Search Us Home Listings

RBC Bank offers financing for the following types of properties:

- Single family homes

- Condotels with a value of more than $500,000

Get Pre-Approved and know what you can afford!

The following property types are not eligible for financing:

- âFor saleâ properties

- Non-warrantable condominiums

- Working farms, ranches or mixed use properties that represent over 20% of commercial use

- Timeshares

- Manufactured or mobile homes

RBC Bank is uniquely positioned to offer our Canadian clients U.S. dollar credit, including , personal lines of credit and real-estate financing. Thatâs because we will review both your Canadian and U.S. credit profile with all three credit bureaus to qualify you for credit. We will then use the strongest profile when making a decision.

While you donât need to be an existing RBC client to apply for credit, we will review your relationship as part of our determining criteria – and being a client certainly makes it easier to process your mortgage payment.

Know what you can afford before you start shopping. Get Pre-Approved Today!

We finance primary residences, second homes and vacation homes up to 80% of the appraised value of the property, which means you will need to put 20% down. If youâre purchasing for investment purposes, a 25% down payment is required, as we finance up to 75% of the appraised value of an investment property.

Get Pre-Approved to know what you can afford before you start shopping.

Why RBC Bank U.S.?

Canadian Bank Closed Mortgage Prepayment Amounts

RBC has one of the lowest prepayment amounts you can pay at only 10% of your original mortgage amount. For some buyers, this may get in the way of you paying your mortgage off very aggressively, however getting anopen mortgagewhere you can pay the loan off at any time in full may be a better option if this is the case.

Increasing Your Monthly Mortgage Payments

When you establish or renew your RBC Royal Bank mortgage, you can increase the amount of your mortgage payments to shorten your amortization period.

You’ll be surprised to see how much faster you can pay off your mortgage. And the shorter pay-off period can save you thousands of dollars in interest over the life of your mortgage!

During the term of your mortgage, you may be anticipating an increased cash flow that you could use to pay down your mortgage. Once in each 12-month period, you can choose to increase the amount of your mortgage payments by as much as 10%, without administration fees and the increased payment amount goes directly toward reducing your principal. You continue these increased payments for the remainder of the term, unless you wish to increase them again after another 12 months.

If mortgage rates drop, you can take advantage of the opportunities to reduce your amortization period at renewal time. You can simply go on making the same regular payments after you renew at a lower interest rate. Less of your payment will go toward interest, so you’ll be paying off more of the principal â a truly painless way to save money!

Recommended Reading: How Much Is Personal Mortgage Insurance

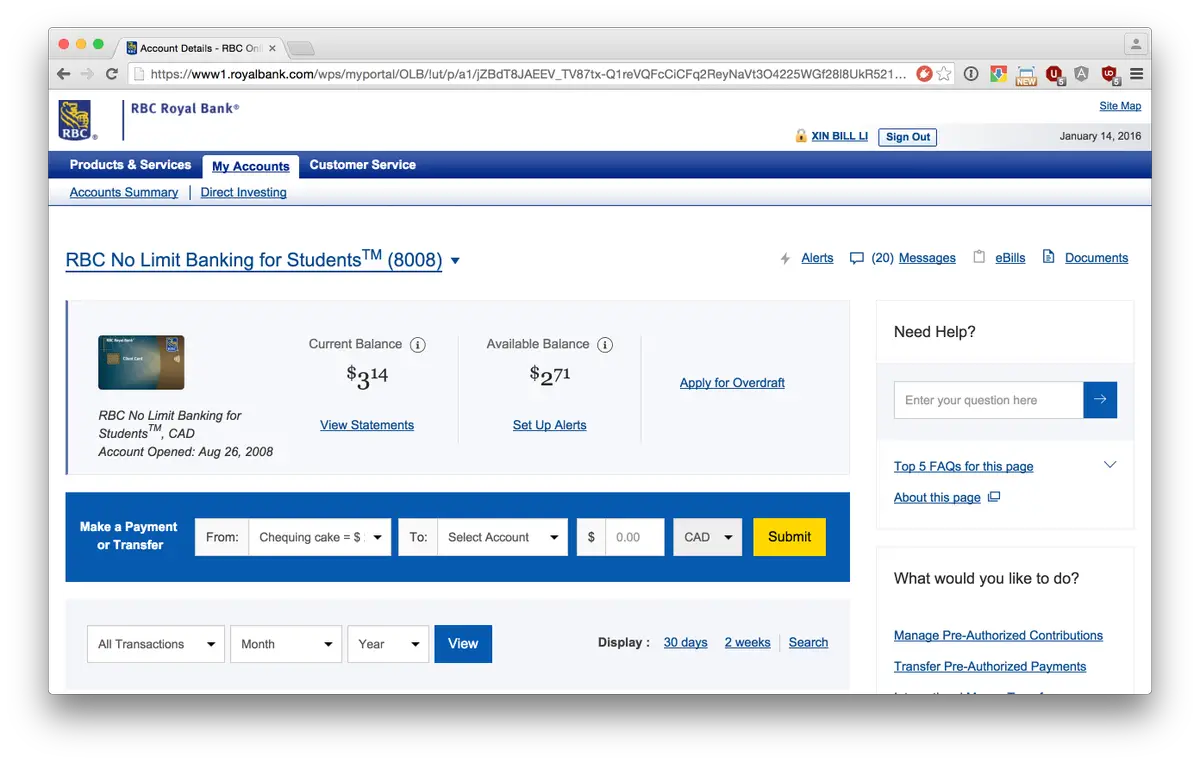

To Skip A Payment Sign Into Rbc Online Banking :

- Sign in to RBC Online Banking

- From the Account Summary page, select your mortgage account.

- Select Skip a Payment all the way at the bottom of the page and follow the instructions.

Skip-a-Payment requests could take up to five days to process. If you are within five days of your regular mortgage payment date, the current payment will be processed, and your next payment may be skipped.

Our financial relief program includes up to 6 months on mortgages. Should you require relief beyond one month, please connect with one of our advisors using our online booking tool for further assistance.

Take Advantage Of Prepayment Privileges

Pay off your home quicker with mortgages that have prepayment privileges. Lenders offer open, closed and convertible mortgages Opens a popup.. Open mortgages usually have higher interest rates than closed mortgages, but they’re more flexible because you can prepay open mortgages, in part or in full, without a prepayment charge. Closed and convertible mortgages often let you make a 10% to 20% prepayment. Your loan agreement explains when you can make a prepayment, so get the details from your lender beforehand. Also, decide which privileges you want before finalizing your mortgage.

Don’t Miss: How To Build A Mortgage Business

Rbc Fixed Mortgage Rates

RBCs fixed mortgage rates help you reduce the risk of future interest rate fluctuations by locking-in a specific interest rate over your whole term. This gives peace of mind to many homeowners without having to worry about your interest rate potentially rising over your term, keeping your monthly principal and interest payments flat throughout. If you are arranging a new mortgage for a future or current home, your fixed interest rate can be guaranteed for up to 120 days before the closing date of your home. If interest rates go up during that time, you will still be guaranteed this lower rate.

Choose Accelerated Weekly Or Accelerated Biweekly Payments

If you switch to an accelerated weekly payment schedule, you’ll increase your mortgage payments from 12 to 52 payments annually a payment every week instead of monthly, and one extra monthly payment every year.

If you switch to an accelerated biweekly payment schedule, youll increase your mortgage payments from 12 to 26 annually a payment every 2 weeks instead of monthly, and one extra monthly payment every year.

Recommended Reading: Can You Refinance A Usda Mortgage

Rbc Variable Mortgage Rates

RBC variable rate mortgages provide you with fixed payments over the mortgage term however, the interest rate will fluctuate with any changes in theprime interest rate. If RBCs prime rate goes down, more of your payment will go towards paying off your principal if RBCs prime rate goes up, more of your payment will go towards interest payments. As a result, this can be a great financial tool for those expectingCanadas interest ratesto fall in the upcoming year.

A convertible mortgage is a variable rate mortgage that will allow you to convert to a fixed rate mortgage at any time. This fixed rate mortgage will be based on the rates your lender is offering at the time you convert it. This feature provides security and flexibility, as it enables you to lock-in a fixed rate longer term if interest rates fall, rise, or stay the same.

| 1.70% | $1,638 |

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

Rbc Self Employed Mortgage

This mortgage offering is tailored specifically for people who own a business or are freelancers. An RBCself-employed mortgagelets you finance up to 80% of the appraised value of your home when refinancing and 90% when purchasing. Additional mortgage insurance may be needed forLoan-to-valuesof higher than 65%.

| 20% with no mortgage insurance, 5% – 19.99% with mortgage insurance. | T1 formfor the last 2 years, financial statements for the last 3 years. | |

| CIBC | 20% with no mortgage insurance, 5% – 19.99% with mortgage insurance. | 2 or 3 years of financial statements, a list of assets and liabilities, article of incorporation . |

| National Bank | Minimum 10% downpayment. | Being self-employed for at least 2 years with proof of 2 years or more of good financial and credit management. |

You May Like: What Is The Monthly Mortgage

Rbc Annual Mortgage Prepayment

You can prepay up to 10% of the original principal amount of your mortgage once in every 12-month period without amortgage penalty. Any additional prepayments over your monthly mortgage payment will go directly to your mortgage principal. Prepaying your mortgage can help you to limit the total amount of interest you will owe during your mortgage term, and helps you repay your mortgage much quicker.

All big 6 banks in Canada offer you the ability to pay down a maximum amount on closed mortgages ranging from 10% to 20% per year of the original principal amount:

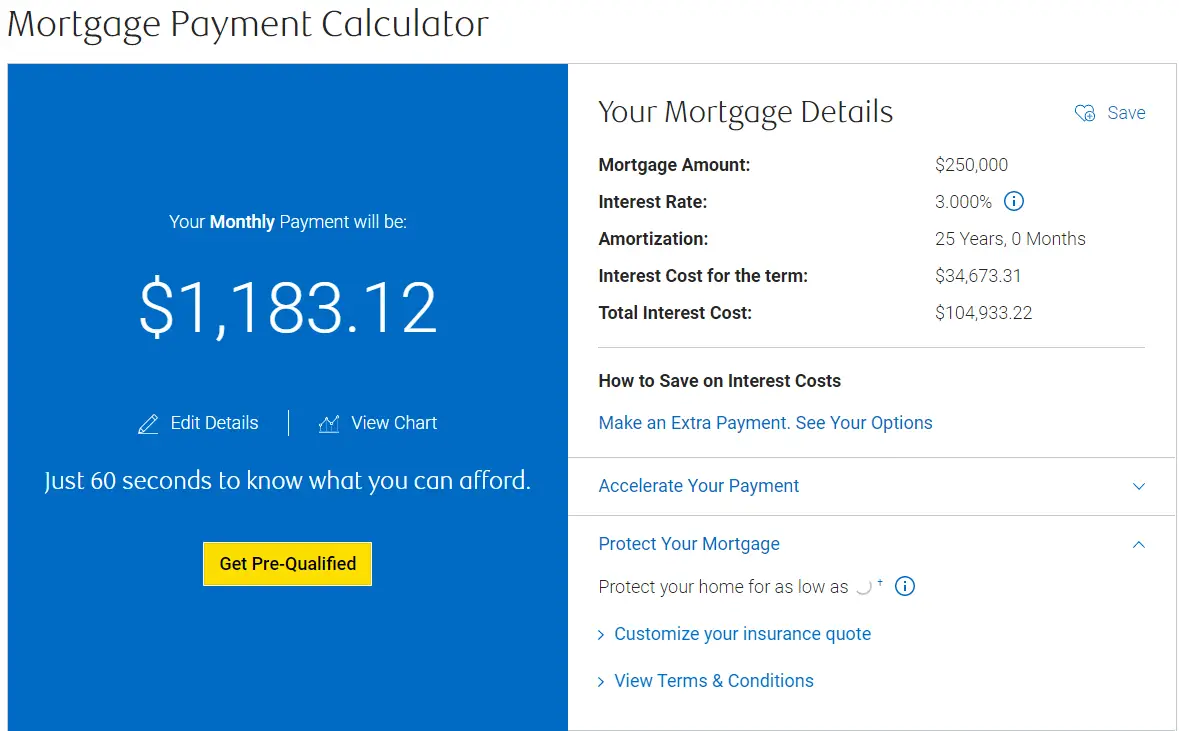

Shorten Your Amortization Period

The amortization period is the length of time it takes to pay off a mortgage, including interest. The shorter the amortization period, the less interest you pay over the life of the mortgage. You can reduce your amortization period by increasing your regular payment amount. Your monthly payments are slightly higher, but you’ll be mortgage-free sooner. Find out how much you could save by shortening your amortization period with our mortgage payment calculator.

Don’t Miss: Who Owns American Pacific Mortgage

Should I Pay Off My Mortgage Or Invest

Investing is one way to raise money for a lump-sum payment. For example, you can invest your money in a tax-free savings account . Then pay a lump sum once your investment grows. Compare rates on your potential investment and your mortgage. If investing offers a higher rate of return than your mortgage, put your money in an investment and watch it grow. If not, put a lump sum on your mortgage instead.

Is The Rbc Homeline Plan Right For You

Your home may be your biggest single investment. An RBC Homeline Plan allows you to invest in other areas of your life that are important to you.

- Home improvements Whether youâre looking to improve the look and feel of your home, repair a leaky roof or replace old appliances, the RBC Homeline Plan can help you boost your homeâs value.

- Education Invest in your future or the future of someone close to you by using your homeâs equity to fund private or post-secondary education.

- Debt consolidation Do you have multiple credit products at high interest rates? Consolidating your debt into a single, lower-interest rate product can save you money and bring you peace of mind.

- Emergency readiness From unexpected job loss to medical expenses to emergency car repairs, an RBC Homeline Plan offers easy access to funds that can help you manage through challenging financial times.

Also Check: How Much Income To Qualify For 200 000 Mortgage

Rbc Cash Back Mortgage

This is a special program that allows you to get up to 7% of your mortgage value, for up to a maximum of $20,000 in cash back. The cash back will be added to your mortgage amount and paid back as part of your mortgage.

The amount of money you will be able to get with a cash back mortgage will depend on your credit history, mortgage terms, mortgage size, income, and if you’re occupying the home or not.

Depending on your home purchase price and your eligibility, you may be able to receive the following amounts in cash back when you purchase:

| Mortgage Amount |

|---|

| $20,000 |

Bank Or Financial Institution

You can pay your property taxes through the bank, credit union or other financial institution you have an account with. When you use your bank or financial institution, we recommend that you always confirm when your payment will be processed by your bank to avoid late payment penalties. For example, banks will often process payments received in the afternoon with the date of the next business day.

There are three ways you can pay your property taxes through your bank or financial institution:

Note: You can no longer make a payment at a financial institution you dont have an account with.

Bill payment service

Most banks and financial institutions offer bill payment services for their clients. Bill payment services can generally be accessed through your online banking account, an automated teller machine , telephone banking or in person with a teller at the financial institution that you bank with.

Note: When you pay in person, you need to set up a bill payment service for Rural Property Taxation before you pay with a teller.

To pay your property taxes using a bill payment service you’ll need to add a payee for Rural Property Taxation to your bank account. To add a new payee to your bank account you need to know our payee name and your folio number.

- Our payee name is PROV BC – RURAL PROPERTY TAX

- Your folio number is listed on your Rural Property Tax Notice. It must be entered without spaces or decimals. For example, 012 34567.890 must be entered as 01234567890

Wire transfer

Recommended Reading: What Should My Mortgage Be

To Pay A Bill In Online Banking:

- From the Accounts Summary page, go to Quick Payments & Transfers on the right side of the page. You can also click on Pay Bills from the information box at the top of the page when viewing your chequing or savings account.

- Select the Amount, the From Account and the recipient in the To field.

- Follow the on-screen instructions.

Manage Your Mortgage Online

Set up a regular overpayment

You can overpay by up to 10% every year. Setting up a regular overpayment could help you pay off your mortgage faster, potentially saving you money on interest payments.

You can set up an overpayment by logging in to Manage my Mortgage online and selecting Make a payment from the My payments section of the My payments and services menu.

You can also change a regular overpayment by logging in to Manage my Mortgage.

Simply select Make a payment from the My payments section of the My payments and services menu and then add the new amount in the amount to overpay field.

Make a lump sum overpayment

Making a one off lump sum overpayment could help reduce your monthly mortgage repayments. That could free up extra funds for something a little more…exciting.

You can set up an overpayment by logging in to Manage My Mortgage and selecting Make a payment from the My payments section of the My payments and services menu.

Change your payment date

You can change your payment date to a day that better suits you. Simply log on to Manage my Mortgage online and select Change payment date from the My payments section of the My payments and services menu.

Change your payment bank account

If you need to update your bank account details, you can do so by logging in to Manage my Mortgage online. Select Change payment account from the My payments section of the My payments and services menu.

Switch to a new rate

Read Also: How To Modify Mortgage Loan

Faqs About The Rbc Homeline Plan

Q. What is a home equity of line of credit?

A home equity line of credit is a revolving line of credit that allows you to borrow the equity in your home, often at a much lower rate than a traditional line of credit. A HELOC cannot exceed more than 65% of the market value of your home, and together with your mortgage cant add up to more than 80% of the market value of your home. RBC Royal Banks home equity line of credit is called the RBC Homeline Plan.

Q. What is the RBC Homeline Plan interest rate?

At RBC, you have the option to go fixed or variable. As of Nov. 23, 2017, the five-year fixed rate for the RBC Homeline Plan is 3.39%. However, the five-year variable rate for this product is RBC Prime + 0%.

Q. What are the details of the plan?

Once you qualify for the RBC Homeline Plan, you can borrow anywhere from $5,000 up to 65% of the value of your home. Again, remember that your total home debt cannot exceed 80% of the value of your home.

Low Down Payment Insured Mortgage

Most lenders now offer insured mortgages for both new and resale homes with lower down payment requirements than conventional mortgages-as low as 5%. Low down payment mortgages must be insured to cover potential default of payment as a result, their carrying costs are higher than a conventional mortgage because they include the insurance premium.

Mortgage default insurance is a one time premium paid when your purchase closes. You can pay the premium or add it to the principal amount of your mortgage. Talk to your mortgage specialist to find out which option is best for you

Also Check: Are Mortgage Rates Going Down Again

Learn How The Rbc Homeline Plan Works

The RBC Homeline Plan combines your RBC Mortgage and Royal Credit Line into one product that allows you to access the equity you have in your home.

As your home equity increases, so does your credit line, giving you the power and flexibility to easily finance your next home improvement project, a family memberâs education or to consolidate debt â all at rates lower than most other borrowing options.

Increase Your Mortgage Payment

Increase the size of your regular mortgage payment to take a large chunk off your mortgage principal. Choose a higher payment amount when you arrange your mortgage, or at any time during the term. This lets you pay down the principal faster.

Example: If you increase your monthly mortgage payment amount by $170 from $830 to $1,000, you’ll save almost $48,000 in interest over the amortization period. And you’ll own your home about 8 years sooner.1

Don’t Miss: Can You Refinance Mortgage Without A Job

Benefits Of Paying Bills With Rbc

RBC provides various way in which you can conveniently pay bills any time of day through RBC Online Banking1 or the RBC Mobile app1. Look here for all your bill payment options.

- 24/7 access to make a payment whenever itâs convenient for you.

- Pay up to 10 bills at one time.

- Set up recurring or postdated payments, so bills get paid automatically.

- Bank with complete confidence, thanks to our RBC Online Banking Security Guarantee2.

- Add a new payee simply by taking a photo of your bill in the RBC Mobile app.

- Pay the wrong amount? Cancel same-day bill payments easily in RBC Online Banking.