Section: If You Have Questions Or Need Assistance

Every document is different, so only use this page as a general guide. We have a similar guide to your Certificate of Eligibility/Award Letter. You can review the entire document or click to a specific section through these shortcuts. Each section is copied here so you can compare the example to your own version.

| Website |

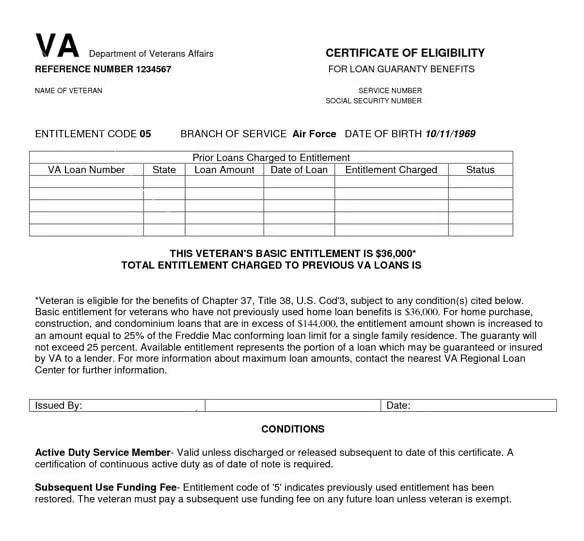

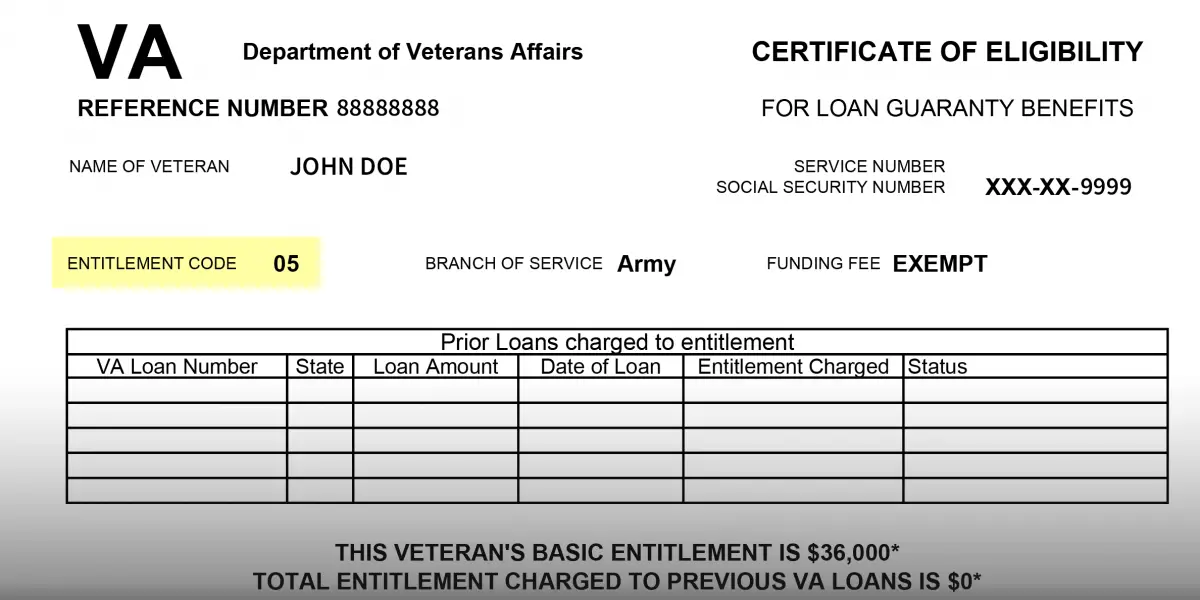

What Does A Certificate Of Eligibility Look Like

See the image below. A Certificate of Eligibility is a relatively simple document that displays basic information like:

- The VA reference number for the certificate.

- The Veteran or service member’s name.

- The last four digits of your Social Security Number.

- Your branch of service.

- Your entitlement code

With A Va Loan Spot Specialist

If you choose to work with one of our specialists at VALoanSpot.com, they will electronically request your certificate of eligibility through the VAs Automated Certificate of Eligibility system called ACE. If ACE has your records, the system will issue your certificate online, and it will be printed in our office within a couple hours at most. If you are not in the system, we will continue to assist you in the process, but you have to provide appropriate documentation of military service. This may include:

- Regular, Active Duty Military Members: You must include an original statement of service signed by, or by direction of the adjutant, personnel officer, or commander of your unit, which identifies you and your social security number and provides your date of entry and the duration of any time lost.

To obtain this proof, you need to fill out the Standard Form 180, Request Pertaining to Military Record. Further mailing directions are including on the form, or your designated specialists can assist you.

You May Like: How Are Interest Rates Calculated On A Mortgage

How To Get Your Coe As An Active Military Member

Those still serving on active duty may need to submit a current statement of service that denotes:

- Veteran’s full name

- Type of Discharge, and

- Name of the command providing the information

There isn’t a standard form or format for statement of service, but this roundup of information is common. The letter should be on official military letterhead.

How Do I Apply For My Coe

Ready to apply for your VA COE? Here are the steps youll need to take:

For the VA COE application process to go smoothly, youll want to confirm your eligibility ahead of time. Lets explore the application requirements below.

Also Check: Do Medical Collections Affect Getting A Mortgage

Next Steps: Obtain Your Pre

If you are interested in purchasing a home with a VA loan, it will benefit you to get pre-approved. This will let you know the maximum loan amount that your income allows you to qualify for so that you can know your price range for homes. Shop for your home with confidence knowing that you have gone through the approval process.

If youd like to get pre-approved, call 240-3742 to speak with a knowledgeable lender, or simply complete a contact request form.

Bottom Line: Va Loan Certificate Of Eligibility

Willy Wonka was not talking about a VA Loan Certificate of Eligibility when he said golden ticket, but any service personnel looking to secure a VA Loan for their mortgage needs likely thinks of it as one.

The COE is the sole document required for lenders to determine eligibility for a VA Loan and all the amazing perks that come with it.

Keep Reading:

You May Like: Should You Buy Down Mortgage Rate

How To Get Your Coe As A Member Of The Reserves Or National Guard

Reservists and National Guard members don’t have a single discharge certificate like the DD-214. Instead, they should submit their latest annual retirement points summary along with evidence of their honorable service.

Army or Air National Guard members can submit NGB Form 22, a Report of Separation and Record of Service, or an NGB Form 23 points statement.

Like their Armed Forces counterparts, active members of the Reserves or National Guard must provide a signed statement of service that shows the required personal information. The statement also needs to clearly state that the applicant is an active Reservist or Guard member.

What Do I Do When I Get My Coe

When you have your COE, its time to move forward with the VA loan process. Receiving a COE doesnt automatically mean you are approved for a VA loan it only means youre eligible to apply for one. Youll still need to go through the application process and meet the lenders criteria, which can vary from lender to lender.

The process looks fairly similar to other loans at this point, and involves reviewing your credit history, your debt-to-income ratio and your overall financial picture.

Also Check: How To Pay Off A 200 000 Mortgage

How To Get Your Coe

You do not need to request your Certificate of Eligibility on your own. Your mortgage broker can help you out with this step, going through the Web LGY system for you. That way, you do not need to jump through these hoops, and can just focus on other aspects of your application process. However if you chose to request it yourself you can follow the steps below.

Once you know what you need, your next step is to get it. There are a few different ways you can approach this:

- Online. The VA has a web portal called the Web LGY system. It may be possible to obtain your Certificate of Eligibility using this online portal, and skip paper mail . This is usually the fastest way to get your COE.

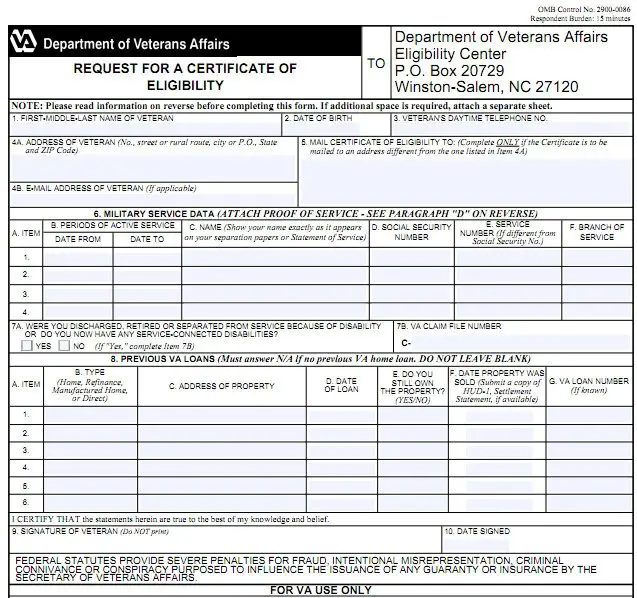

- Mail. If you want to go through mail to get your COE, you need to fill out VA Form 26-1880, which is the Request for a Certificate of Eligibility form. It will take you longer to get your COE if you choose this method.

Let Us Help You Apply for a VA Mortgage

At Blue Square Mortgage, we make it easy to apply for a VA loan in Seattle or elsewhere in WA state. We can assist you with obtaining your COE, and answer any questions you have about eligibility for VA loans. To get started now, please give us a call today at .

Filed Under: VATagged With: VA Loan Tips

How To Apply For A Va Home Loan With A Certificate Of Eligibility

In recognition of your service, the Department of Veterans Affairs financially backs home loans for Veterans, Active Duty Service Members, National Guard, Reserves and some surviving spouses. VA home loans can be used to buy a single-family home or condo, purchase and renovate a house, or build a new home, often with no down payment required in many circumstances.

One of the stipulations to apply for a VA home loan is that you must show your mortgage lender a Certificate of Eligibility which verifies that your length of service and character make you eligible for a VA home loan benefit. While the COE is not usually need to pre-qualify for a home loan, the certificate will be one of the documents you will be required to submit for your VA home loan application, so its a good idea to obtain your COE when you first decide to buy a home.

Recommended Reading: What Required To Refinance A Mortgage

My Lender’s Automated System Can’t Determine My Eligibility What Should I Do Now

If your lender can’t automatically obtain your Certificate of Eligibility, it could be from a few reasons that may include:

- Service members who had a prior VA loan go into foreclosure.

- Service members who were discharged under conditions other than honorable.

- Some Reservists and National Guard members.

- Unmarried surviving spouses.

Don’t panic if you fall into this group. It occasionally happens, and VA-savvy lenders typically know how to handle it. In these cases, your lender will typically ask for your DD-214 or points statement and send it directly to the VA for evaluation.

Where Do I Get A Va Certificate Of Eligibility

There are a few ways to go about getting a COE. You can apply online directly or for your COE from the VA website. You can also work with your lender to receive your COE, but keep in mind that not all lenders are able to do this due to VA guidelines. Make sure to ask your lender if theyre able to originate VA loans.

There are some instances in which your lender may be unable to request your COE for you. Please keep in mind that if any of the following factors apply to you, your lender may not be able to retrieve this document:

- Youre in the Reserves or National Guard

- Youve had a foreclosure in the past

- You received a discharge other than honorable

- Youre a surviving spouse

It is also recommended that you provide your proof of service form along with your COE. For veterans who entered the service after September 7, 1980, and were discharged after serving fewer than 2 years, proof of service is required. The DD Form 214 will ask you for information about your current living situation and your dates of military service.

You May Like: How Long To Get A Mortgage

How Long Does It Take To Get A Certificate Of Eligibility

The COE is not something you want to leave until the last minute, as it might put a major hitch in your giddy-up if youre trying to buy a house in a timely fashion.

The amount of time it takes to receive a COE varies, but it can take up to 6 weeks to receive the document, especially if you are requesting the document by mail.

Mortgage Lender requests do tend to be the quickest way to receive the COE back from the VA, but even that can be delayed given your length of time in service and mitigating factors like understaffing on the VA end.

Certificate Of Eligibility Requirements

Are you or your loved one a veteran or active duty military member trying to figure out the confusing world of VA Home Purchasing and VA Refinancing? Youre in the right place for qualifying for a VA loan. We are VA Loan Spot, and we make it easy.

The first step is making sure you are qualified for our loans.

You may be eligible for a VA Loan if you meet one or more of the following conditions:

- You have served 90 consecutive days of active service during wartime.

- You have served 181 days of active service during peacetime.

- You have more than 6 years of service in the National Guard or Reserves.

- You are the spouse of a service member who has died in the line of duty or as a result of a service-related disability

If you meet one or more of the requirements above, the next step is to receive your COE.

Recommended Reading: What Is The Lowest Fixed Rate Mortgage

Are There Any Special Fees I Should Expect To Pay

Yes. While VA loans usually involve fewer costs, there are still some fees you need to pay. One fee unique to VA home loans is a VA Funding Fee. This fee is paid directly to the Department of Veterans Affairs. The funding fee is set at a maximum of 3.6% until 2023.

If youre looking for a way to reduce the funding fee, you can choose to make a down payment of at least 5%. You may avoid paying the fee in certain situations such as if youre currently receiving disability payments due to your military service. Active duty service members who show proof they received the Purple Heart are also exempt.

Benefits Of A Va Loan

VA loans come with countless benefits, but the biggest perk is that they require no down payment.

Unlike other mortgage programs, which ask for anywhere from 3% to 20% down, VA loans require no down payment at all. This can offer significant savings right off the bat. .

Some other benefits of VA loans include:

- Competitively low interest rates

A lower interest rate translates to a lower monthly mortgage payment and substantial savings over the life of your loan.

Don’t Miss: Why Does My Mortgage Payment Keep Going Up

How Long Does It Take To Get A Coe

The way you choose to apply for your COE will dramatically impact your timeline.

The eBenefits portal application should confirm your eligibility and provide a COE within a few minutes. But if you choose to go the snail mail route, it could take 4 to 6 weeks to receive your VA COE in the mail.

As you begin shopping for a home, keep these timelines in mind. It is a smart move to secure your Certificate of Eligibility as early as possible in the home buying process. With the documentation lined up, you can move on to the next steps of your home search confidently.

Check For Your Va Certificate Of Eligibility :

Your Lender can request for your CEO instantly during your preapproval process, or active Military and Veterans can ordertheir COE one of three ways:

You May Like: How To Modify Mortgage Loan

How Does Va Loan Assumption Work

With a VA loan assumption, the VA loan transfers with the house. The buyer assumes the sellers VA loan, including its same rate, terms, and balance, and resumes making payments as initially planned through the original loan. Though the buyer doesnt need to be a veteran or military member to assume a VA loan, they do need to meet all the financial requirements of the loan program to be eligible.

Mortgage Program For Military Home Buyers

Dubbed the VA loan program, these military-only mortgages are some of the best financing options available. Theyre backed by the Department of Veterans Affairs and offer low interest rates, come with no loan limits, and require zero down payment at all.

So while there is no official GI home loan, military borrowers have access to a VA home loan benefit, a great mortgage program intended to put homeownership into reach for veterans, active-duty service members and their families.

Read Also: How To Know How Much Mortgage I Can Afford

How Does The Va Loan Process Work

If you’ve never applied for a VA home loan, you may wonder how a loan is finalized and what you can do to get things started. Obtaining a VA loan is much like securing a conventional mortgage, but with a few extra steps. Weve outlined the steps below to help ensure you don’t miss any important requirements.

Va Funding Fee Exemption

Michelle is exempt. She didnt pay a funding fee for her VA Loan.

Veterans who receive compensation, retirement, or active duty pay from the VA for a service-connected disability dont pay the fee. A surviving spouse of a veteran who died in service or from a service-connected disability is also exempt.

Also Check: How To Become A Mortgage Broker In Fl

Order Yourself By Calling

No printer? No problem. Call the Department of Veterans Affairs at 1-877-827-3702 and follow the prompts for Eligibility. They will simply mail the form to you.

If you have any further questions about the COE process, please dont hesitate to call 800.537.2050 to Speak with VA Home Loan Expert. We are readily available and willing to help at a time most convenient for you.

Bobby Atkisson

Bobby Atkisson is a seasoned mortgage professional who provides high quality financial services to military members and veterans. With over 14 years experience in the lending and financial industry, his mission is to provide high quality mortgage programs with the most competitive interest rates. For expert advice and guidance on VA Home Loans and Refinance, contact Bobby today at 800-537-2050.

Va Loan Service Eligibility Requirements

VA loans are only for active-duty military members, veterans, and their families , so there are strict service requirements youll need to meet to qualify.

The exact standards depend on when you served, but generally speaking, youll need to have one of the following:

- 90 consecutive days of active service during wartime

- 181 days of active service during peacetime

- 6 years of service in the National Guard or Reserves

- A veteran/service member spouse who died in the line of duty or due to a service-related disability or injury

Recommended Reading: What Is Current Interest Rate On Reverse Mortgage

How Do I Get My Coe

There are three ways to apply for your COE:

1. The easiest way is to talk to your lender. They have access to a portal that allows them to quickly obtain your COE.

2. Apply online. Log in or create an account on the eBenefits portal.

Mail your application. Print and fill out Form 26-1880. Mail the completed form to the correct address specified on the form.