Insured Insurable And Uninsurable Mortgages

Theinsurability of your mortgagewill affect your mortgage rate. Insured mortgages are those with CMHC mortgage default insurance or private default insurance from Canada Guaranty or Sagen. The borrower will pay for the mortgage insurance premiums.

Since the lender has zero risk, they will offer the lowest mortgage rates for insured mortgages. The mortgage rates that you see advertised online are often only for insured high-ratio mortgages, which are mortgages with a down payment less than 20%. Insured mortgages will need to meetCMHC mortgage requirements.

With insurable mortgages, the borrower wont pay for mortgage insurance. The mortgage wont be individually insured either. Instead, the lender can choose to bulk insure their portfolio of insurable mortgages and pay for this insurance themselves.

What this means to you is that the cost of mortgage insurance isnt directly paid by you if mortgage insurance isnt required. Insurable mortgages will have to meet the same requirements as an insured mortgage, but the only difference is that an insurable mortgage will need to have a down payment of at least 20%. Insurable mortgage rates are also slightly higher than insured mortgage rates.

An insurable mortgage can have a mortgage rate that is around 20 basis points added on top of an insured mortgage rate. Uninsurable mortgage rates will have around 25 basis points to 35 basis points added on top of insured mortgage rates.

Mortgage Rates: What The Experts Are Saying

With mortgage rates so low, most experts agree the only direction to go is up. The question now: how fast will it happen?

Experts have been saying all year that mortgage rates will continue ticking upwards through the end of 2021. News of the Omicron COVID-19 variant has created fresh economic uncertainty and is putting upward pressure on rates. At the same time, rates are getting downward pressure due to the highest inflation in nearly 40 years. The result is volatility. For example, since November 10th, rates have followed this up and down pattern each week: 3.15% 3.22% 3.24% 3.2% 3.24% and most recently 3.28%.

While experts still expect rates to increase as the economy recovers, the recent volatility could continue through the end of the year and into 2022. Most experts believe increases would be incremental. Were not expecting an overnight shoot up where all of a sudden mortgage rates are at 3.5% or 4%, says Ali Wolf, chief economist at Zonda, a California-based housing data and consultancy firm.

Despite the ups and downs, todays mortgage rates are still close to 1% lower than pre-pandemic levels. So, if you are in the market to refinance or purchase a home, now is a good time to take action. Here is everything you need to know about scoring the best rate and how much it can save you.

How Do I Find Personalized 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. Specify the propertys ZIP code and indicate whether youre buying or refinancing. After clicking “Get Started”, youll be asked the homes price or value, the size of the down payment or current loan balance, and the range of your credit score. Youll be on your way to getting a personalized rate quote, without providing personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Todays rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Special Home Loan Offers Announced By Leading Banks As Part Of The Festive Season Offers

As part of the upcoming festive season in the country, leading banks are offering special home loan offers to attract customers to avail home loans. State Bank of India is offering attractive interest rates starting at 6.90% p.a. for home loans of up to Rs.30 lakh and 7.00% p.a. for home loans above Rs.30 lakh. Those applying through the banks YONO mobile application get an additional interest rate concession of 5 basis points. Applicants across 8 metro cities in India will get a concession in interest rate of 20 basis points for home loans of up to Rs.3 crore. In the rest of the country, this will be applicable for home loans ranging from Rs.30 lakh to Rs.2 crore. For home loans of above Rs.75 lakh, there will be an interest rate concession of 25 basis points. All interest rate concessions are also linked ot the credit scores of applicants.

23 October 2020

Recommended Reading: Rocket Mortgage Vs Bank

Better Mortgage Company: Best Online Lender

Better.com is an online mortgage lender offering a range of loan products in the majority of states in the U.S, and one of Bankrates best mortgage lenders overall.

Strengths: Better.com can save you time and money with three-minute preapprovals and 21-day closings, on average, and no lender fees. If you get a more competitive mortgage rate from another lender, you can also take advantage of the Better Price Guarantee, in which Better.com either matches that rate or gives you $100. The lender offers seven-days-a-week support by phone, as well, if you need it.

Weaknesses: If youre looking for a VA loan or USDA loan, youll have to search elsewhere Better.com currently doesnt offer these loan types. Although the Better Price Guarantee can help you get a lower rate, its only available if you apply online directly through the lender.

> > Read Bankrate’s full Better Mortgage review

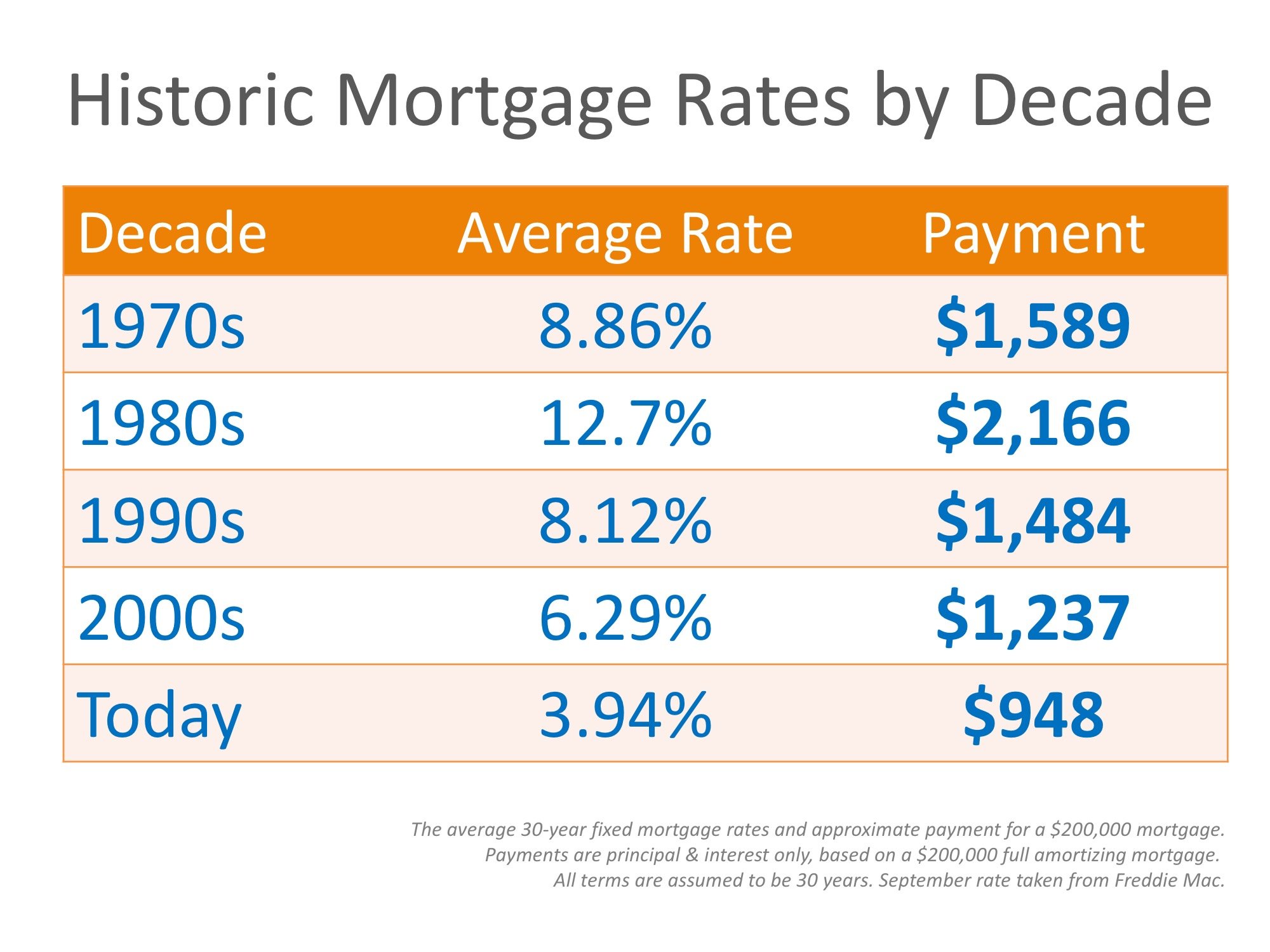

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much you’ll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

Also Check: What Does Gmfs Mortgage Stand For

Canada’s Most Popular Mortgage: The 5

In Canada, out of the $1.2 trillion CAD in outstanding residential mortgages in May 2021, the 5-year fixed rate mortgage takes the crown with over $660 billion, or more than 50%, of all mortgages in Canada. There are more 5-year fixed rate mortgages than all variable rate mortgages combined. The 5-year fixed rate mortgage is so popular that the CMHC uses the Bank of Canada’s 5-Year Benchmark Posted Rate for itsmortgage stress test.

What Are The Current Applicable Interest Rates

The current applicable lending interest rates are posted on our public website at . You can choose an appropriate fixed period in accordance with your loan. After fixed period, floating rates will be applied. You can choose the applicable interest rate according to interest review cycle of 1 month, 3 months or 6 months. Consequently, your applicable interest rate may be adjusted following the agreed interest review cycle.

Don’t Miss: 10 Year Treasury Vs Mortgage Rates

What To Expect In The 2020 Toronto Housing Market

Toronto is a major destination for immigrants and interprovincial migrants looking for employment. Roughly 100,000 people a year move to the greater Toronto area. Add that to its natural population growth, low interest rates, stable employment and expensive land and you have a recipe for further housing price appreciation.

Toronto started 2020 in a sellers market and thats where many analysts believe it will end, barring some major economic shock. Supply will increase to offset some of the demand, but likely not all.

In terms of mortgage performance, Toronto mortgage arrears should remain low. Ontario as a whole had rock-bottom mortgage defaults. At the time of this is being written, the latest data shows just 9 in 10,000 Ontario borrowers were 90 days behind on their mortgage payments, versus 23 out of 10,000 nationwide. . Toronto figures are comparable given its strong job market and equity appreciation.

Types Of Interest Rates In Home Loan

There are mainly two types of home loan interest rates charged by most of the banks.

1. Fixed Interest Rate:

In this system of computation, the rate remains even throughout the loan tenor. There will be no change in the interest charges since the rate remains fixed. Depending on the offer, you may be allowed to switch over to the floating rate system after completing a certain duration into the loan tenure.

- Advantage: Since the rate remains fixed, you know how much interest charges youre paying upfront. Your loan will be shielded from frequent rate fluctuations and saves money in a longer run if there is a hike in lending rates.

- Disadvantage: If the standard lending rates fall, you will not benefit since the interest component remains frozen.

Read More: Fixed Home Loan Rates

2. Floating Interest Rate:

The interest charges on your home loan is subject to the current most lending rates of the bank. The rate is linked to the latest published rate of the bank which in turn depends on multiple factors such as RBIs monetary policy and lending rate revisions, the banks response to the revision etc.

- Advantage: The most visible perk of opting for the floating rate is that you have the advantage of being billed on the basis of the latest rate. If the rates fall, you save on interest charges.

- Disadvantage: In rare scenario, if the standard rates go up, the loan has to be bear the brunt of being billed a higher rate.

Read Also: Reverse Mortgage Mobile Home

How Does The Federal Reserve Affect Mortgage Rates

Home loans with variable rates likeadjustable-rate mortgages andhome equity line of credit loans are indirectly tied to the federal funds rate. When thefederal funds rates increase, it becomes more expensive for banks to borrow from other banks. The higher costs for the bank can mean a higher interest rate on your mortgage. ARM loans that are in their fixed period are not impacted by this increase. However if you suspect a federal increase is about to happen or it has just happened, you’ll want to move fast if you’re looking to make changes or have yet to lock in a fixed-rate mortgage.

Why Should I Compare Mortgage Rates

Choosing a mortgage is a major financial decision since it involves borrowing a significant amount of money. The mortgage interest rate is one of the factors that affects the total amount of money you will have to pay over the course of the amortization period. So, you could save money by finding the lowest rate. But, along with the mortgage rate, you should also compare the terms and conditions of each type of mortgage in order to find the right one for you.

Read Also: Rocket Mortgage Qualifications

Should I Work With A Bank Or A Mortgage Broker

There are benefits and drawbacks to working with either a mortgage broker or a bank. Working with a mortgage broker gives you access to mortgage rates from a wide variety of lenders. That maximizes the chance that you’ll find a lower rate than you would by going directly to a bank. On the other hand, getting a mortgage from a bank can be quick and simple, especially if you already bank with them. We’d generally recommend seeing what rate your current bank will offer you, while also speaking to a local mortgage broker to see what other rates are on offer.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

We compare the most competitive brokers, lenders and banks in Canada to bring you today’s lowest interest rates, free of charge. Canadaâs current mortgage rates at the top of this page are updated every few minutes, so are the best rates currently on offer. to better understand what rate you could be eligible for in a few simple steps – – again, itâs completely free to use and youâre under no obligation whatsoever.

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Don’t Miss: Reverse Mortgage Manufactured Home

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

How Much Mortgage Can I Afford

To know if you can afford 30 year mortgage rates, 20 year mortgage rates, and other home interest rates that are available will be determined by your personal financial situation. You can use an online tool such as NerdWallet to get a personalized estimate or find out accurate information on the lowest mortgage rates by speaking with one of Richrs financial experts.

Also Check: Chase Recast

How Are Mortgage Rates Determined

Mortgage rates are set by the lender. The lender will consider a number of factors in determining a borrower’s mortgage rate, such as the borrower’s credit history, down payment amount or the home’s value. Inflation, job growth and other economic factors outside the borrower’s control that can increase risk also play a part in how the lender sets their rates. There is no exact formula, which is why mortgage rates typically vary from lender to lender.

How To Find The Lowest Mortgage Rate Today

Getting the lowest mortgage rate possible requires a combination of timing and preparation. While external economic factors play a heavy role in what lenders can offer, improving your own financial situation before applying can go a long way in driving down interest rates.

Taking the necessary steps to improve your credit score or save for a substantial down payment will help you get the lowest mortgage rate when the timing is right to apply for a loan.

Once your credit and savings are ready to take on a home purchase, keeping a close watch on the real estate market and its projected developments will help you recognize the best opportunity for a home purchase.

Meeting with multiple lenders and understanding the full scope of your borrowing limits will also help you understand average mortgage rates today and who can offer the best deal.

You May Like: Does Rocket Mortgage Sell Their Loans

Home Loan Interest Rate Faqs

1. What is home loan interest rate?

Home loan interest rate is the percentage of the principal amount charged by the lender to the borrower for using the principal amount. The interest rate charged by banks and non-financial institutions determine the cost of your home loan. So, when you are paying your home loan EMI , the interest rate charged determines how much you have to pay your lender against your loan every month. Interest rates are usually linked to repo rate and can vary from lender to lender.

2. Which Bank has lowest home loan interest rate?

Though interest rates offered by banks can increase or decrease as per the banks discretion, right now the Union Bank of India is offering the lowest home loan interest of 6.40% p.a. to its customers. However, note that this rate is applicable only on home loan for women applicants.

3. How to Get Lowest Home Loan Rates in India?

Home loan interest rates are at a 15-year low, so almost all the banks are offering lower interest rates on home loans compared to what they were offering in the previous financial year. However, to get the lowest home loan interest rates, compare rates offered by lenders. Always use a home loan EMI calculator while comparing rates it will help you estimate how much you have to pay every month against your loan.

4. How to reduce home loan interest?5. How Home Loan Risk weightage is linked to LTV Ratio?6. Which bank has the lowest rate of interest for the self-employed?