Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

Mortgage Rate Forecasting Explained

The constant mortgage rate fluctuations over the last few months may have left even the most informed consumers scratching their heads. They may also have you wondering what exactly goes into predicting future rates.

There are a few key factors that experts use in mortgage rate forecasting:

- Federal Reserve policy: The Fed doesnt directly set interest rates, but it sets short-term rates, which can influence long-term rates.

- Economic growth: As the economy improves, interest rates tend to rise, and vice versa. Indicators of economic growth include employment numbers and gross domestic product .

- Inflation: Inflation refers to the increase in the price of goods and services. As inflation rises, so do interest rates so that lenders can ensure a profit on their loans.

- Bond rates: Mortgage rates and bond rates are interconnected. First, mortgages are repackaged and sold as bonds, and so mortgage rates have to be high enough to make those bonds an attractive investment. Additionally, mortgage lenders often use the 10-year Treasury bond as a benchmark for mortgage rates.

Using the information listed above, historic mortgage rates, and other economic factors, financial experts can make mortgage interest rate forecasts.

Each quarter, Freddie Mac publishes a quarterly report with its mortgage rate predictions. Using the economic outlook at past and current rates, Freddie Macs Economic & Housing Research Group forecasts what we can expect from rates in the coming months.

Expect Mortgage Rates To Rise In 2022 Economists Say

Canadians looking to buy a home can expect mortgage rates to soon be on the rise, experts say.

The Bank of Canadas recent forecast is a good indication of why, said Don Drummond, economist at Queens University and former chief economist for TD Bank. The Bank of Canada announced Wednesday that while its current policy rate remains steady at 0.25 per cent, it will likely increase as early as the second quarter of next year.

According to Drummond, mortgage rates are bound to follow suit, particularly variable ones.

The variable rates will go up quite quickly, they could even go up in anticipation of the bank action, Drummond told CTVNews.ca in a phone interview on Thursday.

He predicts the Bank of Canadas short-term interest rate will increase by about 0.75 percentage points by the end of 2022. Eventually, he anticipates the rate will be anywhere between 1.75 and 3 per cent by the end of 2023, which he describes as a more normal rate. He expects variable mortgage rates to move up in lockstep.

The variable rate is keyed off the chartered banks prime rate, and the prime rate is keyed off the Bank of Canadas policy rate, so the variable rate would move up to the same degree, he explained.

Robert Hogue, a senior economist with the Royal Bank of Canada, predicts an increase of closer to 0.5 percentage points in the central banks interest rate by the end of next year, but sees a rise in variable mortgage rates nonetheless as a result.

Don’t Miss: Are Mortgage Rates Going To Rise

Rbc Self Employed Mortgage

This mortgage offering is tailored specifically for people who own a business or are freelancers. An RBCself-employed mortgagelets you finance up to 80% of the appraised value of your home when refinancing and 90% when purchasing. Additional mortgage insurance may be needed forLoan-to-valuesof higher than 65%.

| 20% with no mortgage insurance, 5% – 19.99% with mortgage insurance. | T1 formfor the last 2 years, financial statements for the last 3 years. | |

| CIBC | 20% with no mortgage insurance, 5% – 19.99% with mortgage insurance. | 2 or 3 years of financial statements, a list of assets and liabilities, article of incorporation . |

| National Bank | Minimum 10% downpayment. | Being self-employed for at least 2 years with proof of 2 years or more of good financial and credit management. |

Tax Implications For A Vacation Home

If your vacation home is not a permanent residence and you already have one home, you will be subject tocapital gains taxif you sell your home in the future for more than your adjusted cost. Your adjusted cost will be your total purchase price and the money you spent on any renovations for the home, meaning it’s important to keep track of these.

Another important tax implication of a vacation home is howrental incomeis taxed. You are able to deduct all the expenses that you have from renting the home out, including maintenance, advertising, utilities, interest, and even depreciation on the home. This is an important tax benefit that will make any rental income you earn from the property that much more lucrative.

Also Check: How Much Would A Million Dollar Mortgage Cost

Rbc Variable Mortgage Rates

RBC variable rate mortgages provide you with fixed payments over the mortgage term however, the interest rate will fluctuate with any changes in theprime interest rate. If RBCs prime rate goes down, more of your payment will go towards paying off your principal if RBCs prime rate goes up, more of your payment will go towards interest payments. As a result, this can be a great financial tool for those expectingCanadas interest ratesto fall in the upcoming year.

A convertible mortgage is a variable rate mortgage that will allow you to convert to a fixed rate mortgage at any time. This fixed rate mortgage will be based on the rates your lender is offering at the time you convert it. This feature provides security and flexibility, as it enables you to lock-in a fixed rate longer term if interest rates fall, rise, or stay the same.

| 1.70% | $1,638 |

The rates shown are for insured mortgages with a down payment of less than 20%. You may get a different rate if you have a low credit score or a conventional mortgage. Rates may change at any time.

Do The Math For A Refinance

In many ways, refinancing a mortgage is much easier than purchasing a home, especially in this market. However, you should approach a mortgage refinance with the same due diligence as you would a home purchase. Paying attention to your refinance rate, the fees and also how long you plan to keep the new loan.

One general guideline to follow is to refinance your home loan when you can reduce your interest rate by 1% or more. However, there are other factors to consider on top of that. You want to make sure that youll be keeping your home long enough for the savings from refinancing to outweigh upfront closing costs. One way to calculate this is to take the upfront fees and divide them by your monthly savings. So if you had $10,000 in refinance closing costs and your monthly payment is $300 less, then it would take roughly 34 months, or just under three years, to break even.

The loans repayment term affects not only your monthly payment, but also your mortgage rate. Shorter-term mortgages typically have lower interest rates than longer-term loans. So a 15-year mortgage will have a better rate than a 30-year mortgage, if all else is equal.

The tradeoff with the lower rate you can get with a shorter mortgage term is that the monthly payment will be higher. Although, a higher monthly payment will allow you to pay off your mortgage more quickly. So ultimately, the decision needs to line up with your current financial situation and your long-term goals.

Read Also: How Much Mortgage Protection Insurance Cost

Why Compare Winnipeg Mortgage Rates With Ratehubca

Ratehub.ca makes it easy to compare Winnipeg mortgage rates, but pulling rates from the big banks, Winnipeg mortgage brokers, and smaller lenders like credit unions, all in one place. By seeing whatâs available in Winnipeg, youâll be able to make sure you get the best possible deal. We do this at no cost to you.

Mortgage Rates Rise Amid Growing Concerns About Inflation

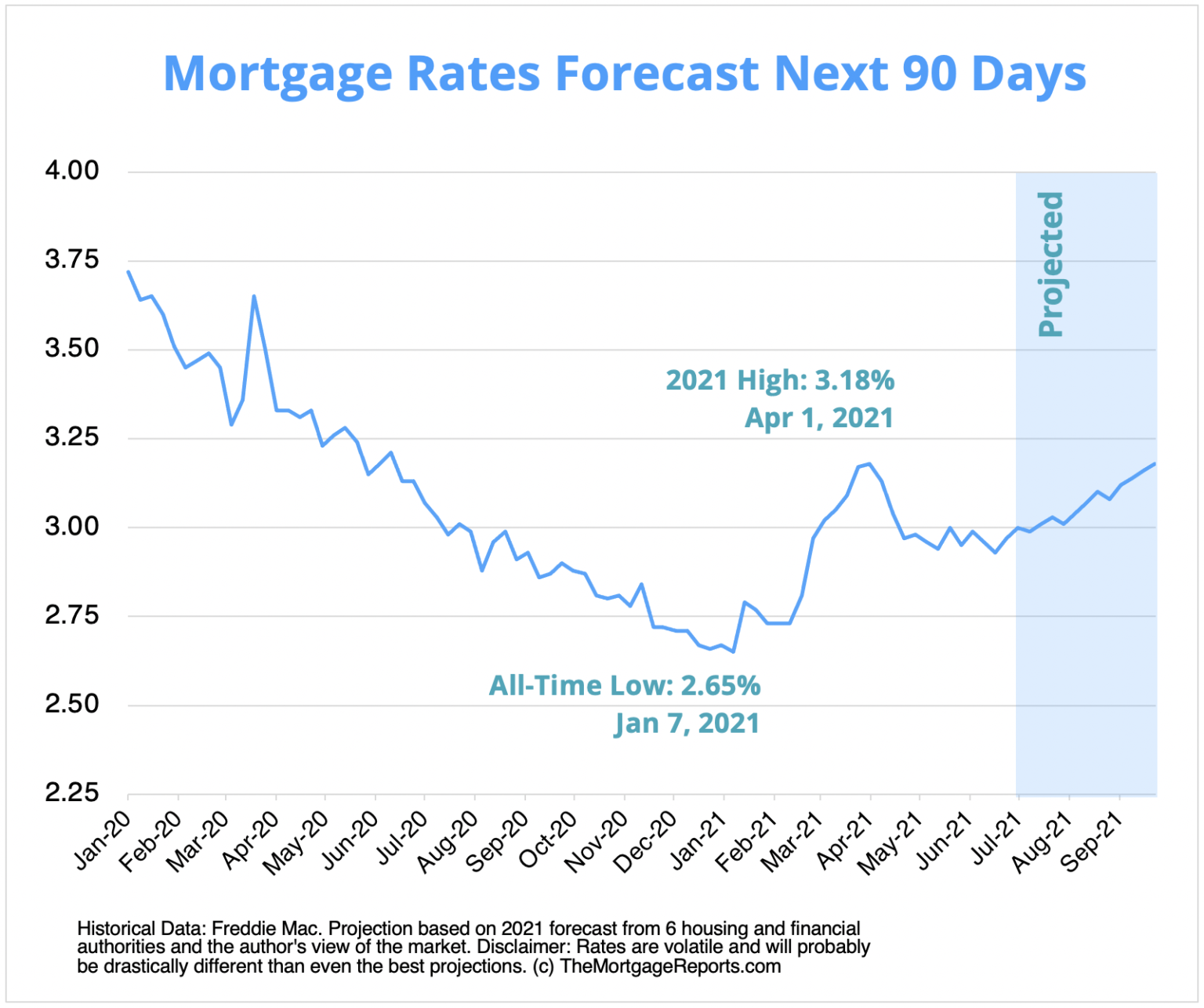

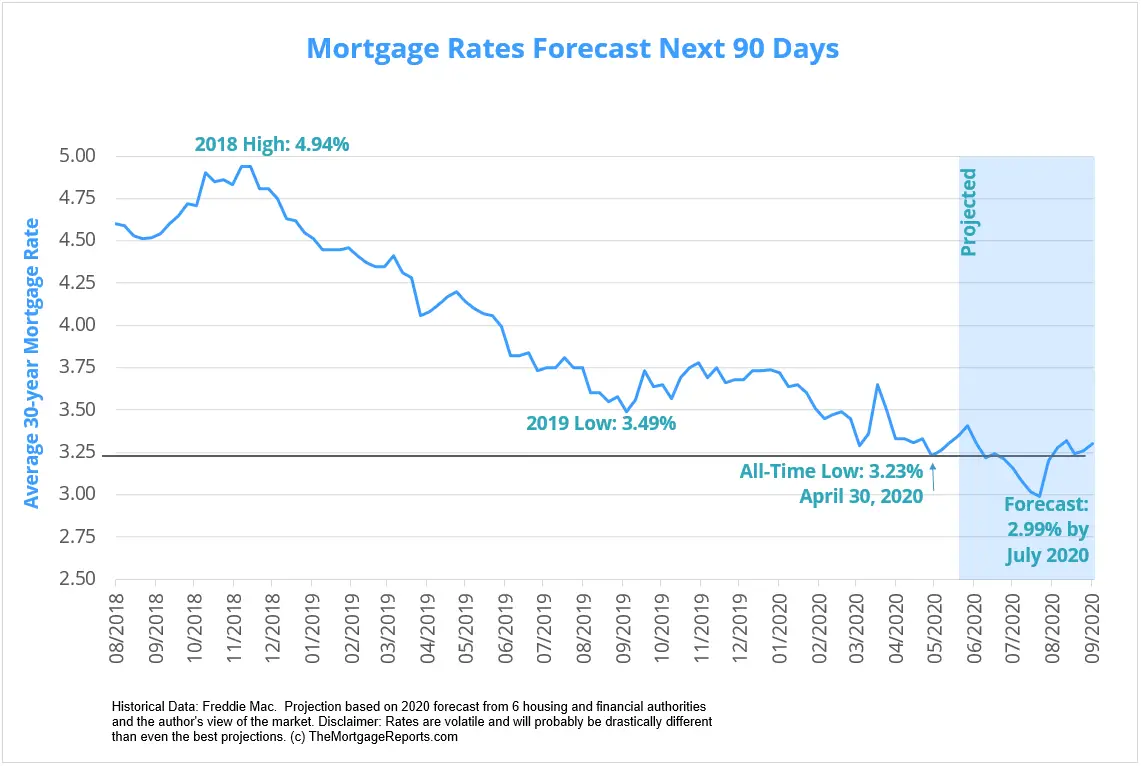

Mortgage rates are continuing to climb, according to data by Freddie Mac released Thursday, driven largely by rising inflation resulting from high demand and shortages of goods across the economy.

The 30-year fixed-rate average rose to 3.09 percent with an average 0.7 point, up from 3.05 percent last week and 2.80 percent a year ago.

The 15-year fixed-rate average increased to 2.33 percent with an average 0.7 point, up from 2.30 percent a week ago. It was 2.33 percent a year ago. The five-year adjustable rate average nudged down to 2.54 percent, with an average 0.3 point, from 2.55 percent a week ago. It was 2.87 percent a year ago.

Mortgage rates have been at historic lows dipping periodically to below 3 percent since the Federal Reserve last year began purchasing $120 billion a month in Treasurys and mortgage-backed securities to keep the economy strong during the pandemic. But those days could be numbered with the Fed announcing that it will taper those purchases and raise interest rates soon to curb inflation.

Inflation in the United States has reached a 13-year high of 5.4 percent annually, according to the government, evidenced by higher prices for homes, cars, energy, food and other goods.

The economy continues to grow, inflation is running hot, and the Federal Reserve is about to begin paring their bond purchases that have helped keep mortgage rates low, said Greg McBride, senior vice president and chief financial analyst at Bankrate.com.

Don’t Miss: How Much A Month Is A 500k Mortgage

Should I Use A Mortgage Broker In Winnipeg

A mortgage broker can connect you with mortgage products from a range of lenders, both big and small. As well as being connected with multiple lenders, brokers often have access to rates and deals that arenât available to the public. Generally, getting a mortgage through a broker will help you secure a lower mortgage rate than going directly to your current bank. Mortgage brokers are free for you to use, so thereâs no risk in approaching one for a chat.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

| Laurentian Bank |

What Are Current Mortgage Rates Today

For today, Friday, October 15, 2021, the average 30-year fixed mortgage rate is 3.200% with an APR of 3.370%. The average 30-year fixed mortgage refinance rate currently is 3.170% with an APR of 3.300%.

Looking at mortgages with shorter loan terms, currently, the average 15-year fixed mortgage rate is 2.430%, with an APR of 2.680%. And the average 15-year fixed refinance rate is 2.410%, with an APR of 2.600%. The average 20-year fixed mortgage rate is 3.070%, with an APR of 3.230%. And the average 20-year fixed refinance rate is 3.030%, with an APR of 3.170%.

For adjustable-rate loans, we are seeing the average 5/1 ARM loan rate of 2.800% with an APR of 3.910%.

Recommended Reading: How Long Does It Take To Do A Reverse Mortgage

What Factors Impact Mortgage Prices

As you look around this site, youll notice we have access to all of the most relevant lenders. That includes all the major banks, all top credit unions, all major mortgage finance companies and an array of top mortgage brokers. Shopping among them is quick, easy andmost importantlyfree.

Rate Tip: Once you’ve chosen the rate you’re most interested in, click the < Get Rate> button to contact the lender or broker directly. Ask them all the questions you need in order to feel comfortable with their mortgage product and service level.

Be sure to spend some time at this and compare multiple mortgage rates. The cost savings of even a puny five-basis-point-cheaper rate can save you $700 over 60 months on a $300,000 mortgage.

On the other hand, the cheapest rates can often cost you more later due to unexpected fees or limitations. Well talk about that momentarily.

In the meantime, lets have a look at what factors impact mortgage prices in Canada.

How To Use Our Mortgage Rate Table

Our mortgage rate table is designed to help you compare the rates youre being offered by lenders to know if it is better or worse. These rates are benchmark rates for those with good credit and not the teaser rates that make everyone think they will get the lowest rate available. Of course, your personal credit profile will be a significant factor in what rate you actually get quoted from a lender, but you will be able to shop for either new purchase or refinance rates with confidence.

Also Check: Is A Timeshare Considered A Mortgage

Take Advantage Of Rising Rates To Boost Your Home Savings Fund

While its important to understand how rising interest rates affect home prices, its also key to know that rising interest rates actually provide more of an incentive to save, for both the upfront and long-term costs of buying. While banks may be charging more for loans, they could also be paying out a slightly higher interest rate on savings accounts.

If youre trying to accelerate your down payment fund or set aside cash for closing costs, every extra penny earned in interest counts. Even if youre planning on staying put in your rental for the moment, you can still take advantage of higher savings account yields so that when youre ready to buy, youll have the money waiting for you.

Danielle Hale Chief Economist At Realtorcom

Hale sees low rates continuing through the first half of 2021. Making any kind of prediction for next year is difficult. But our expectation is that mortgage rates start the year roughly in line with where they are now, and they stay fairly low right around 3% for the first half of the year, Hale says. She believes that in the second half of 2021, if access to a vaccine helps to improve the economy, rates could rise. Mortgage rates could approach 3.4% by the end of the year, she says.

While Hale expects rates to stay low compared to historical averages, we could see a relatively drastic shift in rates. Were at such low levels that 3.4% will be a significant increase, Hale says. Homebuyers will notice it when theyre calculating their monthly mortgage payment. This increase in mortgage rates could slow down the demand for housing in the latter part of next year.

Read Also: What’s An Average Mortgage Interest Rate

Should I Lock My Mortgage Rate Now

A mortgage rate lock guarantees you a certain interest rate for a specified period of time — usually 30 days, but you may be able to secure your rate for up to 60 days. You’ll generally pay a fee to lock in your mortgage rate, but that way, you’re protected in case rates climb between now and when you actually close on your mortgage.

If you plan to close on your home within the next 30 days, then it pays to lock in your mortgage rate based on today’s rates — especially since they’re so competitive. But if your closing is more than 30 days away, you may want to choose a floating rate lock instead for what will usually be a higher fee, but one that could save you money in the long run. A floating rate lock lets you secure a lower rate on your mortgage if rates fall prior to your closing, and while today’s rates are still quite low, we don’t know if rates will go up or down over the next few months. As such, it pays to:

- LOCK if closing in 7 days

- LOCK if closing in 15 days

- LOCK if closing in 30 days

- FLOAT if closing in 45 days

- FLOAT if closing in 60 days

To find out what rates are available to you, compare rates from at least three of the best mortgage lenders before locking in.

Rising Rates Could Mean More Expensive Home Loans

As rates rise, getting a mortgage loan could come with a bigger price tag, says Richard Staley, chief production officer of the Atlanta-based mortgage banking firm Angel Oak Home Loans.

Small fluctuations in interest rates can have significant effects on costs for homebuyers, Staley says.

He offers an example of a $200,000 30-year mortgage at a 4 percent interest rate. Using a mortgage calculator, Staley determined that a 1 percent increase in the rate would raise the monthly payment by $119.

Renters could also feel the effects of rising rates if the pool of buyers shrinks.

If would-be homebuyers opt to continue renting, rather than buy due to higher borrowing costs, then the additional rental demand could drive up rents, says Brian Davis, a real estate investor and co-founder of Spark Rental, an educational resource for renters and rental investors.

Also Check: Are There Different Types Of Reverse Mortgages

What Is A Mortgage

A mortgage is a type of secured loan provided by a financial institution to cover the cost of buying a home should you not have enough cash to pay for it upfront. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.