Lets Talk About Interest Rates And Apr

Megan Woissol |

Borrowers often ask, What is the difference between Interest Rate and APR?

Its a fair question. What are these numbers, and what exactly do they mean?

Interest Rate is the annual cost of the loan to the borrower. It is expressed as a percentage. The interest rate is only the interest that you will pay on the mortgage and rates are often quoted in .125% increments.

You may notice a breakdown of several costs in your monthly mortgage payment. When you pay your mortgage every month, the amount you pay is typically all inclusive of P.I.T.I. . Principal is the original loan you took, interest is an additional cost made up of a percentage of the original loan. These costs are collected and kept by the lender.

Property taxes are paid directly to the county and insurance is paid to your insurance company. However, these are typically paid out of an escrow account by the lender, which a portion of your monthly mortgage payment contributes to. Something to note as you read on is that the taxes and insurance portion of your monthly payment will not be included in the calculation of your APR.

Borrowers often ask, What is the difference between Interest Rate and ?Its a fair question. What are these numbers, and what exactly do they mean?

Interest Rate is the annual cost of the loan to the borrower. It is expressed as a percentage. The interest rate is only the interest that you will pay on the mortgage and rates are often quoted in .125% increments.

How To Compare Mortgage Interest Rates And Aprs

When you review your loan estimates and evaluate your options, remember not to compare a mortgage rate to an APR because thats not an apples-to-apples comparison. Instead, always compare rates to rates and APRs to APRs.

Its important to compare rates because the interest you pay is a big part of your monthly payment. With a lower rate, youll pay less interest over the life of the loan.

Its important to compare APRs because interest isnt the only cost youll pay for your loan.

Never compare an APR for a loan with mortgage insurance to an APR for a loan without mortgage insurance. Mortgage insurance protects your lender if you dont repay your loan. You may have to pay for it if your down payment isnt at least 20% of your homes purchase price.

A loan with mortgage insurance will have a higher APR than the same loan without mortgage insurance because the insurance is a cost thats included in APR.

Dont Settle For A Mortgage With Lender Fees

With most mortgage lenders, closing costs comprise lender fees and third-party fees. But at Better Mortgage, we never charge lender fees, so there are no loan officer commissions, lender origination fees, application fees, or underwriting fees.

The competitive interest rate that you get will be accompanied with an APR that isnt inflated by unnecessary costs, which can equal thousands of dollars over the life of your loan.

Ready to get a Better Mortgage experience? Get your custom rates today.

This blog post is for informational purposes only, and is not intended to provide, and should not be relied upon for tax, legal or accounting advice.

- More

Also Check: 10 Year Treasury Vs 30 Year Mortgage

What’s Included In An Apr

Here are the costs you can expect to be represented in your APR:

- Interest rate

- Discount points: You can pay a fee at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

- Recording fee

- Property survey fees

Ask your lender for an itemized list of fees so you can know what you’re paying, both toward the APR and toward other fees.

Using Apr And Interest Rate To Find A Mortgage

Both APR and interest rate are useful tools for finding the best mortgage for your borrowing needs. For most home buyers, its generally better to use APR than interest rate when shopping for a mortgage. Thats because APR more completely and accurately represents the total cost of the mortgage over the full life of the loan.

Not sure what that looks like in practice? Lets look at an example.

Suppose Lender A offers an interest rate of 3.9%, while Lender B offers an interest rate of 4.0%. It may seem like an obvious decision to go with Lender A, right? Not so fast! In order to understand the true cost of the mortgage over time, youd need to know what both lenders are charging for broker fees, closing costs and other lender fees all of which factor into the APR. If both lenders charge the same fees, but Lender A also requires the purchase of two discount points to get the lower nominal interest rate, you might ultimately be better off with Lender B.

Theres a flipside to this as well. If a lender charges expensive fees in exchange for a lower interest rate than their competitors, you might still choose that lender if it means getting a better APR overall.

No matter what, when shopping for a lender, you should make sure youre comparing like products. You wouldnt want to compare a 15-year mortgage from Lender A to a 30-year mortgage from Lender B. The same goes for fixed-rate and adjustable-rate mortgages: Always compare like with like.

Read Also: Chase Recast

Fixed Vs Adjustablerate Mortgage Aprs

On a fixedrate mortgage, the APR will almost always be higher than the interest rate. Thats because your rate stays the same over the life of the loan so adding fees on top of the fixed rate will naturally increase the APR.

But what about an adjustablerate mortgage?

If youre comparing ARM interest rates, you may notice something odd: the APR can actually be lower than the interest rate.

This isnt because ARMs have low or no loan fees. Rather, its because of the way lenders calculate APR on an adjustablerate loan.

The annual percentage rate on an ARM is based on the index rate your loan is tied to. An index is simply a measurement of the economic conditions at the time, expressed in an interest rate.

But ARM APRs assume the index rate will stay the same over the life of the loan. Not likely.

For instance, say you take out a 5/1 ARM. Your initial interest rate is 3.5%, and your margin is 2.25%. On the day your loan closes, the index rate your loans tied to is at 0.5%.

- Initial interest rate: 3.5%

- Index rate at closing: 0.5%

- Your loans margin: 2.25%

This calculation can make ARMs look incredibly attractive during a lowrate period like the one were currently in especially if youre shopping based on APR.

So, dont be fooled by the ultralow APR on an adjustablerate mortgage. Its an estimate based on some big assumptions

And many borrowers sell or refinance before their ARMs fixedrate period is up, in any case.

How Closing Costs And Interest Rate Affect Apr

While some lenders may advertise a no-closing-cost loan, its important to understand that those costs are still there, but instead of paying them upfront, theyre absorbed into the loan. A common way to do this is by adjusting the opposing levers on interest rates and APR: in exchange for a higher interest rate, you may be able to lower your upfront closing costs and your total APR.

On the other hand, paying more in closing costs will usually result in a lower loan interest rate and a higher total loan cost, or APR.

As a general rule of thumb, interest rates and APRs have an inverse relationship:

- A low closing cost or no-closing-cost loan with higher interest rate = lower APR

- When paying loan closing costs, including paying points for lower interest rates = higher APR

Of course, if youre purchasing a home and your seller is offering a generous amount in closing cost concessions, then you may be able to benefit from both a low rate and low out-of-pocket closing costs.

Don’t Miss: 10 Year Treasury Yield And Mortgage Rates

Can You Negotiate Apr On Your Mortgage

There are certain APR fees you can ask your lender to reduce or waive. Depending on the lender, you may have success negotiating the following:

- Discount points: Some borrowers can buy down their interest rate by purchasing points. One point costs 1% of your loan value and often reduces your interest rate by roughly 0.25%. Buying points means you pay more upfront, but it can save you money if you plan on keeping your loan long-term.

- Closing costs: Some prices are fixed, but try asking for discounts on:

- Origination fees: Lenders charge from 0.5% to 1% of the loan amount to process and fund the mortgage.

- Application fees: Lenders may charge a fee for you to apply for a mortgage.

- Seller concessions: The seller may agree to pay a portion of your closing costs.

- Grant assistance: Depending on your loan, you may qualify for closing cost assistance through local or federal grant programs.

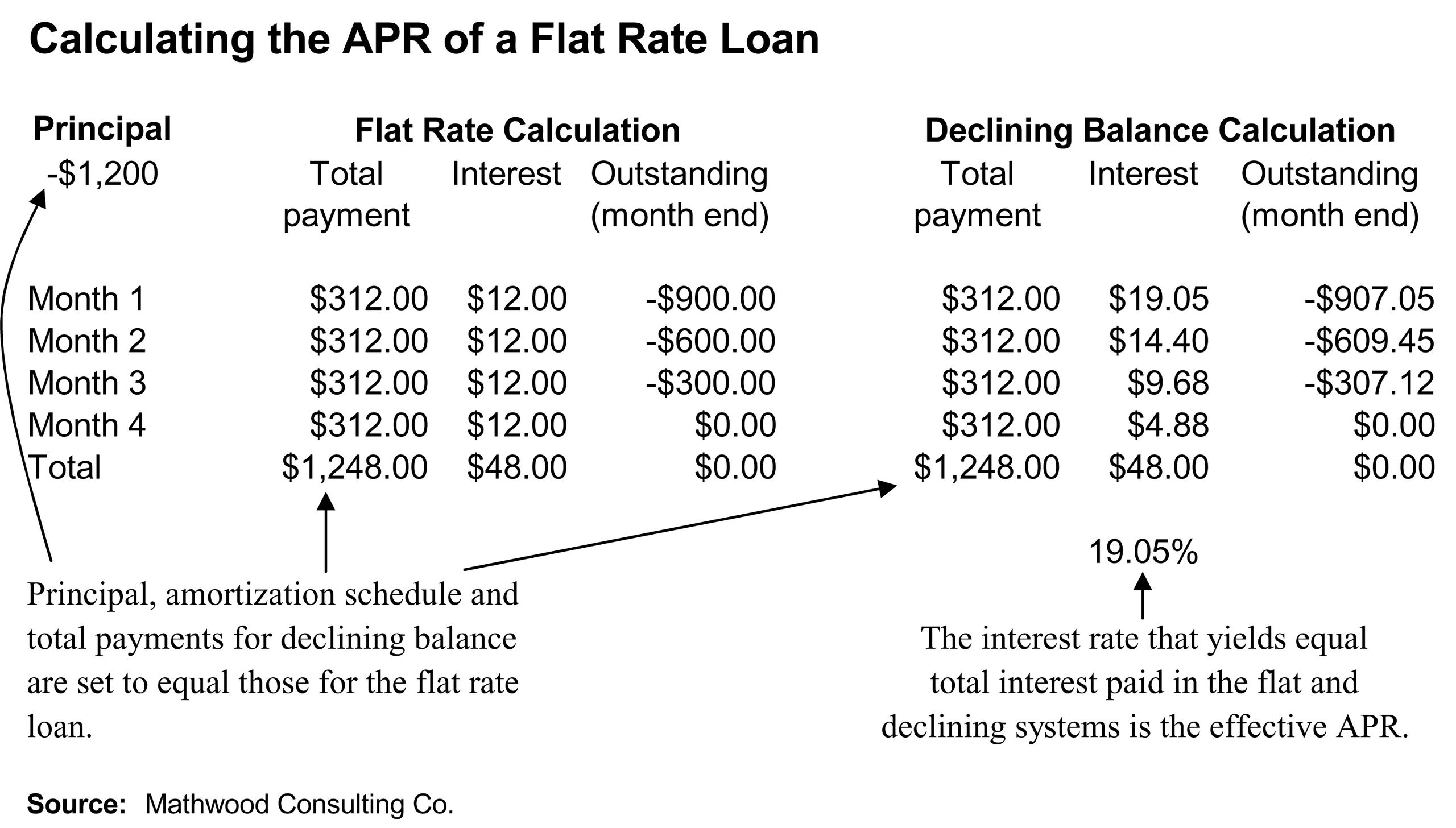

How To Calculate Apr On A Mortgage

If youre shopping for a loan, its a good idea to know exactly how APR is calculated. Having a firm grasp of the concept will better inform your search, and it never hurts to check the math! If you know the amount of fees and interest youll be expected to pay on a loan, then determining the APR is relatively simple:

You May Like: Does Rocket Mortgage Sell Their Loans

Using Apr To Shop For A Mortgage

As noted above, APR provides a more accurate indication of the true cost of a mortgage than simply looking at the mortgage rate. In some cases, mortgage lenders may charge higher fees to offset an unusually low rate they may be offering. APR can help you detect that.

By law, the APR must be disclosed in any loan estimate, including mortgages, and in any advertising for loans that specifies an interest rate. Such advertising for mortgage rates must also include the number of discount points the rate is based on, the more discount points that are included, the larger the difference there will be between the rate and the mortgage APR. While mortgage APR is a useful guide for comparing the costs of different loan offers, it does have some shortcomings. Because it is based on annualized cost of fees amortized over the full length of the loan, it will not give a fully accurate picture of costs if you sell or refinance before the loan is paid off. As a rule of thumb, it’s often better to accept higher fees in return for a lower rate on a long-term loan, where you have more time to amortize their cost. But if you’re only going to have the loan for a few years, it’s often better to minimize fees even if you’re paying a higher rate.

FAQ: See FAQ above under section Mortgage Loan APR Explained for APRs on an Adjustable Rate Mortgage .

Whats The Difference Between Apr Vs Apy

Theres another important number to consider when taking out a loan or applying for a credit card: the annual percentage yield.

As previously mentioned, APR is a measure of the yearly cost of your loan if your loan is based on simple interest. APY is used in cases where interest is compounded, such as with savings accounts or credit card debt. In the APR calculation example, the borrower paid $120 in interest for a $2,000 loan. That means that they were charged 6% of the principal, calculated once, which would be the simple interest.

In some cases, interest on your loan is compounded, or calculated at a regular interval and then added to the principal owed. When interest is next compounded, its calculated using the now higher principal amount. This is how credit cards and adjustable-rate mortgages work. APY represents the annual cost of your credit card or loan while also factoring in how often interest is applied to the balance you owe on the card or loan.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

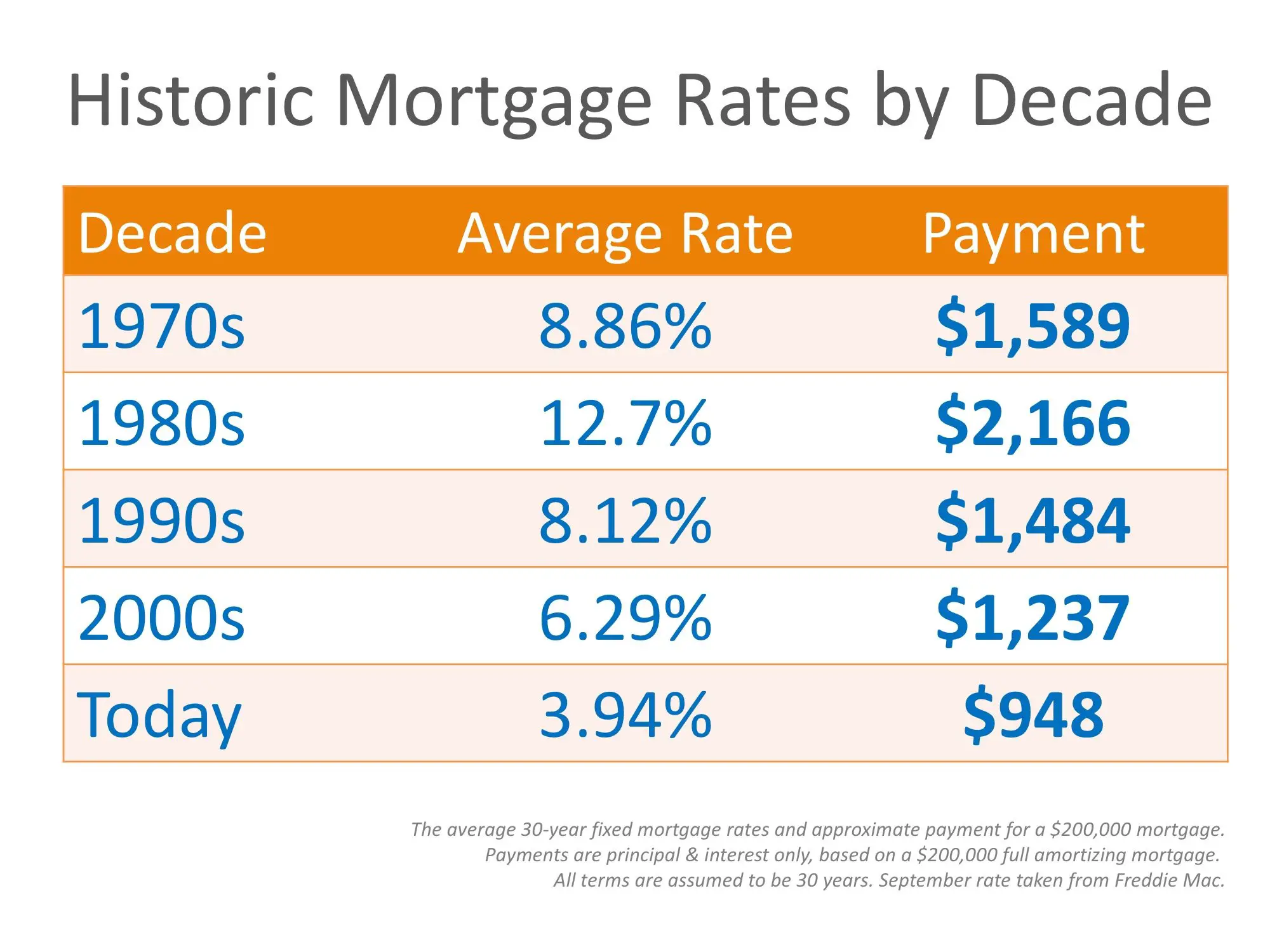

How Are Mortgage Rates Set

Several economic factors influence rates, from inflation to monetary policy. Likewise, different lenders charge different mortgage rates for a variety of reasons, including varying operating costs, risk tolerance and even how much they want new business. Your personal financial informationincluding credit score, debt-to-income ratio and income historyalso have a significant impact on interest rates.

Whats The Difference Between Apr Vs Interest Rate

Lets take a look at the difference between with an example. Say youre applying for a 30-year fixed-rate mortgage loan. One lender might offer you an interest rate of 3.5% and a second might offer one with an interest rate of 3.625%. You might think that your best option is to go with the 3.5% loan but the first thing you should do is compare the loans APRs. By comparing the two loans, youll be able to tell how much each would cost you each year when your lenders fees and charges are included. Maybe that first loan, with the lower interest rate, has an APR of 3.825% and the second loans APR, despite that higher interest rate, is just 3.75%. This means that the second loan, despite coming with a higher interest rate, is in fact cheaper.

You might be asking yourself, How can this be? Its actually quite simple: The first lender is charging higher fees, which makes that loan more expensive.

Don’t Miss: Can You Refinance A Mortgage Without A Job

What Is The Difference Between The Mortgage Interest Rate And Apr

When looking at APR vs. interest rate, at its simplest, the interest rate reflects the current cost of borrowing expressed as a percentage rate. The interest rate does not reflect fees or any other charges you may need to pay for the loan. The APR, also expressed as a percentage rate, provides a more complete picture by taking the interest rate as a starting point and accounting for lender fees and other charges required to finance the mortgage loan.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Mortgage Recast Calculator Chase

Tips To Remember When Loan Shopping

The main takeaway is that shopping around for a mortgage will help you get your best deal. Its not always easy to compare apples to apples while evaluating mortgage offers, but combing through your loan estimates can help.

Dont just settle on one mortgage lender before doing your due diligence pick three to five lenders. Taking the time to comparison shop can potentially save you thousands in interest over the life of your loan.

Keep the following tips front of mind as you prepare to get a mortgage:

Understanding Mortgage Interest Rates

A mortgage payment is made up of the principal and the interest. The principal is the money you borrowed from your lender. The interest is a percentage-based fee that you pay the lender for borrowing that money. Paying the principal reduces the amount you owe, while paying the interest does not.

Rates can be fixed or adjustable. A fixed rate never changes, but the rate for an adjustable rate mortgage, or ARM, can adjust higher or lower while you have your loan. If your rate adjusts, your monthly payment will change. Adjustable rate mortgages typically have caps that limit how much and how often they can change. Most adjustable rate mortgages have a rate thats fixed for a number of years and then can adjust.

Lenders offer different rates to different borrowers. The rates youll be offered typically depend on the following:

- How much you want to borrow.

- How much youve saved to pay upfront.

- How many years youll have to repay your loan.

- Whether you usually pay your bills on time.

- The type of loan you choose.

- Where you live.

When you apply for a loan, the rates youre offered can be either floating or locked. A floating rate can change before you close your loan. A locked rate shouldnt change for 30, 45 or 60 days, depending on how long your rate lock lasts. If you wont be able to find a home and complete the loan process in that time frame, you can usually pay a fee to get a longer lock.

Recommended Reading: Rocket Mortgage Requirements