Rocket Mortgage Ease Of Application

Rocket Mortgage allows you to complete your mortgage application online, providing shortcuts along the way to make the process even faster. You can apply on the Rocket Mortgage app or on its website, which unsurprisingly, given Rocket’s online-first roots is fully optimized for mobile. The biggest difference between applying on your phone versus your computer is the size of your screen.

If you’d prefer to work with an actual person face to face , you can reach out to a mortgage broker affiliated with Rocket Mortgage.

A typical online application takes about half an hour, according to Rocket Mortgage, but you can work at your own pace. You’ll start by creating an account, then answering basic questions like the ZIP code where you’re planning to buy a home. Much of your financial information, such as bank and investment accounts, can be downloaded directly by Rocket Mortgage from many U.S. financial institutions. Rocket can also import income and employment information for many working Americans.

Then, you’re at the “See solutions” stage. This is where Rocket Mortgage pulls your credit data and reveals your loan choices, as well as how much house you can afford. From there, you can customize your options by changing the term, the money due at closing or your interest rate.

What Can You Do Online With Rocket Mortgage

You can do everything online with Rocket Mortgage thats the basis behind its creation. Back in 2015 during its release, Quicken explained, were obsessed with finding a better way to help our clients get a mortgage. Thats why we build Rocket Mortgage, a completely online, self-service mortgage experience. That said, you can still talk to a home loan expert by phone or via online chat at any time in the process.

The online process starts with the application for initial mortgage approval, which as advertised, takes minutes. After that, you can start the full application process and home-buying process which takes longer. How long from approval to mortgage close depends on your financial situation as well as home-related factors such as the appraisal.

You can provide all the necessary financial documentation through the online interface called Rocket Mortgage . Through this portal, you can access the status of your loan 24/7. For updates on the go, you can download the app for Android or Apple users.

Consider Biweekly Payments To Pay Off Your Mortgage Early

Rocket Mortgage clients can set up biweekly payments at no cost. By doing this, homeowners pay off their mortgage early and save money on their interest, over the life of the loan. Lets go over how it works.

Every 2 weeks, you would make a half payment, which is applied to your loan when we receive enough to satisfy a full contractual payment. Because of the calendar, there will be 2 months when you make 3 half-payments a month. This third payment is applied directly to your loan principal, so youre making the equivalent of one extra payment directly toward your mortgage balance each year.

Don’t Miss: Rocket Mortgage Payment Options

Paying Your Mortgage In

If your mortgage lender is local, the company may allow you to submit payments by check or money order in person. If youre unfamiliar with money orders, they are considered secure payments since they dont include personal information. The downside is money orders have a limit between $700 $1000. According to the U.S. Census Bureau, the average mortgage payment is $1,595. So, money orders may not be the best option for most homeowners.

Other in-person options include a certified check or a cashiers check, which has no limit.

A check is a dependable method, but its not immune to fraud. Keep in mind, checks contain information such as your name, address, account number and routing number, all of which would be valuable to a scammer.

Additionally, checks take time to be delivered, so theyre not the most reliable option to send a mortgage payment. Especially during the holiday season or bad weather, since theres a high chance mail can be delayed.

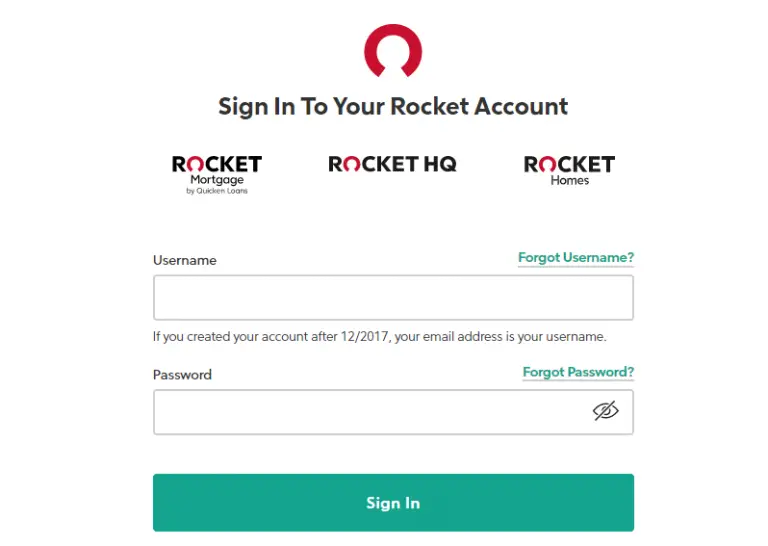

Exciting Rocket Loans Update: Now Introducing Rocket Account

3-Minute Read

At Rocket Loans, we want our clients to have all the resources they need to achieve more. Thats why we recently joined Rocket Account: offering our clients an accessible and seamless user experience. Now, you can manage and navigate across Rocket Companies using one personalized account.

To understand our Rocket Account transition, and how to get connected, read our FAQ below:

Don’t Miss: Requirements For Mortgage Approval

Can I Get A Rocket Loans Personal Loan With Bad Credit

Youre less likely to get approved for a loan with Rocket Loans when you have bad credit, but it may still be possible, depending on your exact credit score. Be aware, however, that even if you are approved for a loan with bad credit, you may end up with a higher interest rate. We recommend pre-qualifying with multiple lenders on our best personal loans for bad credit list to see which lender one gives you the best rate before accepting any loan offer.

How To Qualify For A Rocket Loans Loan

In order to qualify for a Rocket Loans personal loan, you need to be a U.S. citizen or permanent resident at least 18 years old in most states . You also must reside in a state where the company does business, which currently includes all states except Nevada, Iowa, and West Virginia. Rocket Loans personal loans are not available to non-U.S. residents.

To determine whether to grant you a loan, Rocket Loans will look at your credit score, income, and other debts. Rocket Loans doesnt list its credit score or income requirements on its website, and we were unable to reach a company representative for a response as of the time of publication. However, if you are denied a loan, you can re-apply if you improve your credit score or reduce your debt-to-income ratio.

Read Also: How Much Is Mortgage On 1 Million

How Do I Become A Rocket Homes Verified Partner Agent

In order to join the Rocket Homes Verified Partner Network, all Verified Partner Agents need:

- Be a licensed, full-time real estate agent with a minimum of 24 months experience

- Have a minimum of 8 closed transactions over the last 12 months

- Work for an approved Rocket Homes brokerage

You can register to join the Rocket Homes Partner Agent Network in 4 easy steps:

After we get your information, we will:

Rocket Mortgage Online Payments

To make your mortgage payment on the website, youll need the Rocket Mortgage login for your Rocket account. Once in the account, you can set up a direct debit from your bank to Rocket Mortgage. This method is more advisable than setting up an automatic bill pay directly with your bank because your mortgage payment might change over time. The amount you owe for taxes or insurance might vary from year to year, and if you have an adjustable-rate mortgage, your payment might rise or fall with interest rates. Setting up your payment directly with Rocket Mortgage can ensure that you dont overpay or underpay your mortgage at any time.

Read: Rocket Mortgage Review Options to Customize Your Loan

Don’t Miss: Reverse Mortgage On Condo

Whats The Process For Getting A Mortgage With Rocket Mortgage

The first step is setting up an account on Rocket Mortgages website. After that, youll answer a number of questions about where you live, where you want to buy, who will be on the loan with you and your financial information. This includes employment history and salary. Your assets and income are required as well as your Social Security number for a credit check. Rocket Mortgage integrates with most banks so youll be able to log in to your bank account directly through the system if you want to verify your assets using the quickest method available.

When youve finished entering the required information, youll see a countdown. After a few minutes or so, Rocket Mortgage will display which loans you qualify for. This could include fixed-rate or adjustable-rate mortgages, or specialized loans such as VA or FHA. Theres a slider bar that can help you see what happens if you change the loan term, interest rate or closing costs.

If you find an option that suits your needs, you can lock your rate in and send your application for approval. Rocket advertises that youll find out if youre approved within minutes. If you are, you can print out an approval letter to help prove your intent to purchase to a realtor. When you have a purchase contract to buy a home, youll work with Rocket Mortgage to finalize the loan. That includes setting up a closing date and moving forward with the house-centric portion of the home-buying process, such as the appraisal and home inspection.

How Do I Know If I Aready Have A Rocket Account

If you are a Rocket Mortgage client or if you previously created a login with Rocket Mortgage or Rocket Homes, you already have a Rocket Account.

When prompted to sign in to your Rocket Account, please do so with the username and password you use to log in to Rocket Mortgage and/or Rocket Homes. You do not need to create a new Rocket Account. Once multiple Rocket accounts are linked, you will only need to use your Rocket Account log in credentials on any Rocket site moving forward.

If you do not have login credentials for Rocket Mortgage or Rocket Homes, we will help you create a Rocket Account by connecting your active Rocket Loans dashboard. Log in to your Rocket Loans dashboard as usual and follow the prompts.

Once you have created a Rocket Account, you will use that e-mail and password moving forward to sign in to Rocket Loans and other Rocket dashboards.

Please note, if you created your Rocket Account after 2017, your username is your email address.

Recommended Reading: Monthly Mortgage On 1 Million

How To Pay Your Mortgage Over The Phone

Sometimes things can go wrong with mailing a payment. If that happens, paying your mortgage by phone can ensure on-time payment.

The phone number of your lender will be located online and on your monthly bill. The process is usually clear-cut, once you call the phone number, you will be instructed to follow directions. Always be prepared to provide your banking information and mortgage account number.

Typically, paying by phone will approve your payment quickly. Before making the payment, be sure to ask the lender if there is an extra fee for using this option. At Rocket Mortgage, there is no additional fee.

What About Automated Withdrawals

Another easy option to make sure your mortgage is getting paid on time is automated withdrawals, which will be pulled from your checking or savings account. Meaning your lender automatically withdraws the mortgage payment from your bank account on the same day each month.

To take advantage of automatic withdrawals, visit your lenders website. Once this option is set up, your mortgage payments will be auto deducted each month. By doing this you can guarantee reliable and on-time payments without stressing over having to remember the payment due date. Autopay will also automatically adjust changes to escrow.

Lets say youre a Rocket Mortgage client and missed your payment due date. After the grace period, which ends on the 16th of the month, your mortgage payment will be considered late, with fees and likely negative effects on your credit.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

What Are The Benefits Of Working With A Rocket Homes Verified Partner Agent

With a Rocket Homes Verified Partner Agent, youll have local expertise, top-rated service and a team of real estate pros on your side.

- Verified Partner Agents are top performers in their local market, so youll have a proven agent who knows your area inside and out.

- All of our Verified Partner Agents must maintain a 4.5/5-star client satisfaction rating, so youll know your agent has your best interests in mind.

- Your Verified Partner Agent and Rocket Homes real estate coordinator will work together, making sure everything is handled all the way through closing.

Would You Qualify For A Mortgage From Rocket Mortgage

Rocket Mortgage looks at a number of factors to determine what loan products you qualify for. FHA loans have the lowest minimum credit score, at 580. Most conventional loans will require a score in the good credit range, or better. Youll find the lowest rates and most reasonable terms will be available to those with higher credit scores. This is one of the reasons most lenders urge homebuyers to improve credit scores prior to applying for a loan. It saves you a significant amount of money over the course of a mortgage.

Another factor thats considered is your debt-to-income ratio. This is your total monthly debt compared to your total monthly income. Its looked at to determine whether you can afford a monthly mortgage payment. Car payments, student loans, credit card debt and child support all fall under debt thatll come under consideration. You can find your percentage by calculating your monthly liabilities and dividing by your gross monthly income.

Down payment savings is another factor for loan qualification. The norm is 20% of the home purchase price, but certain programs, such as VA loans and FHA loans come with low or no down payment requirement. For those who dont qualify for a government-backed mortgage loan, youll need private mortgage insurance if you put less than 20% down.

Also Check: Rocket Mortgage Requirements

Pay Online At Rocketmortgagecom Login:

- One-Time Payment. When you need to make a loan payment, all you have to do is access your account, select the loan for which a payment is due, type in how much you want to pay, and then pay that amount.

- Monthly AutoPay. Once logged in to your Rocket Mortgage account, select to set up auto-draft and follow the instructions. It is possible to allow payment to come right out of their bank account courtesy of the online payment system offered by your ban. But a better option might be to opt for automatic payments with your lender. The reason for this is that mortgage payments change every now and then. The sum needed for taxes and insurance may change year after year, for instance. The amount can also change if after the fixed period of an adjustable-rate agreement. If you opt for an automatic payment agreement through Rocket Mortgage rather than through your bank, you wont have to worry about paying too little or paying too much.

- Bi-Weekly Payments. If you opt for bi-weekly payments, you will go from making 12 monthly payments to making half of your monthly payment amount every two weeks. You can now opt for bi-weekly payment for free using Rocket Mortgage.

I Have A Rocket Loans Dashboard But Not A Rocket Account

If youve never created an account with Rocket Mortgage or Rocket Homes you will need to upgrade your Rocket Loans dashboard to a Rocket Account. We have customized, easy-to-follow prompts to connect your Rocket Loans dashboard to Rocket Account. Just start by signing in to your Rocket Loans dashboard as usual and well meet you there with guidance.

Also Check: Rocket Mortgage Qualifications

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Rocket Mortgage Review 2022

- Rocket Mortgage is licensed in all 50 states

- Fast, web-based application process

- Quicken, Rockets parent company is the largest online mortgage lender in the country

Cons

- Website is not transparent you have to start an application to see all of your mortgage options

- Rocket Mortgage is only for mortgages and refinances, meaning you cant bundle additional financial accounts such as banking or investing services

Rocket Mortgage launched in 2015 as the face of Quicken Loans online mortgage application. It is now largely integrated with Quicken, along with having the same underwriting standards. The main draw of Rocket Mortgage is that the entire mortgage process can take place online. Customers can complete the application without speaking to a single service representative. However, the option to speak to a representative is available.

Headquartered in Detroit, Quicken Loans is the largest online mortgage lender, according to National Mortgage News. Founded in 1985, the company has grown to originating 375,656 loans in 2019 alone.

While Rocket Mortgage is marketed as an online-only service, with the option to call or chat online if you choose, you can also apply for a mortgage from Quicken Loans directly. Just like Rocket Mortgage, the process is done remotely, but relies more on phone if you choose this option.

Recommended Reading: Rocket Mortgage Loan Requirements

Rocket Mortgage Loan Types

Rocket Mortgage offers a loan lineup that’s fairly typical of nonbank lenders. Conventional loans, FHA loans and VA loans are available with fixed or adjustable rates. A customizable fixed-rate conventional loan with a term from eight to 29 years is also available, in addition to the standard 15- or 30-year mortgage.

Even though FHA loans made up only 7% of its total business, Quicken was the second-largest FHA lender in the nation in 2020, boasting more than twice the FHA loan volume of the next lender.

Home equity loans and home equity lines of credit, or HELOCs, aren’t available. Those seeking to put their home equity to work with Rocket will need to look to a cash-out refinance.