Removing Fha Mip: Key Takeaways

To eliminate the annual mortgage insurance premium on an FHA loan, you can either:

- Wait for MIP to expire If you put down at least 10% when you bought the home, your FHA MIP expires after 11 years

- Refinance into a conventional loan Replacing your FHA loan with a conventional loan eliminates the FHAs MIP requirement. This is the only FHA MIP removal option if you put less than 10% down

The good news is that home values are rising nationwide. So many FHA homeowners have enough equity to refinance into a conventional loan and cancel mortgage insurance even if they only bought a few years ago.

You can check your FHA removal eligibility with a lender.

What Is Mortgage Insurance And How Does It Work

Mortgage insurance lowers the risk to the lender of making a loan to you, so you can qualify for a loan that you might not otherwise be able to get.

Typically, borrowers making a down payment of less than 20 percent of the purchase price of the home will need to pay for mortgage insurance. Mortgage insurance also is typically required on FHA and USDA loans. Mortgage insurance lowers the risk to the lender of making a loan to you, so you can qualify for a loan that you might not otherwise be able to get. But, it increases the cost of your loan. If you are required to pay mortgage insurance, it will be included in your total monthly payment that you make to your lender, your costs at closing, or both.

Piggyback Mortgages And Pmi

Some lenders recommend using a second piggyback mortgage to avoid PMI. This can help lower initial mortgage costs rather than paying for PMI. It works like this: You take out a first mortgage for most of the homes purchase price . Then you take out a second, much smaller mortgage for the remainder of the homes purchase price, less the first mortgage and down payment amounts. As a result, you avoid PMI and have combined payments less than the cost of the first mortgage with PMI.

However, a second mortgage generally carries a higher interest rate than a first mortgage. The only way to get rid of a second mortgage is to pay off the loan entirely or refinance it into a new standalone mortgage, presumably when the LTV reaches 80% . However, these loans can be costly, particularly if interest rates increase from the time you take out the initial loan and when youd refinance both loans into one mortgage. Dont forget youll have to pay closing costs again to refinance both loans into one loan.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Upfront Mortgage Insurance Premiums Vs Annual Insurance Premiums

In addition to upfront mortgage insurance premiums, all FHA loans charge an annual insurance premium. Each premium charges a different percentage on the base loan amount and has specific requirements.

- Upfront mortgage insurance premiums is a one-time charge due at closing. All loan types are charged 1.75% on the base loan amount.

- Annual insurance premiums in most cases are paid over the life of the loan. The percentage youll be charged is dependent on the base loan amount, your down payment amount, and the loan term.

How To Get A Refund Of Mortgage Insurance Premiums

Mortgage insurance protects lenders rather than homeowners.

Mortgage insurance is designed to protect the financial interests of lenders and mortgage investors in the event that you default on your loan. Typically, you pay for the insurance with an upfront premium and monthly charges that form part of your mortgage payment. In some instances, you can not only cancel the insurance but you may also get a refund.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

Automatic Fha Mortgage Insurance Removal

If you received your FHA loan before June 3, 2013, you were eligible for MIP cancelation after five years.

But you must have 22% equity in the property, and you must have made all payments on time.

For homeowners with FHA loans issued on or after June 3, 2013, you must refinance into a conventional loan and have a current loantovalue ratio of 80% or lower.

Loantovalue ratio is another way to measure your home equity.

If you owed $160,000 on your home thats valued at $200,000, your LTV would be 80% because the loan balance is 80% of the homes value .

An LTV of 80% means you have 20% home equity which should be enough to refinance into a conventional loan with no PMI.

How To Get Rid Of Pmi

Once your mortgage balance reaches 80% of the home’s value at the time you bought it, contact your mortgage servicer and let them know that you would like to discontinue the PMI premiums. Under federal law, a lender must inform you at closing how many years and months it will take for you to reach that 80% level so you can cancel PMI. Even if you don’t request PMI cancellation, the lender must automatically cancel it once the balance gets to 78%. .

Fannie Mac, Freddie Mac Issue COVID-19 PMI Termination Guidelines

If you have a Fannie Mae or Freddie Mac loan, one requirement for canceling PMI is that you must have an acceptable payment record. Forthese kinds of loans, when looking at whether you have an acceptable payment record, theservicercan’t consider any payment that’s 30 or more days past due in the last 12 months or 60 or more days past due over the previous 24 months that’s attributable to a coronavirus financial hardship if the servicer provided you with a COVID-19 related mortgage-relief plan, like a forbearance, repayment plan, trial period plan, or payment deferral. The loan must be current when you request a cancellation of PMI. For mortgages brought current under a COVID-19 payment deferral, you have to make three consecutive payments following the settlement of the COVID-19 payment deferral before you can cancel PMI.

Don’t Miss: Can You Do A Reverse Mortgage On A Mobile Home

How Long Do Guarantee Fees Last

The downside here is that guarantee fees live for the life of the loan. The only way to get rid of them is by refinancing into a conventional loan and requesting PMI removal after you reach 20% equity.

This isnt common, but there are cases in which you can receive your loan directly from the USDA. In these instances, there are no guarantee fees.

Mortgage Disability And Critical Illness Insurance

Mortgage disability and critical illness insurance may make mortgage payments to your lender if you can’t work due to a severe injury or illness.

Mortgage disability and critical illness insurance is usually a combination of several insurance products, including:

- critical illness insurance

- job loss insurance

- life insurance

Most insurance plans have a number of conditions attached to them, including a specific list of illnesses or injuries that are covered or excluded. Pre-existing medical conditions are usually not covered. These terms and conditions of insurance are listed in the insurance certificate. Ask to see the insurance certificate before you apply, so you understand what the insurance covers.

Before you buy mortgage disability or critical illness insurance, check if you already have insurance coverage that meets your needs through your employer or another policy.

Read Also: Reverse Mortgage On Condo

What Is Mortgage Loan Insurance

Mortgage loan insurance protects the mortgage lender in case you cant make your mortgage payments. It doesnt protect you. Mortgage loan insurance is also sometimes called mortgage default insurance.

If your down payment is less than 20% of the price of your home, you must buy mortgage loan insurance.

Your lender may require that you get mortgage loan insurance, even if you have a 20% down payment. Thats usually the case if youre self-employed or have a poor credit history.

Mortgage loan insurance isnt available if:

- the purchase price of the home is $1 million or more

- the loan doesnt meet the mortgage insurance companys standards

Your lender coordinates getting mortgage loan insurance on your behalf if you need it.

Fha Mortgage Insurance Premium

If you cant qualify for a conventional loan product, you might consider an FHA loan. Like some conventional loan products, FHA loans have a low-down payment optionas little as 3.5% downand more relaxed credit requirements.

Lenders require mortgage insurance for all FHA loans, which are paid in two parts: an up-front mortgage insurance premium, or UFMIP, and an annual mortgage insurance premium, or annual MIP. Both costs are listed on the first page of your loan estimate and closing disclosure.

Read Also: 10 Year Treasury Vs 30 Year Mortgage

Can I Cancel My Mortgage Insurance At Some Point

Mortgage insurance is maintained at the option of the current owner of the mortgage. In many cases, the lender will allow the cancellation of mortgage insurance when the loan is paid down to 80% of the original property value. However, lenders may take more than your home value into account to consider eliminating PMI. If you’ve had late payments in recent months, it may disqualify you from removing PMI earlier than is required by law. Lenders requirements for this can vary state to state so contact your loan servicer directly to find available options.

Whats Changing With Insured Mortgages

The COVID-19 pandemic is affecting our economy, including our housing market. The country is experiencing job losses, the closure of businesses and fewer people immigrating to Canada. These factors all contribute to our housing market.

The Canadian Mortgage and Housing Corporation is changing their qualification criteria for insured mortgages as a means of helping to reduce their risk during these turbulent times. Note that Genworth and Canada Guaranty are not making any changes to their qualification criteria at this time.

There are several changes that will go into effect on July 1, 2020 and may affect your eligibility for an insured mortgage.

The three main changes include:

1. The maximum Gross Debt Service ratios will be lowered from 39% to 35%, and the Total Debt Service ratios will be lowered from 44% to 42%.

What does this mean?

Your debt service ratio is based on your monthly expenses divided by your total monthly income. The GDS accounts for the expenses of owning a home, such as mortgage payments, property tax and condo fees, while the TDS adds in the additional debt you may be paying for each month, such as loans or credit card payments.

The lender takes a look at how much you earn monthly, against your anticipated home ownership expenses and current debt you are carrying. They want to ensure that your mortgage payment will be manageable based on these factors.

The amount of debt you can carry will decrease slightly with these changes.

What does this mean?

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

Have Questions About Pmi

While many borrowers may gripe about the costs of PMI, the reality is paying these costs often provides a quicker, more affordable path to homeownership. Without PMI many people would be forced to wait a few more years to save for a higher down payment. Itâs a tradeoff, but not one that many people would forgo.

Get helpful articles directly in your inbox!

Is Life Insurance Worth It

Individually owned life insurance tends to be cheaper than mortgage insurance. In some cases, its significantly less expensive than mortgage protection insurance from a lender. The tax-free proceeds can remove a huge financial burden from the shoulders of the family you leave behind, says Wouters.

Plus, people often have other needs besides paying off a mortgage, like providing income for a surviving spouse, home maintenance, education for your kidsall of which life insurance can cover. If you have plenty of other assets and investments that wouldnt trigger any taxes on your death, your spouse is working and earns even more than you do, and your survivor would move to a less-expensive home if you passed away, then having extra life insurance may not be as important, says Wouters. A growing number of people in their 60s and 70s have a mortgage and no heirs, or have heirs to whom they dont want to leave much. The house would be sold on death, and whatever is left after the mortgage and other expenses are covered goes to the heirs. For those people, life insurance may not be as important a consideration when looking at paying off the mortgage.

You May Like: Chase Mortgage Recast

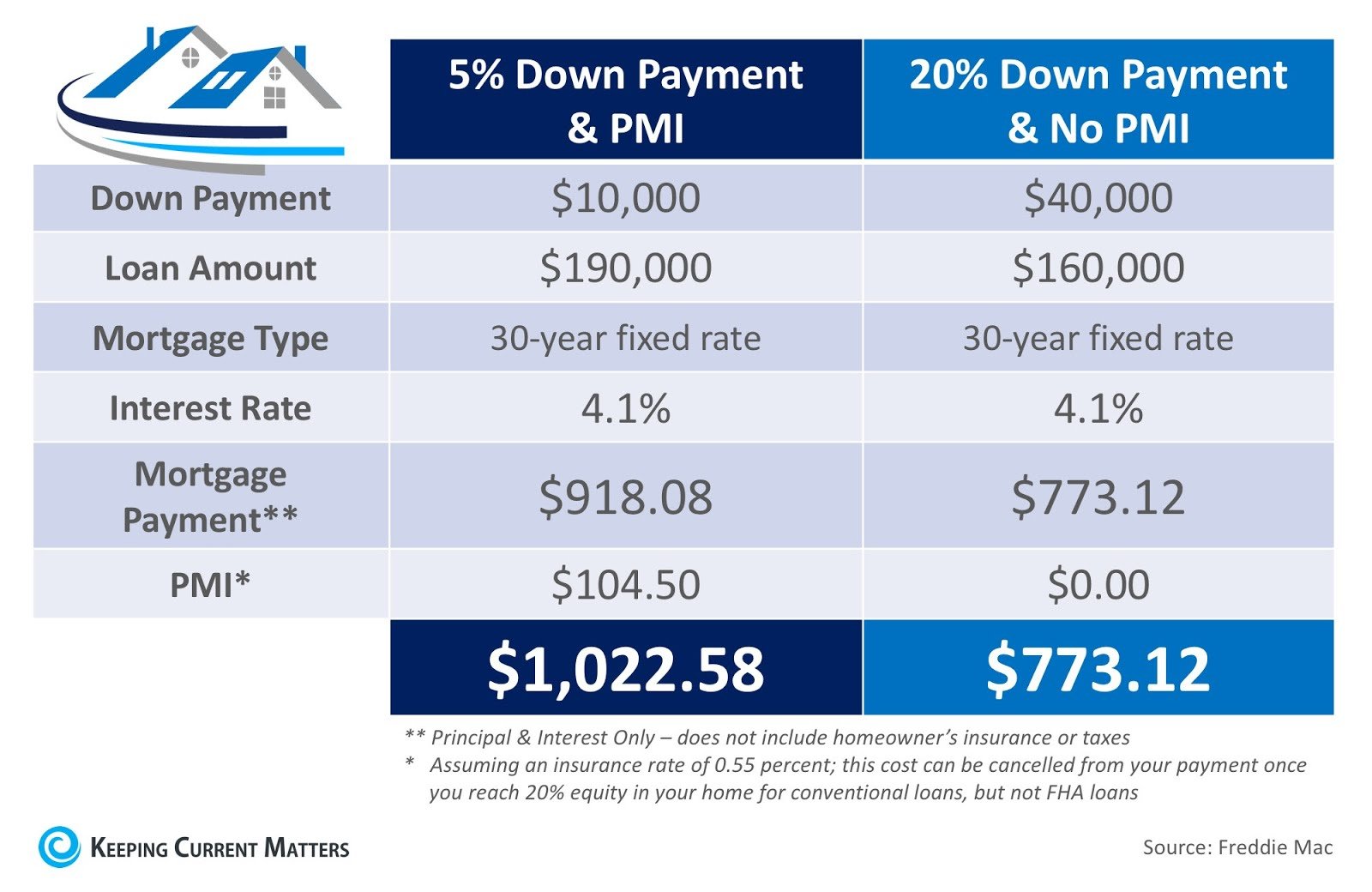

How Much Does Pmi Cost

The average range for PMI premium rates is 0.58 percent to 1.86 percent of the original amount of your loan, according to the Urban Institute. Freddie Mac estimates most borrowers will pay $30 to $70 per month in PMI premiums for every $100,000 borrowed. How much you will pay for PMI depends on two key factors:

- Your loan-to-value ratio How much you put down will impact how much youll pay for PMI. For example, if you put down 5 percent, your LTV ratio would be 95 percent. If you put down 15 percent, your LTV ratio would be 85 percent. When you can only make a small down payment, the lender is assuming a bigger risk, and your PMI payments will be higher to account for that risk.

- Your credit score Your credit history and corresponding credit score play a major role in the cost of PMI. For example, consider the Urban Institutes example of someone buying a $250,000 property with a 3.5 percent down payment. With an excellent FICO score of 760 or greater, the monthly mortgage payment including the insurance is $1,164. For a buyer with a credit score between 620 and 640, those monthly payments are $1,495 a reflection of a significantly higher PMI charge.

Heres a look at how PMI might play out based on how much you put down, according to the Freddie Mac mortgage insurance calculator and the Bankrate mortgage calculator. These examples assume a $329,000 purchase price and a 3.25 percent interest rate, and do not account for homeowners insurance and property taxes.

| Down payment |

|---|

Advantages And Disadvantages Of Fha Mortgage Insurance

Here are some of the advantages of FHA MIP:

- Premiums are set FHA mortgage insurance premiums dont fluctuate according to credit score.

- Easier to qualify FHA mortgage insurance helps borrowers who might not otherwise qualify for a conventional loan. With MIP, mortgage lenders are able to absorb more risk and therefore extend loans to less-creditworthy borrowers.

- Lower down payment With the insurance, borrowers with a credit score of 580 and up can put down as little as 3.5 percent on an FHA loan. Those with scores between 500 and 579 can put down as little as 10 percent.

Here are some of the disadvantages of FHA MIP:

- Adds to overall loan cost The upfront and annual costs of FHA mortgage insurance increase both your total loan amount and monthly payment.

- Difficult to get rid of Generally, there are only a couple of ways out of paying for FHA mortgage insurance you can either refinance into a conventional loan or pay off your mortgage in full.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Is Mortgage Insurance Worth It

A home is probably the biggest asset youll own, and a mortgage is one of the biggest debts youll take on in your lifetime to buy it.

Mortgage debt in Canada stood at almost $1.63 trillion dollars in the third quarter of 2020, according to Statistics Canada, says Wouters. Life insurance can pay off the mortgage for pennies on the dollar when a breadwinner dies, and this can save many thousandsperhaps hundreds of thousands of dollarsin interest payments, too.

You and your family can gain peace of mind in that they can continue to live in your home and in the same neighbourhood you chose with their best interests in mind. If its worth it to buy a home, for many its worth the additional costs of insurance. Consider what would happen if a critical illness struck or the breadwinner suffered a disability. Theres coverage for that, which can cover the mortgage or mortgage payments for a period of time.

Mortgage default insurance may not be as important if you own a home that has risen substantially in value in the event of your death, your family could downsize to another home and pay for it in full. Dont forget about moving expenses, and legal and registration fees, which can really add up, says Wouters. Consider all of these things should a critical illness or disability strike. The needs for cash and cash flow are still there.

Federal Housing Administration Loan

If you get a Federal Housing Administration loan, your mortgage insurance premiums are paid to the Federal Housing Administration . FHA mortgage insurance is required for all FHA loans. It costs the same no matter your credit score, with only a slight increase in price for down payments less than five percent. FHA mortgage insurance includes both an upfront cost, paid as part of your closing costs, and a monthly cost, included in your monthly payment.

If you dont have enough cash on hand to pay the upfront fee, you are allowed to roll the fee into your mortgage instead of paying it out of pocket. If you do this, your loan amount and the overall cost of your loan will increase.

You May Like: Monthly Mortgage On 1 Million

Mortgage Insurance Vs Life Insurance

How does mortgage protection insurance compare to life insurance? We break it down here. The first thing youll notice, though, is that mortgage insurance protects the lender for debt, and life insurance protects the homeowners beneficiaries for debt.

| Mortgage protection insurance through the lender | Life insurance through a life insurance company or financial advisor |

|---|---|

| Homeowner | |

| 2.8% to 4.0% of their mortgage amount | Significantly less than mortgage insurance. Approx. $500 a year, depending on the policy |