What You Need To Know About Mortgage Rates

For homeowners or those looking to buy their first home, mortgage rates are perhaps one of the most critical mechanisms of home purchasing. With long reaching financial implications, it’s essential to fully arm yourself with as much knowledge about how mortgage rates work, what determines their rate and the influencing factors that change them. With this knowledge it puts you in a far stronger position to make decisions by clearly understanding the forces that impact rates.

Mortgage Calculations And Mortgage Considerations

Use the free online Mortgage calculator to calculate your monthly repayments, compare Mortgage repayments over different periods and define what is the most affordable option for your financial situation. The Mortgage calculator will provide you a monthly interest repayment over 1 year,2 years,3 years,4 years,5 years, 10 years and compare them to a monthly repayment period of your choosing .

Why Should I Use A Mortgage Calculator

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Factors In Your California Mortgage Payment

Your monthly mortgage payment will consist of your mortgage principal and interest. On top of that bill, youll have to consider property taxes and homeowners insurance as two more recurring expenses.

Property taxes in California are a relative bargain compared to the rest of the nation. With limits in place enforced by Proposition 13, generally property taxes cannot exceed 1% of a propertys market value. Assessed value cannot exceed increases of more than 2% a year. With those rules, Californias effective property tax rate is just 0.73%. On the local and county level, additional taxes can be levied if you live in a special district thats financing an improvement or other local concern.

Unlike many other states which employ local assessors to determine market value, California bases your initial property tax rate on the purchase price of the property. Each year the value will increase by the rate of inflation, capped at 2%. If the property is your principal place of residence, youre entitled to the homeowners exemption of $7,000 decreased assessed value, which cannot surpass $70 in savings.

As for homeowners insurance, California has reasonable rates. Despite the relatively frequent occurrence of natural disasters, including wildfires and earthquakes, the state has lower insurance costs than half of the nation. The average annual policy is about $1,166 a year, according to Insurance.com data.

Recommended Reading: Recasting Mortgage Chase

Fixed Rate Vs Adjustable Rate

A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment.

Canadian Mortgage Regulations Taxes And Fees

Canada-wide mortgage regulations are set by the Ministry of Finance to help protect home buyers and lenders alike. These regulations include guidelines on minimum down payments, maximum amortization periods, as well as mortgage default insurance.

Here are the key regulations you need to be aware of, and that are included in the Ontario mortgage calculator above:

- The minimum down payment in Canada is between 5% and 10%, depending on the purchase price of the home.

- The maximum amortization is 25 years for down payments under 20% and 35 years for higher down payments.

- Mortgage default insurance – also called CMHC insurance – must be purchased for down payments between 5% and 20%. Visit our CMHC insurance page to learn more.

You May Like: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Trying To Predict Mortgage Rates

One of the biggest misconceptions is that mortgage rates should follow and equal the Federal Reserve’s benchmark interest rate – in fact due to the intricate nature of the markets the opposite is actually far more likely. The market conditions that are good for the Federal Reserve are often not so favorable for mortgage borrowers. It’s important to understand the function, and differences, of the two rates. The Federal Reserve has a far shorter-term outlook whereas mortgage rates are based on a much longer economic outlook – the most commonly held US mortgage is a 30-year term loan and requires a far deeper analysis. Far more accurate is to follow the 10-year United States Treasury note as a predictor of the movement of mortgage rates.

How To Increase Your Mortgage Affordability

If you have found that your maximum affordability is lower than you expected, here are some reasons that might beand what you can do about it.

- GDS ratio: If your GDS ratio is limiting your mortgage affordability, youll need to increase your gross household income.

- TDS ratio: If its your TDS ratio, the likely culprit is existing debt. Focus on paying off your credit card balances or car loans to increase your mortgage affordability.

- Down payment: Youll need to save at least 5% of your homes purchase price or more, depending on the desired purchase price. If this is a limiting factor, consider options to increase your down payment, such as putting more money aside each month, accessing up to $35,000 in RRSP funds through the Home Buyers Plan or asking a family member for a monetary gift.

- Get a co-signer: Having a family member co-sign your mortgage will add their income to your application, increasing how much mortgage you can afford. Keep in mind that if you default on your payments, your co-signer will be responsible for the debt.

You May Like: Does Rocket Mortgage Service Their Own Loans

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

Costs To Expect When Buying A Home In California

One of the costs youll want to consider during the home-buying process is a home inspection. Before you close the deal on a house, theres usually a period where you can arrange a home inspection to determine the state of the house and any potential problems with the property. If problems are found, you generally have some negotiating power over the seller for repairs or price. Typical costs range from $300 to $550, with larger houses falling on the higher end of the price range. Some types of mortgages will require additional tests such as termite inspections. Any additional services will cost extra, but may help you discover serious issues prior to moving in, such as a mold infestation. One last consideration for testing is radon. California doesnt have as high of risk for radon as some regions in the U.S. However, there are some areas, such as Tulare, that are depicted as having high concentrations of radon, according to the California Department of Conservations indoor radon potential map. Youll want to check to see if your property is in one of those high-risk areas.

If the inspection goes well and you set a closing date for the home, youll have to budget for the additional fees that are called closing costs. These costs vary based on the location and value of the home, your mortgage lender and a number of other factors. On a county to county basis, closing costs in California range from 0.81% to 2.57% of your home’s value.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

What Will My Mortgage Statements Look Like

A monthly mortgage statement looks like any other general bill you receive from a financial organization. It shows charges paid, charges owed, overdue payments, account information, and more. In some cases, a loan servicer will send the statement on behalf of your lender. Mortgage statements also provide you with contact information if you have any questions. You can probably ask your lender to show you an example of what mortgage statements looks like so you know what to expect.

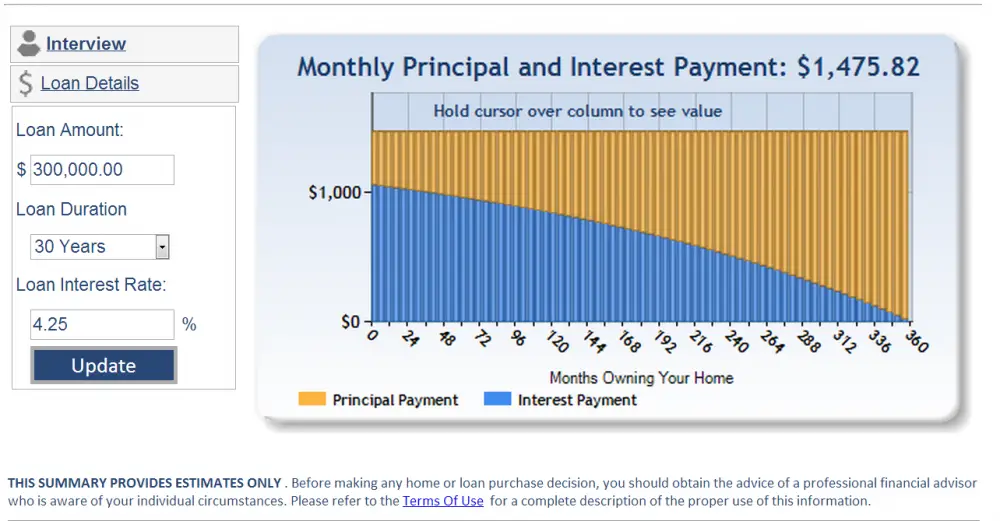

How To Calculate Principal And Interest Portion Of Mortgage Payment

Asked by: Prof. Sydni Keeling V

Subtract the monthly interest payment from your total monthly payment. Also subtract any special amounts paid for things like property tax, homeowners’ insurance or other costs. The rest of your monthly payment is the principal.

multiply your monthly payment amount by the total number of monthly payments you expect to makeCalculating interest on a car, personal or home loan

the annual interest rate divided by 12, multiplied by the outstanding mortgage principalSI = P × R × T40 related questions found

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

What Is An Amortization Schedule

An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your principal vs. interest. The maximum amortization in Canada is 25 years on down payments less than 20%. The maximum amortization period for all mortgages is 35 years.

Though your amortization may be 25 years, your term will be much shorter. With the most common term in Canada being 5 years, your amortization will be up for renewal before your mortgage is paid off, which is why our amortization schedule shows you the balance of your mortgage at the end of your term.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

You May Like: Who Is Rocket Mortgage Owned By

What Is Listed On A Mortgage Statement

The exact information and formatting of a mortgage statement will vary depending on the lender or loan servicer. However, most will include the following:

This mortgage statement is a sample provided by the CFPB

- The current balance of the mortgage statement.

- Interest paid on the mortgage.

- Current interest rate.

Apply For A 250000 Mortgage

To find out more about our range of £250,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Explore this product

Also Check: Requirements For Mortgage Approval

Typical Costs Included In A Mortgage Payment

- Principal: This is the amount you borrowed from the lender.

- Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage.

- Property taxes: Local authorities assess an annual tax on your property. If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment.

- Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, youll have an additional policy, and if youre in Hurricane Alley or earthquake country, you might have a third insurance policy. As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it’s due.

- Mortgage insurance: If your down payment is less than 20 percent of the homes purchase price, youll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

How A Mortgage Calculator Can Help

- The loan length thats right for you. If your budget is fixed, a 30-year fixed-rate mortgage is probably the right call. These loans come with lower monthly payments, although youll pay more interest during the course of the loan. If you have some room in your budget, a 15-year fixed-rate mortgage reduces the total interest you’ll pay, but your monthly payment will be higher.

- If an ARM is a good option. With fixed rates at record lows, adjustable-rate mortgages have largely disappeared. But as rates rise, an ARM might be a good option for some. A 5/6 ARM which carries a fixed rate for five years, then adjusts every six months might be the right choice if you plan to stay in your home for just a few years. However, pay close attention to how much your monthly mortgage payment can change when the introductory rate expires.

- If youre spending more than you can afford. The Mortgage Calculator provides an overview of how much you can expect to pay each month, including taxes and insurance.

- How much to put down. While 20 percent is thought of as the standard down payment, its not required. Many borrowers put down as little as 3 percent.

Also Check: Can You Get A Reverse Mortgage On A Condo

Details Of Minnesota Housing Market

Minnesota, also known as the North Star State, has just 5.6 million residents, according to the Census Bureau. In comparison, thats about 65% of New York Citys population. What Minnesota lacks in population, however, it makes up for in size. The Canada-bordering state is the 12th largest in the U.S. by size, encompassing roughly 86,900 square miles. While much of the land is farm or forest, you will find a number of metro areas in the state. The largest cities in Minnesota are Minneapolis, St. Paul, Rochester, Duluth and Bloomington. The twin cities of St. Paul and Minneapolis are on the southeastern side of the state and border Wisconsin. Duluth is northeast and borders Lake Superior. The most northern and southern and western parts of the state have the least number of residents.

Minneapolis and St. Paul experienced an extreme shortage of homes available for sales, according to the University of St. Thomas Real Estate Analysis. In St Louis County, home to Duluth, the median home value is $152,000. In Ramsey County, home to St. Paul, the median home value is $219,400.

Some of the most affordable places to live in Minnesota, as ranked by our study, are Otsego, Montevideo, Redwood Falls and Austin. This study factored in average closing costs, property taxes, homeowners insurance, average mortgage payment and median income.

Ontario Mortgage Regulations Taxes And Fees

Most taxes and fees are set at the provincial, or even municipal level. In Ontario, purchasers are responsible for obtaining Ontario mortgage rates, paying the provincial sales tax for CMHC insurance, and covering Ontario land transfer taxes.

For those purchasing in Toronto, a second set of municipal land transfer taxes apply in addition to the state tax, as well as an overseas speculation levy for properties in the Golden Horseshoe.

Read Also: 10 Year Treasury Yield And Mortgage Rates