How To Pay Less Interest On Your Loan

To further minimize your loan costs, try to pay off your debt early. As long as there’s no prepayment penalty, you can save on interest by paying extra each month or by making a large lump-sum payment.

Depending on your loan, your required monthly payments going forward might or might not changeask your lender before you pay.

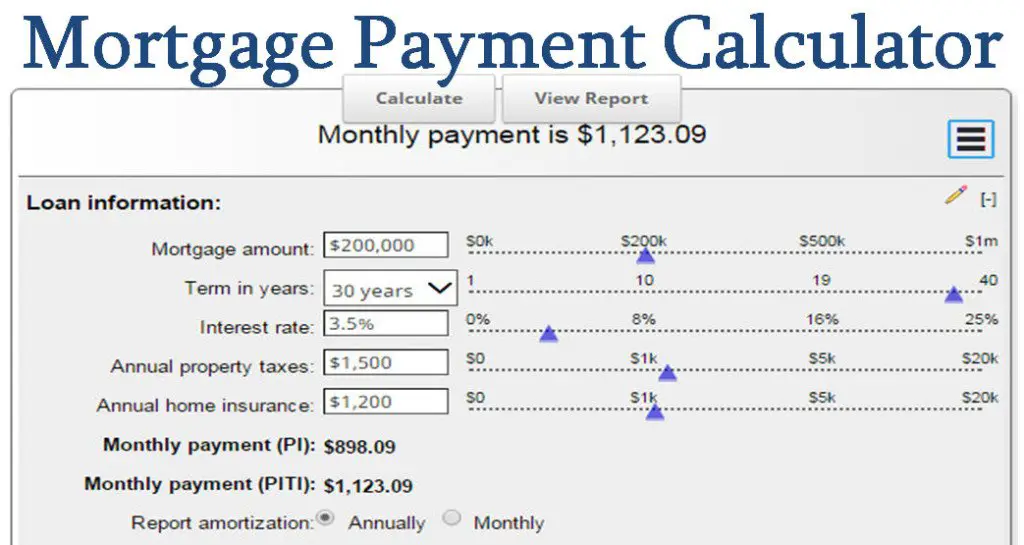

How To Calculate A Mortgage Payment

Under “Home price,” enter the price or the current value . NerdWallet also has a refinancing calculator.

Under “Down payment,” enter the amount of your down payment or the amount of equity you have . A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe.

On desktop, under “Interest rate” , enter the rate. Under “Loan term,” click the plus and minus signs to adjust the length of the mortgage in years.

On mobile devices, tap “Refine Results” to find the field to enter the rate and use the plus and minus signs to select the “Loan term.”

You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you dont wish to use NerdWallets estimates. Edit these figures by clicking on the amount currently displayed.

The mortgage calculator lets you click “Compare common loan types” to view a comparison of different loan terms. Click “Amortization” to see how the principal balance, principal paid and total interest paid change year by year. On mobile devices, scroll down to see “Amortization.”

Mortgage Calculator: How To Calculate Your Monthly Payments

See Mortgage Rate Quotes for Your Home

There are quite a few factors that go into the calculation of your mortgage expenses, but most homebuyers like to begin by determining their monthly payments and the lifetime cost of the mortgage. Calculating these two figures is a good first step toward understanding all of your other expenses.

Read Also: How To Know How Much Mortgage I Can Afford

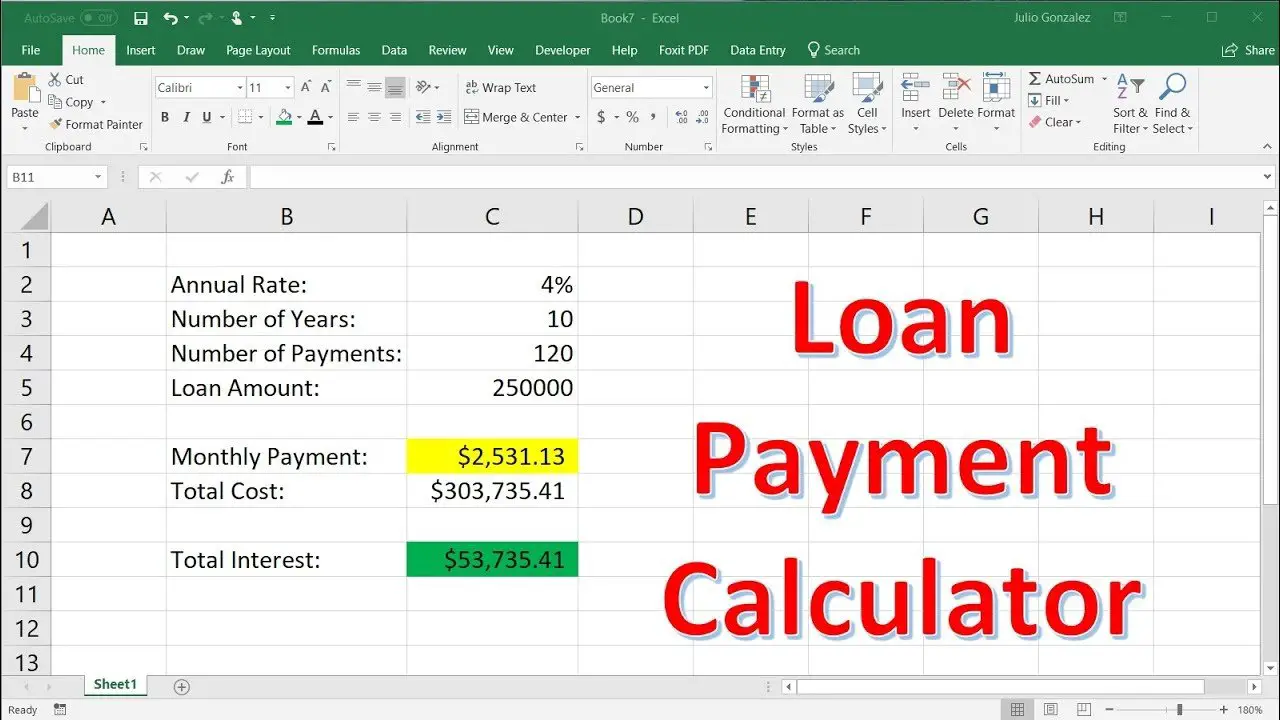

Calculating Mortgage Payments Using A Spreadsheet Program

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Recommended Reading: How Much Money Do I Need To Get A Mortgage

How To Calculate Homeowners Insurance

According to Insurance.com, the average annual cost for homeowners insurance on a home with $300,000 in dwelling coverage, $300,000 in liability coverage, and a $1,000 deductible is $2,305 per year. Thats an additional $192 per month to add to your initial mortgage payment calculation.

But because so many factors go into determining insurance rates, if youre serious about knowing exactly how much youll pay, its best to pick up the phone and speak directly with an insurance agent.

If you already have auto or renters insurance, your current provider may be a good place to start. You can also you guessed it ask your agent or lender if they have an insurance agent to recommend.

What Is Cmhc Insurance

CMHC insurance protects lenders from mortgages that default. CMHC insurance is mandatory for all mortgages in Canada with down payments of less than 20% . This is an additional cost to you, and is calculated as a percentage of your total mortgage amount. For more information on mortgage default insurance rates, please read our guide to mortgage default insurance .

Don’t Miss: What Are The Fees For A Reverse Mortgage

Renting Vs Owning A Home

There are many advantages to owning a home versus renting. Among them is the fact that you gain equity with each payment as opposed to giving your money to a landlord and the ability to paint your living room with zebra stripes if you so desire.

However, theres a mathematical piece of this as well. You have to know how much you need for a down payment and whether owning a home will be cheaper or require you to pay more when looking at the monthly cost of homeownership.

In many cases, its better to get a mortgage because the rate can be fixed for the life of the loan. There are very few controls that can stop landlords from raising your rent every year if they want to. However, not every situation is the same.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

How Much House Can I Afford With An Fha Loan

With a FHA loan, your debt-to-income limits are typically based on a 31/43 rule of affordability. This means your monthly payments should be no more than 31% of your pre-tax income, and your monthly debts should be less than 43% of your pre-tax income. However, these limits can be higher under certain circumstances.

If you make $3,000 a month , your DTI with an FHA loan should be no more than $1,290 â which means you can afford a house with a monthly payment that is no more than $900 .

FHA loans typically allow for a lower down payment and credit score ifcertain requirements are met. The lowest down payment is 3.5% for credit scores that are 580 or higher. If your credit score is between 500-579, you may still qualify for an FHA loan with a 10% down payment. Keep in mind that generally, the lower your credit score, the higher your interest rate will be, which may impact how much house you can afford.

FHA loans are restricted to a maximum loan size depending on the location of the property. Additionally, FHA loans require an upfront mortgage insurance premium to be paid as part of closing costs as well as an annual mortgage insurance premium included in your monthly mortgage payment â both of which may impact your affordability.

Recommended Reading: Is It Difficult To Refinance Your Mortgage

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

Amortized Loan Payment Formula

Calculate your monthly payment using your principal balance or total loan amount , periodic interest rate , which is your annual rate divided by the number of payment periods, and your total number of payment periods :

Assume you borrow $100,000 at 6% for 30 years to be repaid monthly. To calculate the monthly payment, convert percentages to decimal format, then follow the formula:

- a: 100,000, the amount of the loan

- r: 0.005

- n: 360

- Calculation: 100,000//=599.55, or 100,000/166.7916=599.55

The monthly payment is $599.55. Check your math with an online loan calculator.

Also Check: What Is Loan To Value Mortgage

How Much House Can I Afford

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

You May Like: How To Know If I Should Refinance My Mortgage

Types Of Down Payment: Conventional Fha Va And Usda

You might be surprised to find that some mortgage programs have low down payment requirements.

Most conventional loans have guidelines set by either Freddie Mac or Fannie Mae that allow for a smaller down payment. However, to compensate for the risk of this low down payment, conventional lenders require borrowers to purchase private mortgage insurance, or PMI, when they put less than 20 percent down. With PMI, you can borrow up to 97 percent of the homes purchase price or, in other words, put just 3 percent down. Some property types, like duplexes, condominiums or manufactured houses, require at least 5 percent down.

Some of the mortgage programs requiring the smallest down payments are government-backed loans: FHA, VA and USDA.

- FHA loans require 3.5 percent down for borrowers with credit scores of 580 or higher. Borrowers with lower credit scores must put at least 10 percent down.

- Eligible VA loan borrowers can get mortgages with zero down .

- Eligible USDA loan borrowers can also borrow 100 percent.

Government-backed loans require borrowers to pay for some form of mortgage insurance, as well. With FHA and USDA loans, its called MIP, or mortgage insurance premiums. For VA loans, its called a funding fee.

This insurance covers potential losses suffered by mortgage lenders when borrowers default. Because insurance protects lenders from losses, theyre willing to allow a low down payment.

Loan Payment Calculations Explained

The Balance / Julie Bang

Loan payment calculations, or monthly payment formulas, provide the answers you need when deciding whether or not you can afford to borrow money. Typically, these calculations show you how much you need to pay each month on the loanand whether it’ll be affordable for you based on your income and other monthly expenses.

Don’t Miss: Can I Change Mortgage Companies

Home Down Payment: When Bigger Isnt Better

While making a larger down payment offers many benefits, its not always the right decision. In general:

- Dont deplete your emergency savings to increase your down payment. Youre leaving yourself vulnerable to financial emergencies.

- Its not wise to put savings toward a larger down payment if youre carrying high-interest debt like credit cards. Youll make yourself safer and pay less interest by reducing debt before saving a down payment.

- Putting off buying a home for many years to save a large down payment can be a mistake. While youre saving your down payment, the price of that house is probably going up. While appreciation is not guaranteed, home prices in the U.S. have historically increased each year.

The size of your mortgage down payment is obviously a very personal decision. Tools like Bankrates affordability calculator or down payment calculator can help you determine the right amount for you, and so can a trusted mortgage professional. Ultimately, the decision comes down to your desire, your discipline and your resources.

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Also Check: What Is Congress Mortgage Stimulus Program

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

- Get the match. If youre not getting the full company match from a workplace retirement plan, youre passing up an instant return. The typical company match equals 50 percent to 100 percent of your contribution, up to a limit . Thats where extra money should go first until youre on track for retirement. Retirement plan contributions get a tax break and the more time your money has to grow, the better.

- Pay off your higher-rate debt. It doesnt make sense to pay off a 4 percent mortgage if you have credit cards accruing at 16 percent or more.

- Plan for emergencies. A savings account with at least three to six months worth of expenses can help you weather most setbacks.

- Protect yourself. You should be adequately insured, which for most people means having property, health and disability policies. If you have financial dependents, youll probably want life insurance, as well.

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

You May Like: How To Get Assistance With Mortgage Payments

What Other Expenses Does Homeownership Entail

It’s important to recognize that the estimated total cost of your home purchase is only an estimate and not necessarily representative of future conditions. There are many factors that are not taken into account in the calculations we illustrated above we include a few below for your consideration.

Taxes

While these fixed fees are charged regularly, they have a tendency to change over time, especially in large metropolitan areas like New York and Boston. New-home purchases often have their values reassessed within a year or two, which impacts the actual taxes paid. For that reason, your originally forecasted tax liability may increase or decrease as a result of new assessments.

HOA Dues

For buyers considering condos, homeowners associations can increase their monthly dues or charge special HOA assessments without warning. This can make up a large portion of your housing expenses, especially in large cities with high maintenance fees. You might also be subject to increased volatility in HOA fees if the community you live in has issues keeping tenants or a troubled track record.

Maintenance Costs

Finally, typical mortgage expenses don’t account for other costs of ownership, like monthly utility bills, unexpected repairs, maintenance costs and the general upkeep that comes with being a homeowner. While these go beyond the realm of mortgage shopping, they are real expenses that add up over time and are factors that should be considered by anyone thinking of buying a home.