Save At Least A 35% Down Payment

The minimum required down payment for an FHA loan is 3.5%. In reality, youll need to save closer to 6% of the homes purchase price to account for closing costs- which include an upfront mortgage insurance premium equal to 1.75% of the homes value. You can reduce this premium to 1.25% by undergoing an FHA-approved credit counseling program prior to closing.

Fha Loan Income Requirements

There is no minimum or maximum salary that will qualify you for or prevent you from getting an FHA-insured mortgage. However, you must:

-

Have at least two established credit accounts. For example, a credit card and a car loan.

-

Not have delinquent federal debt or judgments, tax-related or otherwise, or debt associated with past FHA-insured mortgages.

-

Account for cash gifts that help with the down payment. That can include money from a friend or family member, a charity, your employer or union, or from a government agency. These gifts must be verified in writing, signed and dated by the donor.

What You Can Do If You Dont Meet Fha Requirements

If youre initially ineligible for an FHA loan, here are a few strategies that can help improve your chances:

Rates and terms vary greatly across lenders. So if youre considering getting an FHA loan, make sure you shop around for mortgages first.

Credible makes getting a mortgage easy

Don’t Miss: Can You Get A Reverse Mortgage On A Condo

Who Is Eligible For An Fha Disaster Loan Modification

- The mortgage was current OR

- The mortgage was less than 30 Days past due as of the date of the applicable federal disaster declaration

- The lender confirms the borrowers income is equal to or greater than it was prior to the Disaster using a recent pay stub for income, W-2, bank statement or other documentation reflecting the amount of income

- Alternatives to income documentation include having the borrower complete a three-month Trial Payment Plan , which will confirm that their income has returned to pre-disaster levels

- The lender must agree to waive the borrowers accumulated late fees.

How To Decide If An Fha Loan Is The Right Choice

An FHA loan does offer significant benefits, but it’s not the right choice for every would-be homebuyer. An FHA loan could make sense for you if:

- Your credit needs improvement. Conventional mortgage loans usually require a , while FHA loans allow for lower credit scores. Even if you’ve had more significant credit problems, such as a bankruptcy, you could still qualify for an FHA loan.

- You don’t have much saved for a down payment. Since FHA loans allow you to put down as little as 3.5%, they’re an option for homebuyers who haven’t been able to set aside a significant sum.

- You need help with closing costs. Conventional mortgages require borrowers to pay hefty upfront costs in addition to the down payment, which can easily total in the thousands. To help homebuyers, the FHA allows some closing costs to be rolled into the mortgage and paid over time.

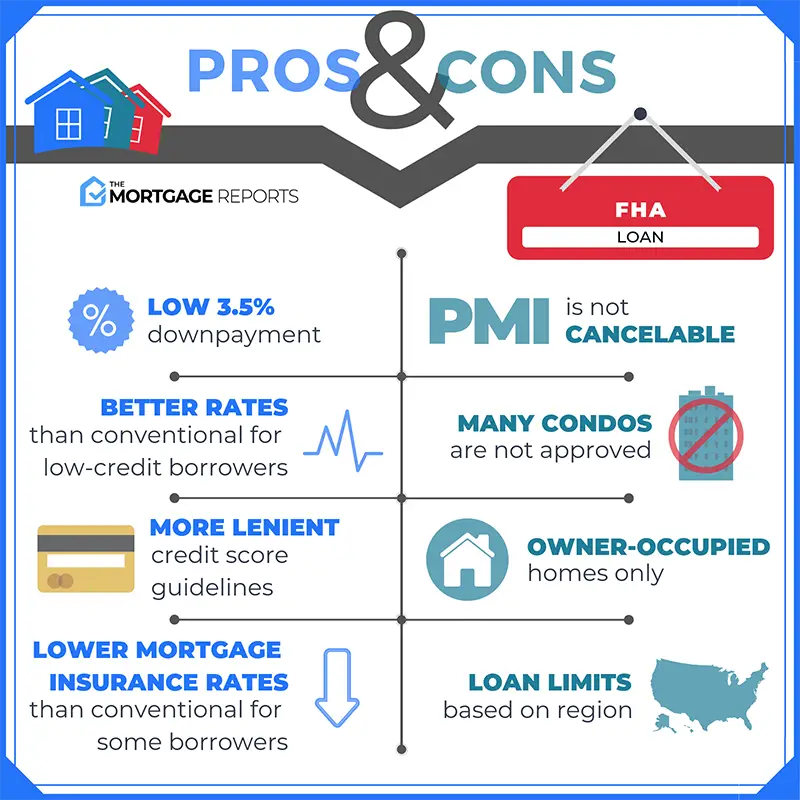

FHA loans have their advantages, but there’s a trade-off in the form of the mortgage insurance. Homebuyers who take out an FHA loan must pay an upfront premium that’s usually 1.75% of the base loan amount. There’s also an ongoing annual mortgage insurance premium that usually costs 0.45% to 1.05% of the loan amount. This annual premium lasts for the life of the loan unless you refinance later on or put down 10% or more, in which case it falls off after 11 years.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Fha Loan Credit Issues

Your FHA lender will review your past credit performance while underwriting your loan. A good track record of timely payments will likely make you eligible for an FHA loan. The following list includes items that can negatively affect your loan eligibility:

- No Credit History If you don’t have an established credit history or don’t use traditional credit, your lender must obtain a non-traditional merged credit report or develop a credit history from other means.

- Bankruptcy Bankruptcy does not disqualify a borrower from obtaining an FHA-insured mortgage. For Chapter 7 bankruptcy, at least two years must have elapsed and the borrower has either re-established good credit or chosen not to incur new credit obligations.

- Late Payments It’s best to turn in your FHA loan application when you have a solid 12 months of on-time payments for all financial obligations.

- Foreclosure Past foreclosures are not necessarily a roadblock to a new FHA home loan, but it depends on the circumstances.

- Collections, Judgements, and Federal Debt In general, FHA loan rules require the lender to determine that judgments are resolved or paid off prior to or at closing.

Fha Limits For High Cost Homes

There is a chance that you’ll fall in love with a home that costs more than what the FHA will insure. However, if it turns out that you are able to afford a larger down payment, you can stick with an FHA loan. By putting up more than the minimum 3.5% on the house, borrowers are able to buy a pricier home with the same FHA loan limit.

Another option is to apply for a conforming mortgage. This may work out better since the conforming loan limit is typically higher than the FHA limits in nearly 80% of the counties in the U.S. Buyers with good credit and sufficient income who can afford a larger down payment can benefit from this type of mortgage and may find it less expensive in the long run.

However, some houses may exceed both conforming and FHA loan limits. In such cases, borrowers might want to consider a jumbo loan.

Don’t Miss: Chase Mortgage Recast Fee

How Fha Loans Work

FHA loans come in 15-year and 30-year terms with fixed interest rates. The agencys flexible underwriting standards are designed to help borrowers who do not have pristine credit or a high income and cash savings become homeowners.

But theres a catch: Borrowers must pay FHA mortgage insurance. This coverage protects the lender from a loss if you default on the loan. Mortgage insurance is required on most loans when borrowers put down less than 20 percent. All FHA loans require the borrower to pay two mortgage insurance premiums:

- Upfront mortgage insurance premium: 1.75 percent of the loan amount, paid when the borrower gets the loan. The premium can be rolled into the financed loan amount.

- Annual mortgage insurance premium: 0.45 percent to 1.05 percent, depending on the loan term , the loan amount and the initial loan-to-value ratio, or LTV. This premium amount is divided by 12 and paid monthly.

So, if you borrow $150,000, your upfront mortgage insurance premium would be $2,625 and your annual premium would range from $675 to $1,575 , depending on the term.

FHA mortgage insurance premiums will be canceled after 11 years for most borrowers if they financed 90 percent or less of the propertys value and stay current with their monthly mortgage payments. Loans with an LTV ratio greater than 90 percent will carry insurance until the mortgage is fully repaid.

Can Closing Costs Be Included In Loan

Including closing costs in your loan or rolling them in means you are adding the costs to your new mortgage balance. This is also known as financing your closing costs. Financing your closing costs does not mean you avoid paying them. … So if you’re able to pay closing costs in cash, that’s typically the best move.

You May Like: Recast Mortgage Chase

Drawbacks Of An Fha Loan

- FHA loans require the borrower to pay two mortgage insurance premiums : one upfront that equals 1.75 percent of the loan principal and an annual premium of 0.45 percent to 1.05 percent based on your loan term, amount borrowed and loan-to-value ratio at the time the loan was made.

- The FHA MIP can only be cancelled if you made a down payment of at least 10 percent, and only after 11 years.

- FHA loans come in 15- or 30-year terms only – no flexibility.

- There might be higher fees for an FHA loan than a conventional loan.

Fha Loan Property Requirements

You can only use an FHA loan to buy a house where you intend to live . You can’t buy a vacation home or an investment property with an FHA loan, and in most cases you can only buy one house at a time with these loans. There are also FHA loan limits that cap the total amount of money you can borrow with an FHA loan.

To qualify for an FHA loan, the house must meet certain health and safety standards during the appraisal. These standards include requirements related to toxic chemicals, excessive noise, and flood risk. The house itself must also meet standards for structural soundness. There are requirements for the foundation, roof, mechanical systems, heating, doors and windows, and more1.

Don’t Miss: Can I Get A Reverse Mortgage On A Condo

Fha Energy Efficient Mortgage

This program is a similar concept to the FHA 203 Improvement Loan program, but its aimed at upgrades that can lower your utility bills, such as new insulation or the installation of new solar or wind energy systems. The idea is that energy-efficient homes have lower operating costs, which lowers bills and makes more income available for mortgage payments.

Apply For The Correct Type Of Fha Loan

Lenders offer a variety of FHA loans in addition to the most common type, the 30 year fixed interest. You can also get a fixed interest rate on an FHA loan for 10, 15, 20 or 25 years or you can get an adjustable rate FHA loan. An adjustable rate loan allows for the fluctuation of interest rates at certain periods of time. For example, a 3/1 adjustable rate FHA loan means the interest rate is fixed for 3 years and can adjust every year thereafter. FHA adjustable loans come in the form of a 3/1, 5/1, 7/1 or 10/1 with 30 year terms. These are not as popular as fixed interest FHA loans since they provide more risk to the average homebuyer.

Also Check: Requirements For Mortgage Approval

Gifts As Down Payments

You must show proof of the gifted down payment by asking the donor to provide a letter with a statement that the money is a gift without expected repayment. The donor will also need to provide proof of the account from which he withdrew the funds. You cannot receive the gift in cash. Cashier’s check and money order are the preferred method, with a copy of both sides of the check and the bank statements showing where the money was taken from and deposited to.

You must document the source of any large sums of money deposited to your account recently, other than your regular paycheck. What the lender considers a large sum might be as little as $500.

How Long Do Borrowers Have To Pay Fha Mortgage Insurance

The duration of your annual MIP will depend on the amortization term and LTV ratio on your loan origination date.

For loans with FHA case numbers assigned on or after June 3, 2013:

Borrowers will have to pay mortgage insurance for the entire loan term if the LTV is greater than 90% at the time the loan was originated. If your LTV was 90% or less, the borrower will pay mortgage insurance for the mortgage term or 11 years, whichever occurs first.

| Term |

|---|

Read Also: How Does Rocket Mortgage Work

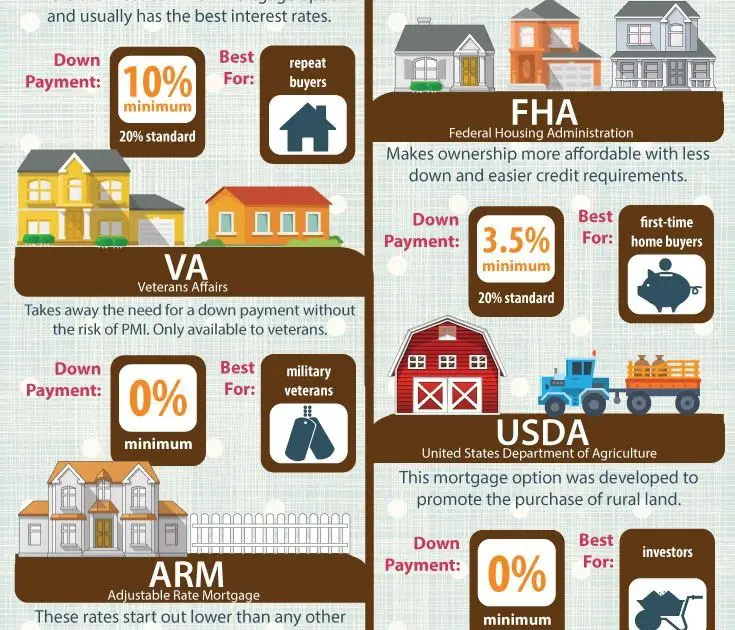

What Is A Federal Housing Administration Loan Loan

A Federal Housing Administration loan is a mortgage that is insured by the FHA and issued by an FHA-approved lender. FHA loans are designed for low- to moderate-income borrowers. They require a lower minimum down payment and lower than many conventional loans do.

Because of their many benefits, FHA loans are popular with first-time homebuyers.

How To Calculate Your Dti Ratio

There are two ways to calculate a DTI ratio. Most loan officers call one the front-end ratio and the other the back-end ratio. The FHA uses different terminology to express the same ideas. Your loan officer might use either set of terms to describe your DTI.

How does your DTI measure up? Use our quick and easy calculator to find out.

Conventional or conforming lenders call the typical maximum ratio the “28/36 rule.” For FHA loans, it’s the “31/43 rule.”

Also Check: 10 Year Treasury Yield Mortgage Rates

Gauging Your Eligibility For A Second Fha Loan

If youre a low- or moderate-income homeowner low on cash, the government established the Federal Housing Administration loan program to assist your financial needs. This can also help you if you dont have the best credit history.

Whatever the situation, the FHA loan provides a way for those who might otherwise be turned down by banks to become homeowners. Although FHA guidelines state that an FHA loan can only be used to finance a primary home, there are ways to get around this restriction and utilize an FHA loan to finance a second home.

In the following paragraphs, you will find out more about obtaining another FHA home loan, the roadblocks you need to pass if youre ineligible, and the possible loopholes to overcome your ineligibility.

Daca Status Recipients Now Eligible For Fha Mortgages

4 MINUTE READ

In January, the Federal Housing Administration to allow Dreamers, US residents with DACA status, to qualify for FHA mortgages, which are federally-backed mortgages. The FHA will now approve home loans for DACA recipients, allowing them access to the low down payments traditionally associated with FHA loans that are so popular with homebuyers in the US.

What does this mean for DACA recipients? This new rule expands the mortgage choices for Dreamers, giving them access to more affordable and accessible avenues to owning a home.

If youre a DACA recipient who now qualifies for an FHA loan, or if you know someone who is, heres what youll want to know.

Previous FHA Rules for Dreamers

The FHAs official policy before this change was that DACA recipients were not eligible for FHA loans. The FHAs official statement, according to its Single-Family Housing Handbook, was that non-US citizens without lawful residency in the US are not eligible for FHA-insured mortgages. Further, prior to the agency rule change, those individuals who qualified for this program did not count as lawful residents to the US Department of Housing and Urban Development , the agency that oversees the FHA.

FHA loans have much more lenient and relaxed guidelines and requirements than other mortgage loans, making them one of the easiest mortgage loans to qualify for. Considering this, the FHAs new agency rule is a significant development for many Dreamers who hope to own their own homes.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

An Fha Mortgage Sounds Great Where Do I Get Started

FHA loans were created to make homeownership affordable and attainable for borrowers who didnt meet traditional lending criteria. Whatever your financial circumstances today, an FHA loan may be your ticket to buying your own home.

If youre interested in an FHA loan, get started with a short online eligibility request. You may be on your way to FHA homeownership sooner than you think.

Understanding Fha Loan Mortgage Insurance

FHA borrowers have to pay two types of FHA mortgage insurance to protect FHA-approved lenders from the financial risk of defaults. The first is an upfront mortgage insurance premium of 1.75% of your loan amount, which is charged at closing and typically added to your mortgage balance.

The second is an ongoing annual mortgage insurance premium that ranges from 0.45% to 1.05%, depending on your down payment and loan term. Its charged annually, divided by 12 and then added to your monthly payment. Heres an example of how much FHA mortgage insurance youd pay on a $300,000 loan amount assuming you make a 3.5% with an annual MIP charge of 0.85%.

FHA UFMIP calculation:

- Convert 1.75% to the decimal

- Multiply by the loan amount: 0.0175% x $300,000 = $5,250 FHA UFMIP premium added to your loan amount

- Convert 0.85% to a decimal

- Multiply by the loan amount 0.0085% x $300,000 = $2,550

- $2,550 divided by 12 = $212.50 monthly MIP charge added to your monthly payment

There are some important differences between FHA mortgage insurance and conventional private mortgage insurance :

Youll typically pay FHA MIP for the life of your loan. This is true if you make a minimum FHA 3.5% down payment. However, if you can make at least a 10% down payment, MIP drops off after 11 years. You can get rid of conventional PMI once you can prove you have 20% equity.

You May Like: Does Prequalifying For A Mortgage Affect Your Credit

Fha Loans: What You Need To Know In 2021

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

The Federal Housing Administration backs home loans with flexible borrowing guidelines for homebuyers who might not qualify for conventional loans with more stringent requirements. FHA loans are popular with first-time buyers who may have little savings and credit issues, and the government backing allows many lenders to offer lower average rates than conventional mortgages.