Will Interest Rates Rise Again In 2022

The Bank now expects CPI inflation to get even higher, and peak at 13%. In other words, the squeeze on our finances is likely to continue.

Much of this is down to another rise in the energy price cap which the industry regulator now expects to go up by around 73% in October.

Huw Pill, the Banks chief economist has separately warned that more interest rate rises might be needed to curb inflation.

Economists predict that the base rate could eventually rise to around 3%.

Fed Signals Hikes May Well Continue Through End Of 2022

The Federal Reserve has directed four rate hikes this year alone, and is signaling to expect three more before the year is out. Rock bottom rates cause home prices to skyrocket, and now inflation is a runaway train. The Fed hopes repeated hikes will exert pressure and help slow inflation, but experts disagree on how well this tact will work.

The upcoming Federal Reserve rate hike is estimated to be anywhere between 50 and 100 basis points. The past three hikes have been split the difference at 75. Analysts say the Fed can be expected to keep raising rates in an effort to slow inflation even if, as some warn, it puts the U.S. into a tailspin and starts a recession.

What Is A Mortgage

A mortgage is a type of secured loan that is used to purchase a home. The word mortgage actually has roots in Old French and Latin.. It literally means death pledge. Thankfully, it was never meant to be a loan you paid for until you died , but rather a commitment to pay until the pledge itself died .

You can also get a mortgage to replace your existing home loan, known as a refinance.

Also Check: What Is Considered A High Balance Mortgage Loan

How To Shop For Interest Rates

Rate shopping doesnt just mean looking at the lowest rates advertised online because those arent available to everyone. Typically, those are offered to borrowers with perfect credit and who can put a down payment of 20% or more.

The rate lenders actually offer depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment

- Your home equity

- Your loan-to-value ratio

- Your debt-to-income ratio

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a real rate quote based on your financial situation.

You should get three to five of these quotes at a minimum, then compare them to find the best offer. Look for the lowest rate, but also pay attention to your annual percentage rate , estimated closing costs, and discount points extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Current Mortgage Rates Take Another Tumble

Leslie CookKristen Bahler19 min read

The average rate on a 30-year fixed-rate loan dropped 0.31 percentage points, decreasing to 4.99%, according to Freddie Mac’s weekly survey.

This is the second week in a row that the 30-year rate has decreased. Mortgage rates soared by more than 2 percentage points during the first 6 months of the year, ending a two-year run of historically low mortgage rates caused by the economic disruption of the pandemic. The last time the rate averaged less than 5% was the first week of April.

“The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment,” Sam Khater, Freddie Mac’s chief economist, said in a press release.

Average rates for other loan categories are lower as well. The 15-year fixed-rate mortgage is averaging 4.26% while the 5/1 adjustable-rate mortgage is averaging 4.25%.

If you are offered a rate that is higher than you expect, make sure to ask why, and compare offers from multiple lenders.

Don’t Miss: How To Get A Contractor Mortgage

How Are Mortgage Rates Set

Lenders use a number of factors to set rates each day. Every lender’s formula will be a little different but will factor in the current federal funds rate , competitor rates and even how much staff they have available to underwrite loans. Your individual qualifications will also impact the rate you are offered.

In general, rates track the yields on the 10-year Treasury note. Average mortgage rates are usually about 1.8 percentage points higher than the yield on the 10-year note.

Yields matter because lenders don’t keep the mortgage they originate on their books for long. Instead, in order to free up money to keep originating more loans, lenders sell their mortgages to entities like Freddie Mac and Fannie Mae. These mortgages are then packaged into what are called mortgage-backed securities and sold to investors. Investors will only buy if they can earn a bit more than they can on the government notes.

What Are Closing Costs

Youll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Closing costs often entail taxes and fees associated with the purchase that arent included in the sale price.

Expect closing costs to total around 3% to 6% of the purchase price, so youre looking at between $8,250 and $16,500. They might include fees charged by the lender like loan origination fees, points paid to get a lower mortgage rate, fees associated with the property such as an appraisal or inspection, or prepaid costs such as property taxes or homeowners association dues.

Recommended Reading: Can I Get A Mortgage With A Fair Credit Score

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV.

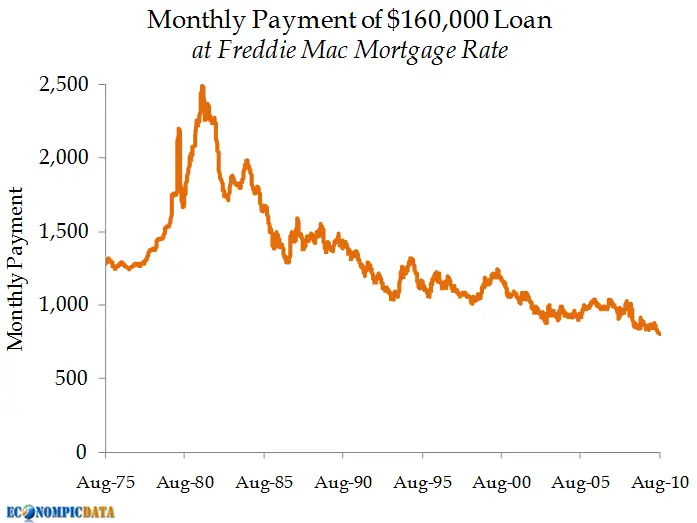

Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.

Are Mortgage Interest Rates Going Up

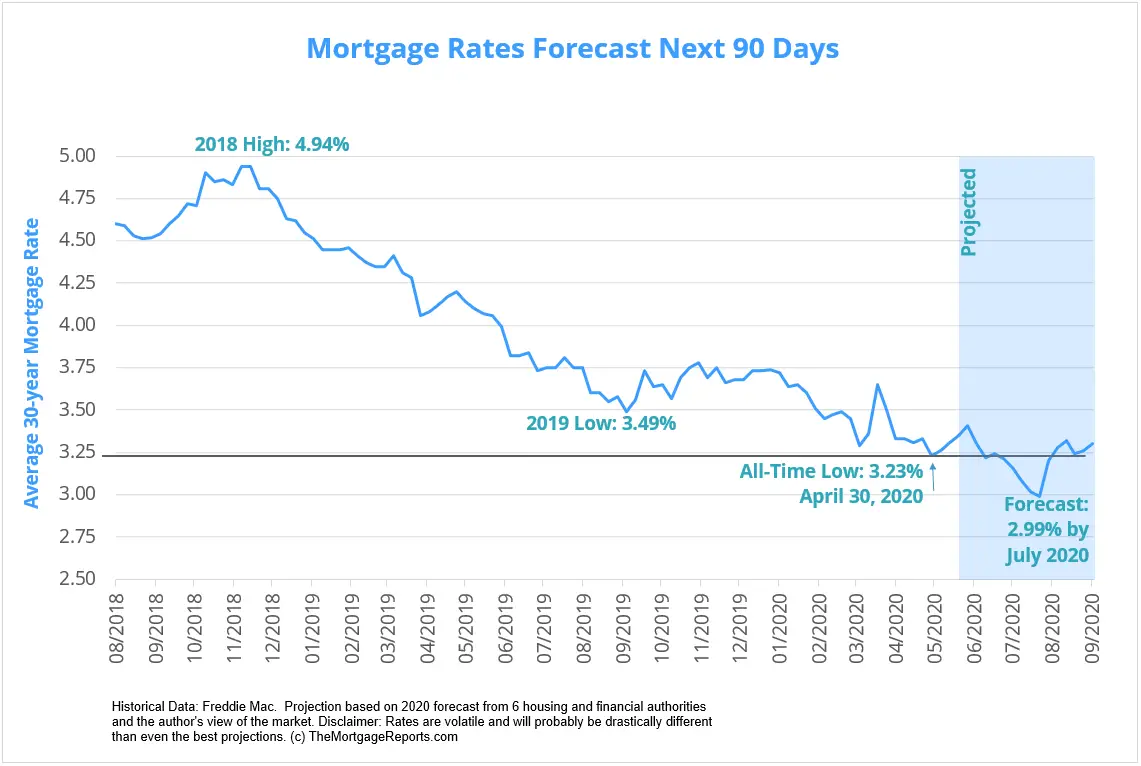

Interest rates declined throughout 2019 and when January 2020 rolled around, the average rate for a 30-year fixed was about 3.7%. Furthermore, when COVID-19 hit the United States, the Federal Reserve responded by dropping the federal funds rate to between 0% â 0.25%.

In 2021, mortgage interest rates were 2.98% on January 21 and by October 21, Freddie Mac reported an average mortgage rate of 3.09% for 30-year mortgages. Though mortgage rate forecasts predict a continual increase in mortgage rates, these interest rates will be lower than historical mortgage rates, according to Freddie Mac.

Recommended Reading: How Much Would A 100k Mortgage Cost Monthly

What Is A Mortgage Rate

A mortgage rate is the interest lenders charge on a mortgage. Mortgage rates come in two forms: fixed or variable.

Fixed rates never change for the life of your loan and in exchange for this certainty, the rate is higher on longer loans.

Variable-rate mortgages can have lower interest rates upfront, but fluctuate over the term of your loan based on broader economic factors. How frequently a variable-rate mortgage changes is based on the loans terms. For example, a 5/1 ARM would have a fixed rate for the first five years of the loan, then change every year after that.

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process, the lender will look at your overall financial profile to determine how much it will lend to you. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI is typically 43%. So if you make $5,000 a month, your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Also Check: What Does Icd Stand For In Mortgage

Wild Swings In Mortgage Rates Last Week Caused A Rare Surge In Refinancing

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 5.47% from 5.43%.

- Refinance applications rose 4% for the week but were 82% lower than the same week one year ago.

- “The purchase market continues to experience a slowdown, despite the strong job market,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting

After dropping at the end of July, mortgage rates moved higher on average again last week, but the daily moves were volatile. Mortgage demand was split, with gains in refinancing but declines in applications from homebuyers, according to the Mortgage Bankers Association’s seasonally adjusted index.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances increased to 5.47% from 5.43%, with points rising to 0.80 from 0.65 for loans with a 20% down payment. While the weekly average didn’t change much, daily moves were more dramatic.

Another read from Mortgage News Daily showed the average rate on the 30-year fixed jumping 45 basis points at the start of last week, then falling 41 basis points on Thursday and then jumping up again by 36 basis points. Mortgage rates don’t often move in such large increments.

Mortgage applications to purchase a home, which are less reactive to weekly rate moves, were down 1% for the week and down 19% from one year ago.

Mortgage Rates This Week

Mortgage rates rose in the week ending Aug. 25, implying a measure of hopefulness about the overall economy, even as the housing market put on a gloomy face.

-

The 30-year fixed-rate mortgage averaged 5.64% APR, up 30 basis points from the previous week’s average.

-

The 15-year fixed-rate mortgage averaged 4.83% APR, up 17 basis points from the previous week’s average.

-

The five-year adjustable-rate mortgage averaged 5.07% APR, up 46 basis points from the previous week’s average.

Usually, when mortgage rates rise significantly, the cause is plain to see: a report of rapid job growth or signs of a vigorously expanding economy. But none of the week’s economic reports were positive enough to push mortgage rates upward.

In fact, Tuesday’s report on new home sales in July was dismal: People signed contracts to buy new homes at a seasonally adjusted annual rate of 511,000 dwellings a 29.6% decrease compared to July 2021. And the median price of a new home went up 8.2% over the same period. That’s a hefty price increase, but it’s also a slowdown from the previous few months. It’s another sign that the housing market is cooling as home buyers gain more negotiating power.

Yet mortgage rates have been going up for most of August, and that tends to be a sign that the economy isn’t in terrible shape. What’s up with that? It could be a result of changing expectations, and that investors are less pessimistic about economic performance over the next few months.

Don’t Miss: Why Are Mortgage Rates Lower Than Prime

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 6.5% right now.

What Are Mortgage Interest Rate Price Predictions For The Next 5 Years

Here’s where the experts think mortgage rates could go from here

- A rising federal funds rate has driven mortgage rates higher

- However, with medium-term expectations for continued hikes, where mortgage rates will be five years from now is uncertain

- Accordingly, calls for 9%+ rates in 2026 have investors concerned

As the Federal Reserve ramps up its interest rate hiking schedule and reduces its balance sheet, the interest rate consumers pay on almost everything will rise. For new homeowners, or existing homeowners looking to refinance, this isnt a good thing. Mortgage rates are rising fast, and they are likely to continue rising. Accordingly, interest in mortgage interest rate price predictions over the next five years is high right now.

Where were at today is rather telling. According to Bankrate, the following rates are what homeowners can expect to pay at the time of writing:

- 30-year mortgage rate: 5.42%

- 5/1 ARM mortgage rate: 3.84%

- 30-year jumbo mortgage rate: 5.38%

Lets dive into where the experts see mortgage rates headed. Now, these rates are down considerably over the past week, following the bond markets moves. Weve also covered where mortgage rates may be headed in the near term. That said, over the longer term, rates will likely rise dramatically.

Recommended Reading: How To Make Extra Payments On Mortgage

When Should I Lock My Mortgage Rate

It can be tricky to time any market, and mortgage rates are no exception. If conditions are choppy, and interest rates are likely to at least stay the same, if not rise, it may be smart to lock in a rate that works with your budget and seems fair to you.

Be sure to ask your lender about the consequences of not closing within the timeframe specified in a rate lock agreement and also about what could happen if rates fall after you lock in a rate.

Mortgage Rates Rise On Robust Economic Activity

Mortgage rates continued to rise last week.

While inflation measures are improving, the rate of inflation is still well above the Federal Reserve’s long-term targets. Data releases last week showed that economic activity is still robust and labor markets continue to be very tight. With Fed officials all indicating a commitment to containing inflation as the main goal in the near term, markets have adjusted expectations to account for further significant increases in the Fed Funds rate. Investors are pricing in a higher probability of a 75-basis point rate hike at the Fed’s September meeting and a likely higher terminal rate, driving up interest rates in Treasuries and mortgage-backed securities.

Recommended Reading: What Is A Mortgage Inspection

Which Mortgage Loan Is Best

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a highpriced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits, which max out at $ in most parts of the U.S.

On the other hand, if youre a veteran or service member, a VA loan is almost always the right choice. VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance . But you need an eligible service history to qualify.

Conforming loans and FHA loans are great lowdownpayment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620. FHA loans are even more lenient about credit home buyers can often qualify with a score of 580 or higher, and a lessthanperfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates similar to VA and reduced mortgage insurance costs. The catch? You need to live in a rural area and have moderate or low income to be USDAeligible.

The Fed Is Determined

The bottom line is that house prices continue to rise, making it difficult for would-be buyers to find homes they can afford. But it’s hard to dispute that the Federal Reserve is succeeding in slowing down runaway house prices. Eventually, in a roundabout way, the slowdown in home prices will be reflected in the overall inflation rate.

Is it necessary for the Fed to cause a recession to chop the inflation rate to its 2% goal? Powell danced around that question in his July 27 news conference. He said he’s not the person who defines when a recession begins and ends, and he added, “our goal is to bring inflation down and have a so-called soft landing, by which I mean a landing that doesn’t require a really significant increase in unemployment.”

But he also implied that he’s willing to restrict the U.S. economy, including the strong job market, if that’s what’s necessary to bring inflation under control. If and when the Fed succeeds in cutting the inflation rate to 2%, mortgage rates could decline because mortgage rates respond to inflation expectations.

Don’t Miss: What Income Can Be Used To Qualify For A Mortgage