What Are Closing Costs And Prepaids

- PART OF OURHome Financing

When buying a home you will need to come up with more money than just the expense of your down payment. There are closing costs and prepaid expenses that you will pay at the time of closing.

These are typically referred to as the closing fees and you will need to pay these fees, along with your down payment. The amount of these costs is different for everyone.

Closing costs include:

- Recording fees

- Home inspections or any other inspections

On average, home buyers can expect to pay between 2 and 3 percent of the purchase price of their home in closing costs. That means if your home costs $200,000, you could expect to pay around $5,000 in closing costs.

Prepaid items are other costs or expenses paid at the closing table.

Prepaid items include:

- First years hazard insurance premium

- Taxes

- Insurance

- Escrow money

- Mortgage Interest this is the interest due from the day you close to the first of the month.

Avoiding closing costs

WHAT CLIENTS SAY ABOUT STEVE

Sorry, we couldn’t find any posts. Please try a different search.

Prepaid Items Are Paid In Advance Of The Due Date

While closing costs are paid when you close on your mortgage, prepaid items are paid in advance of it. For example, mortgage interest is collected so your lender can use it to pay for the first payment of your Kansas City mortgage. By paying these additional amounts every month, your lender will pay for homeowners insurance or property taxes on your behalf out of an escrow account.

The escrow account will help protect the lender by making sure that necessary expenses are paid on time. If you did not pay expenses like property taxes off and you lose your home, the lender would have no collateral.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: What Is The Payoff On My Mortgage

What Are The Estimated Prepaid Items On An Fha Loan

Your monthly mortgage payment can yield tax savings.

You can refinance or buy a home using the Federal Housing Administration’s insurance program if you have low to moderate income or credit challenges. An FHA borrower pays fees to escrow, title and the lender. He must establish an impound account, which the lender requires for tax and insurance payments. The fees, known as closing costs, also include prepaid items such as mortgage interest.

Accounting Entries For Prepaid Expenses And Subsequent Amortization

After understanding the key definitions and different types of prepaid expenses, now it is time to know how to account for the prepaid expenses as well as how to record the amortization.

Following the three examples for the types of prepaid expenses above, the accounting entries at the time of making advance payment and recognizing the amortization expenses are as follow:

You May Like: What Does Conforming Mean In A Mortgage

What’s An Escrow Account

If you put less than 20 percent down on your home, or refinance with less than 20 percent equity, the lender will set up an escrow account. How it works is, you make your mortgage payment each month plus an additional sum to cover property taxes, mortgage insurance and homeowners insurance. The additional money goes into the escrow account and the mortgage company draws from this account to make sure your tax and insurance bills get paid on time. Your lender can ask for a little extra money each month to put into the escrow account as a cushion, up to 1/6 of the yearly total.

You Dont Know What You Dont Know

Its true you dont know if you dont know. We can often forget that not everyone knows what we do, or understands what it takes to close on a home. Great customer service to our clients means that we lay out exactly what is required of them and what they can do about it. It is easy for most people to get overwhelmed when first seeing the cost breakdown for a mortgage loan. Assisting your customers by breaking down the costs of homebuying, prepaid items and closing costs individually can help them understand and feel comfortable in their decision.

If you or your customers have questions about closing costs, please dont hesitate to contact us!

Also Check: What Is A Mortgage Inspection

How Mortgage Escrow Accounts Work

An escrow account is a savings account that the lender sets up to manage your homeowner’s insurance and property tax payments.

If you escrow, the payments you send to the lender each month includes insurance and taxes. The lender deposits the insurance and tax portions into the escrow account. When the bills are due, the lender withdraws money from the account to pay them.

Look at the Payment Calculation on Page 1 of the Loan Estimate to see if your loan requires an escrow and how much the lender plans to put aside each month for insurance and taxes.

Prepaid Homeowners Insurance Premium

Lenders require proof that you have homeowners insurance on the property. Homeowners insurance protects you and the lender in the event of an accident or disaster involving your home.

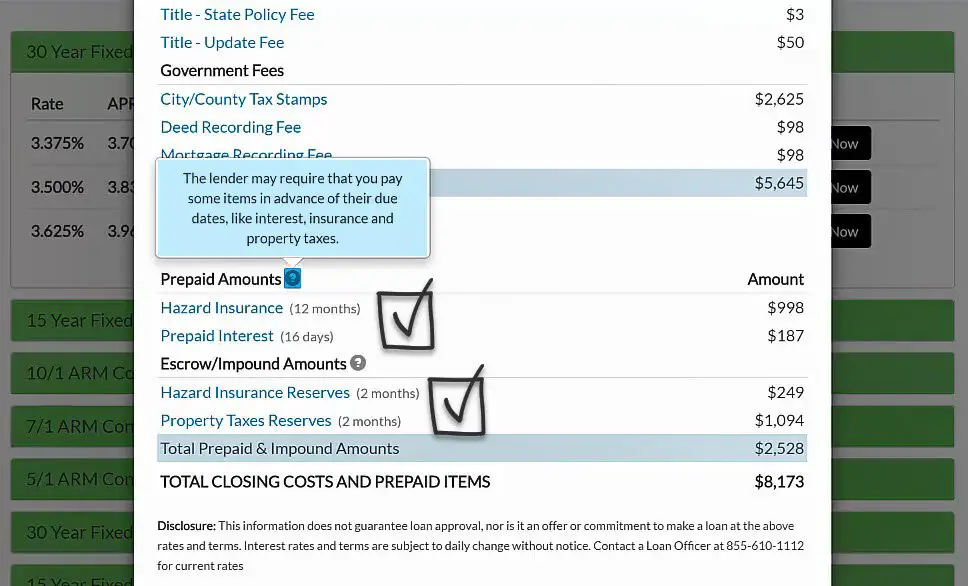

Before you purchase a home, you must buy insurance that covers the property for the next 12-months. In our example, the buyer paid $998 for insurance coverage from October of this year through October of next year.

To satisfy the lender’s requirements for homeowner’s insurance,

- Choose an insurance company. The lender does not.

- Pay the insurance premium for the next 12-months.

- Give the lender evidence of insurance and the paid receipt at least 1-week before you close.

Don’t Miss: How To Go About Getting Pre Approved For A Mortgage

Where To Find Prepaid Items On The Loan Estimate

Lets start by looking at the prepaid items on the Loan Estimate, the form the lender gives you after you apply for a mortgage. At the bottom of Page 1, the Estimated Closing Costs include Other Costs. The prepaid items – the insurance, interest, and taxes that were unraveling today are Other Costs.

Page 2 of the Loan Estimate divides the prepaid items into two sections, Prepaids and Initial Escrow Payment at Closing.

- Prepaids are the Homeowner’s Insurance Premium and the Prepaid Interest.

- Initial Escrow Payment at Closing includes Homeowner’s Insurance and Property Taxes.

How Is Prepaid Mortgage Interest Calculated

Your mortgage payment consists of principal and interest. Principal is applied towards your loan amount and interest is paid to the lender for giving you the loan. Heres where it gets a little tricky interest is paid in arrears. When you make your mortgage payment, the interest is for the previous month. When you make Junes mortgage payment, youre paying Mays interest. However, when you close, there may be a short period of time that needs to be covered and youll pay that as prepaid interest.For example, if you close on April 15 and your first payment is due on June 1, your June payment will cover all of Mays interest. But, what about the interest from April 15 May 1? Youll pay that at closing as a pre-paid.In order to reduce the amount of prepaid interest, youll probably be like most people and try to get a closing as near to the end of a month as possible. Your lender can help you estimate the amount youll need in prepaids so that you can make sure to have the funds available.

Also Check: How Much Would A Million Dollar Mortgage Cost

Prepaid Items: Taxes And Insurance

Typically, one full year of homeowner’s insurance is collected and prepaid to your insurance company at closing. Alternatively, some homeowners choose to pay this amount prior to closing.

An additional cushion for homeowners insurance, along with property taxes, are collected and placed into an escrow account. This is so your new lender can build reserves and have enough to pay those bills when they come due.

What Does Prepaid Mean

Prepaid items are exactly what the name implies – payments made in advance of the monies due to obtain your new loan.

These amounts are often necessary to fund what’s known as an “escrow” or “impound” account for property taxes and insurance. Lenders often require homeowners, especially those with less than 20 percent down, to have escro accounts associated with their mortgage loan. This means homeowners pay an additional amount each month to an account administered by the lender.

An escrow account on behalf of the lender lowers the its risk by making sure the home is protected. No liens for missed taxes should occur, and property insurance coverage protects the lender’s collateral.

Read Also: How To Understand Mortgage Payments

How To Calculate Your Refinance Break

Refinancing is only worth it when you can save more than what you have to spend to refinance. You will break even on the refinancing when the cost to refinance equals the savings you expect to gain. Here’s how to estimate the point at which you break even and beyond.

Use a refinance calculator. Refinance calculators account for the difference in interest costs not just the difference in payment and they can show your true savings even if the new loan has a higher payment than the old one.

Using the quick, dirty, and dangerous way, your refinance might look like this: If it costs $3,500 to refinance, and your new payment is $70 per month less than the old payment, the estimated break-even is 50 months , or four years and two months.

Keep in mind that while the quick, dirty, and dangerous way is easy, it could also lead you to the wrong conclusion. That’s because the difference between your old payment and your new payment does NOT equal true savings some of the difference is the result of stretching out the remaining balance of your loan over a new loan term.

In other words, you pay less each month, but you pay for more months.

What Common Prepaid Costs Can I Expect

Prepaid costs include the homeowners insurance premium, property taxes, and mortgage interest that you pay when you buy a home. As mentioned, prepaid costs would cost the same amount whether or not you have a lender and would be required whether or not you obtain a loan. However, they do increase how much money you’ll need at closing.

Note: Mortgage interest refers to any interest that accrues between your closing date and the end of the month. Remember, mortgages are paid in arrears. That means for buyers, theyd pay less in mortgage interest if they closed at the end of the month compared to the beginning of the month. Buyers have less upfront expenses by selecting a closing date at the beginning of the month because theyll have to pay less interest on their mortgage. However, sellers typically prefer to close at the beginning of the month to receive their sales proceeds more quickly.

Recommended Reading: How Long To Pay Off 70000 Mortgage

What Are Mortgage Prepaid Interest Charges

Prepaid or interim interest represents the cost of borrowing money over the period of time between your mortgage closing date and the date of your first payment. Most mortgage lenders will charge you prorated interest for each day from your closing date until the end of the current month, based on the rate agreed upon for your full term. You can find the exact cost of prepaid interest for your mortgage in the documents that lenders are legally required to provide prior to the closing date.

With the exception of reverse mortgages, all mortgage products include a Loan Estimate and Closing Disclosure that summarize the financial details of your monthly and upfront costs. Both forms include a section listing out the various “prepaids” you’ll need to cover upfront: homeowner’s insurance premiums, property taxes and prepaid interest. While the final cost of prepaid interest depends on your loan amount and mortgage rate, it generally makes up the smallest single item among your prepaid costs.

Can The Seller Pay For Your Prepaids With The Rest Of Your Closing Costs

Maybe. If your sales contract includes language that states that your seller is paying just closing costs, then you cant include prepaids. Its important that you have your contract state both closing costs and prepaids are being taken care of by the seller. Be careful, though, because some loan types put restrictions on how much your seller can cover. Ask your mortgage banker what is acceptable.If you have any questions at all about your closing disclosure or any of the costs associated with your loan, please contact us today.

Recommended Reading: How To Get Approved For Mortgage With Low Income

Understanding Mortgage Discount Points

Discount points can be purchased at the time of the closing to lower the initial interest rate on a home loan. While there is some variation between different loan products, most lenders will allow borrowers to buy down their rate.

For example, if you have a 4% interest rate on a $200,000 mortgage, your monthly mortgage payment would cost roughly $955 per month. If you buy one mortgage discount pointor pay $2,000 upfrontyour interest rate may drop to 3.75%, lowering your monthly payment by roughly $29 per month.

Alternatively, borrowers can take advantage of rebate points, sometimes referred to as negative points, to lower their closing costs. Note that this will result in a higher interest rate.

Just remember, the associated interest rate discounts will vary depending on the real estate market and your mortgage company, so be sure to discuss your lenders point practices before you decide to purchase any points.

Assume you have a 30-year fixed rate mortgage in the amount of $200,000 that includes total fees and costs of $4,000. To determine your total amount due at closing, your rebate or discount points are added or subtracted from your total fees and costs.

Scenario $6,000 $926

How Much Are Closing Costs

In general, closing costs average 1-5% of the loan amount. Though, closing costs vary depending on the loan amount, mortgage type, and the area of the country where youre buying or refinancing.

Below is a list of the most common closing cost description and approximate costs. Everyones situation is different. The best way to get an accurate estimate of your loans costs is after your mortgage application is processed, and you receive an itemized closing cost sheet from your lender.

In this article:

Recommended Reading: How Much Is Average Mortgage Insurance

Prepaid Costs Vs Closing Costs

As we mentioned earlier, there is a difference between prepaid costs and closing costs. We already know that prepaid are upfront costs for the monthly mortgage expenses you will be making. But typically, closing costs are more closely related to originating and closing a mortgage loan. As a result, closing costs are paid to the lender as a fee for processing the loan. Closing costs are also listed on a closing disclosure. Finally, another difference between prepaid costs and closing costs is that the seller may cover the closing costs but the buyer will always pay the prepaids.

Practical Guide To Manage Prepaid Expenses

In practice, there are many prepaid items, thus in order to manage those prepayment properly, accountants or bookkeeping staff shall need to maintain a proper prepayment schedule. When they have proper schedule, it will save a lot of time in managing and recording those amortization expenses.

Below are the basic schedule to maintain the prepaid expenses. For illustration purpose, we just show only from Jan to Jun 2019.

You can take the below schedule as the basis and develop your own schedule as per your need.

Practical Amortization Scheduleof Prepaid Expenses

When we have such schedule, each month we can record the amortization expenses in one transaction together. This way, it will save your time as you will not need to record one by one as per the example above.

Read Also: Can You Apply For A Mortgage Before Finding A House

Prepaid Interest For The Mortgage

Prepaid Interest is mortgage interest you pay to the lender from the day you sign the loan agreement through the last day of the month. For example, the buyer closed on October 28. She prepaid interest for the 4-days left in the month. At $31.17 per day, the prepaid interest cost her $125.

You can lower the amount of money youll need at closing by scheduling the closing date for the end of the month. If the homeowner in our example closed on October 1, she would prepay interest for 31-days, costing her $966. Instead, she closed at the end of the month, prepaid interest for 4-days, and saved $841.