Pros And Cons Of Rolling Students Loans Into A Mortgage

| Pros | |

|---|---|

| Your interest rate will be lower than most student loan rates | Youll make less profit when you sell your home |

| Youll have only one monthly payment | You could lose your home to foreclosure if you cant afford your payments |

| You may lower your total monthly payments | Youll lose the ability to defer loan balances if you decide to go back to school |

What Documents Do I Need To Refinance My Mortgage

To refinance your mortgage, youll need to supply identification, income verification and credit information. Be sure to ask your lender for a list of documents youll need. The faster you can give the lender everything they need to process your loan, the quicker youll be able to close.

Heres a general checklist:

How Much Will It Cost To Complete The Refinancing

Depending on your lender and your loan terms, you may pay as little as a few hundred dollars or as much as 2% to 3% of the new loan value to complete a refinancing. If its going to cost you $3,000 to complete the refinance and it will take four years to recoup that money, it may not make sense for you.

Alternatively, if you can refinance and pay only $1,000, and have no plans to sell anytime soon, its very likely worth paying that $1,000 to save over time. In addition, some lenders allow you to roll your closing costs into the amount of the loan, so you dont have to come up with money out of pocket for closing costs.

Recommended Reading: Can You Take A Cosigner Off A Mortgage

Drawbacks Of Having Only One Spouse On The Mortgage

There are a couple of reasons it may be best to have both spouses name on a new mortgage application:

If both spouses have comparable credit and shared estate planning, it often makes sense to use a joint mortgage application. Thats because leaving a creditworthy spouse off the mortgage can sharply decrease your borrowing power.

Dont Miss: How Much Would An 85000 Mortgage Cost

Your Next Steps For Debt Consolidation

Its key to remember that even though your credit card debt may feel overwhelming, there are options available to help reduce that monthly burden. Because everyones debt is a little different, youll need to put together an accurate monthly budget to know how much cash is coming in and going out. Here are other steps you should consider when consolidating debt:

- Research all your financial options thoroughly before taking any action

- Review your monthly cash flow and trim away at unnecessary spending

- Inquire with mortgage lenders about current refinancing rates

- Build a realistic plan that gets you out of debt in a less expensive way

With a little homework, and a lot of determination, you may be able to reduce your monthly payments and still tackle credit card debt.

Maintaining good financial health doesnt have to be difficult. Thats why weve put together our financial advice section on money matters. While youre considering your lending options, remember to reach out to your American Family Insurance agent and review your homeowners policy. Youll find real peace of mind with a carefully crafted policy that meets your insurance needs and your budget.

Don’t Miss: How To Process A Mortgage Loan

Who Is Responsible For What

When you take out a home loan, you, as the borrower, assume the responsibility of paying the loan back in full and on time. Your monthly mortgage payment will include principle, interest, taxes, and insurance. Taking out a loan and making payments affects your credit. If you make late payments or miss payments, your credit will be negatively effected, and vice versa.

A co-borrower is basically a co-owner and the borrowers equal in the mortgage loan process. The co-borrower is just as responsible as the borrower is for repaying the full loan amount on time.

A co-borrower assumes the same credit risk as the borrower.

If the mortgage payments arent made on time, it will hurt the credit scores of both borrowers. If theyre made correctly, it will benefit both scores.

Is It A Good Idea To Consolidate Debt Into A Mortgage

Building up a case to refinance your mortgage for debt consolidation purposes can depend on a number of key factors. The amount of equity youve got in your home can dictate the total amount of debt youll be able to pay off. With the right market conditions, and enough equity to knock out a sizable portion of your high-interest credit card debt, you can benefit when you refinance your mortgage to pay off debt. Here are a few other good reasons to consider a re-fi:

- You could be paying off your credit card debt at a lower interest rate

- Your new monthly payment will likely be less than your current credit card payment

- You may be able to raise your credit score more quickly

- You may get a better rate on your new mortgage

- You may be able to switch to a better mortgage type

Also Check: What’s Refinancing A Mortgage

Starting Your Own Business

Many people who want to start their own business may not have the funds to do so, which is why home equity loans may be an option to explore. Whether you want to start a company from scratch or open a franchise, home equity loans can help you access money that you may not have had in your personal savings account.

How Do I Add Or Remove A Spouse From A Mortgage

The only way to change the names listed on a mortgage is to refinance in the new borrowers names. If you divorce, for example, youll need to meet the qualifications to refinance the house in your name alone. If you want to add someone to your mortgage, youll both need to jointly qualify to refinance the mortgage.

Recommended Reading: Who Owns Prosperity Home Mortgage

Yourhomes Exposure To Financial And Legal Liabilities

A monetaryjudgment against the additional title holder can put the home at risk. Aninterest in your home could be reachable by your co-owners creditors.

Even if youmean to convey just a fraction of your interest in the property, you losecontrol. The new co-owner will have full control of that portion of theproperty. In certain circumstances, your co-owner might have the right tocompel a sale of the house.

The deed canbe created to include restrictions on further conveyances. Yet burdening theproperty title is likely not what you have in mind when offering a loved onethe interest in your parcel.

Stranger things can happen, too. Sometimes, a co-owner predeceases the gift-giver. The co-owner then leaves shares of the real estate to yet another party. This can leave the person who gave the interest to a loved one stuck sharing a home with an unexpected new co-owner.

Even in thebest-case scenario, most anything major you want to do with your property willnow need another persons permission. Again, probably not what you have in mindwhen you give a loved one an interest in your home.

Donât Miss: Reverse Mortgage For Condominiums

Alternatives To A Mortgage Co

Borrowers who have poorer credit but dont want to add a co-borrower to their mortgage could consider the following:

- Establish or reestablish credit. Working on improving your credit can up your chances of getting approved for a loan, or getting approved for a loan with a more favorable interest rate. Building credit takes time, so be patient. One of the easiest strategies to improve your standing is to make on-time payments on any existing balances, or to open a secured credit card and do the same.

- Pay down debt. Paying down your debt decreases your debt-to-income ratio, showing lenders that you have the means to take on a mortgage by yourself without stretching your finances too thin.

- Consider an FHA loan or VA loan. Both the FHA and VA loan programs have less strict credit and down payment requirements, which can help you qualify for a loan independently.

Read Also: How Long After Car Repossession Can I Get A Mortgage

How Does A Second Mortgage Work

The equity you have in your home is a valuable asset, but unlike more liquid assets like cash, it isnt typically something that you can utilize.

A second mortgage, however, allows you to use your homes equity and put it to work. Instead of having that money tied up in your home, its available for expenses you have right now. This option can be a help or a hindrance, depending on your financial goals.

Specific requirements for getting approved for a second mortgage will depend on the lender you work with. However, the most basic requirement is that you have some equity built up in your home.

Your lender will likely only allow you to take out a portion of this equity, depending on what your home is worth and your remaining loan balance on your first mortgage, so that you still have a certain amount of equity left in your home .

To be approved for a second mortgage, youll likely need a credit score of at least 620, though individual lender requirements may be higher. Plus, remember that higher scores correlate with better rates. Youll also probably need to have a debt-to-income ratio thats lower than 43%.

Do You Have To Pay Stamp Duty If You Add Someone To A Mortgage

If you transfer the outstanding mortgage In this case the person taking ownership will pay Stamp Duty Land Tax on the total chargeable consideration of either or both of the following, if it exceeds the Stamp Duty Land Tax threshold: any cash payment that one of the couple makes to the other for their share.

Read Also: Can A Second Mortgage Be Discharged In Chapter 7

What Can I Add To My Fha Mortgage Loan

What can I add to my FHA mortgage loan? Theres a list of items that may be allowed to be added to your mortgage loan above and beyond the adjusted value of your property. Lets examine what the FHA loan handbook, HUD 4000.1, has to say about adding certain costs to your home loan amount.

Calculating The Maximum Mortgage Amount On Your FHA Loan

To start, lets see what HUD 4000.1 says about how the lender is expected to calculate the maximum mortgage amount. The maximum mortgage amount that FHA will insure on a specific purchase is calculated by multiplying the appropriate LTV percentage by the Adjusted Value. In order for FHA to insure this maximum mortgage amount, the Borrower must make a Minimum Required Investment of at least 3.5 percent of the Adjusted Value.

Up Front Mortgage Insurance Premiums

FHA loan rules state that in general, restrictions to mortgage amounts and LTVs are based upon the amount prior to the financing of the Upfront Mortgage Insurance Premium . The total mortgage amount may be increased by the financed UFMIP amount. That is good news for borrowers who need to include that expense into the loan amount.

It should be pointed out that UFMIP must be paid entirely up front in cash or entirely rolled into the loan. You cant pay half up front and include half into the loan, or other variations of that notion.

Energy-Related Improvements

How Can You Lower Your Mortgage Payment Without Refinancing

There are a few ways to potentially reduce your monthly housing costs without spending a lot of money refinancing, such as:

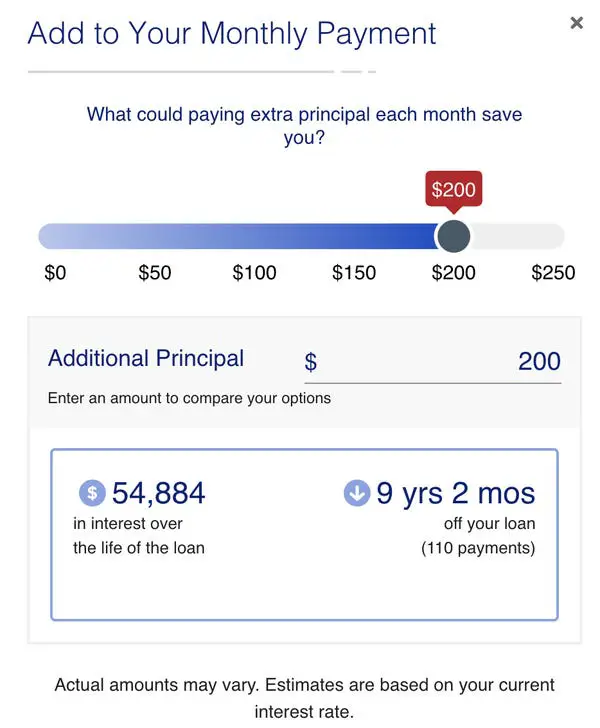

- Recasting your mortgage. In this situation, your lender can recalculate your payments based on what you currently owe. To be eligible for recasting, youll typically need to pay a large amount toward your principal and pay a feeusually a few hundred dollars.

- Getting rid of mortgage insurance. If you put down less than 20% of your loan amount on a conventional loan, youre required to get private mortgage insurance . But if youre able to pay down your principal to 80% of your homes original price, you can request for your lender to remove your PMI.

Recommended Reading: How To Know How Much Mortgage You Can Qualify For

A Comprehensive Guide To Help You Understand Your Options For Adding Renovation Costs To Your Mortgage

Mar 8, 2021 byRich Garner

The most money and lowest monthly payment for your renovation

Borrow up to 90% of your future home value with a Renofi Renovation Loan

I WANT TO RENOVATE:

Whether buying a fixer-upper or looking to remodel a current home, both homebuyers and homeowners often wonder if they can add renovation costs to their mortgage.

And on the one hand, doing this means a single loan and one monthly payment, but it doesnt come without its drawbacks.

And in this guide, well walk you through what these are from higher interest rates and the extra steps that can cause significant delays.

If youre looking for a way to combine renovation costs into your mortgage, well help you to understand your options as well as introduce you to RenoFi Loans, a new type of home renovation loan that could be the perfect solution to financing your renovation.

Specifically, were going to take a look at:

Faqs About 100% Financing Fixed

What fees should I expect on my mortgage?Why choose Members Choice for my 100% financing mortgage?

Our promise is to provide a high level of service and work in your best interests:

- We have personalized customer service that aims to meet your personal needs

- Our member service team offers a local person to talk to and provide faster service

- You’re a member, not just a number

- We try to make the home buying experience a great one easy and stress-free

- Well never sell your loan and will retain servicing for the life of the loan

Recommended Reading: How Does Selling A Home With A Mortgage Work

How To Add A Person To A Mortgage

Is closing day the last day to get your name on a mortgage? Technically, yes. Lenders don’t want to add another person to an existing lending agreement because they don’t have a way to assess risk without restarting the application process.

However, there are some ways around this problem that can allow you to add a co-borrower to your mortgage. There are also ways to share ownership with another person even if you can’t add them to your mortgage right now. Take a look at how to add someone to a mortgage.

Can Someone Be On The Title Without Being On The Mortgage

Yes, adding someone to the title for your home without refinancing to include them on the mortgage is an option. This is something that is often done with a spouse, child or parent. The benefit to adding someone’s name to a title is that the home will legally transfer to that person after your death.

Getting this done is often just a matter of contacting your title company. While you can create a verbal agreement with the understanding that the person being added to the title will contribute to mortgage payments, they aren’t under any legal obligation to do this unless they are a co-borrower. Only by adding someone to your mortgage through a refinance can you make the other person legally responsible for the mortgage debt.

References

Also Check: What Percentage Of Mortgages Are Fannie Mae And Freddie Mac

Can I Add A Family Member To My Mortgage

Most types of home loans will only allow you to add one co-borrower to your loan application, but some allow as many as three. Your co-borrower can be a spouse, parent, sibling, family member, or friend as an occupying co-borrowers or a non-occupying co-borrowers.Can I go on the deeds but not the mortgage?It is possible to be named on the title deed of a home without being on the mortgage. However, doing so assumes risks of ownership because the title is not free and clear of liens and possible other encumbrances. Free and clear means that no one else has rights to the title above the owner.

When Should I Get A Second Mortgage

Second mortgages arent for everyone, but they can make perfect sense in the right scenario. Here are some of the situations in which it makes sense to take out a second mortgage:

- You need to pay off credit card debt. Second mortgages have lower interest rates than credit cards. If you have many credit card balances spread across multiple accounts, a second mortgage can help you consolidate your debt.

- You need help covering revolving expenses. Do you need revolving credit without refinancing? Unlike a refinance, HELOCs can give you access to revolving credit, as long as you keep up with your payments. This option can be more manageable if youre covering a home repair bill or tuition on a periodic basis.

- You cant get a cash-out refinance. Cash-out refinances, compared to home equity loans, usually have lower interest rates. But if your lender rejects you for a refinance, you may still be able to get a second mortgage. Consider all of your options before you get a second mortgage.

Recommended Reading: What Would I Be Approved For Mortgage

What Is A Co

A co-borrower, also referred to as a co-applicant, is an additional borrower on a mortgage. In a co-borrowing situation, both borrowers complete an application, and the mortgage lender considers both your qualifications and those of the co-borrower, including assets, credit history and income. Typically, the borrower with the better credit profile determines the terms of the loan.

Importantly, both you and the co-borrower can have ownership of the property in other words, both your names are on the title and are responsible for repaying the mortgage.

A co-borrower isnt the same as a co-signer. A co-signer doesnt have their name on the property title, but is responsible for repaying the loan. Generally, a co-signer can be beneficial if a borrower needs help from someone with good credit to get approved for a mortgage. If the borrower fails to pay, the lender has the right to pursue payment from the co-signer.

A borrower might ask his parent to be a co-signer on a mortgage, for example, since the parents credit history and added income and assets can increase their chances of securing a competitive mortgage rate.