What If I Become Disabled And Cannot Work

This is a very good question because adults age 50 or younger have a greater chance of becoming disabled and unable to work than dying unexpectedly.

Many of the insurers that offer Mortgage Protection Insurance also offer a disability rider that will pay a monthly sum to policyholders who become disabled. The amount of your monthly benefit and the duration of payments will depend on the insurance company you select.

How To Compare Mortgage Protection Policies In Ireland

Comparing mortgage protection policies is easy with bonkers.ie.

Just fill in some simple details such as your age, the amount of cover you want, and the term the policy should run for using our online comparison service, and we’ll compare policies from Ireland’s main providers and produce a quote for you in just seconds.

You can then apply online with us. Our in-house insurance specialists will look after you right until your policy has issued and in some cases we can get your policy live in less than an hour!

Where To Buy Mortgage Disability And Critical Illness Mortgage Insurance

You can buy mortgage disability and critical illness insurance through your mortgage lender, or through another insurance company or financial institution. Shop around to make sure youre getting the best insurance to meet your needs.

Your lender cant force you to buy a product or service as a condition for getting another product or service from them. This is called coercive tied selling.

Also Check: How To Recruit Mortgage Loan Officers

What Affects The Cost

When it comes to protection insurance, its not simply a case of signing up to the cheapest policy.

Theres no one size fits all and your monthly payments also known as premiums will depend on a number factors. These include:

- the product youre taking out

- how long youre taking it out for

- age

- whether you smoke or have smoked

- lifestyle for example, do you do extreme sports?

- health your current health, weight, family medical history

- job some professions are higher risk than others

- any add-ons that you want to include

- whether youre taking out a single or joint policy.

How much cover you might need will depend on:

- your take-home pay

- debts

- mortgage/rent.

Its useful to weigh up the costs of a policy against the risks of being uninsured. For example:

- how much would you lose if you became ill and found yourself unable to work?

- how would you cover your essential costs, such as mortgages or rent?

- how would your family cope financially after you die if theres no life insurance in place?

Summary: Mortgage Life Insurance Features

|

When do I buy it? |

Usually when you buy the house, or shortly thereafter |

|

Who gets the life insurance payout? |

Your mortgage lender |

|

Your premiums will stay level over the course of the policy |

|

|

Can I have a policy with my spouse? |

Yes, mortgage insurance can cover co-borrowers |

|

What happens when I pay off my mortgage? |

The mortgage life insurance ends when the mortgage ends |

You May Like: How Much Is Mortgage On 1 Million

How To Decide Whether You Need Mortgage Protection Insurance

You’re not required to purchase mortgage protection insuranceit’s up to you to decide if this coverage is a worthwhile investment.

A policy may make sense if your finances aren’t in tip-top shape and you don’t have enough life insurance to cover the mortgage payments or pay off the loan if you pass away. However, you may not need mortgage protection insurance if you have a life insurance policy that can pay off the loan, cover your final expenses and replace your income for a set period. It also may not be a smart financial move if, on top of having adequate life insurance, you have job security and are in good health.

If you’re undecided, consult with insurance professionals to learn more about your options and decide if mortgage protection insurance is a good fit for you, or if another type of coverage makes more sense.

Should I Protect The Entire Mortgage Duration

Mortgage protection coverage can be customized to any duration that you choose.

You can always decide on how long you would like to lock in your mortgage life insurance rates.

Keep in mind that the average length of time for living in a home is only ten years.

So, you could save money by purchasing only a 10-year mortgage term life policy.

However, if you think you will live in your home for a long time, you can also coordinate your coverage to match your loans amortization schedule.

For example, if your mortgage loan runs for either 15 or 30 years, you could buy a matching 15 or 30-year mortgage term life insurance policy.

You May Like: How Much Usda Mortgage Can I Qualify For

How Mortgage Protection Insurance Works

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

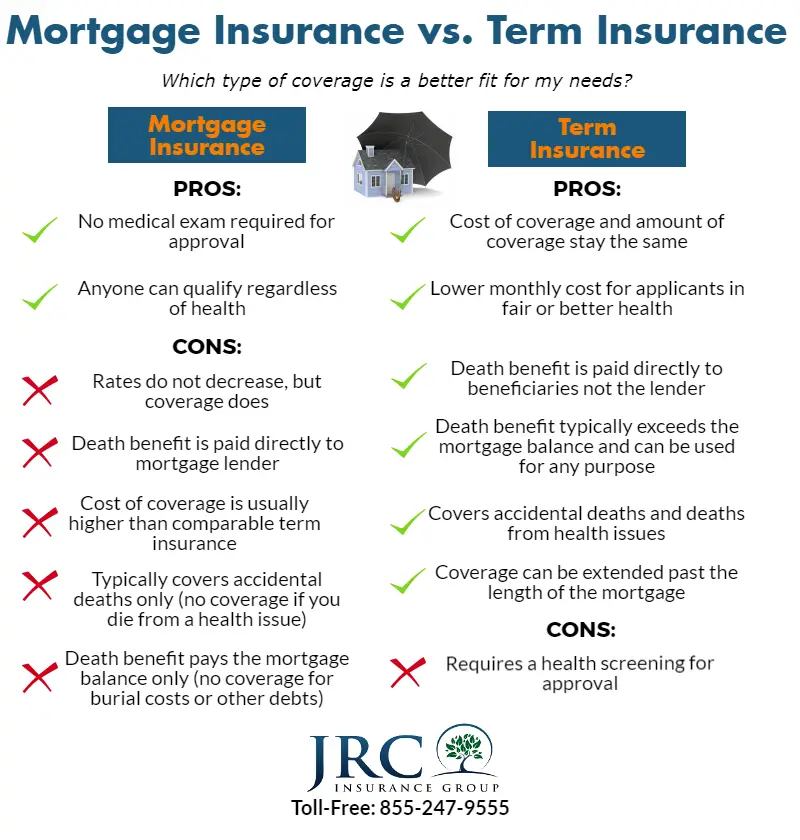

The promise of mortgage life insurance is simple and appealing when you die, your family can keep the house with its mortgage paid off. The reality is more complex. For many people, a normal policy is a better option than mortgage life insurance.

As the name implies, mortgage protection insurance is a policy that pays off the balance of your mortgage should you die. It often is sold through banks and mortgage lenders.

The reason lenders like mortgage life insurance is simple they’re the ones who get paid when you die. The death benefit of a normal life insurance policy goes to . But with a mortgage life insurance policy, the beneficiary is the lender, which will be paid the remaining balance of your mortgage.

That means your family only benefits indirectly. If you owe $150,000 on your mortgage, the mortgage protection policy will pay it off, and the property will be mortgage-free, but your family will have no say in how that money is spent.

Since your mortgage decreases over time as you make payments, that means the death benefit of your mortgage life insurance decreases, as well.

» MORE:

» MORE:

How We Chose The Best Mortgage Protection Insurance

We researched over 30 providers to find the best mortgage protection insurance options to fit the needs of a wide variety of people. In addition to the providers reputations and financial stability, we considered the types of policies, how much they cost or what you need to do to get a quote, and what it takes to qualify for a policy.

All of the mortgage protection insurance options on our list are offered by reputable companies and provide good protection for whats usually your most valuable asset.

Also Check: What Should My Mortgage Be

Advantages Of Mortgage Life Insurance

One of the convenient things about mortgage life insurance is that its easy to get. Anyone can buy a policy and typically no medical exam is required in the underwriting process. This is especially helpful for someone with a pre-existing condition or an illness that either disqualifies them from other types of life insurance or pushes their life insurance rates up to an unaffordable level.

If the policy offers affordable premiums, mortgage life insurance also might be a good way to supplement your other life insurance coverage. If you have a policy in place to pay off your mortgage balance, your loved ones can then use the payout from your other life insurance policy toward other expenses.

To recap, mortgage life insurance pros:

- No medical exam required

- Most people can qualify, which generally makes it a good option for those who have pre-existing health conditions or who have been declined life insurance coverage in the past

- If the premiums are reasonable, mortgage protection insurance could be a good supplement to life insurance coverage you already have

Is Mortgage Life Insurance A Good Idea

While some folks may be attracted to mortgage life insurance because you dont need to take a life insurance medical exam, there are very few advantages to mortgage life insurance over term life insurance.

For many, the biggest deal breaker is the lack of flexibility. With mortgage life insurance, the death payout goes directly to your mortgage lender. With term life insurance, the death benefit goes to your beneficiary who can use the money as they see fit .

You May Like: Can You Refinance Mortgage With Poor Credit

Mpi Vs Fha Mortgage Insurance

MPI also isnt the same thing as the mortgage insurance you pay on an FHA loan. When you take an FHA loan, you must pay both an upfront mortgage insurance premium and a monthly premium. Like PMI, FHA insurance payments protect against default on mortgages. However, FHA mortgage insurance affords you no protection as the homeowner.

Regardless if your loan has PMI or FHA insurance, it can be a good idea to buy an MPI policy if you cannot afford a traditional life insurance policy and want to ensure your home goes to your heirs.

Is Mortgage Protection Insurance Worth It

If youâre worried about leaving loved ones with a mortgage payment if you die but canât get a competitive life insurance rate due to age or health issues, a mortgage protection insurance policy may help. Look into different mortgage protection insurance companies before signing up with your mortgage lender to make sure you’re getting the best deal. But first, you should see if youâre eligible for a traditional term life insurance policy.

For most people, a term life insurance policy is the better option. Itâs more affordable, provides more protection, and allows for more flexibility than most mortgage protection insurance companies do. And even if you think an affordable policy is out of reach because of your health, itâs worth getting a free quote â youâll probably be surprised at how competitive your term life insurance rates can be.

Additionally, because your house is such a major investment, youâll probably want to keep protecting it while youâre alive. A homeowners insurance policy protects the structure of your home and any attached property as well as the contents inside of the home, even if youâre still making mortgage payments. That way, if you lose your home or if itâs seriously damaged because of a covered peril, you wonât necessarily lose your investment.

Ready to shop for life insurance?

Read Also: How Do You Refinance Your Mortgage

Case Study #: 51 Year Old Woman Needs Mortgage Insurance To Cover A $350000 Mortgage

If Ms. Jones, a 51 year old non-smoker with a Preferred Rating has a $350,000 mortgage she needs to protect. She could go with a more-expensive $350,000 Banner Life Term policy for 30 years.

This will cover the mortgage, but will cost her $97 per month for 30 years, a total of $34,920.

That would look like this:

Notice her coverage is much higher than her mortgage balance in the yellow years.

Alternately, she gives the Protective Mortgage Strategy a try, wherein she purchases a $500,000 Protective Custom Choice UL policy for 20 years.

This policy will provide a full $500,000 in coverage for the first 20 years, giving her beneficiary ample funds to pay off the mortgage, plus extra to cover additional expenses.

Then, the policy will continue, with a declining death benefit until the end of the 30 year mortgage. This policy will cost her only $74.31 per month, a savings of over $8,168 over the life of the loan!

Why Term Life Insurance Is A Better Value Than Mortgage Protection Insurance

When you buy term life insurance, you get to choose a coverage amount and term length that meets the needs of your family. If mortgage protection is your primary goal, choose a coverage amount that would pay off your mortgage and a term length thats at least as long as the life of your home loan.

But for most families, theres more financial protection needed than merely an amount that covers your mortgage payment. You should consider income replacement for both spouses, day-to-day bills, and the cost of childcare and your childrens education to name a few of our many financial responsibilities.

Flexibility is one of the significant benefits of a traditional life insurance policy. You can purchase coverage that not only helps protect your family from needing to pay off a mortgage without you but can also help ease the financial burden of day-to-day life. Another key benefit? Affordability. Medically underwritten term life insurance is usually more affordable than mortgage protection insurance.

Not sure how much is needed for day-to-day life? No problem. A life insurance calculator can look at your income, family structure and debts to help you determine the right policy for your needs.

Recommended Reading: What Are Mortgage Underwriters Looking For

If I Pay Back My Mortgage Early Can I Cancel My Mortgage Protection Policy

Yes but youll have to let your insurer know you want to cancel the policy early as it usually wont be done automatically.

However you can also choose to continue with your mortgage protection policy, meaning if you were to die before the end of the original term, any remaining benefit would be paid out to your estate, instead of being used to pay off your mortgage.

State Farms Mortgage Protection Life Insurance Plan

State Farm is one of the few companies that still offer an old-fashioned Mortgage Protection Life Insurance plan.

For the first 5 years, the death benefit remains level and begins to decline annually as your mortgage is reduced. It never goes below 20% of the original benefit.

Terms are available for 15 or 30 years, and premiums are scheduled to be level for the life of the policy. Unfortunately, State Farm has to option to raise the premiums up to the maximum amount stated in the policy.

Did you know?: Mortgage life insurance policies with decreasing benefits typically cost more than policies with level death benefits.

Sounds impossible, right? Its because most of them dont require a medical exam.

Many of these mortgage life insurance offers come via snail mail when a homeowner purchases a new home or refinances their mortgage, and the no exam life insurance company vultures send out their offerings! Typically they cost more than guaranteed level term, but are easier to qualify for.

Recommended Reading: How Much Is The Mortgage On A $300 000 House

How Much Does Mortgage Protection Cost Per Month

The cost of mortgage protection will depend on several factors such as the size of your mortgage, your age and health status, and whether you want single life cover for just you, or joint life cover for you and your partner for example.

Smokers will also pay more for cover than non smokers. Just use our free mortgage protection comparison service to find the price of cover for you in minutes right now.

Who May Want Mortgage Insurance

Anyone with a mortgage balance could benefit from mortgage insurance.

My advice is to purchase life insurance to cover the mortgage in the event one of the homeowners dies prematurely. Dont just buy an amount of life insurance equal to the mortgage amount you probably have other financial bases to cover, Mitchell said.

Shanbrom said MPI can also help people who rely on the main note holder. If that person dies and cant make payments, it could impact the equilibrium of the household and make it hard for those within to go back to work.

Necole Gibbs, licensed independent broker at TNG Insurance and Financial Services, said mortgage insurance is an especially good idea for young couples with children.

If something were to happen to either of the two during the term, the surviving spouse would receive the death benefit and would then be able to pay off the mortgage, Gibbs said.

If youre concerned about losing money through premiums, you could choose a return of premium policy. Those policies, which can be pricey, pay you back your premiums if you outlive your mortgage insurance. Gibbs said these policies get returned as a lump sum at the end of the policys term.

This is a great strategy because if nothing happens to the couple during the term, Gibbs said.

MPI is also an option if you dont want to take a medical exam to buy a regular term life insurance policy. Some insurers dont require an exam for an MPI policy.

Don’t Miss: What To Expect When Applying For A Mortgage Loan

What Mortgage Protection Insurance Will Not Do For You

Mortgage Protection Insurance is not like a homeowners policy and will not pay to repair or replace your home and the policy does not provide liability if you are sued by someone that gets hurt on or in your property.

Mortgage protection insurance is not the same as Private Mortgage Insurance which you may be required to purchase if your down payment on your home is insufficient. PMI does not protect you or your family it only protects your lender if you default on your mortgage loan. Usually, a home buyer is required to purchase PMI if their down payment on the home is less than 20% of the purchase price.

Whats Bad About Mortgage Protection Insurance

The main drawback of a mortgage protection insurance policy is its narrow scope. Being able to cover mortgage payments is great, but youâre doing so at the expense of your familyâs other debts and bills. A regular term life insurance policy allows you to cover your mortgage, plus other expenses.

For anyone looking for the most affordable term life insurance options, mortgage protection insurance isnât your best bet. Itâs more expensive than a typical term life insurance policy for an applicant in excellent health, generally, more than double a comparable term life insurance policy.

The decreasing death benefit amount is also a limiting factor. Because the death benefit is matched to your mortgage balance, it doesnât give you much flexibility if things change in your life. Worse, policies are usually level premium, meaning that, as time goes on, youâre paying the same premium rates for less coverage.

And the lack of flexibility doesnât end there. The coverage amounts, limited terms, and age restrictions all contribute to a strict policy that doesnât take into account the numerous changes you and your family may go through during the course of the policy. Overall, mortgage protection insurance’s cost isn’t worth the relatively limited protection.

You May Like: What Is Needed For Mortgage Application