How To Calculate Your Piti Correctly

You can use a calculator to easily estimate your PITI payment online.

The number you get wont be exact, because mortgage rates change every day, and your taxes and insurance will likely be estimated. But this will be a close enough figure to start budgeting for homeownership.

Calculating your P& I payment

The first two parts of your PITI principal and interest are easiest to estimate.

You can find todays mortgage rates online. And when you use a calculator, your principal and interest payments will be automatically calculated based on the loan amount.

Calculating property taxes

Figuring out your taxes and insurance is a little more involved.

To estimate your property taxes, youll need to know the homes value and local tax rate.

You may already know the homes value if you have your eye on a property. But you can also check public records online. And tax rates can be found on your local tax assessor or municipality website.

See this helpful article on calculating your property taxes for more.

Calculating homeowners insurance

To find out what your homeowners insurance premium will be, estimate 0.25% of the purchase price. This will yield an estimate which is likely in the ballpark of your actual premium.

But it could be way off too. If you have a property address, get a quote from the insurance agent that insures your car.

Next, divide the annual rate by the 12 to estimate your monthly homeowners insurance cost.

HOA dues & home warranties

Read More On Mortgages:

- Which reverse mortgage is right for me?Two lenders in Canada offer reverse mortgagesand while their offerings are similar in many ways, there are key differences you should understand if youre considering one. How much can you borrow? What rates do they charge? Can you pay back the loan at any time? Read on for answers.

Obama To Direct Fha To Cut Home Loan Insurance Premiums

Youll need PMI if you have a standard home loan one not ensured by the government whenever you borrow with less than a 20% down payment. PMI generally is required for traditional loans when the homebuyer makes a deposit of less than 20 percent. The Tax Relief and Health Care Act first presented the home loan insurance coverage deduction in 2006. Many real estate analysts had actually anticipated the cut to be challenged. There are indeed FHA lending institutions that decrease to 550, though you still need other characteristics like earnings and task to get authorized. Many aspiring homeowners, especially first-time buyers, simply cannot manage to put down 20% on a home. Its often offered through banks and home mortgage lenders. Our house evaluated at $157,000, we acquire for $135,000 and our loan quantity was for $128,500 .

You May Like: How Does Rocket Mortgage Work

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Shop Quickly Review Slowly

Mortgage pricing changes continuously, like stocks, bonds and other financial products.

This means a rate quote from Lender A on Monday morning cant reliably be compared with one from Lender B on Tuesday afternoon. Round up your quotes quickly so that youre making valid comparisons, then take your time reviewing offers.

Mortgage shopping does not have to be a tedious process. Getting written quotes from just three lenders is usually sufficient.

Also Check: Is 3.99 A Good Mortgage Rate

Also Check: Reverse Mortgage For Mobile Homes

What Is Your Principal Payment

The principal is the amount of money you borrow when you originally take out your home loan. To calculate your mortgage principal, simply subtract your down payment from your homes final selling price.

For example, lets say that you buy a home for $300,000 with a 20% down payment. In this instance, youd put $60,000 down on your loan. Your mortgage lender would then cover the cost of the remaining amount on the loan, which is $240,000. In this case, your principal balance would be $240,000.

Your principal is the most important factor in deciding how much home you can afford. The principal you borrow accumulates interest as soon as you take it out.

If you arent sure how much home you can afford, a good place to begin is with our mortgage calculator. Simply enter your purchase price, down payment and a few other factors. The calculator will then give you a rough estimate of your monthly mortgage payment. When deciding on a mortgage payment thats in your comfort zone, dont forget that youre also responsible for maintenance, repairs, insurance, taxes and more.

What Is An Interest

Interest-only payments do not contain the principal. Many of the interest-only mortgages available today feature an option for interest-only payments. Here is an example:

- $200,000 loan, bearing interest at 6.5%. Amortized payments for a 30-year loan would be $1,254 per month, containing principal and interest.

- An interest-only payment is $1,083.

- The difference between a P& I payment and an interest payment is a savings of $170 per month.

You May Like: How Much Is Mortgage On 1 Million

Interest Only Versus Principal And Interest Calculator

Confused?

Try the to work out the costs of just paying interest only and whether it makes sense for your long term financial goals.

Bear in mind that the calculator only provides dollar figure savings when comparing interest only loans to P& I repayments over a 30-year term.

How you use the savings is the key to making the right decision so speak to your mortgage broker and get financial advice.

Examples Of P& i Payment In A Sentence

Loan Modifications Numeric Decimal 0.075 9.999999 Modified Loans Only > = 0 to < = 1 150 Pre-Modification P& I Payment Scheduled Total Principal And Interest Payment Amount Preceding The Modification Effective Payment Date or if servicer is no longer advancing P& I, the payment that would be in effect if the loan were current.

For Initial Interest ARM PCs, the lowest interest rate of the Mortgages in an ARM PC pool having the same Component Coupon Adjustment Date and Component First P& I Payment Date, net of servicing, management and guarantee fees.

For Initial Interest ARM PCs, the lowest lifetime ceiling of the Mortgages in an ARM PC pool having the same Component Coupon Adjustment Date and Component First P& I Payment Date, net of servicing, management and guarantee fees.

For Initial Interest ARM PCs, the weighted average of the interest rates of the Mortgages in an ARM PC pool having the same Component Coupon Adjustment Date and Component First P& I Payment Date, net of servicing, management and guarantee fees.

For Initial Interest ARM PCs, the highest lifetime ceiling of the Mortgages in an ARM PC pool having the same Component Coupon Adjustment Date and Component First P& I Payment Date, net of servicing, management and guarantee fees.

For Initial Interest ARM PCs, the highest Mortgage Margin in an ARM PC pool having the same Component Coupon Adjustment Date and Component First P& I Payment Date, net of servicing, management and guarantee fees.

Don’t Miss: Mortgage Rates Based On 10 Year Treasury

Who Would Benefit

Interest-only mortgages are beneficial for first-time home buyers. Many new homeowners struggle during the first year of ownership because they are not accustomed to paying mortgage payments, which are generally higher than rental payments.

An interest-only mortgage does not require that the homeowner pay an interest-only payment. What it does do is give the borrower the OPTION to pay a lower payment during the early years of the loan. If a homeowner faces an unexpected bill — say, the water heater needs to be replaced — that could cost the owner $500 or more. By exercising the option that month to pay a lower payment, that option can help to balance the home owner’s budget.

Buyers whose income fluctuate because of earning commissions, for example, instead of a flat salary, also benefit from an interest-only mortgage option. These borrowers often pay interest-only payments during slim months and pay extra toward the principal when bonuses or commissions are received.

Can You Pay Extra

Yes you can pay extra, but there may be fees associated with early pay off.

Check your loan documents for a clause called pre-payment penalty. It will tell you up to how much of your loan balance you can pay off each year without incurring a fee.

You may be able to send additional towards principal and even towards your escrow account. If youre like me, you like paying nice whole amounts each month and those extra few dollars and cents here and there can add up.

As we mentioned in a previous article about private mortgage insurance, paying extra towards principal may even help get the private mortgage insurance removed from your loan sooner.

If your mortgage payment changes due to increases in taxes and insurance, youll receive a letter before the changes occur so that you can adjust your budget accordingly.

Read Also: Does Rocket Mortgage Service Their Own Loans

Fixed Vs Adjustable Rates

When you have a fixed-rate mortgage meaning one in which your interest rate is locked in for the life of the loan your P& I payment will never change. If it’s, say, $1,200 at the start, it will be $1,200 at the end. The only difference is that the first payment might be $100 in principal and $1,100 in interest, while the last payment might be $1,180 in principal and $20 in interest.

If you have an adjustable-rate mortgage, however, your interest rate can rise and fall according to conditions in the market. Whenever your rate changes, your lender will recalculate your P& I payment based on the new interest rate. That new payment will then stay consistent until your rate changes again.

How Will The Changes Impact You

Regardless of whether you are a property investor with an interest-only home loan, or you have been thinking about buying an investment property in the not-too-distant future, you may be wondering how the recent spate of changes to interest-only loans will affect you.

The good news is, it shouldn’t affect you adversely. While some lenders have made some significant changes to their interest-only pricing and policy, others are more than happy to offer this type of product.

Your Mortgage Broker can talk you through your options and help you find the right loan and lender for your needs.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

What Is Interest

Interest is simply just the rate at which you are borrowing the money from the bank. Youre paying the bank to borrow their money that is how the bank is compensated.

The higher risk you are, meaning the lower you are, the higher the rate that the bank needs to make in order to compensate themselves for taking on risk. In other words you are going to get a higher interest rate on your mortgage.

So, higher risk, higher rate, lower risk, lower rate. The better your is going to be.

What Is A Fixed

A fixed-rate mortgage is a home loan that has the same interest rate for the life of the loan. This means your monthly principal and interest payment will stay the same. The proportion of how much of your payment goes toward interest and principal will change each month due to amortization. Each month, a little more of your payment goes toward principal and a little less goes toward interest.

Don’t Miss: Reverse Mortgage Manufactured Home

So What Is A Mortgage

Unlike a normal loan, a mortgage is specifically tied to the house youre buying. You usually borrow a percentage of the value of that property repaying the amount you borrowed plus the interest charged by the mortgage lender. If you fail to repay your mortgage then your house could be taken away and sold to cover the loan taken out.

When youre buying a house for yourself their are two main types of mortgage to choose from.

How To Use This Mortgage Payment Calculator

You May Like: Recast Mortgage Chase

Principal And Interest Loans

Making principal and interest repayments helps to trim the principal , as well as the mortgage interest on the home loan. This is a popular choice for owner-occupiers.

A P& I loan can be a competitive choice if you intend to live in the property for a long time. By paying off the capital, you not only increase your own equity stake in the property, but this strategy will result in outright home ownership.

As you pay down the principal, youll simultaneously help to reduce the interest youll pay over the term of the loan. However, if you select a P& I option, your monthly repayments will be higher than if you make interest-only payments.

What Can Change Your Piti Payment

The type of mortgage you have has an ongoing effect on PITI. If your mortgage has a fixed interest rate, then the principal-and-interest portion of your monthly payment will never change. However, if you have an adjustable-rate mortgage, then your rate can go up and down. When your interest rate changes, the lender will recalculate your monthly payment. If your rate goes up, your payment will rise, too. If your rate drops, so will your payment.

Property taxes and homeowners insurance premiums commonly change from year to year, even if only by a small amount. As a result, your total PITI payment will likely change over time, even if you have a fixed-rate loan.

Also Check: Who Is Rocket Mortgage Owned By

Why Would You Get An Interest

Advantages of Interest-Only Loans That allows borrowers to afford a more expensive home. That only works if the borrower plans to make the higher payments after the introductory period. For example, some increase their income before the intro period is over. Others plan to sell the home before the loan converts.

How To Lower Your Mortgage Payments

Once youve calculated your potential monthly payment and find that you cant afford the mortgage, you have a few options aside from purchasing a less expensive home.

Extending your loan term will reduce the amount you pay each month. For instance, youll make smaller payments with a 30-year fixed mortgage compared to a 15-year loan. You can crunch numbers using our calculator above to see the impact of a 30-year versus 15-year loan on your monthly mortgage payments.

Another option is to make a larger down payment. If you put at least 20% down, you wont have to pay PMI, which lowers your monthly borrowing costs. Plus, borrowers who have higher credit scores and lower debt-to-income ratios tend to qualify for lower interest rates, saving them money on mortgage payments.

Before applying for a loan, check your credit scores and take proactive steps to boost them. You can lower your DTI ratio by paying down existing debt or increasing your income.

Dont forget to shop around with multiple lenders to compare rates and loan terms. Lenders can also help you explore different home loan programs to ensure youre choosing the best loan option for your specific situation.

Don’t Miss: Bofa Home Loan Navigator

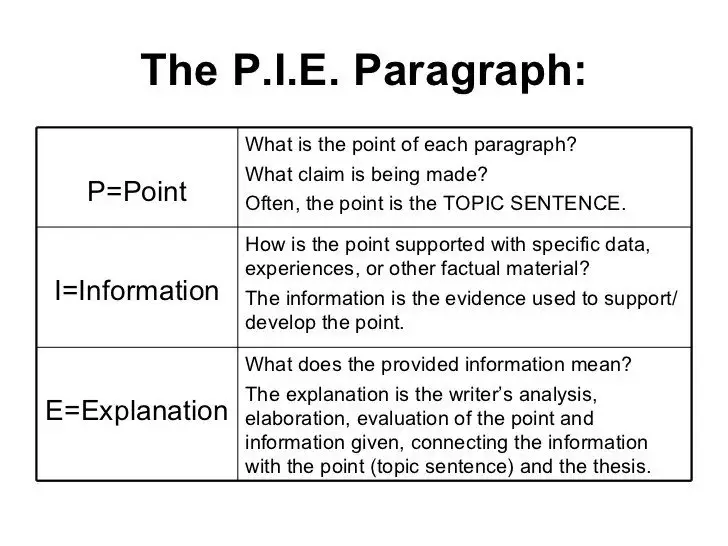

The 4 Factors That Make Up A Home Mortgage P

Lets run through the 4 factors that go into a mortgage payment. If you understand the acronym of P-I-T-I, that simply stands for Principil, Interest, Taxes and Insurance. If youre a real estate investor you know these 4 letters like the back of your hand and if you dont lets run through these very quickly.