Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

What Mortgage Can I Afford On 80k Salary

So, if you make $80,000 a year, you should be looking at homes priced between $240,000 to $320,000. You can further limit this range by figuring out a comfortable monthly mortgage payment. To do this, take your monthly after-tax income, subtract all current debt payments and then multiply that number by 25%.

Also, How much is a $200 000 mortgage per month?

If you take out a $200,000 mortgage payment at 5.000% for 30 years, your monthly mortgage payment would be $1,073.64. The payments on a fixed-rate mortgage dont change over time. The loan amortizes over the repayment period. This means that the proportion of interest paid vs.

Hereof, What salary do I need to afford a 350k house?

How much income do I need for a 350k mortgage? A $350k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $86,331 to qualify for the loan.

Also to know Can I buy a house making 80k a year? The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28% of your gross monthly income . For example, if you and your spouse have a combined annual income of $80,000, your mortgage payment should not exceed $1,866.

What house can I afford on 40k a year?

Take a homebuyer who makes $40,000 a year. The maximum amount for monthly mortgage-related payments at 28% of gross income is $933.

16 Related Questions Answers Found

Read Also: How Much Is Mortgage On 1 Million

Home Affordability By Debttoincome Ratio

Your debttoincome ratio measures your total monthly debts including your mortgage payment against your monthly income. The higher your existing monthly debts, the less youll be able to spend on your mortgage to maintain a healthy DTI.

For example, say you make $50,000 a year and want to stay at a 36% DTI.

In that case, your total debts, including mortgage and any other debt payments cant exceed $1,500. Heres how that affects your home buying budget:

| Annual Income | How Much House You Can Afford |

| $50,000 | |

| $1,000 | $180,406 |

The examples above assume a 3.75% fixed interest rate and 3% down on a 30-year mortgage. Your own rate and monthly payment will vary.

Loan To Value And The Size Of Your Deposit

All mortgages require some form of deposit, but they are not directly linked to how much you could borrow. The loan to value or LTV of your mortgage, means how much the mortgage is in relation to the value of the property. So, if you have a £50,000 deposit for a £200,000 property, the mortgage you need would be £150,000 75% of the property’s worth, or 75% loan-to-value.

Don’t Miss: What Are Current 20 Year Mortgage Rates

How Much House Can I Afford 50k Salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. Thats because salary isnt the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Use A Piggyback Loan To Put 20% Down

Another strategy that could help increase your budget is to finance your home with two different home loans simultaneously. This strategy is known as an 801010 loan or piggyback loan.

An 801010 mortgage means youd get:

- A first mortgage for 80% of the homes cost

- A second mortgage for 10%

- A cash down payment of 10%

This gives you the benefit of having a bigger home buying budget . It also eliminates the need for private mortgage insurance , which is usually required on conventional loans with less than 20% down.

Recommended Reading: How To Transfer A Mortgage To Someone Else

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Can I Get A Mortgage For 150k If Im Self

Your ability to get approved as a self employed borrower depends on a multitude of factors, including your credit history, reliability of income and gross yearly income.

If youre able to prove you have an income and potentially a future income, in the form of contracts, that is enough to repay your mortgage, a lender could be willing to accept your application.

Youll also need:

-

Two or more years’ certified accounts

-

SA302 forms

-

A tax year overview for the past two or three years

Keep in mind that some lenders deem self employed borrowers as higher risk and they can ask for higher deposits.

This isnt always the case but it can be helpful to have a mortgage broker check the market to compare a range of lenders as it may be possible to get a mortgage with a lower deposit requirement.

Also Check: What Is The Going Mortgage Interest Rate

How Do Lenders Determine How Much Mortgage I Qualify For

Before you figure out how much house you can afford, its useful to know how lenders calculate whether you qualify for a mortgage. Mortgage lenders determine your qualification based on your credit score and debt-to-income ratio .

Your DTI enables lenders to evaluate your qualifications by weighing your income against your recurring debts. Based on this number, lenders will decide how much additional debt youll be able to manage when it comes to your mortgage.

To see if youll qualify for a mortgage, you can begin by calculating your DTI:

Once you have calculated your DTI, you can evaluate whether its low enough to get approved for a mortgage. The lower your DTI, the more likely youll get approval.

If your total monthly debt is $650 , and your monthly income is $4,500 before taxes, your DTI would be 14%. A DTI of 14% is quite low, so youd be likely to obtain a mortgage.

Very rarely will mortgage lenders give a loan to an individual whose DTI is above 43%. After calculating your DTI ratio, if you find that its over 43%, youll need to work on lowering it.

How Much Income Is Needed For A 200k Mortgage

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

You May Like: How Much Is A 180k Mortgage Per Month

Where You Want To Buy

When it comes to real estate, its all about location, location, location especially when it comes to what you can afford. Every market and even every neighborhood within a market is different, and you can probably find a variety of price ranges where youre looking.

Its also good to keep in mind the property taxes youll be needing to pay depending on the state or city youre looking in and whether theres any additional home insurance youll need .

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Don’t Miss: How Much Can You Get On A Reverse Mortgage

How Much Deposit Do I Need To Buy A 150000 House

Most UK lenders are asking their borrowers to put down 15 – 20% of the property’s market value, though this certainly isnt always the case as some lenders can still offer advantageous deals.

Having a larger deposit can mean having to save a little longer but it can also make the cost of borrowing cheaper in the long run. Another benefit of having a larger portion of the propertys value as a deposit is that sometimes it can allow you to access a wider range of lenders, who may be more open to lending at lower loan to value rates.

See the table below to learn more about how your deposit size can lower the amount you have to borrow.

|

Property value |

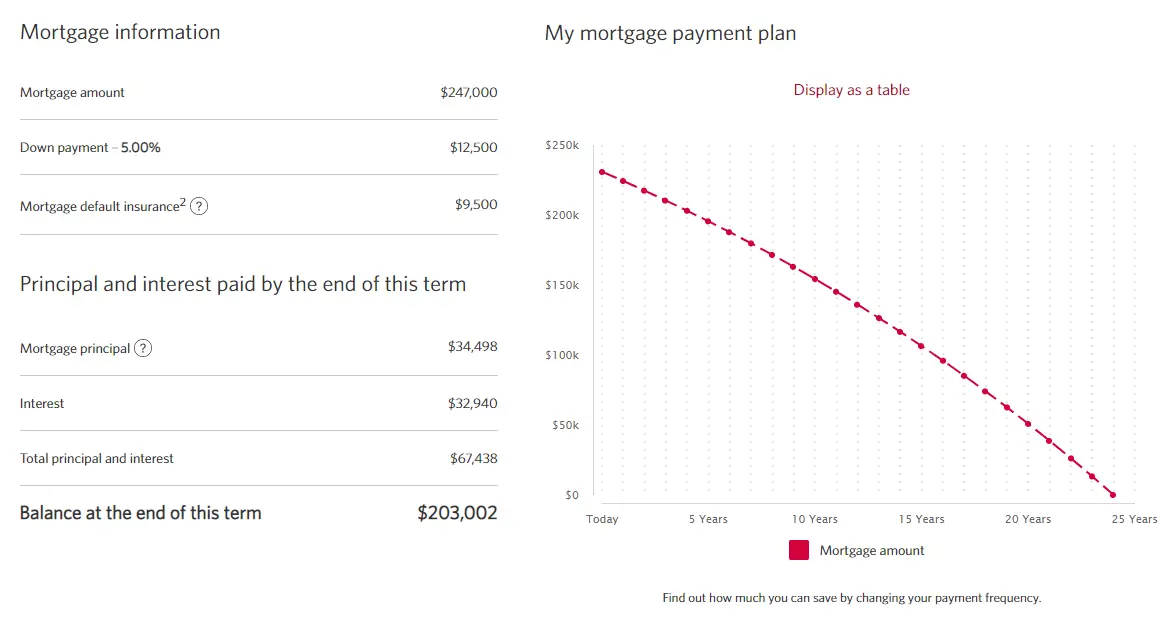

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Also Check: Which Credit Reporting Agency Do Mortgage Lenders Use

What Are The Monthly Repayments

The table below is based on borrowing £150,000 at an interest rate of 3% individual circumstances may affect the rate you can get, but the figures below are designed to give you an indication of the monthly mortgage payment you could expect over different loan terms.

| Loan Term | |

|---|---|

| £632 | £375 |

The above table is for comparative purposes only. You should talk to your lender or broker for the most up-to-date information for your circumstances.

Talk To An Expert Mortgage Broker

If want to speak to an expert for the right advice, call 0808 189 2301 or make an enquiry. Well match you with one of the whole-of-market brokers we work with. They will be able to answer your questions and help you find the right mortgage at the best available rate based on your specific circumstances. The service we offer is free, theres no obligation and we wont leave a mark on your credit rating.

Also Check: How To Get A Mortgage After Chapter 7

How To Calculate Annual Income For Your Household

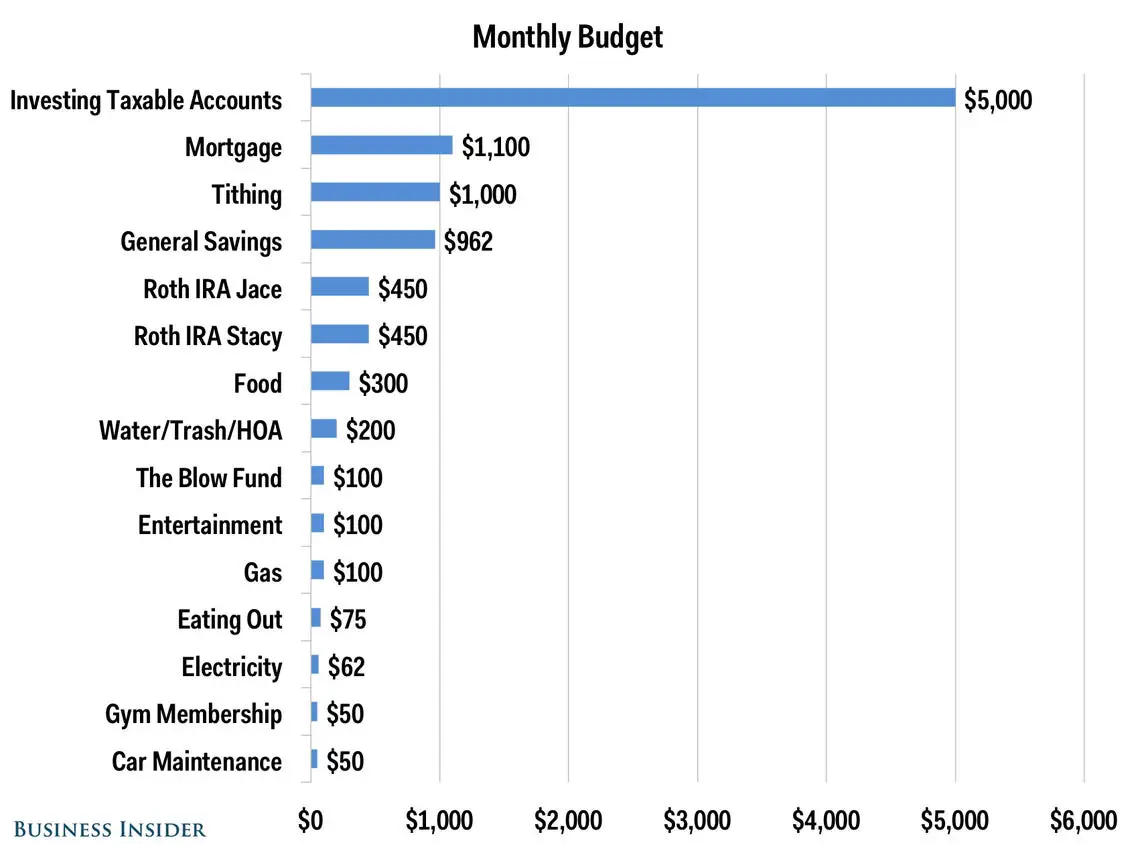

In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Consider all your earnings for the year, which could include salary, wages, tips, commission, etc.If you have a spouse or a partner that has an income which will also contribute to the monthly mortgage, make sure to include that as well into your gross annual income for your household. Then take your annual income and divide by 12 to determine your monthly income.

Follow the 28/36 debt-to-income rule

This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income against all debts, including your new mortgage. Keeping within these parameters will ensure you enough money left over for food, gas, vacations, and saving for retirement.Example: Lets say you and your spouse have a combined monthly income of $5,000. Applying the 28/36 rule, you wouldnt want to spend more than:

$1,400 on house related expenses

$1,800 on total debt

How Can You Estimate An Affordable Property Price

Take 30% of your annual gross income, equate this into a loan amount using an average rate of 2.75%, factor in a 10% deposit, and then use these calculations to estimate a potential purchase price.

Assuming that you dont have any debts or liabilities, and using a rate of 2.75% over a 30-year loan term, here are three potential scenarios:

Scenario 1 – $50k income

- With a mortgage at 2.75% p.a. this equates to a loan amount of $305,000.

- With a 10% deposit contribution worth around $34,000, the maximum affordable property price would be $339,000.

Scenario 2 – $75k income

- With a mortgage at 2.75% p.a. this equates to a loan amount of $460,000.

- With a 10% deposit contribution worth around $51,100, the maximum affordable property price would be $511,000.

Scenario 3 – $100k income

- With a mortgage at 2.75% p.a. this equates to a loan amount of $614,000.

- With a 10% deposit contribution worth just over $68,000, the maximum affordable property price would be $682,000.

Read Also: How Much Mortgage Can I Get On 50k Salary

That Makes Sense I Think My Credit Score Is In Good Shape Thankfully Is There Anything Else That Happens Before I Get The Mortgage

As far as the lenders work goes, not really. When determining the answer to How much mortgage can I afford?, the lender can tell you what theyre willing to give you, but it is very important that you take stock of your current situation and assess your future before committing to a loan. In other words, were back to the question of what size debt are you comfortable taking on.

Approval Aside What Percentage Of Your Income Should You Put Toward Your Mortgage

The focus of this article so far has been on the requirements to gain the approval of a lender for your home purchase. Its also important, however, for you to make your own decisions about the percentage of your income you should dedicate to a mortgage. Although each situation is different, its typically not recommended that you put more than 28% of your income toward your mortgage, no matter how stunning the dream home.

The median home price in the U.S. is $284,600. With a 20% down payment, you can expect to pay roughly $1,200 a month for your mortgage on a home at that price. That means that in order to follow the 28% rule, you should be making $4,285 each month.

Recommended Reading: What Is The Monthly Payment On A 500 000 Mortgage

Ok So Theyve Got My Information And Done Some Math Now What

From there, the lender will determine what length of loan and interest rate they feel comfortable giving you. To figure this out, theyll take a look at your credit score, which ranges from 300 to 850 . As youd expect, the higher your credit score, the lower the interest rate youll generally get, though the amount of your down payment also gets factored in.

Its difficult to say what constitutes an ideal credit score for taking out a mortgage , but a number between 700 and 740 seems to be a good range. In general 620 is considered the lowest acceptable score that will get you the green light.

If your credit score isnt where you want it, it might be useful to try to boost your number a bit before applying for a mortgage. The difference between a 3-percent and 5-percent rate might not sound huge, but all that interest adds up over the 15 or 30 years of the loan to some pretty significant money.

How Much Of A Down Payment Do You Need For A House

A 20% down payment is standard, if you can afford it. Though some mortgage loans may only require as little as 3.5 percent down, or none at all, a larger down payment will have a greater impact on your monthly mortgage payment.Your down payment effectively reduces the total amount of your home loan, which increases your home affordability estimate, and at the same time, decreases your mortgage payment each month. For example, below is a chart showing how a certain level of down payments, based on a percentage of the sale price, directly impacts your monthly mortgage payment :

| Percentage |

|---|

List out your expenses and then add them together to get your total monthly spending.

Don’t Miss: How Much Income To Qualify For 200 000 Mortgage