Russia Admits Oil Output May Drop 17pc

Russia has admitted its oil output may fall as much as 17pc this year as international traders shun the Kremlin’s energy.

Anton Siluanov, Russia’s finance minister, said: The output will decline. By what amount? 17pc, a bit more or a bit less, thats possible.

Russias 2021 oil production was just over 524m tonnes, or 10.5m barrels per day. If Mr Siluanov was talking about annual averages, a 17pc decline would bring the nations output this year to some 435m tonnes, or around 8.7m barrels per day the lowest in almost 20 years.

The exact volumes will depend on foreign appetite for Russias barrels.

Mr Siluanov said: We dont know now which countries will refuse them and which wont, adding that Russia will work to redirect its flows to markets still interested in buying its oil.

Government Asks Drax To Keep Coal Plants Open Longer

Power generation group Drax says it’s been asked by the Government to consider keeping its coal-fired power plants open for longer as the UK tries to ditch Russian gas.

The company had planned to close its operations in September this year.

It said: “Drax continues to expect to formally close these two legacy coal units following the fulfilment of their Capacity Market obligations in September 2022 but remains committed to supporting security of supply in the UK.”

Nadia Evangelou Director Of Forecasting National Association Of Realtors

Mid-2022 mortgage rate forecast: 5.5% , 4.8%

Late-2022 mortgage rate forecast: 5.7% , 5.0%

Factors that may influence rates in 2022

Apart from raising interest rates, the Federal Reserve will start reducing the size of its balance sheet in June, says Evangelou. This means that the Fed will lower its bonds holding, thereby increasing the supply of US Treasuries on the market. This strategy is expected to move up further Treasury yields and mortgage rates in the second half of 2022. The Fed will raise interest rates at least five more times this year to drop inflation to the 2% target. These rate hikes will continue to push up mortgage rates.

When will rates stop rising?

The outlook is for mortgage rates to rise even further in the next couple of years. However, as inflation will start slowing down, mortgage rates wont rise as fast as they have been rising.

Advice to home buyers and homeowners

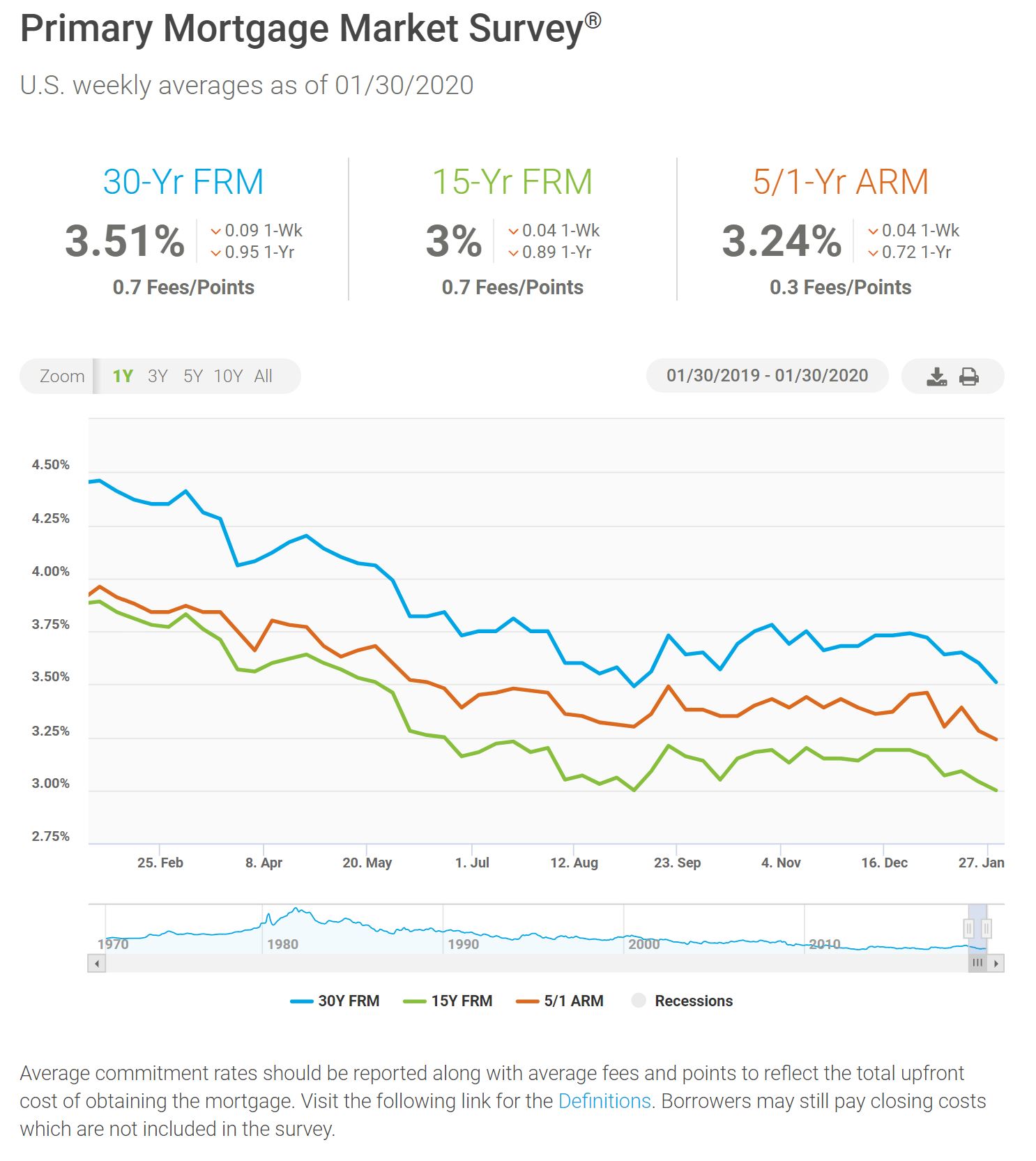

Keep in mind that, even though mortgage rates are higher now than last year, on a historical level rates arent as high as they used to be. For example, in 2002, the average rate on a 30-year fixed mortgage was about 7 percent.

You May Like: Which Credit Score Is Used For Mortgage Loans

Tips For Selling In A Hot Housing Market

The first step for a successful sale is to find a listing agent who knows the area and comes highly recommended. A good agent will work closely with you to price your home competitively while fielding questions and offers from prospective buyers.

Tayenaka notes the outsize number of homes falling out of escrow recently as a cautionary tale to sellers who continue to demand 2021 prices. âEveryone thinks their house is special,â she says.

Even though the market may still be tipped in your favor, itâs in your best interest to present your home in the best possible light. Not everyone has cash dedicated to renovations and repairs, but a little sweat equity can go a long way. The first step is to declutter, organize and clean.

Tuck away stacks of bills and receipts, store toys and make sure your kitchen is tidy. Bright lighting is also a great way to make your home feel spacious and light.

Even if your home is outdated, a clean space gives buyers a chance to envision the potential of the new home.

Read More Real Estate Coverage

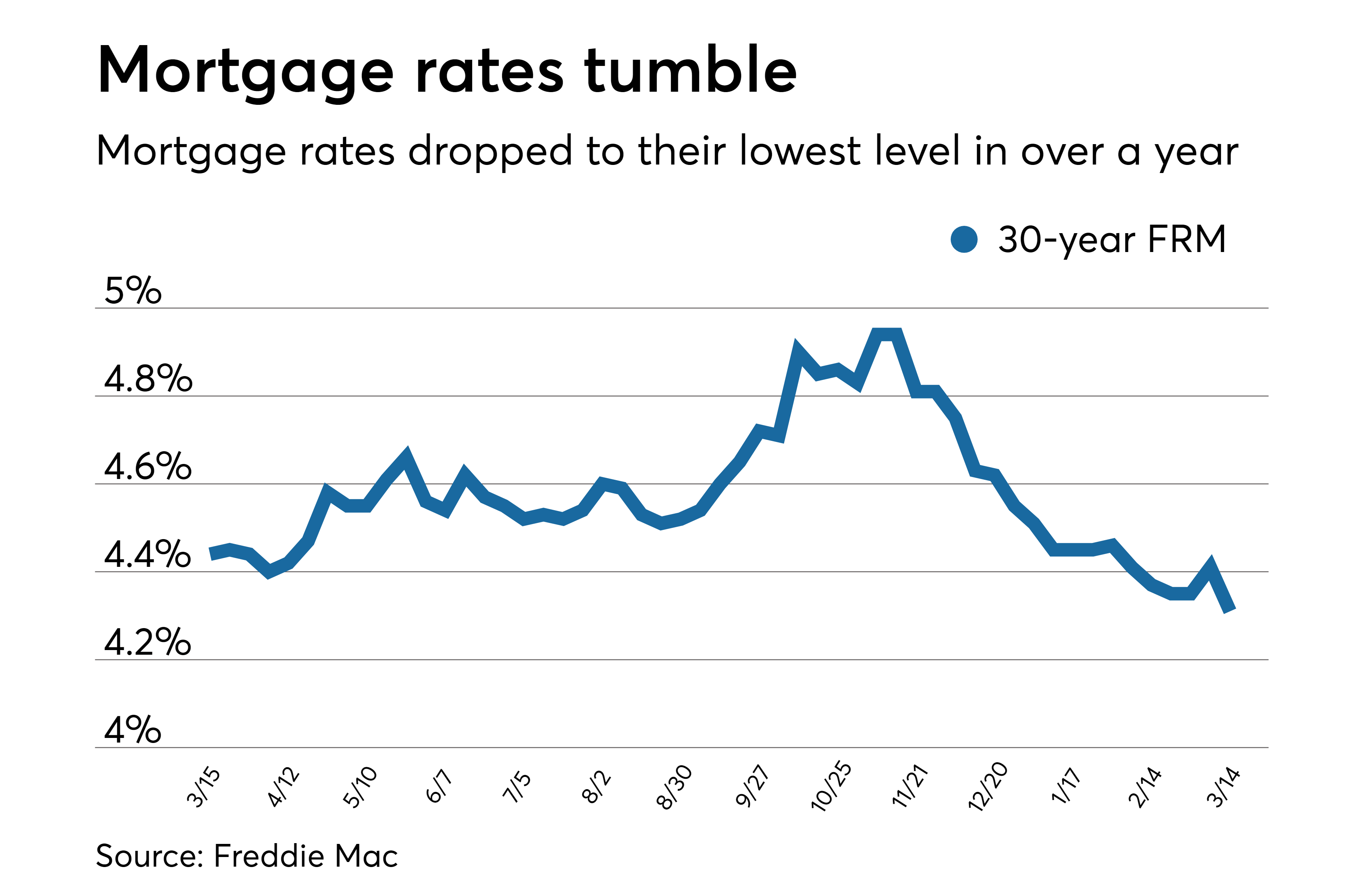

“This is an exceptionally fast drop!” wrote Matthew Graham, COO of Mortgage News Daily. “Perhaps even more interesting is the fact that mortgage rates have dropped faster than U.S. Treasury yields. It’s typically the other way around as investors flock first to the most basic, risk-free bonds.”

Graham said the big picture shift in rates over the past month has created a situation where investors greatly prefer to be holding mortgage debt with lower rates.

“In a way, mortgage investors are trying to get ahead of the game. If they’re holding mortgages at a higher rate, they will lose money if those loans refinance too quickly,” he added.

The question now is whether the market is in a new range, and rates will settle where they are now.

“If rates reverse course, volatility could be just as big going in the other direction,” Graham warned. He also noted that mortgage rates could move even lower if economic data continues to be gloomy and inflation moderates.

Already, lower rates appear to be having a slight impact on potential homebuyers. Real estate brokerage Redfin just reported seeing a slight uptick in searches and home tours in the past month, as rates came off their recent highs.

The increase in buyer interest, however, has not translated into new contracts, nor sales. The supply of homes for sale is increasing slowly, and there are reports of more sellers dropping their asking prices.

Read Also: Is A Home Equity Line Of Credit Considered A Mortgage

Housing Market Crash Predictions For Next Years

The overarching concern is whether or not the housing market will crash, and if so, when. The simple answer is that it will not crash anytime soon and we certainly don’t see a housing market crash coming in 2022. Rising rates are cooling the market as some expected but the prices are still rising at a slower rate. The current trends and the forecast for the next 12 to 24 months clearly show that most likely the housing market is expected to see a positive home price appreciation.

In recent years, the price of homes has climbed dramatically. Many prospective buyers, especially those with limited financial resources, are eager to hear whether and when home prices will become more accessible. Here is when housing market prices are going to crash. While this may appear to be an oversimplification, this is how markets operate.

When demand is satisfied, prices fall. In many housing markets, there is an extreme demand for properties at the moment, and there simply aren’t enough homes to sell to prospective buyers. Home construction has been increasing in recent years, but they are so far behind to catch up. Thus, to see significant declines in home prices, we would need to see significant declines in buyer demand.

References

- https://www.freddiemac.com/research/consumer-research/20220617-housing-sentiment-second-quarter-2022

- https://www.mba.org/news-and-research/research-and-economics/single-family-research/mortgage-credit-availability-index-x241340

London Metal Exchange Boss Backtracks On Plans To Leave

Matthew Chamberlain, chief executive of the London Metal Exchange, has said he’ll stay on in the role permanently, backtracking on his plans to exit following last month’s nickel market turmoil.

Mr Chamberlain’s imminent departure would have come at a critical time for the LME, which is facing an investigation over its handling of a short squeeze that forced it to halt nickel trading for a week and cancel billions of dollars in transactions.

The boss had planned to take a job in the crypto industry, but will now remain in his role, the LME said.

Mr Chamberlain said: Events of recent weeks have brought into focus the importance of the LME and the metals markets. I want to continue to work with the team on supporting the long-term health and efficiency of the market and drive forward the sustainable development of our industry.

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

House Prices ‘to Fall’ In 2023 And 2024

Analysts at Capital Economics have warned house prices will fall 5pc over 2023 and 2024 as mortgage rates double.

But Andrew Wishart, senior property economist, said the market wouldn’t see a repeat of either 2008 or 1990, when house prices fell by about 20pc.

First, while the house price-to-earnings ratio is roughly the same now as in 2007 we do not anticipate a return to pre-financial crisis mortgage rates of 6pc, so the cost of mortgage repayments will remain much less of a burden.

Second, strong pay growth means a modest fall in prices will be enough to return the house price-to-earnings ratio to a more sustainable level.

Mortgage Interest Rates Forecast Next 90 Days

The Federal Reserve made an aggressive policy plan to bring inflation down. While that would normally lead to mortgage rate growth, the lending market may have already accounted for the Feds rate hikes.

Because of this, many experts currently believe mortgage interest rates will move within a tighter range in the fall compared to the big weekly swings we saw throughout the year.

Of course, the Russian-Ukrainian war or a new wave of Covid-19 could create economic uncertainty and cause more rate volatility in the coming months.

Recommended Reading: How To Get A Mortgage Loan With No Credit

Rishi Sunak: I’d Consider Windfall Tax On Energy Firms

Rishi Sunak has said he’s consider a windfall tax on the profits of energy companies an apparent backtracking on his previous stance.

The Chancellor has long rejected the prospect of a tax on the surging profits of energy firms, advocated by the Labour Party, saying it would discourage further investment in the sector.

But he suggested such a levy might be on the cards if the companies didn’t do enough to invest in developing Britain’s domestic energy supplies.

He said in an interview with Mumsnet: “If we don’t see that type of investment coming forward, if companies aren’t going to make investments in our energy security, of course that’s something I’d look at. Nothing is ever off the table in these things.”

The Caveat Of Mortgage Interest Rates Forecasting

Mortgage rate forecasting is not a sure thing. It’s a good idea to treat these forecasts as a guide rather than a hard-and-fast rule. Mortgage rates have taken some unexpected turns over the past 2 years, and experts have certainly been wrong before. However, these predictions may help you plan your home purchases in the future.

Each quarter, Freddie Mac publishes a quarterly report with its mortgage rate predictions. Using the economic outlook at past and current rates, Freddie Macâs Economic & Housing Research Group forecasts what we can expect from rates in the coming months. You may want to keep tabs on this report to see what’s coming down the pike.

Don’t Miss: Can You Wrap Closing Costs Into Mortgage

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners’ insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Germany Slashes Growth Forecasts Over War And Energy Crisis

Germany has slashed its economic growth forecast for 2022 to 2.2pc from its previous prediction of 3.6pc as Russia’s invasion of Ukraine, sanctions and high energy prices take toll on output.

However, the country’s economy ministry expects the economy to grow by 2.5pc in 2023, up from the 2.3% previously predicted.

The conflict in Ukraine is driving up energy, commodity and food prices even higher, posing a further threat to economic growth.

Germany is predicting an inflation rate of 6.1pc over 2022 as a whole and 2.8pc next year.

Read Also: How To Pay Off My Mortgage In 15 Years

Have A Plan And Stick To It

Dont doom scroll, dont get too seduced by the headlines. It can be tough for the first-time home buyer, but it also doesnt have to be if you have a plan.

-Paul Buege, chief executive officer and president at Inlanta Mortgage

Between ballooning prices and a lack of listings, home buying in 2022 has been tough and likely even frustrating for many borrowers. However, conditions are beginning to ease.

With listings sitting on the market longer and interest rates possibly peaked, nows not the time to give up or be erratic with your money. Much like playing at a blackjack table, your best bet at winning or in this case, buying a home comes with sticking to a consistent strategy and patience.

Dont doom scroll, dont get too seduced by the headlines. It can be tough for the first-time home buyer, but it also doesnt have to be if you have a plan, Buege said. If someone wants to buy a home, you can, it just might be at a different time than what youre hoping. But I think things are cooling down. We really try to advise everyone to respect the market. Virtually everything thats going on out there is outside all of our control.

So figure out when you want to buy a home, prepare yourself, and know all the borrower requirements. While affordability took a hit over the last few years, you can still get creative and find ways to save money.

Expert Mortgage Rate Predictions For September

Paul Buege, chief executive officer and president at Inlanta Mortgage

Prediction: Rates will rise

I think were going to be range-bound and well see rates stay at this level, maybe a little bit higher. The market is responding to the Feds two significant rate increases and the economy is cooling. What youre seeing right now is the initial response: a recession and people arent buying as much.

But always lurking in the background is going to be some economic news showing that things havent cooled to the level that you might think. Thats why I think youre gonna have these little rate bumps up and down. If you wanted to work with a really broad range, probably 6% would be the high and 5% might be the low. Thats what were using as we manage our book of business as a company.

Danielle Hale, chief economist at Realtor.com

Prediction: Rates will moderate

There isnt a Fed meeting but there is the annual economic policy symposium in Jackson Hole that a lot of the Fed decision makers participate in. Investors will look to that symposium to get an updated sense of how the Fed is thinking about monetary policy and we may see mortgage rates react to whatever is discussed.

Selma Hepp, deputy chief economist at Corelogic

Prediction: Rates will moderate

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will moderate

Jessica Lautz, VP of demographics and behavioral insights at National Association of Realtors

Prediction: Rates will moderate

You May Like: Do I Have To Pay To Refinance My Mortgage

Jason Gelios Realtor At Community Choice Realty

Mid-2022 mortgage rate forecast: 6.5% , 5.5%

Late-2022 mortgage rate forecast: 7.0% , 6.0%

Factors that may influence rates in 2022

We will continue to see mortgage rates increase slightly throughout 2022, with a slight increase in available housing inventory, predicts Gelios. Mortgage rates are rising because of inflation and the fact that they were due to jump since they were at record lows for so long.

When will rates stop rising?

It will probably take about three to four years before we really see mortgage rates decrease enough to be noticed. Considering that weve had two to three years of mortgage rates at very attractive offerings, its time that they increased. To see a dramatic decrease in mortgage rates, we need to observe a sizable increase in the number of homes available for buyers. This would certainly cause rates to slow their increase and possibly decrease. Unfortunately, I dont see this happening anytime soon.

Advice to home buyers and homeowners

The best time to buy real estate is when its right for you. Those who are financially ready to purchase a home in 2022 should consider it a good time to buy because housing values are slated to stabilize by the end of this year. Home buyers who purchase in 2022 will see a healthy equity gain in the upcoming years. If a potential buyer is considering waiting for a change in the market, they will face a higher mortgage rate and possibly a higher-priced home.

Affordability Rules Could Ease

Affordability rules could ease, so it might be easier to buy a new property in 2022. It appears the Bank of England is going to propose relaxed affordability checks for banks.

They are looking to remove the rule that says potential borrowers must provide proof of affordability on any amount, showing you can afford the highest standard interest rate, plus 3%

The banks rejected another suggestion to allow lenders to increase the number of large mortgages lent to individuals who can borrow more than 4.5x their salary.

But hopefully, they comply with this potential rule as it may make it easier to qualify for a mortgage.

In 2022, Nationwide offered a lending ratio of 5.5x to 5,0000 households only, and Habito has announced they will offer 7x to public sector workers and individuals with a salary of more than £75,000.

Recommended Reading: How Much Mortgage Can I Get On 30 000 Salary