Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

How Can I Get A 100k Loan

How to Get a $100,000 Personal LoanCheck Your Credit Score. Large loans are typically more difficult to qualify for than those with smaller limits. Compare Lenders and Interest Rates. Gather the Required Documentation. Apply Online or In-person. Repay Your Loan. SoFi. LightStream. Wells Fargo.Apr 4, 2021

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

Calculating Rolled Up Payments On Bridging Finance

Taking out a bridging loan with rolled up payments means you do not repay interest during the lifetime of the loan. Instead, interest owed on a rolled up bridging loan is calculated at the time of application and charged at the redemption of the loan . It is important to understand that, when calculating costs on a bridging loan with rolled up interest, the total borrowing must be within the lenders loan to value restrictions – e.g. to calculate the amount you can borrow, you must include the amount of borrowing plus the rolled interest owed, which in total can’t go over the maximum loan to value.

“Six Stars to Commercial TrustAs a landlord with a portfolio of properties for a number of years, I have sourced many mortgages and always dread the experience. As most brokers act like they are just a post box or act as a barrier to progress. I always check the market usually choosing the deal myself prior to contacting a”

“Excellent service from start to finish. Everyone is professional, friendly and kindly. We are very happy with their services. They are always ready to respond to your call and always helpful with high quality services.”

“Jack and Corinna were extraordinary and both went the extra mile to get the right mortgage deal and to get our home bought. Would not go anywhere else now.”

“Great experience at all stages, each person lovely to deal with, couldn’t be more friendly and helpful. Well worth the cost.”

Also Check: Mortgage Recast Calculator Chase

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

What Is A Fixed Rate Mortgage

Fixed rate mortgages allow you to benefit from a set interest rate for an extended period of time. You can find fixed rate mortgages with high street banks for 2,3,5 or 10 years.

Securing an interest rate could help you know exactly how much you have to pay each month for the first few years of your mortgage. However, it is impossible to predict how interest rates will behave, and it is possible that the best interest rate today may not continue to be as competitive throughout your fixed rate period.

You May Like: Rocket Mortgage Launchpad

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

Important Questions To Ask Yourself Before You Put In An Offer

If the answer to any of these is I dont know then speaking to a mortgage advisor might be a really good first step for you, and its not as stressful as you may think.

With the right advice and the perfect lender, you could have your £150 000 mortgage-in-principle in no time, ready to start looking for your dream home.

You May Like: Chase Recast

Serviced Payment Calculations On A Bridging Loan

This option gives you the maximum borrowing on day one. Monthly payments on a serviced bridging loan are calculated based on paying the interest monthly. The capital lump sum must be repaid at the end of the loan.This method of borrowing suits customers who will have a consistent, regular cash-flow throughout the lifetime of the loan and will be able to service monthly payments, without over-extending themselves.

Common Pitfalls To Avoid When Shopping For A Loan

Applying for any loan requires careful consideration. Naturally, the prospect of buying a new RV and heading out on the road brings with it a good deal of excitement, and it can be all too easy to get caught up in the moment and miss some key points when it comes to securing the financing for your purchase. Before you sign on the dotted line, slow down and consider the following common mistakes people make when applying for financing.

If you keep these tips in mind, you can avoid many of the common pitfalls associated with financing a new or used RV.

Read Also: Reverse Mortgage Manufactured Home

Whether You Already Own Property

Some lenders will consider you a slightly higher risk if you already own a home and are buying a second home to live in part time somewhere else. You may need more deposit as well as meet additional higher minimum income requirements, and there could well be greater scrutiny around mortgage affordability.

Does Bad Credit Affect How Much Deposit I Need On A 150k Mortgage

The short answer is yes. If youve had bad credit, mortgage providers will see you as a greater risk and the worse your history, the greater risk youll be seen as so a larger deposit will be needed.

- Payday loans

- Multiple credit problems

All mortgage lenders are different, so may require different deposits depending on your circumstances and how they access the risk.

For instance, if youve relatively light bad credit , some lenders may be happy with a smaller deposit and higher LTV.

But if your credit history includes more serious matters, such as a repossession or bankruptcy, then they may insist on a larger deposit to provide a lower LTV, which means lower risk to the lender. Moreover, you may also be considered higher risk if youve ever used payday loans. It is usually more difficult to get a mortgage with payday loan use on your file.

So depending on your perceived risk to the lender, you may be required to provide a proportionately higher deposit.

| LTV Band | |

|---|---|

| £150,000 | £150,000 |

The above is for demonstrative purposes only and you should consult your mortgage broker or lender for the most up-to-date information and rates.

We touch on bad credit history further into this article, but if youre unsure if your credit history will be an issue, talk to one of the advisors we work with today, theyre experts when it comes to finding mortgages for customers with bad credit.

Don’t Miss: Rocket Mortgage Loan Requirements

How Much Deposit Is Needed

Mortgage lending is based on how much you want to borrow in relation to the value of the property. This is known as the loan-to-value ratio.

If you put down a £15,000 deposit on a property worth £150,000, then you own 10% outright and need to borrow 90%. This means your LTV ratio is 90%.

The current minimum deposit is 5% or 95% LTV for residential mortgages. So for a mortgage on a £150,000 home, youll need to raise at least £7.5K for a deposit.

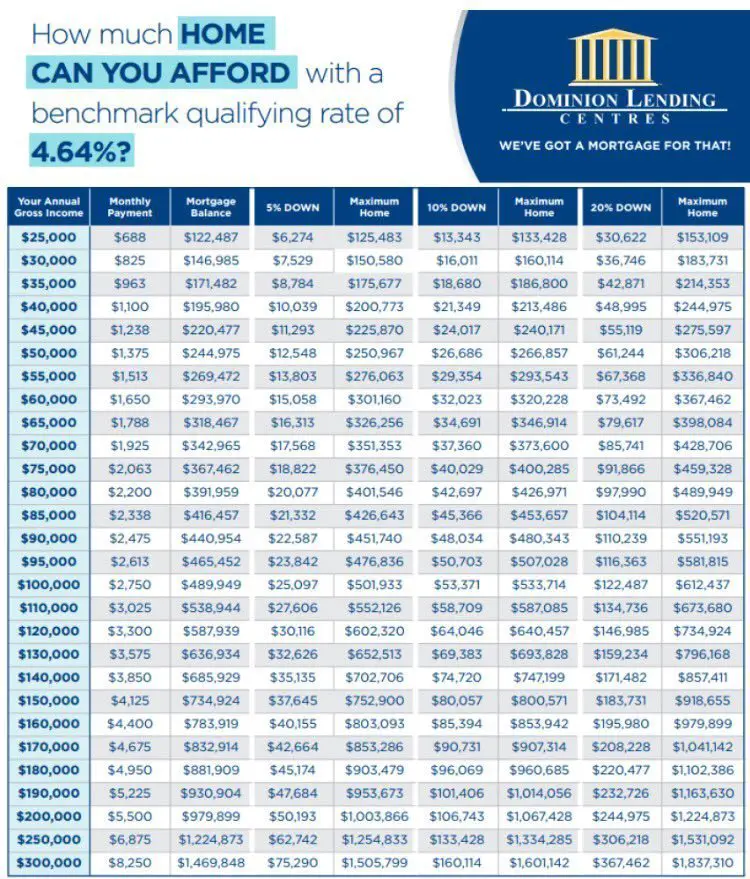

How Much Can You Afford To Borrow

Lenders generally prefer borrowers that offer a significant deposit. They typically request at least 5% deposit based on the value of the property. If a house is valued at £180,000, a lender would expect a £9,000 deposit. In this example, the lender would be willing to offer a loan amount of £171,000. Meanwhile, some lenders may offer first-time buyers a 100% mortgage with a £0 deposit. However, obtaining this sort of deal usually forces a borrower to pay a much higher interest rate on their loan. This is usually one percent higher than a mortgage that requires a deposit. Consider this expensive trade-off before choosing a zero-deposit deal.

If you know the interest rate youll be charged on a loan, you can easily use the above calculator to estimate how much home you can afford. For example, at 2.29% APR on a £180,000 home loan, it will require £788.61 of full repayment per month, or £343.50 per month with an interest-only payment. If your maximum monthly budget for a home payment is £1,000 per month, you would then divide this amount by the above payments to get the equivalent loan capital. The example is shown in the table below.

Default Calculation

| £551,596 £524,016 = £27,580 | £240,272 £228,258 = £12,014 |

If you had £200 in other monthly home ownership related fees, then this might take a renter equivalent of £1,000 down to £800.

You May Like: Monthly Mortgage On 1 Million

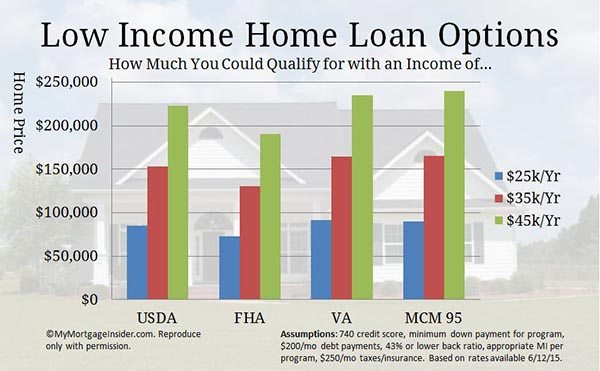

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

What Is A Bridging Loan Calculator

A bridging loan calculator is a tool used to figure out costs associated with a bridging loan.

It shows an illustration of how much interest you will pay. The figures from our calculator are not conclusive in isolation, as there are other costs associated with bridging loans. For a full breakdown of costs, please get in touch with our advisors.

Also Check: How Much Is Mortgage On A 1 Million Dollar House

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Advantages & Disadvantages Of Buying Used

| Pros | Cons |

|---|---|

| Cost Second-hand RVs are naturally less expensive than newer models, so buying used can help you stretch your budget. | Pricing While a used RV is typically less expensive than a newer model it can be difficult to know just what a fair market asking price should be. Before buying used research the make and model you are interested in to figure out its current market value. The Recreational Vehicle Blue Book is a good online resource for estimating the current market value of most self-contained and towable RVs. |

| Insurance It is generally cheaper to insure a used motorhome or travel trailer. However, the savings here will be largely dependent on how you will be using it. If you are thinking of making it your full-time home, the discount in insurance may not be that significant. | Vehicle History When buying any used vehicle there is always a question of condition and history of accidents. Before committing to the purchase of any second-hand RV be sure to have it checked out by a reputable mechanic with experience working on motorhomes and travel trailers. |

| Resale Value Again, RVs depreciate in value fairly quickly. Buying used gives you a better chance of recouping a larger part of your investment should you decide to sell your vehicle in the future. | Maintenance A second-hand RV will likely require more maintenance than a new model, and without a manufacturers warranty the cost of the maintenance will be coming out of your pocket. |

Recommended Reading: How Does Rocket Mortgage Work