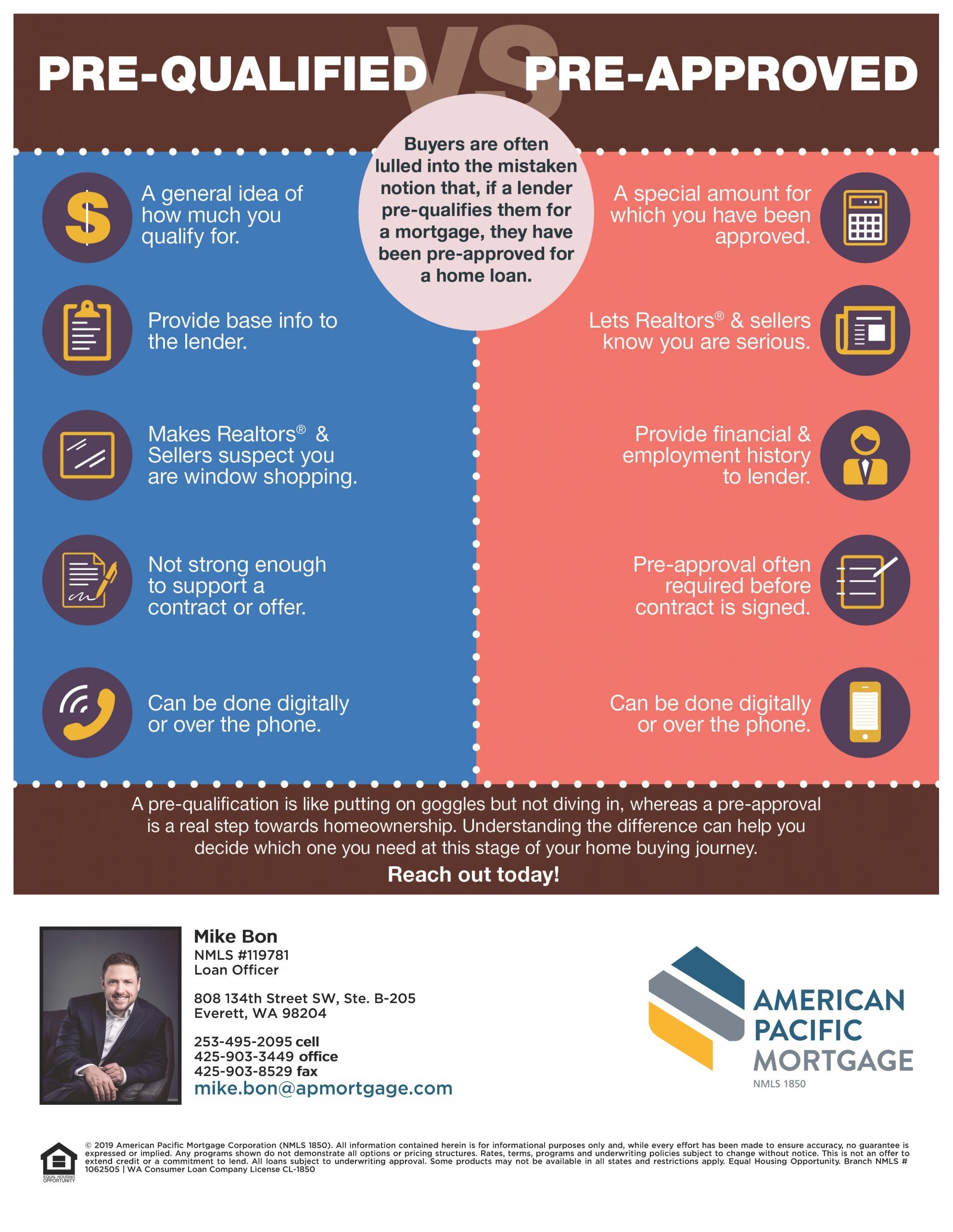

Getting pre-approved for a mortgage gives a person bargaining power since they have mortgage financing already lined up and can therefore make an offer to the seller of a home in which they are interested. Otherwise the prospective buyer would have to go out and apply for a mortgage before making an offer and potentially lose the opportunity to bid on a home.

What You Need To Know About Cmhc

Written By: of Bridgewell Real Estate GroupIf youre looking for a realtor to help you purchase a property, !

Canada Mortgage and Housing Corporation is a mortgage insurer for mortgage loans that are considered high ratio, or have down payments of less than 20%.

We discuss the common question: How long does it take for CMHC approval?

This blog also discuss what a mortgage insurance premium is, and important details about CMHC approvals and turnaround times.

Read for details on how long it takes to get CMHC approval a mortgage in BC.

Recommended Reading: Recast Mortgage Chase

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

How Long Does Prequalification Or Preapproval Take

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time. You should receive your preapproval letter within 10 business days after youve provided all requested information.

You May Like: Rocket Mortgage Vs Bank

Two Types Of Dti Ratios

- Front-end DTI: This is the portion of your income that pays for all housing costs. It includes monthly mortgage payments, property taxes, homeowners insurance, etc.

- Back-end DTI: This is the portion of your income that pays for housing expenses together with all your other debts. It includes your car loan, student loan, credit card debts, personal loan, etc.

Furthermore, expect conventional mortgages to have different DTI limits from government-backed loans. Lets review the different types of mortgages below.

Most homebuyers generally choose conventional loans, which are not directly financed by the government. Conventional loans are usually packaged into mortgage-backed securities that are guaranteed by Fannie Mae and Freddie Mac. These are available through private lenders such as banks, credit unions, and mortgage companies.

How Long Does It Take To Buy A House

Everyones path to homeownership is different. Sometimes, its straight and smooth other times, it curves, takes a detour or comes riddled with bumps and obstructions. Buying a home involves business and financial transactions, but its a deeply personal process as well. Thats why no two buying experiences are the same, and neither are their timelines.

While the amount of time it takes to close on a house varies by person and by state, it generally takes 30 60 days from start to finish. If youre looking for an exact number, according to Ellie Maes October 2019 Report, its 47 days. This reflects the average time from loan application to funding for three common types of loans. Broken down even more, thats 47 days for an FHA loan, 46 days for a Conventional loan and 49 days for a VA loan. Of course, that average is for the transactional processes of the home buying experience. Whats not included is the more personal stuff, like how long it takes to choose an agent or find the home. Both of these steps can prolong the process and are what makes the length of time to purchase a home so unique to each home buyer.

How Long To Buy A Home?

|

Action |

Average Amount Of Days To Complete |

|

Get preapproved |

|

|

About 47 days |

Don’t Miss: Reverse Mortgage Manufactured Home

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

What Can I Do To Accelerate My Application

Most people asking how long does it take understandably just want to move in as soon as they can.However, there is no set way to speed up how long it takes. That said, there are a few things you can do to try and make the mortgage application process quicker:

- Get mortgage advice from a mortgage broker. A mortgage broker helps ensure you get your mortgage application right, first time. This reduces your chances of errors and having to reapply.

- Being prepared for your appointment with your mortgage broker. To speed up the process further, go to your mortgage broker prepared. Take all the documents they will want to see, such as bank statements for proof of income and current address.

- Get a mortgage agreement in principle.

Another helpful tip is to start applying for mortgages before you start serious property hunting. This saves time, since it shows you what you can afford/borrow. It also means that the process of buying your new place is not delayed due to complications in getting a mortgage.

“A mortgage broker can give invaluable mortgage advice when buying a home. Their service can be especially important if you are a first time buyer, or want to speed up the process of getting a mortgage.”

Help & Advice

Also Check: How Does Rocket Mortgage Work

Borrower Requirements Vary By Home Loan Type

You might think buying a home isnt a feasible goal because you dont have an 800 credit score or thousands of dollars in the bank. However, its possible to be approved for a mortgage loan with less-than-excellent credit and you dont even have to drain your savings to offer a down payment.

Owning a home might be a real possibility, even if you worry you wouldnt qualify. If homeownership is a dream of yours, start by investigating your loan options.

How Long Is A Mortgage Offer Valid

An offer for a property can be valid for different lengths of time, based on a number of factors. One key determining factor is whether you are applying for a remortgage, or just a standard mortgage.

Another thing that impacts how long the offer on your property is valid is the terms and conditions of your lenders mortgages.

For example, one lender might give you 6 months from the date you submit your forms, whilst another might give you 6 months from the date the mortgage on your property is approved.

Remember, if you think you are going to run out of time ask your lender to extend the offer on your property sooner rather than later.

Recommended Reading: Reverse Mortgage For Mobile Homes

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Ready to prequalify or apply? Get started

Does The Process Differ For Buy To Let Mortgages

If you are looking at purchasing a property as a buy to let property then you might need to give additional details during your application. However, if you are prepared this wont necessarily lengthen the process.

The main additional detail you need to give for a buy to let mortgage is the rent you expect to receive. This forms part of your affordability assessment. You will need to do this even if you are just wanting to remortgage your current buy to let mortgage.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

Can I Get A Mortgage If I Just Started A New Job

You can get a mortgage even if you’re just starting your career: You don’t always need years and years of work experience in order to get a home loan approved. Sometimes, a lender will approve you on the strength of a job offer alone especially for highearning positions like physicians and lawyers.

What Time On Completion Day Will I Be Able To Pick Up The Keys

Youve learnt how long does a mortgage take but when can you expect to actually get your keys. This really depends on where you are in the chain and how long the chain is. If you are a buyer who is purchasing an empty property, then the completion will be quick and there is no reason why it cant be before lunchtime.

The higher you are up the chain, the later in the day it is likely to be. When the chain is very long completion can be as late in the day as 4pm.

You May Like: How Much Is Mortgage On 1 Million

Finding Your New Home

The time it takes to find your new home will depend on several factors, including:

The market. If its a buyers market and there are more homes for sale than there are buyers, you may have an easier time finding a home. There are plenty of houses available for you to choose from and you may be able to negotiate a lower price. If its a sellers market meaning theres more demand it may take more time to find the home you want since the pickings are slim and sellers can ask for higher prices.

The location of the home. If you want to find a home in a highly sought-after location, competition can be fierce. And if the average sale price is more than you can afford, you may have to wait some time until a home within your budget goes up for sale.

Your criteria. If you have very specific ideas about your home and are adamant about getting all of your must-haves and avoiding all of the deal-breakers, it may take more time. The more specific and less flexible you are about what you want in a home, the more you limit your search pool. On the other hand, if you have no idea what you want, it may be hard to find and commit to a home that makes you happy.

Your schedule. If youre really busy and can only go to showings on the weekends, it may take you longer to find a home simply because you have limited time to search for one.

The Advantages Of Paying 20% Down

- Improves your chances of loan approval: Paying 20% down lowers risk for lenders. A larger down payment also makes you look like a more financially responsible consumer. This gives you better chances of qualifying for a mortgage.

- Helps lower your interest rate: Paying 20% down decreases your loan-to-value ratio to 80%. LTV is an indicator which measures your loan amount against the value of the secured property. With a lower LTV ratio, you can obtain a lower interest rate for your mortgage. This will help you gain interest savings over the life of your loan.

- Reduces your monthly payment: A large down payment also significantly decreases your monthly mortgage payments. Though you spend more now, having lower monthly payments will make your budget more manageable. This gives you room to save extra money for emergency funds, retirement savings, or other worthwhile investments.

- Helps build home equity faster: Paying 20% down means paying off a larger portion of your loan. This allows you to pay off your mortgage sooner. If you plan to make extra payments on your mortgage, having 20% equity will help speed up this process, allowing you to cut a few years off your loan term.

- Eliminates private mortgage insurance : As mentioned earlier, PMI is an added cost on a conventional loan if you pay less than 20% on your mortgage. Consider paying 20% down to avoid this extra fee.

Know the Closing Costs

Read Also: 10 Year Treasury Yield Mortgage Rates

How Long It Takes To Get A Pre

How long it takes to get a pre-approval depends on the situation and lender. In general, lenders require certain documents to verify your finances such as your W-2s and bank statements as well as identification and employment verification.

Theyll also evaluate your debt-to-income ratio , run a hard credit check to get your credit score, and look for any red flags on your credit report.

Some of the factors that can impact how long it takes to get pre-approved include:

- How long it takes you to gather supporting documents

- Whether there are mistakes on your credit report that need to be fixed

- Your employment status

- Unusual circumstances involved with your assets

Tip:

Having all of the required documents on hand before you start can also help speed up the process.

Ready to get pre-approved?

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

Shop Around Among Different Lenders

While these factors are considered by all mortgage lenders, different lenders do have different rules for who exactly can qualify for financing.

Be sure to explore all of your options for different kinds of loans and to shop around among mortgage lenders so you can find a loan you can qualify for at the best rate possible given your financial situation.

Recommended Reading: Reverse Mortgage On Condo

How Long Does It Take To Complete The Mortgage Application

After you have received an agreement in principle, you can begin the second part of the mortgage application.

When putting in an offer to buy a property, you will usually show the seller proof of your mortgage in principle as evidence that you should be able to complete the process.

However, once the offer is accepted, there is usually a long process to carry out the purchase and finally be able to move in.

Is It Possible To Speed Up The Mortgage Application Process

A mortgage broker can really help with the mortgage process as they will be familiar with all of the latest deals on the market, and the ones you are most likely to be accepted for. This will save you a considerable amount of time as you wont have to research for the deals that are best suited to your circumstances.

Your broker will also help you to fill in your application forms and let you know what documentation you need to complete the process quickly. Furthermore, they will handle the submitting of the application and liaising with your solicitor to get the whole process moving much quicker.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

How Many Preapproval Letters Should You Get

While you can get multiple preapproval letters, it can be harmful to your credit score. Since lenders run a credit check to make a letter, it creates a hard inquiry on your credit report. A hard inquiry can decrease your credit score by several points, and too many inquiries can be a red flag to future lenders.

There is a grace period, however. If you apply for preapproval with multiple mortgage lenders in 14 days or less, it will show up only as one hard credit pull on your credit report. So, when youre shopping around, dont wait several weeks between applications. Do them all at once to lessen the impact on your credit score.