What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

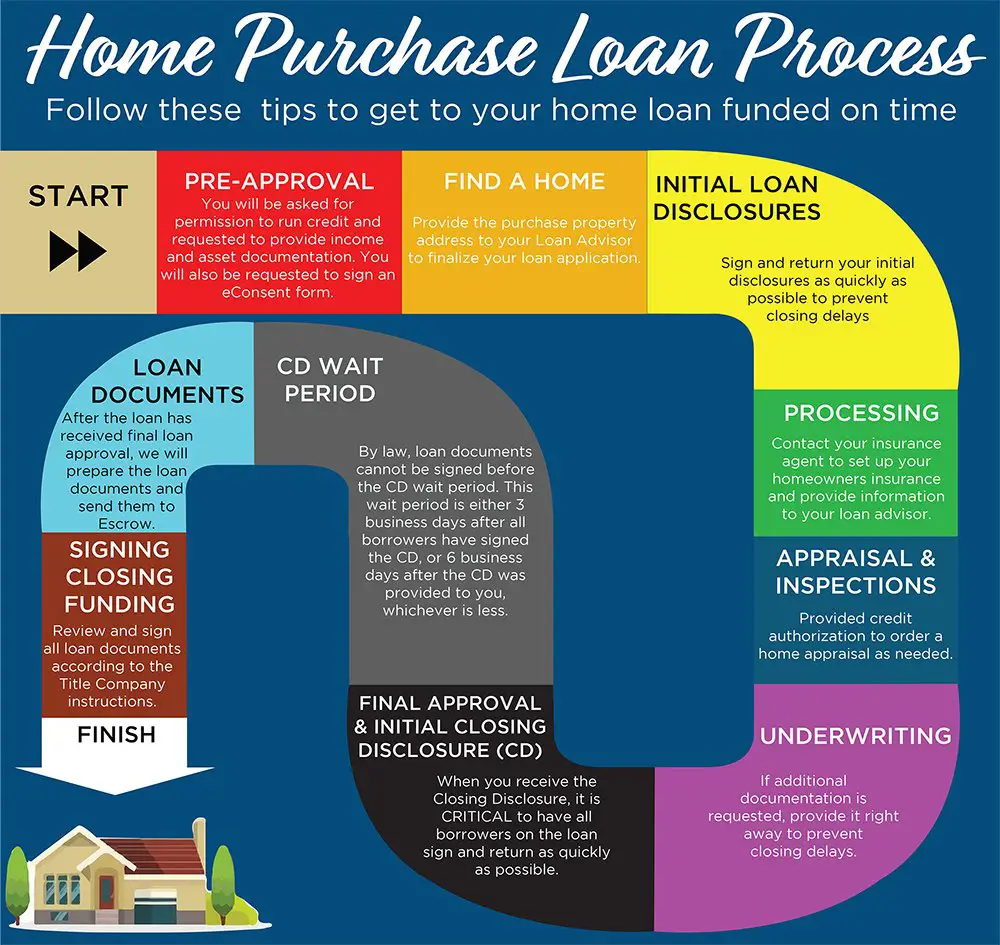

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

What Happens During Mortgage Processing

When applying for a home loan, the buyer will work with a loan officer or mortgage broker, who acts as a mediator between borrowers and lenders. Once you apply for a home loan, the time between applying and closing is known as mortgage processing.

The lender reconfirms the home buyers records during mortgage processing to ensure accuracy and completion of all the necessary data. The process entails verifying the buyers information, ordering their credit reports and scheduling a home appraisal. The data found will determine your loan approval status.

Choose A Mortgage Lender

Now that youve found a home and your offer has been accepted, its time to make a final decision about your lender.

You can stick with the lender you used during the pre-approval process or you can choose another lender. Its always a good idea to shop around with at least three different lenders.

When shopping for a mortgage, remember your rate doesnt depend on your application alone. It also depends on the type of loan you get.

Of the four major loan programs, VA mortgage rates are often the cheapest, typically beating conventional mortgage rates. USDA and FHA loan rates also look low at face value, but remember these loans come with obligatory mortgage insurance that will increase your monthly mortgage payment. Conventional loans also have PMI, but only if you put less than 20% down.

So look at a few different lenders rates and fees, but also ask what types of loans you qualify for.

There may be much better deals available than what you see advertised online, especially if youre a veteran who qualifies for the VA home loan program.

For a detailed explanation of how to compare offers and choose a mortgage lender, see: How to shop for a mortgage and compare rates

Don’t Miss: What Is Needed For A Mortgage Loan

How We Assist You To Improve Your Mortgage Processing Framework

We leverage well-defined mortgage back-office process flows and advanced automation technologies to process over 10000 loan applications within a single month. Partnering with us will open access to cross-skilled experts who can help you handle about 50% of more loan volumes even during rush hours.

However, we believe in maintaining the right blend of human intelligence and automation. In todays era, automation is inevitable to improve mortgage processing. We also understand that it is an incredibly difficult task to choose and invest into the right kind of automation technology. You will need to bring significant changes in your legacy infrastructure to use any new kind of technology.

On this note, we make the task easier for you by bringing to MSuite, our proprietary optical character recognition-based platform enhanced by machine learning and artificial intelligence algorithms. This tool is platform-agnostic which means that it can be hosted both on-premises and on cloud. The modular structure of MSuite allows it to be used with other technologies as and when needed.

MSuite is designed to process mortgage loans with efficacy and acceleration. It performs data extraction and document indexing within minutes ensuring 90% data accuracy. As an indexing engine, it recognizes over 350 document types in varied format. It scans documents with a quality as low as 150 DPI while ensuring 95% of data accuracy.

How To Get A Mortgage: A Step

You probably already know that a mortgage is a type of loan that you use to buy a home. Its a good idea to learn as much as you can about getting a mortgage before you start shopping for a home.

The best way to avoid wasting time is to know the players and the process. That means working with a lender to get the best possible loan.

In this article, well get you ready to go mortgage shopping by going over what lenders are looking for, the paperwork involved and the five steps it takes to complete the mortgage process.

Read Also: Where Is Rocket Mortgage Golf Tournament

Get Preapproval For The Loan:

We always suggest people get approval from their lenders before looking for a property in the market. It is because a person can get an idea about how much funds he can arrange, which will help find the suitable property according to his financial health. Even the brokers or real estate agencies wont pay much attention to you without any pre-approved loan.

Usually, all the real estate companies work based on commission, which is why they wont profoundly take you while looking for a property. But when you have a pre-approved loan letter with you, both the brokers and the sellers would consider investing their valuable time in showing you the properties and giving you all the required information.

Finalizing Your Mortgage Loan:

After you have got a purchasing agreement from the seller, it is time for you to apply for the loan finally and get it finalized. Complete all the paperwork that is required. However, there wont be much paperwork for you because you have already done most of it in the preapproval process. Submit all the documents whatever the lender may need to close the loan.

Also Check: What Will Mortgage Rates Do Next Week

How To Assume A Mortgage

This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.There are 8 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 302,861 times.

Assuming a mortgage is a process by which you take over the payments on an existing loan rather than secure your own financing to purchase the house. Most lenders include a due-on-sale clause that prohibits a buyer from assuming a mortgage by making the note payable upon the transition of ownership of the mortgaged property. However, some loans, like VA, USDA, and FHA loans, are inherently assumable. If you’re thinking about taking over someone else’s payment, make sure you know how to assume a mortgage before you sign any paperwork or hand over any funds. Assuming a mortgage is not limited to “underwater” mortgages.

How Do I Become A Mortgage Loan Processor

Lets review the steps you should take to become a loan processor:

Read Also: How Much Should Your Mortgage Be Compared To Income

How To Become A Loan Processor

The key to becoming a loan processor is developing a skill set that is diversified and works well in the financial industry. Gaining as much experience as possible through on-the-job training sessions and online financial courses will set you up to be more of an appealing hire. Lets review the steps you should take to become a loan processor:

Step 1:Earn a high school diploma. This is usually a minimum educational requirement at many loan companies.

Step 2:Earn a higher-level degree. Its highly recommended to graduate with at least an associate degree in a related subject, like finance, banking or business. This allows you to have the basic concepts of financial management and banking practices down.

Step 3: Receive your mortgage license. Youll need to take the NMLS Mortgage Education pre-training and pass the Mortgage License National Test to receive your mortgage license. This process will depend on the state that you reside in.

Step 4: Obtain employment. A loan processor works at places like credit unions, mortgage lenders and banks. From there, youll want to receive on-the-job training. Its recommended to obtain computer software, communication and information processing skills.

Step 5:Work your way up. The longer you stay in the field, the easier it will be to advance in financial positions.

The salaries listed below do not represent salary estimates from Rocket Mortgage® and were pulled from the Bureau of Labor Statistics for educational purposes only.

How Long It Could Take To Get A Loan

The entire process of getting a mortgage loan comprises several processes. These include getting pre-approved and getting the home appraised before you get the loan. Because of the many steps in this process, it is impossible to put a definite time frame. In the usual market, it takes an average of 30 days to get a mortgage.

If there are problems with your application, getting your loan approved could take much longer. It is advisable to start the mortgage application process as soon as possible to shorten this process. You don’t have to wait until you find the perfect property before you begin the mortgage process. You can save time by starting the process to get pre-approved first.

Possible problems that might arise in the loan approval process include delayed appraisal, delayed tax transcript verification from the IRS, delayed verification of employment by employers, and provision of incomplete or incorrect information to the lender by the borrower. Although you may not have much control over most of these, you should ensure all documents provided to the lenders are submitted in a timely fashion and as detailed and accurate as possible. Doing this would speed up the approval process and shorten the time it takes to get a loan.

Read Also: How Many Mortgages Can You Have For Rental Property

Common Underwriting Stages And Conditions

Now that weve touched on rate locks, appraisals, and inspections, lets get back to the steps most every borrower experiences during the home loan process. Next up after processing is underwriting. This is where the lender will check your eligibility, confirm the information you’ve provided, and determine if you are approved or denied. It is an incredibly thorough stage, and it may include you falling into conditional approval, where youll need to send in more documentation.

How Strict Is Mortgage Underwriting

In 2020, 9.3 percent of applications for a home purchase loan were denied, according to Home Mortgage Disclosure Act data.

For the most part, mortgage lenders follow specific standards for the loans they originate.

For conventional loans, lenders adhere to Fannie Mae and Freddie Mac standards, because if a loan meets those requirements, the lender can sell it on the secondary market and use that capital to create more mortgages for more borrowers.

For an FHA, VA or USDA loan, lenders follow the guidelines of the Federal Housing Administration, Department of Veterans Affairs and Department of Agriculture, which guarantee or insure those types of loans if the borrower defaults.

Lenders also have to account for the business of making mortgages they cant take on more risk than what their operation supports. So, in addition to baseline loan standards, lenders can impose additional requirements, known as overlays.

Sometimes, lenders implement stricter protocols in response to economic volatility. Throughout the pandemic, for example, many lenders began requiring higher credit scores and larger down payments.

That said, some lenders can be flexible, such as allowing a borrower to qualify based on assets instead of income.

Read Also: What You Need To Get Approved For A Mortgage

Confidently Navigate This Process

The process of buying your first home is more manageable if you take steps to prepare for the purchase . Once first-time buyers get to the stage of applying for a mortgage loan, itâs important to be well-informed. These tips can help you navigate the mortgage loan application process.

Consider shopping for your mortgage loan firstâ¦before you find your house

Knowing your loan options before you start looking at houses will help you in your home search by providing the amount a lender will loan you to buy a house. This information will help you target homes in a price range you can afford. When you find a lender and mortgage thatâs right for your situation, you can get a preapproval for the loan, which will save time later when youâre ready to make an offer on a house, since lenders will have most of the information they need to move forward with the loan.

Find the mortgage that works best for you

There are many different types of mortgages to choose from, and an important aspect of the process is to choose the mortgage that works for you now and in the future. When shopping for a mortgage, consider the type of interest rate and whether a conventional loan or a government-guaranteed or insured loan is best for you.

Rates

Loan types

For suggestions on how to save money with worksheets to help you plan to save visit: Money Smart – Your Savings.

Loan estimate

Moving forward with the loan

Closing the loan

Additional resources

What Does A Mortgage Loan Processor Do

The main benefit of a loan processor is that they help streamline the process of applying for a home loan. The steps can be quite complex, but the loan processor helps you find the right loan for your budget and needs.

Here are some of the core tasks a mortgage processor performs:

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Also Check: How To Become A Mortgage Loan Officer In Michigan

Bringing It All To A Close

Youve made it to the final step in the home-buying process. All the planning, preparation and waiting are finally over. But before you get the keys to your new home, you have one more thing to do.

At your closing, you will meet with your closing agent to sign all your mortgage documents. Take your time, make sure you understand what youre signing and dont be afraid to ask questions. And voilà, once youve dotted all the Is and crossed all the Ts, youll officially be a homeowner!

The closing process doesnt have to be nerve-wracking if you know what to expect. We can help you prepare for this exciting step, so your big day is a success.

We understand how overwhelming the home-buying and mortgage process can be. You can count on us to help you through it. Buying a home can be one of the most exhilarating and stressful moments of your life. But finding a home you can call your own makes it all worthwhile.

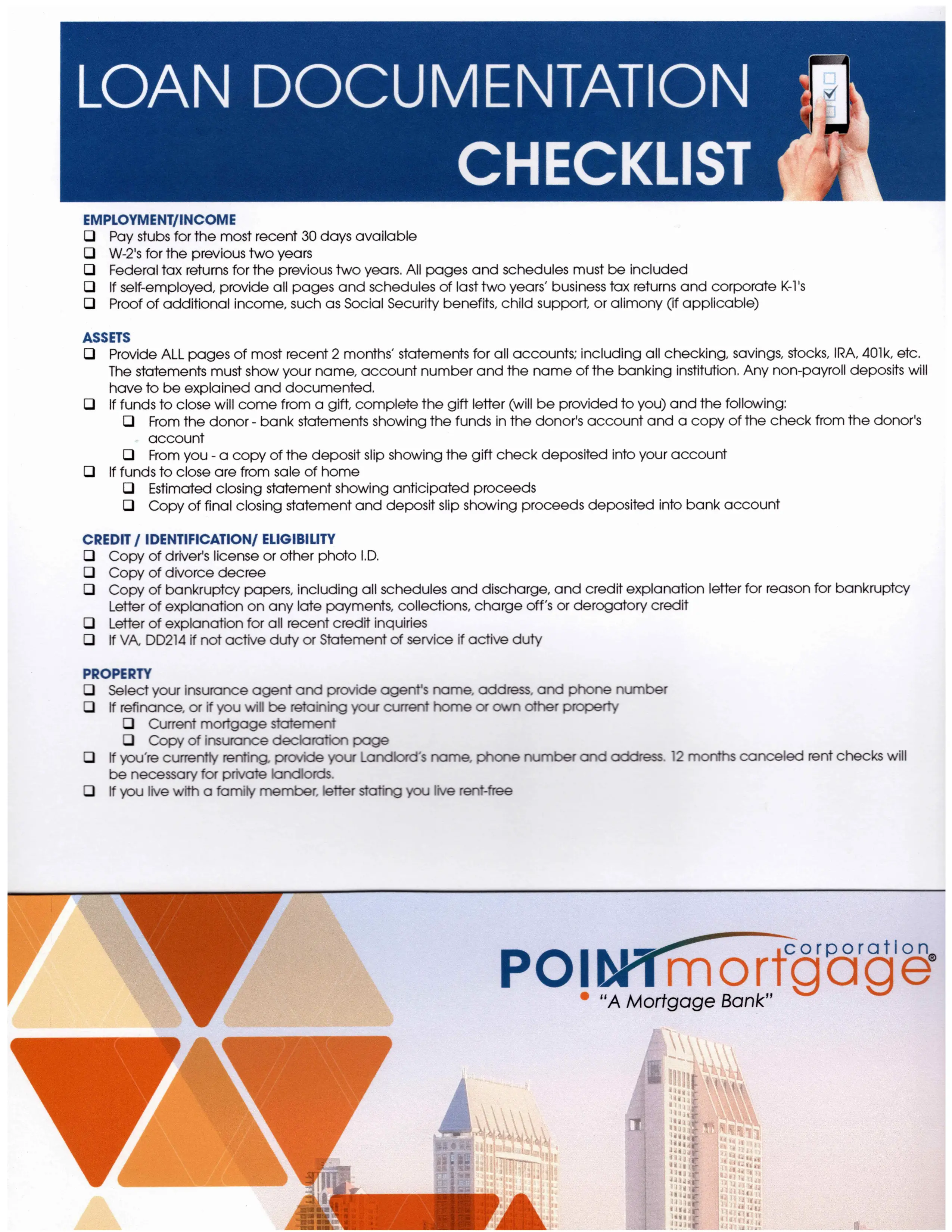

Using Loan Checklists To Error

It is one thing to have processes, systems and procedures to ensure that your loan process is carried out in a standardised way. Its another to ensure its actually done that way, every time.

This is where checklists come in. Checklists are a simple yet profoundly effective way of ensuring that processes are executed correctly, every time. .

The only thing is that for lending, these checklists need to be Dynamic Checklists, as opposed to Static Checklists.

Static Checklists are the same for every deal, whereas Dynamic Checklists are customised checklists that relate to the specific deal at hand. With Dynamic Checklists, you have less chance of missing an important detail that can delay or derail your deal and frustrate your client.

These checklists not only ensure that everything is done right, but they also provide an audit trail for each deal in case anything should go wrong. Heres one example:

By adopting the right loan processing system, you free up time to focus on , client acquisition and client service. These are the activities that ultimately grow the value of your practice.

Read Also: Are Mortgage Interest Rates Going Up

Collecting Proof Of Employment Assets Debt Income And Homeowners Insurance

Your loan processor’s primary job is to verify all of the information you have provided on your mortgage application. This means checking your income verification , assets , and outstanding debts

Loan processors will pay particular attention to your income. Why is this? Well, lenders don’t want your total monthly mortgage paymentsâprincipal, interest, property taxes, and homeowners insuranceâto swallow up your monthly gross income. Remember, lenders want to be certain you will be able to comfortably manage your current obligations and your new monthly mortgage payments.

In addition, loan processors will make sure you have a current homeowners insurance policy for the house you are planning to buy or are currently refinancing. This insurance will protect you and your lender from suffering a financial catastrophe in the case of a fire, flood, etc.

In order for your lender to verify all of the factors that make up your overall financial situation, you will need to provide:

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

Read Also: How Much Mortgage Can I Afford On 200k Salary