Higher Mortgage Rates Soon

But, even if theres no such deal, and oil prices remain high, that should fairly soon start to drive mortgage rates higher. Because those prices feed into inflation, something that investors in bonds, including mortgagebacked securities, hate. When investors sell bonds, that pushes prices down and yields up.

And higher inflation might also force the Federal Reserve to act more aggressively to keep prices and salaries in check. Which is something else that should push mortgage rates higher.

So we may, perhaps, see lower mortgage rates for a while. But dont bank on them staying that way for long.

For a more detailed look at whats happening to mortgage rates, read the latest weekend edition of this report.

The Bank Of Canada And Mortgage Rates

Through the key policy rate and its other monetary policy tools, the Bank of Canada influences the interest rate for all borrowing and lending transactions in Canada. For example, changes in the key policy rate usually lead to changes in bank Prime rates. Subsequently, the key policy rate has significant influence on variable mortgage rates that are based on a lender’s Prime rate.

Changes in the key policy rate and monetary policy can also affect fixed mortgage rates. Fixed mortgage rates usually follow the yields of Government of Canada 5-Year bonds. A shift in monetary policy can lead to changes in the bond yields, which will then lead to changes in fixed mortgage rates.

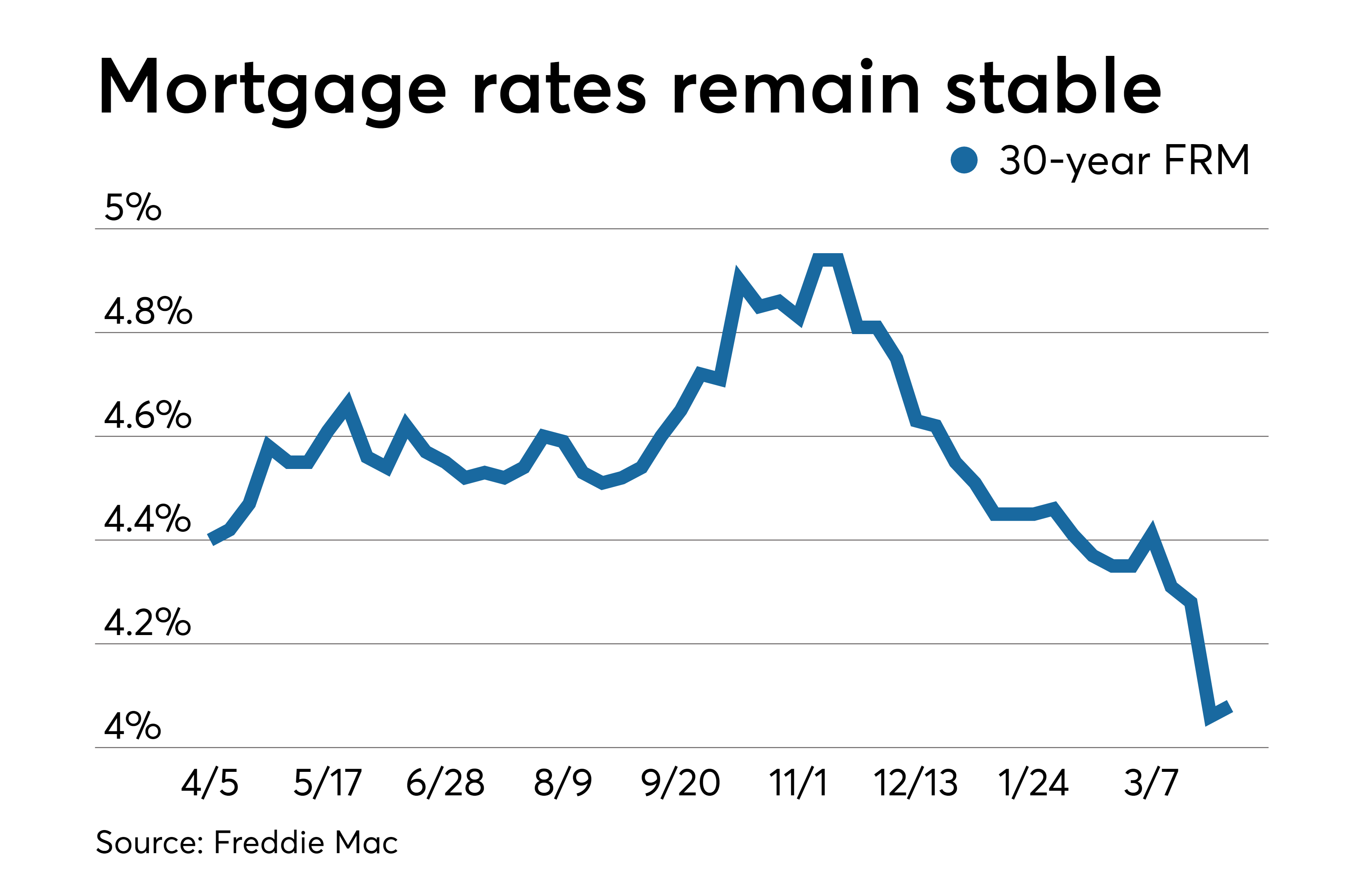

Latest Mortgage News: Rates Rise Again Hold Above 4%

Mortgage rates inched up again this week, keeping rates at their highest levels since before the pandemic. The average rate on 30-year mortgages climbed to 4.08 percent from 4.03 percent last week, according to Bankrates weekly survey of large lenders.

The Federal Reserve has signaled that a hike in interest rates is imminent, perhaps as early as next months meeting.

The rapid rise has outpaced most forecasts. While mortgage experts expected rates to continue to climb from the all-time bottom of 2.93 percent achieved in January 2021, this jump has been steep. A year ago, the benchmark 30-year fixed-rate mortgage was at 3.18 percent. Four weeks ago, the rate was 3.71 percent. The 30-year fixed-rate average for this week is 1.08 percentage point higher than the 52-week low of 3 percent.

The 30-year fixed mortgages in this weeks survey had an average total of 0.32 discount and origination points.

Over the past 52 weeks, the 30-year fixed has averaged 3.27 percent.

- The 15-year fixed-rate mortgage rose to 3.31 percent from 3.29 percent a week ago.

- The 5/1 adjustable-rate mortgage remained at 3.8 percent .

- The 30-year fixed-rate jumbo mortgage was 3.85 percent, down from 3.92 percent last week.

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

Understand Inflation In The Us

- Inflation 101: What is inflation, why is it up and whom does it hurt? Our guide explains it all.

- Your Questions, Answered: We asked readers to send questions about inflation. Top experts and economists weighed in.

- Whats to Blame: Did the stimulus cause prices to rise? Or did pandemic lockdowns and shortages lead to inflation? A debate is heating up in Washington.

- Supply Chains Role: A key factor in rising inflation is the continuing turmoil in the global supply chain. Heres how the crisis unfolded.

Rates are rising as strong demand for homes, along with a tight supply of properties for sale, has pushed up home prices. The typical sale price of a previously owned home in 2021 was just under $347,000, according to the National Association of Realtors an increase of nearly 17 percent from 2020.

Shoppers should still expect a competitive spring housing market, Ms. Hale said. Some potential buyers who have been on the fence may move quickly to lock in mortgage rates before they rise further. It gives shoppers some urgency to close sooner rather than later, she said.

But some shoppers particularly first-time buyers may decide to wait until even higher rates help cool off prices later in the year. The largest share of home buyers are millennials ages 21 to 40, many of whom are first-time buyers, according to the National Association of Realtors.

The spring season will be very interesting, said Lawrence Yun, the chief economist with the Realtors association.

Expert Mortgage Rate Forecasts

Looking further ahead, Fannie Mae, Freddie Mac and the Mortgage Bankers Association each has a team of economists dedicated to monitoring and forecasting what will happen to the economy, the housing sector and mortgage rates.

And here are their current rate forecasts for the four quarters of 2022 .

The numbers in the table below are for 30year, fixedrate mortgages. Fannies were published on Feb. 18 and Freddies and the MBAs on Jan. 21.

| Forecaster | |

| 3.7% | 4.0% |

Of course, given so many unknowables, the whole current crop of forecasts may be even more speculative than usual.

Read Also: Reverse Mortgage For Condominiums

Year Mortgage Rate Forecast For 2021 2022 2023 2024 And 2025

| Month |

| 31.1% |

30 Year Mortgage Rate forecast for .Maximum interest rate 3.14%, minimum 2.96%. The average for the month 3.05%. The 30 Year Mortgage Rate forecast at the end of the month 3.05%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.07%, minimum 2.89%. The average for the month 3.00%. The 30 Year Mortgage Rate forecast at the end of the month 2.98%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.02%, minimum 2.84%. The average for the month 2.94%. The 30 Year Mortgage Rate forecast at the end of the month 2.93%.

Mortgage Interest Rate forecast for .Maximum interest rate 2.98%, minimum 2.80%. The average for the month 2.90%. The 30 Year Mortgage Rate forecast at the end of the month 2.89%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.10%, minimum 2.89%. The average for the month 2.97%. The 30 Year Mortgage Rate forecast at the end of the month 3.01%.

Mortgage Interest Rate forecast for May 2022.Maximum interest rate 3.25%, minimum 3.01%. The average for the month 3.11%. The 30 Year Mortgage Rate forecast at the end of the month 3.16%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.37%, minimum 3.16%. The average for the month 3.24%. The 30 Year Mortgage Rate forecast at the end of the month 3.27%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.42%, minimum 3.22%. The average for the month 3.31%. The 30 Year Mortgage Rate forecast at the end of the month 3.32%.

Caveats About Markets And Rates

Before the pandemic and the Federal Reserves interventions in the mortgage market, you could look at the above figures and make a pretty good guess about what would happen to mortgage rates that day. But thats no longer the case. We still make daily calls. And are usually right. But our record for accuracy wont achieve its former high levels until things settle down.

So use markets only as a rough guide. Because they have to be exceptionally strong or weak to rely on them. But, with that caveat, mortgage rates today might not move far. However, be aware that intraday swings are a common feature right now.

You May Like: Does Rocket Mortgage Service Their Own Loans

Mortgage Interest Rate Faq

What are current mortgage rates?

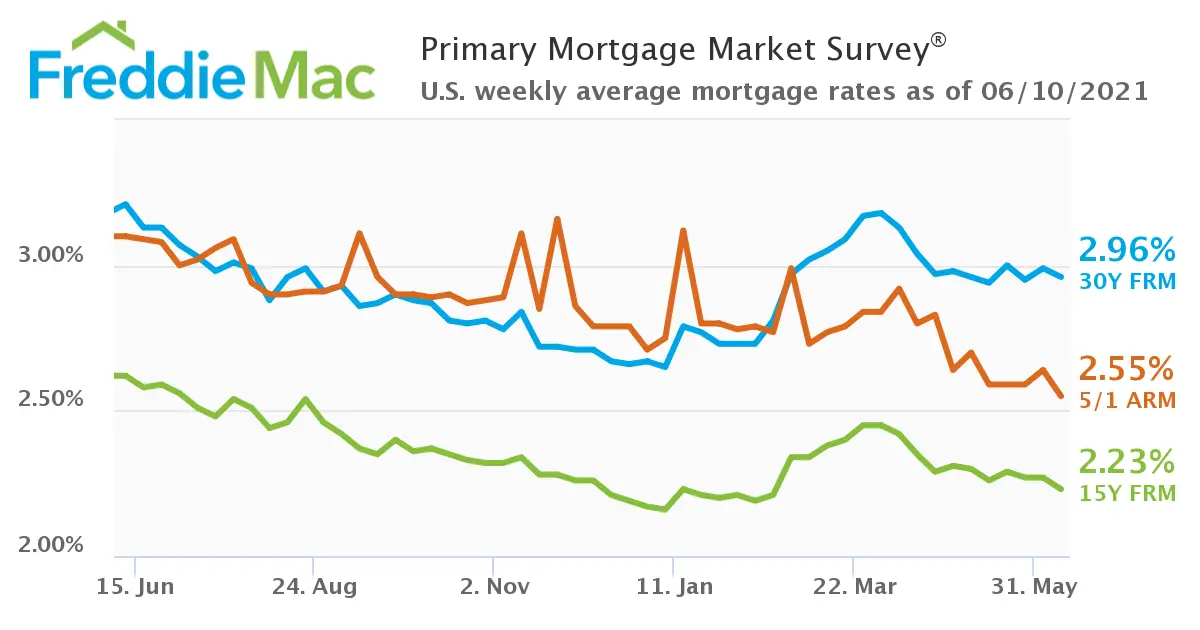

Current mortgage rates are averaging 3.12% for a 30-year fixed-rate loan, 2.34% for a 15-year fixed-rate loan, and 2.45% for a 5/1 adjustable-rate mortgage, according to Freddie Macs latest weekly rate survey. Your individual rate could be higher or lower than the average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Will mortgage rates go down next week?

Mortgage rates could decrease next week depending on the severity of Omicron variant case numbers. If the curve keeps uptrending, it could lead to rates falling despite inflation growth and the Fed changing its policies.

Will mortgage interest rates go down in 2022?

Its unlikely mortgage rates will go down in 2022. The ultra-low rates enjoyed by homeowners and buyers in 2020-2021 were largely driven by the Covid pandemic. And as the pandemic recedes in 2022, rates should keep on climbing.

Will mortgage interest rates go up in 2022?

Yes, its very likely mortgage rates will increase in 2022. Along with a decline in new Covid cases, were seeing positive growth in the U.S. economy. Increased consumer spending, low unemployment, and a strong real estate market could all help push rates up. Not to mention, the Fed expects to have completely withdrawn its pandemic-era mortgage support by mid-2022. And that means it will no longer be keeping mortgage rates artificially low.

What is the lowest mortgage rate right now?

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Also Check: Chase Mortgage Recast Fee

Mortgage Bankers Associations Forecast

The highly respected MBA, in its most recent Mortgage Finance Forecast, posted a bold prediction: Mortgage rates will average 4% by the end of the year, although rates in the second quarter may average 3.5%.

In their December 2021 , Mike Fratantoni and Joel Kan with the MBA state the following:

Mortgage rates have been kept lower than they otherwise would have been through the Feds purchases of longerterm Treasuries and MBS. Given this faster rate of tapering and improving economy, we forecast that mortgage rates will rise to 4 percent by the end of 2022 and may be more volatile as the Fed backs away from the market, reducing its role as the largest buyer of MBS.

Given this faster rate of tapering and improving economy, we forecast that mortgage rates will rise to 4 percent by the end of 2022 and may be more volatile as the Fed backs away from the market

Mike Fratantoni and Joel Kan, Mortgage Bankers Association

Fratantoni and Kan also predict a sea change in the mortgage industry.

As rising mortgage rates lead to a drop in refinances, we expect that the strong economy will support an increase in home sales in 2022. Thus, we see 2022 as a transition year, moving from a refinance market to a purchase market.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Don’t Miss: How Does Rocket Mortgage Work

Shall I Get A Variable Rate Mortgage

Variable rates are typically a little lower than fixed rates because the borrower takes on the risk of rates changing over time.

Variable rates are expected to remain below 3 percent well into 2023. That’s pretty low, but you could also lock in a 5-year guaranteed fixed rate lower than 3 percent today.

Bank Of Canada Interest Rate Forecast For The Next 5 Years

Above, we have predicted that the Bank of Canada’s Target Overnight Rate will remain at 0.25% for 2021 andrise to 0.50% in 2022. From 2023 onwards, the outlook is less certain and highly dependent on global macroeconomic factors. CPI inflation is expected to surpass the BoC’s target of 2% in 2021 and stabilize at 2% in 2022 and beyond. However, it is likely that increased global liquidity and fiscal spending will continue to put upward pressure on prices and drive inflation upwards. Conventionally, this would prompt the BoC to continue to raise rates.

However, the massive amounts of debt raised by both federal and provincial Canadian governments will pose a barrier to any further increases in interest rates. The Federal government alone is expected to borrow$713 billion CADin 2020, more than double the amount raised in 2019. The 2021 Federal Budget shows a commitment to further deficit spending with a deficit of $154.7 billion this year. While much of Canada’s debt is already owned by the Bank of Canada, it would be counter-productive to the aims of Canada’s government to increase rates and tighten monetary policy while the government is deficit-spending to boost the economy.

Also Check: Rocket Mortgage Conventional Loan

How Are Mortgage Rates Impacting Home Sales

The total number of mortgage applications inched lower during the week ending December 17, 2021. The 0.6% decline was driven by a decrease in the number of purchase loan applications, according to the Mortgage Bankers Association.

- The total number of purchase loan applications decreased by 6% week-over-week, breaking a five-week run of increases. Compared to the same week last year, there were 9% fewer applications.

- Refinance applications, on the other hand, increased by 2% from the week prior but were 42% lower year-over-year. Refis made up a little over 65% of all applications.

Freddie Mac : 30year Fixed Rate At 422%

According to governmentbacked Freddie Mac, last week, the average 30year fixed rate mortgage rate slipped 13 basis points to 4.22% nationwide with the rate available to prime borrowers willing to pay 0.7 discount points at closing.

0.7 discount points carries a cost equal to 0.7% of your loan size.

A borrower in Boston, Massachusetts, therefore, whose loan size is equal to the local Freddie Mac mortgage loan limit of $417,000 would pay $2,919 at closing in order to lock a 4.22% mortgage rate. A borrower in Orange County, California with a loan size at the local limit of $625,500 would pay $4,379.

Borrowers opting out of discount points will pay slightly higher rates.

Freddie Mac reported rates for 15year fixed rate mortgages lower, too. The groups survey of more than 100 mortgage lenders showed the average 15year fixed rate mortgage rate down eight basis points to 3.27% nationwide.

Like its 30year counterpart, the 15year rate requires 0.7 points to be paid at closing.

There is now a 0.95 percentage point difference between the published rates of a 30year and 15year fixed rate mortgage among the largest spreads in recorded mortgage history. Borrowers using a 15year mortgage now pay close to 70% less to own their own home than via a 30year loan.

Don’t Miss: Rocket Mortgage Loan Types

Mortgage Rates For Feb 22 2022 Are Mixed

Today, some mortgage rates inched up and others went down. If you haven’t locked in a rate yet, see how your payments might be affected.

Mortgage rates today were varied, but an important rate crept up: average 30-year fixed mortgage rates. Meanwhile, average rates for 5/1 adjustable-rate mortgages and average 15-year fixed mortgage rates receded. Mortgage interest rates are never set in stone, but it may be a good time for prospective homebuyers to lock in a fixed rate. Before you purchase a house, remember to take into account your personal needs and financial situation, and speak with multiple lenders to find the best one for you.

Are Mortgage And Refinance Rates Rising Or Falling

Overnight, reports were coming in of several unmarked tanks being seen in and around the Ukrainian city of Donetsk, according to Reuters. Some think the lack of insignia suggests theyre part of Russias initial incursion.

Whether or not they are, we know that the Russian president has ordered an invasion of that region and neighboring Lugansk. Yesterday, he formally recognized those as sovereign republics. How delighted he must have been that these sudden, unexpected ideas happened to coincide with his amassing 190,000 troops on Ukraines borders.

This morning, some Wall Street investors were spooked by the news. But their actions have so far had only a limited effect on mortgage rates. The questions are: Will that change and for how long?

Don’t Miss: Reverse Mortgage For Mobile Homes