How To Calculate Debt To Income Ratio

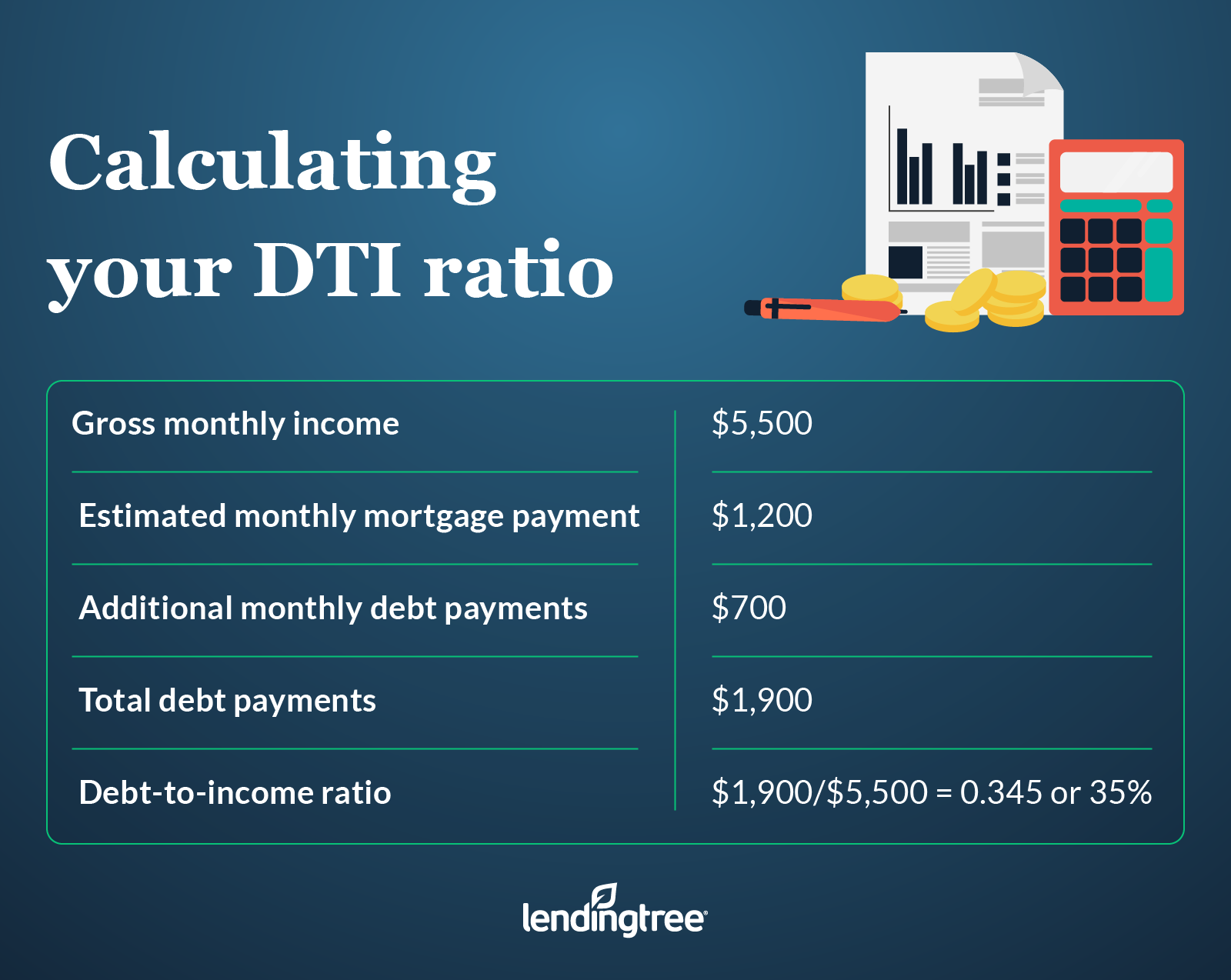

Okay easy enough, but your ratio is likely not as clear-cut as half your income . How do you calculate your exact DTI? Theres math involved, but thankfully its pretty basic .

Simply divide all your monthly debt payments by your gross income, and then multiply that number by 100. This will give you your DTI percentage.

In some cases, what constitutes income and debts is clear-cut. In other cases, not so much. Generally, lenders follow these guidelines for what to include for each.

Debt includes:

-

Minimum required credit card payments

Income includes:

-

Pre-tax monthly salary

-

Income from additional jobs or side hustles

-

Revenue from rental property or other investments

-

Regular income from annuities, trust funds, and retirement accounts

-

Any child support or alimony payments you receive

Lets look at a real-world example:

Auto loan: $350 per monthStudent loans: $220 per monthCredit cards: $130 minimum monthly paymentExpected housing costs: $1,800 per month= $2,500 monthly debt obligation

Monthly salary: 5,000 Monthly side-gig income: $1,500

x 100 = 38% DTI

The above scenario is for illustrative purposes only.

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

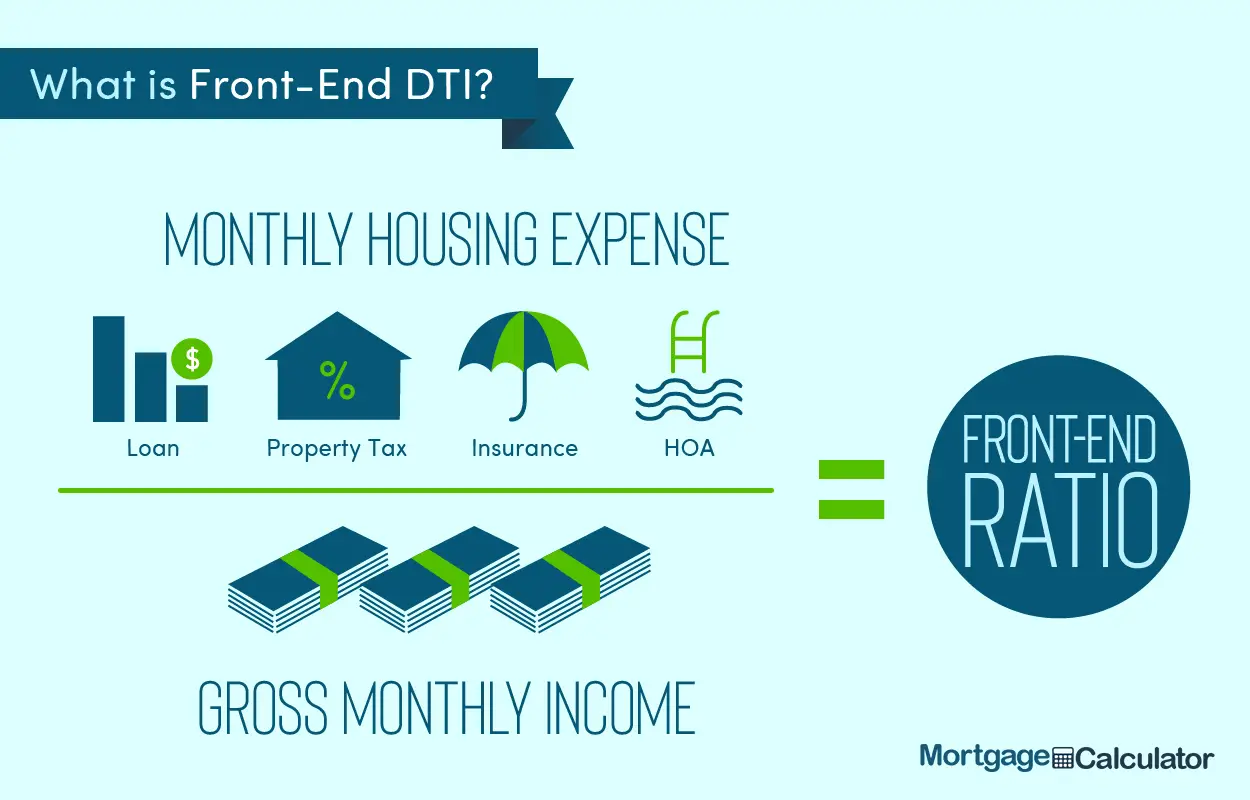

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

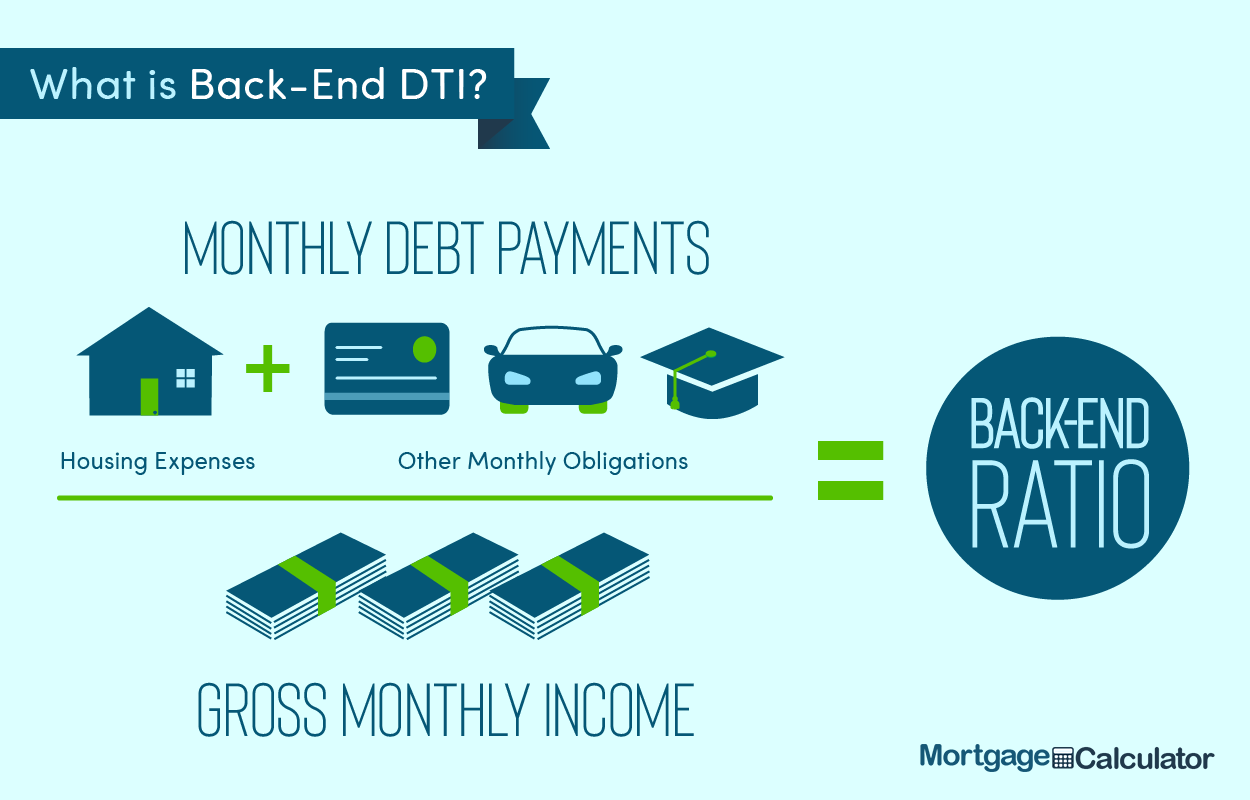

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Dti Limits For Key Loan Types

Here are the acceptable DTI ratios for conventional, FHA, VA, and USDA loans.

| Loan type |

| 44% or less |

Although the table above shows the maximum acceptable DTI ratios for different mortgages, keep in mind that different lenders have different standards for each loan program they offer. Also, some lenders may require a higher or lower DTI ratio, based on its underwriting guidelines, your credit score, down payment amount, and income.

Also Check: What Documents Do I Need To Get A Mortgage

How To Calculate Your Dti Ratio

total monthly debt payments divided by monthly income = debt-to-income ratio

1. Take your annual income and divide it by 12 to get your monthly income.

2. Add up your reoccurring monthly expenses such as:

- Minimum monthly payments on credit cards

- Auto loans

Note: To find your back-end DTI ratio add your monthly mortgage payment

3. Divide your monthly debt obligations by your monthly income to get your DTI ratio

For example: If your yearly income is $60,000 and your total monthly debt payments come to $1,000

$60,000 divided by 12 = $5,000

$1,000 divided by $5,000 = .2

= 20% debt-to-income ratio

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

Read Also: Is Fairway Mortgage A Broker

Tips For Improving Your Debt

In order to make things a bit easier for you, we have decided to include a few specific tips about things you can do to improve income and lower debts. As we mentioned, its all about lowering debts and raising income, but that is pretty broad, so here are some real-life examples that should help.

Rent Your Space or Items

If you own a home, one of the best ways you can help lower your DTI ratio is to rent out a room or area of your home. Most of the time, this could potentially cover most, if not all, of your mortgage payment, which is one of the most common reasons for a high DTI ratio. It would essentially be lowering your mortgage payment, which is always a good thing. In addition to that, you could also rent out items or things you own in order to get a bit more cash.

What is a rent-to-own home?

Pick Up a Second Job or Get a Higher Paying Main Job

Raising your income is one of the best ways to lower your DTI ratio. Of course, the first thing you could do is approach your boss about a raise. If they are unwilling, you can either look to get a job that is higher paying or simply find a second job to supplement your income.

Heres a list of the Top 10 Highest Paying Jobs in Canada.

Look At Making Some Money Online

Pay Off Your Debt More Quickly

Is it better to deal with debt or save your money? to find out.

Take a Long Look at Your Expenses

Check out our guide to automatic savings and automatic payments.

Look at Selling Your Car and Getting a Cheaper One

How To Lower Your Dti Ratio

There are two key ways to lower your DTI ratio: reducing your debt and increasing your income.

Here are some tips for decreasing your DTI ratio.

- Ask for a raise at work to boost your income

- Take on a part-time job or freelance work on the side

- Make extra payments to your credit card to lower the balance

- Reduce your day-to-day expenses so you can make a bigger dent in your debts, such as your student loan or auto loan balances

- Avoid making large purchases on credit that arent absolutely necessary

- Avoid taking out any new loans or lines of credit

You May Like: How Long After Bankruptcy Can You Get A Mortgage

Examples Of Mortgage Payment Percentage

Now, lets look at some examples of mortgage payment percentages so you can work out how much you can afford to borrow from a lender and what percentage of income you need for your mortgage.

What value of property can you afford on a $60,000 a year income?

As mentioned above, the rule of thumb is that you can typically afford a mortgage two to 2.5 times your yearly wage. Thats a mortgage between $120,000 and $150,000 at $60,000 per annum. However, youll have to be able to afford the monthly mortgage payments.

What are the payments on a $200,000 mortgage?

Lets imagine a $200,000, 30-year mortgage with a 4% interest rate. This would set you back about $954 per month.

What are the monthly payments on a $300,000 mortgage?

With a 4% fixed interest rate, monthly mortgage payments on a 30-year mortgage would total around $1,432.25 a month. However, if you opt for a 15-year plan, it could cost up to $2,219.06 a month.

Pay Down Certain Credit Accounts

If you have a car loan, tryto pay that account down to fewer than ten payments. If you can, lenders maydrop that payment from your DTI.

Or pay down your creditcards as much as possible. But to get the most bang for your reduction buck,take every balance on your credit cards and divide them by their monthlypayments. Pay off the ones with the highest payment-to-balance ratio.

Say you have a credit cardwith a balance of $500 and a $45 payment. That is a 9% payment-to-balanceratio. You also have a credit card with a $3,000 balance and a $150 payment.That is a 5% payment-to-balance ratio. Pay off the $500 balance first.

You May Like: How Much Do You Owe On Your Mortgage

Defining Debt And Income

To calculate your DTI, you first need to know what counts as debt and what counts as income.

-

What counts as debt?

Debt includes your regular monthly repayments on personal loans, student loans, car loans, mortgages or any other type of loan. Your monthly minimum credit card payments also count as debt, as do unpaid bills sent to collection agencies.

-

What doesnt count as debt?

Things like rent, utility bills, cable bills arent included in your DTI. Car insurance, health insurance and other types of insurance premiums also dont count as debt.

You might think that monthly bills besides credit card and loan payments should count but heres why they dont: With these bills, youre paying for a service, typically one thats consistent.

-

What counts as income?

The income DTI refers to is your gross monthly income that is, your income before taxes or deductions are subtracted. Income includes your salary, but its not limited to just what you bring in each month.

Tips or bonuses, CPP and OAS benefits, alimony and child support all count as income too. Think of income as any kind of money thats coming in that you dont have to repay.

Your lender didnt ask about your debt or income? It could be a scam.

If you come across a lender that markets itself in this way, make sure its legitimate before signing on. Read online reviews, check out its accreditations and confirm that it has no complaints on the Better Business Bureau website.

What Is A Good Debt

The lower your DTI ratio, the more likely you will be able to afford a mortgage opening up more loan options. A DTI of 20% or below is considered excellent, while a DTI of 36% or less is considered ideal. Compare your debt-to-income ratio to our measurement standards below.

| 36% or less | DTI ratio is good | A debt-to-income ratio of36/43 is favorable to lenders, because it shows you’re not overstretched. After paying your monthly bills, you most likely have money left over for saving or spending. |

|---|---|---|

| 37% – 50% | DTI ratio is OK | The maximum allowed DTIcan vary depending on the type of home loan you’re applying for and the requirements set by your lender. In most cases, the highest DTI that a homebuyer can have is 50%. |

| 51% or higher | DTI ratio is high | Just because you have a high DTI ratio doesn’t mean you can’t still qualify for a home loan. Lenders will look at your credit score, savings, assets, down payment and property value in addition to your DTI when considering your loan eligibility. Paying down debt or increasing your income can helpimprove your DTI ratio. |

You May Like: What Salary Do I Need For A 200k Mortgage

Final Thoughts On How To Calculate Debt To Income Ratiofor Refinancing

Getting your DTI as low aspossible is a critical factor to get a mortgage refinance. If you are havingproblems getting approved, make sure you try the strategies we mention above.

Also, some lenders still may consider you if your DTI is 43% or higher. A smaller lender with assets under $2 billion must still look at your DTI, but they may approve you if your credit score is high enough.

The most important thing isto shop around. Try a few lenders to see if you can get approved for yourrefinance. Each lender has different requirements, so keep trying and you couldget a great rate on your mortgage refinance.

References

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

Also Check: Do I Qualify For A Second Home Mortgage

This Number Gives Lenders A Snapshot Of Your Financial Situation

If youre applying for a mortgage, one of the key factors mortgage lenders will look at is your DTIor debt-to-income ratio.

That ratio, which shows the amount of your income that will go towards debt payments, gives lenders a snapshot of your entire financial situation. That helps them understand what you can comfortably afford in terms of a mortgage payment.

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

Also Check: How Many Times Annual Salary For Mortgage

Want To Improve Your Debt

The only way to really improve your debt to income ratio is by giving debt the bootfor good. How? Ramsey+ is your one stop shop for helpful content, tools, and the step-by-step plan to stop the cycle of debt. Theres never been a better time to improve your financial standing. Get started with your 14-day free trial today.

Looking For Help To Manage Your Debt Compare Debt Relief Companies

My personal loan application was rejected because of my DTI. What do I do?

If you dont need the loan right away, consider holding off on reapplying until youve taken steps to improve your DTI. Showing that you can repay your loan is one of the most important factors to a reputable lender.

If its an emergency, consider applying for a short-term loan, which often comes with more lenient eligibility requirements. Keep in mind theres no guarantee youll be approved for a short-term loan either. Even if you are approved, you could end up with astronomical interest rates that can send you into a debt spiral if youre unable to make your repayments on time.

Don’t Miss: What Is The Mortgage On 800k

What Is Gross Monthly Income

Your gross monthly income is the sum of everything you earn in one month, before taxes or deductions. This includes your base monthly income and any additional commissions, bonuses, tips and investment income that you earn each month. To calculate your gross monthly income, take your total annual income and divide it by 12. If you’re hourly, you can multiply your hourly wage by how many hours a week you work, then multiply that number by 52 to get your annual salary. Divide your annual salary by 12 to get your gross monthly income.

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you won’t likely have money to handle an unforeseen event and will have limited borrowing options.

Read Also: How Much Is A Habitat For Humanity Mortgage

What Are The Limitations Of Dti Ratio

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Tips For Getting A Mortgage

- The debt-to-income ratio is just one of several metrics that mortgage lenders consider. They also look at your credit score. If your score is less-than-stellar, you can work on raising it over time. One way is always to pay your bills on time. Another is to make small purchases on your credit card and pay them off right away.

- If you cant get a mortgage for the amount you want, you may need to lower your sights for now. But that doesnt mean you cant have that dream home someday. To realize your housing hopes, consider hiring a financial advisor who can help you plan and invest for the future. Our matching tool will connect you with up to three advisors in your area.

Read Also: How Do You Buy Down A Mortgage Rate