How To Get A Loan To Build A House

Can you take out a loan to build a house? There is the possibility of getting a mortgage to build a house. While they are technically mortgages, they are sometimes referred to as construction loans. A home loan can finance the entire construction process and after delivery of a home can be turned into a classic home loan.

Key Responsibilities Of A Mortgage Loan Processor

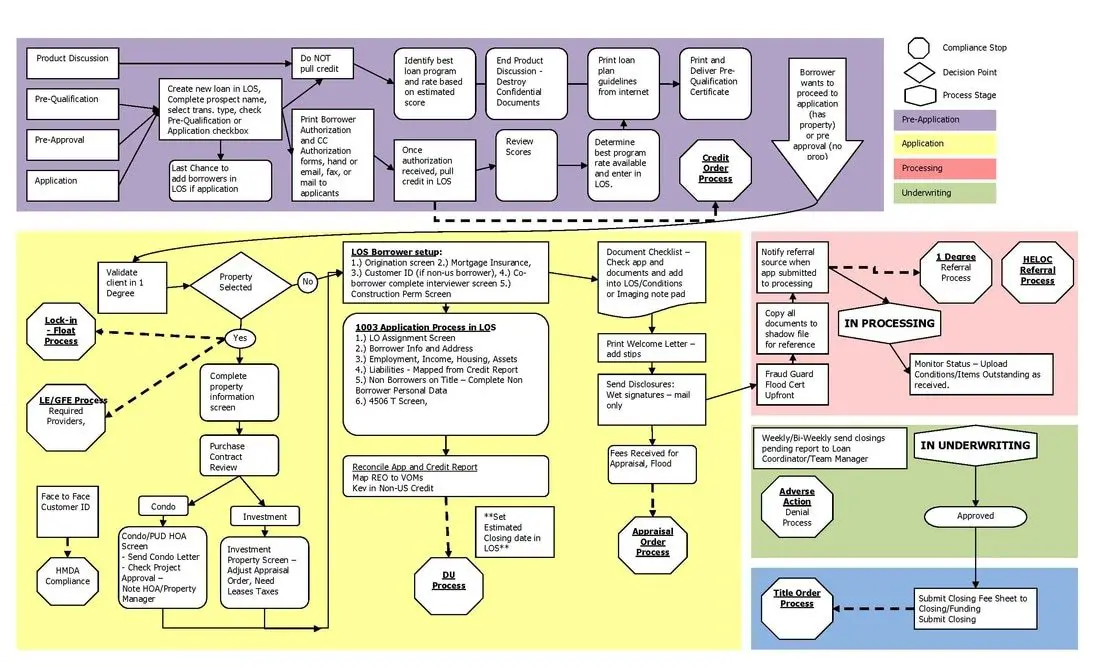

A mortgage processors primary duty is to ensure the proper documentation is included in a loan file and that the borrower meets the requirements for the loan program they want. Most loan processors will perform some or all of the following seven functions:

How To Start A Mortgage Loan Processing Business

This advice is written for those of you who are thinking about starting a mortgage loan processing business. Read these tips before you begin your venture.

Thinking about opening a mortgage loan processing business? We tell you what you need to know to get started.

Business Plans 101 for Mortgage Loan Processing Business Startups

As an aspiring mortgage loan processing business owner, you’ve invested time and effort in the creation of your initial business plan. Now it’s time to address details about your industry.

A detailed, yet concise industry analysis is a basic component of a startup mortgage loan processing company business plan. Industry analyses are critical for contextualizing your startup within an industry setting.

Although you’ll need to provide the right information, you’ll also need to be careful to avoid common industry analysis mistakes because the wrong tone and content here could negate all of the hard work you’ve invested in the rest of your business plan.

Don’t Ignore Competitors

Well in advance of opening a mortgage loan processing business in your town, it’s a good idea to see how you will fit in the competitive landscape. Try our link below to generate a list of competitors near you. After following the link, enter your city, state and zip code to get a list of mortgage loan processing businesses in your area.

Learn from Others Who Are Already In This Space

Simple. Let your fingers do the walking by using the link below.

Also Check: How Does Rocket Mortgage Work

Have Your Documents Organized

The best way to keep the mortgage underwriting process on track is to have all of your financial documents organized before you apply for a loan. If you have to request paperwork from a specific institution, for instance, do so as soon as possible. It can be smart to put together a file that includes the following:

- Employment information from the past two years

- W-2s from the past two years

- Pay stubs from at least 30 to 60 days prior to when you apply

- Account information, including checking, savings, money market, CDs and retirement accounts

- Additional income information, such as alimony or child support, annuities, bonuses or commissions, dividends, interest, overtime payment, pensions or Social Security payments

In addition, if you plan to use gifted funds for a down payment, its important to have those funds in your possession well before you apply. Youll also need to have a gift letter to verify that the money is indeed a gift. Doing both can help you avoid unnecessary setbacks in underwriting.

Tips For Quick And Painless Mortgage Processing

Completing the mortgage loan process can feel never-endingâparticularly when you are waiting to move into your dream home. Fortunately, there are several things you can do to speed up the process:

- Make sure you provide your loan processor with all the necessary documentation early as possible and respond promptly to any requests.

- Stay in touch with your lender. Communication is the key to making the loan process move along quickly and smoothly.

- Proactively let your lender know if you have any changes in your employment, income, debt, insurance coverage or other things that may impact your loan.

Getting a mortgage can be frustrating and confusing if you are not working with an experienced lender with a commitment to superior service. Contact a PennyMac Loan Officer today if you are ready to learn more about how we can help you purchase or refinance your home.

Jump to…

Also Check: Mortgage Recast Calculator Chase

It Only Takes A Stroke Of Your Pen To Get Someone On Their Way To Purchasing Their First Home Or Business Space

A bachelors degree isn’t always necessary to be a mortgage loan officer.

A mortgage isnt just a financial loan. It gives a family a home, a restaurant owner a space to serve up their favorite recipes, and a small business owner a place to bring their vision to life. Very few people can pay for real estate property out-of-pocket. As a mortgage loan officer, it only takes a stroke of your pen to get someone on their way to purchasing real estate. If you think youre the person for the job, learn how to become a mortgage loan officer.

While many people are involved in the loan process, mortgage loan officers are a key part of the mortgage industry. Theyre the ones who initiate fee-based mortgage loans that generate revenue for financial institutions and help borrowers get the funding they need. Mortgage loan officers enjoy flexible schedules, lucrative pay, and a steady demand for their services.

If a career as a mortgage loan officer interests you, Monster can help you seize the opportunity. Read on to find out how to become a mortgage loan officer.

Top Skills For A Mortgage Loan Processor

The skills section on your resume can be almost as important as the experience section, so you want it to be an accurate portrayal of what you can do. Luckily, we’ve found all of the skills you’ll need so even if you don’t have these skills yet, you know what you need to work on. Out of all the resumes we looked through, 19.4% of Mortgage Loan Processors listed Customer Service on their resume, but soft skills such as Communication skills and Math skills are important as well.

- Customer Service, 19.4%

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Complete Your Mortgage Application

The first step is to fill out a loan application. The information you provide will help determine if youre eligible for a loan. Since every situation is unique, the exact documents youll need may vary. Youll likely need to provide:

- ID and Social Security number

- Pay stubs from the last 30 days

- W-2s or I-9s from the past two years

- Proof of any other sources of income

- Federal tax returns

- Recent bank statements or proof of other assets

- Details on long-term debts such as car or student loans

- Real estate property information/Accepted Offer to Purchase

Our online application process is a safe and secure way to get started on your mortgage application from your smartphone or computer. After you sign up, youll answer simple questions along a guided path and easily import or upload documents. You can start your application on your own, or with the help of a mortgage loan officer. Within three business days of submitting your complete application, your lender will deliver a Loan Estimate showing your estimated closing costs.

Start your application if youve found a home you love.

Well confirm your personal and financial information, pull your credit, and then a mortgage loan officer will connect with you about the results.

How Strict Is Mortgage Underwriting

In 2020, 9.3 percent of applications for a home purchase loan were denied, according to Home Mortgage Disclosure Act data.

For the most part, mortgage lenders follow specific standards for the loans they originate.

For conventional loans, lenders adhere to Fannie Mae and Freddie Mac standards, because if a loan meets those requirements, the lender can sell it on the secondary market and use that capital to create more mortgages for more borrowers. For an FHA, VA or USDA loan, lenders follow the guidelines of the Federal Housing Administration, Department of Veterans Affairs and Department of Agriculture, which guarantee or insure those types of loans if the borrower defaults.

Lenders also have to account for the business of making mortgages they cant take on more risk than what their operation supports. So, in addition to baseline loan standards, lenders can impose additional requirements, known as overlays.

Sometimes, lenders implement stricter protocols in response to economic volatility. Throughout the pandemic, for example, many lenders began requiring higher credit scores and larger down payments.

That said, some lenders can be flexible, such as allowing a borrower to qualify based on assets instead of income.

Recommended Reading: Reverse Mortgage Manufactured Home

Mortgage Loan Processor Skills

A loan processor, sometimes called a mortgage processor, is the individual responsible for processing your loan and submitting it to the underwriter for final approval. Processing the loan means reviewing the mortgage application, making sure the borrower has provided all the required paperwork, and that all the information is accurate and up to date.

Ability To Assess Risk

- Mortgage Underwriters are tasked with the tough job of recommending the final mortgage structure, underwriting is a very technical role that requires a lot of skill. No skill is more important, however, than risk assessment. Without extensive risk assessment knowledge, candidates are not qualified to piece together profitable mortgages and may generate loan structures that are more likely to default by the borrower after the loan has been disbursed.

Don’t Miss: Can You Get A Reverse Mortgage On A Mobile Home

How Much Does It Cost To Build A New Home

The idea of building a new house may scare you because you think it is a more expensive option. But depending on the location and equipment of the house, the cost of building a house is comparable to buying an existing house. According to a 2020 study by the National Association of Home Builders, building a new home in 2020 will cost an average of $296,652.

How Much Money Does A Mortgage Loan Originator Make

Mortgage Loan Originators typically make 0.5% to 1% of the buyers loan amount. For example, a $300,000 mortgage loan will yield $1,500 to $3,000 in commission. This is the origination fee. Before the housing crash of 2008, the origination fees were as high as 4% to 5% of the loan amount.

Your annual income depends on the area you work. Most loan originators work on commission instead of a salary. However, large banks tend to offer a base salary with benefits and sometimes include a bonus structure. According to Indeed, the average base salary of a Mortgage Loan Originator in the United States is $81,492 per year.

You May Like: Rocket Mortgage Requirements

Consider Other Associated Costs

As you go through the mortgage process, it’s important to think about the true cost of owning a home. Besides the costs required at closing and regular mortgage payments, there are other recurring costs such as property tax, home insurance, heating costs, condo fees and more. Even though pre-approval specifies an amount you may be approved for, consider a lower principal amount to reduce regular expenses while leaving money for other unforeseen expenses.

How To Take Out A Loan

The fastest and easiest way to get a personal loan is to go to a bank that you already have a business relationship with. After talking to someone and going through a loan application, they can often get it approved right away. Plus, your loan is paid to the same bank, making payment processing a little more convenient.

You May Like: Rocket Mortgage Payment Options

Is It Possible To Build A Debt

After you are done working on your new home, you can use the money you would have spent on your mortgage for whatever you want. Getting out of debt requires you to raise money gradually, but this task can seem daunting if you don’t have a goal to measure your progress.

Credit to buy a houseWhat is a good credit score to buy a house? These are the credit requirements for the most popular mortgages: Typically: 620 FHA: 500 to 580 VA: Usually low to medium USDA 600, depending on the lender: Usually around 580, depending on the lender.Do I need a good credit score to buy a house?In general, a good credit rating for buying a home is 620 or higher. With a of at least 6

Collecting Proof Of Employment Assets Debt Income And Homeowners Insurance

Your loan processor’s primary job is to verify all of the information you have provided on your mortgage application. This means checking your income verification , assets , and outstanding debts

Loan processors will pay particular attention to your income. Why is this? Well, lenders don’t want your total monthly mortgage paymentsâprincipal, interest, property taxes, and homeowners insuranceâto swallow up your monthly gross income. Remember, lenders want to be certain you will be able to comfortably manage your current obligations and your new monthly mortgage payments.

In addition, loan processors will make sure you have a current homeowners insurance policy for the house you are planning to buy or are currently refinancing. This insurance will protect you and your lender from suffering a financial catastrophe in the case of a fire, flood, etc.

In order for your lender to verify all of the factors that make up your overall financial situation, you will need to provide:

Read Also: Reverse Mortgage On Mobile Home

Can I Use My Own Land For A Construction Loan

If you already own a home, you can use it as equity to obtain a construction loan. Your lender will also check your developer’s credit history and credentials. Payouts are usually made at mandatory completion points, so inspectors must approve progress.

How to buy a house with low incomeHow much income do I need to buy a house? The rules differ depending on which part of the house you want to buy, depending on your annual income. For example, some lenders claim that the sale price of a home should not exceed your annual salary. If you follow this example and your annual salary is $150,000, avoid buying a home worth more than $300,000.What are the steps to buying a house?Here are 10 steps to bu

Examples Of Online Mortgage Lenders

A number of lenders provide fully digital mortgages, with Rocket Mortgage, Better Mortgage, and loanDepots mello smartloan being some of the more popular options.

Heres a look at what makes each of these options unique:

- Rocket Mortgage This lenders a good option if youre looking to apply for your loan via mobile app. It offers an easy application process and handson help if you need it. Plus, it comes from wellknown lender Quicken Loans the nations toprated mortgage company for 10 years running

- loanDepot Mello Smartloan Smartloan is interesting in that it lets you import all your income, employment, and asset info digitally, and then makes personalized loan recommendations based on that data. You can then connect with an advisor to help you choose the best route. A nice perk of Smartloan is that it has a builtin appraisal waiver process that can save you hundreds of bucks and lots of hassle .

- Better Better is known for its customer service, as well as its low rates and closing costs. Like Smartloan, you also get assigned a personal loan advisor, and since theyre not commissionbased, theyre able to give you honest, unfiltered advice. A quick note here: Better doesnt offer VA or USDA loans, so keep this in mind. Its also not licensed to originate loans in all 50 states.

Some other lenders offering digital mortgages include SoFi, HomeLight Home Loans , and Guaranteed Rate.

Don’t Miss: Reverse Mortgage Mobile Home

How Much Do Mortgage Loan Processors Make

Mortgage loan processors make $41,782 in average yearly salary or $20.09 per hour.

On the lower end of the salary range, you may only make around $33,000, usually for entry-level positions. On the higher end, you can make around $52,000. Senior-level positions can earn an average salary of $61,300 or more compared to mid-level positions of $45,000.

As most jobs go, education, location, and experience can determine your salary. Those with a college degree typically earn more than those without. Some of the top-paying states are West Virginia, California, and Connecticut, with average salaries above $46,000.

What Do All These Refinance Terms Mean

When it comes to refinancing, there are a number of words and terms that you should become familiar with. Many of them are key variables that youll want to take into consideration to determine whether refinancing makes sense for you.

Heres a glossary of the most important refinancing terms:

Interest rate: This is the amount of money that your bank or credit union charges each year for lending you money in a mortgage. Its expressed as a percentage . The lower your interest rate, the less youre paying in interest. When you begin the process of refinancing your mortgage, you can typically get a mortgage rate lock, which guarantees that youll be able to get the current interest rate on your new mortgage while you proceed through the refinance process.

In some cases, you may be able to pay extra for a float down rate option, which protects you if market interest rates fall further while youre in the middle of refinancing by allowing you to release your rate lock and re-lock at a lower rate.

Annual percentage rate : This is the actual cost of a loan to a borrower. It differs slightly from the interest rate as it includes not just interest, but also additional costs charged by the lender. Again, its expressed as a percentage, and lower is better.

Fixed-rate mortgage: A type of mortgage in which the interest rate does not change for the entire length of the loan. A 15 or 30-year mortgage will almost always be at a fixed-rate.

Also Check: Recasting Mortgage Chase