Disability Insurance Payment Exclusions

No benefit will be paid if total disability results from or occurs during:

- A normal pregnancy, or maternity or parental leave

- A leave of absence

- Self-inflicted injuries

- Any disability during which you are not under the regular care of a physician and following the appropriate treatment

- Committing or attempting to commit an assault or criminal offence

- Any act of war, terrorism, or insurrection

- A pre-existing condition within 24 months following the effective date of coverage

- Medical conditions due to alcohol or drug abuse

- Also, no disability insurance benefit will be paid if you are receiving job loss benefits under this Plan

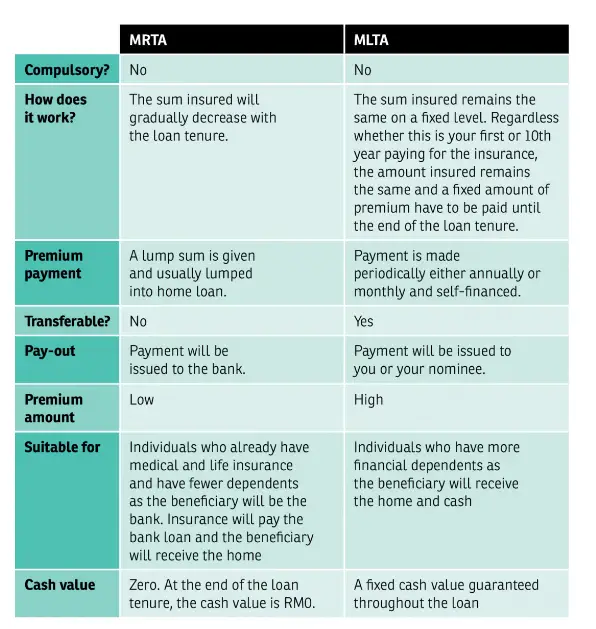

How Is Mortgage Disability Insurance Different From Other Types Of Insurance

Unlike life insurance, mortgage disability insurance provides financial protection for your family while youre still alive. It also doesnt have as stringent an underwriting process as traditional life insurance, which makes it easier to qualify for a policy.

But the coverage it provides is narrower than other life or disability insurance products since it can only be used to cover your mortgage principal and interest payments. The coverage isnt meant for other everyday expenses or housing-related expenses like property taxes and utilities.

Another way mortgage disability insurance differs is that if you become disabled, your policy issues payments directly to your lendernot to youto pay your mortgage.

Pros And Cons Of Mortgage Protection Insurance

In general, mortgage protection insurance is only a good idea for people who cant get approved for traditional forms of life or disability insurance, or for whom premiums for a traditional policy are cost prohibitive. If youre in that situation, here are some pros and cons of mortgage protection insurance you should consider.

Read Also: How Is Debt To Income Ratio Calculated For A Mortgage

Whats The Difference Between A Benefit Period And An Elimination Period

One thing to keep in mind with mortgage disability insurance is that once youre approved for a policy, there will be both a benefit period and an elimination period. Heres how they differ:

- Benefit period Your policys benefit period defines how long youll receive coverage. Benefit periods can last only a few months or until you reach retirement age. However, the longer the benefit period, the higher your premium.

- Elimination period The elimination period is a waiting period that can range from 30 to 90 days, depending on your policy. During this period, you wont have coverage. So, its best to consider the elimination period when youre searching for a policy. At the very least, you should have savings sets aside to cover your mortgage until your insurance coverage kicks in. A longer elimination period typically means a lower premium.

Mortgage Disability Insurance Riders

Insurers allow you to customize a policy that works best for you. They do this by offering riders.

A rider is an add-on to your policy. These are common in life insurance, including long-term care coverage. The downside to riders is that they often increase the cost of your policy.

Here are types of riders:

- Return of premium This rider requires the insurance company to return your premiums at the end of your policy if you dont file a claim. The return of premium is costly and can double your premiums.

- Involuntary unemployment The rider waives premiums for a period if youre involuntarily unemployed. The longer youre eligible for premium waivers, the more you can expect to pay for this rider.

- Homeowner-related expenses The rider helps you with costs that go beyond your mortgage payments, such as helping you with homeowners insurance and real estate taxes. This rider provides help for mortgage-related expenses not other costs. For instance, it wont help you with credit card bills, auto insurance or other regular costs.

Also Check: What License Do You Need To Sell Mortgage Insurance

How Does Job Loss Mortgage Insurance Work

Job loss mortgage insurance pays your monthly mortgage payment for a specified period while you’re out of work.

This type of job loss insurance isnt private mortgage insurance. Private mortgage insurance safeguards your lender if you cant pay your mortgage. Instead, unemployment insurance companies offer mortgage unemployment insurance only to qualified applicants, such as:

- You must buy it before you become unemployed.

- You must be employed full-time in a relatively stable occupation.

- You cant be self-employed, an independent contractor, member of the military, retiree or someone over age 60 or under age 18.

“If losing your job would likely prevent you from making timely mortgage payments, you’re a good candidate for mortgage unemployment insurance in theory,” Martucci says. “The benefit of this insurance is twofold: It can protect your credit score if you can’t make timely payments on your own temporarily, and it reduces the risk of foreclosure during an extended layoff.”

Certain mortgage protection insurance policies may pay your complete monthly mortgage payment for an extended time. However, most job loss mortgage protection insurance polices only cover your mortgage costs for six to 12 months up to a certain ceiling. For instance, if your monthly mortgage bill was $1,000 per month, Policy A may pay out $600 while a more expensive policy B would cover the full $1,000.

Job loss mortgage insurance premiums can differ. Costs are based on:

- Your mortgage balance

The Maximum Insurance Amount Of $500000 Will Cover:

- The average month-end balance of your Manulife One account over the last 12 months or the outstanding balance on the day you pass away whichever is less.

- Interest accumulated on the debt balance between the date of death and the date the insurance payment is made.

- Fees and expenses to discharge your mortgage up to 5% of the total insurance payout.

Recommended Reading: How Does The 10 Year Bond Affect Mortgage Rates

When Do You Have To Pay Pmi

PMI must be paid as a condition of conventional mortgage loans if your down payment is less than 20%. For example, if the price of your new home is $200,000 and you’re only able to pay $7,000 up front, then you pay PMI because your down payment is only 3.5% of your home’s purchase price.

Down payment < 20% of the purchase price = PMI

Down payment > 20% of the purchase price = No PMI

Mortgage Protection Insurance Vs Private Mortgage Insurance

Mortgage insurance may sound similar to Private Mortgage Insurance , but theyre entirely different.

PMI protects the bank or lender in case a homeowner stops paying a mortgage. If youve purchased a home with less than 20% down, your lender probably required you to purchase PMI.

While mortgage protection insurance will pay off your loan when you die, PMI is intended to cover a portion of your loan if you default. The benefit is paid to your lender, not your family.

You May Like: Can Low Credit Score Get Mortgage

My Budget Is Already Tight Why Would I Want Another Monthly Bill For Mortgage Protection

If you are struggling financially now, imagine how tough it will be if a loved one dies unexpectedly. You will have no financial safety net and a household income earner dies, you will lose your home.

For a reasonable monthly premium, you can get your entire home paid off when an income earner dies unexpectedly.

Most families can easily come up with money for mortgage protection on a monthly basis by limiting unnecessary purchases. For one or two dollars a day, many families can protect their mortgage, their families, and their childrens future.

What Is Job Loss Insurance

There are three types of job loss insurance that can help qualified unemployed workers:

One comes from the government, one you can buy separately and a third you can buy for your mortgage.

Don’t Miss: How Much Would 100k Mortgage Cost

How Much Does Supplemental Unemployment Insurance Cost

The amount you’ll pay for supplemental unemployment insurance varies depending on your:

- Coverage amount

“One insurance company, SafetyNet, previously charged a monthly premium at various price points based on coverage, with policies running anywhere from $4 to $60 per month,” explains Virginia Hamill, the senior insurance analyst at New York City-based FitSmallBusiness and a previous insurance expert with Insureon.

If employed, check to see if your employer or union automatically provides these benefits at no charge to you if you are terminated without fault. Some businesses offer this insurance instead of or in addition to a severance package.

Who Should Get Mortgage Disability Insurance

Anyone with a mortgage may be interested in getting a policy, but ideal candidates for mortgage disability insurance are:

- People in a high-risk occupation

- People who dont have existing disability coverage through work

- People who cant get traditional long-term disability coverage

Since most of these policies are simplified or even guaranteed issue, people with health conditions can benefit from them, as well, Anthony adds. If you work in a hard-to-insure occupation, such as restaurant service, then mortgage disability insurance may be your only option to protect yourself and your home.

Also Check: What Kind Of Mortgage Loan Should I Get

Best Mortgage Protection Insurance Companies

Mortgage protection insurance offers limited coverage and is more expensive than term life insurance, which is affordable and provides a more comprehensive financial safety net for your family.

If you want to make sure the rest of your mortgage is paid off if you die, we recommend purchasing a 15-, 20-, or 30-year term life insurance policy instead of MPI. These are our top picks.

Where To Buy Mortgage Protection Insurance

If mortgage protection insurance feels like a good fit for you, its important to take the same approach you took with finding your actual mortgage. Comparison is key.

MPI is not as widely available as other types of insurance, so you might need to do some digging to determine which companies offer it. Evaluate the pricing and features of different MPI policies from a few insurance companies, and make sure you understand what the policy does and doesnt cover before committing to it. While youre at it, be sure to compare life insurance costs with that MPI policy you might find one option is more suitable for your situation than the other.

Recommended Reading: How To Become A Licensed Mortgage Loan Officer

Should I Purchase Mpi

Again, unlike PMI, this type of insurance is purely voluntary. If you’re in good health, relatively secure in your job, have no unusual lifestyle risks, and are adequately otherwise insuredfor example, you have life insuranceyou might not want or need to purchase this type of insurance.

But if you think that your particular circumstances or risk factors could warrant getting this type of insurance, consider contacting an insurance agent.

Alternatives To Mortgage Protection Insurance

Mortgage insurance is one way to protect your home, but there are other options, including term life and permanent life insurance.

Most mortgage insurance policies are similar to term life policies. But there are notable differences.

Here are the pros and cons of mortgage insurance, term and permanent coverage.

| Insurance type |

|---|

|

No matter what policy you decide on, make sure to shop around to find the right plan for you. Mortgage life insurance can be a wise choice if whats most important is to pay off your mortgage.

Don’t Miss: Where To Get A Mortgage With Low Credit Score

Purchasing Job Loss Insurance For Your Mortgage

Borrowers who are self-employed, underemployed, over age 50, retired, or in the military, may want to think about taking job loss insurance for their Arizona mortgage. With such high unemployment rates right now, no ones job is totally secure. Job loss insurance is now being offered by a variety of lenders and new home builders.

Job loss mortgage insurance will pay all or a portion of your mortgage in the event you lose your job. Many times, the protection is available at no additional cost to the borrower or for a nominal fee. You should check with your Arizona mortgage broker to find out what insurance is available in the Phoenix or Scottsdale area for your mortgage.

Does Standard Life Insurance Cover Your Mortgage

Another insurance coverage type that can pay off your mortgage if you die is a standard life insurance policy. There are two main types of standard life insurance, term and permanent.

- A term policy is in place for a set number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away during that term.

- A permanent policy provides coverage for your entire life span and pays out when you pass away.

Instead of paying your mortgage lender directly the way mortgage protection insurance does, standard life insurance policies go to the beneficiaries you select, who can then choose to pay off the mortgage. Of course, this will only work if the policy pays out enough money to cover the outstanding mortgage balance, but many people plan for this when they purchase their life insurance policy.

One common rule of thumb is to aim for a life insurance policy that will pay out up to ten times the policyholders salary amount. Alternatively, you might choose to use something like the DIME method, which adds a familys debt, income, mortgage and education expenses to calculate how much life insurance is needed.

Heres how mortgage protection insurance measures up against standard life insurance.

| Mortgage Protection Insurance |

|---|

| No |

Don’t Miss: Will Mortgage Insurance Cover Death

The Best Insurance Companies To Protect Your Mortgage

The life insurance companys financial rating and the coverage cost are the two most essential elements to consider when selecting the best term life insurance plan. Because all term life insurance plans operate similarly, its about ratings and price. The best life insurance companies to protect your mortgage are:

What It Doesnt Cover:

Other costs of homeownership. The policy wont cover property taxes, homeowners insurance or HOA fees.

Funeral costs. Theres no coverage provided for your funeral arrangements.

Non-mortgage debt. The policy wont pay off any debt outside of your mortgage balance.

Living expenses for beneficiaries. Standard life insurance policies may help cover ongoing living expenses for your beneficiaries, but mortgage protection insurance typically doesnt.

Recommended Reading: How Much Will My Mortgage Be Calculator

Best Mortgage Protection Life Insurance Companies

The market for mortgage protection is crowded. Multiple companies offer their own version of the product. Some, unfortunately, are overpriced, and others have very thin policies which dont provide many features.

We represent over 30 of the best life companies. Because we specialize in life products, we have been able to sift through the options and understand exactly what is being offered and at what price. Beware of solicitations that dont provide options. If the agent you are working with only represents one company, the offer is probably better for the agent than it is for you.

The most significant factor when choosing the best mortgage protection company is determining which company will offer you the best rate class. If you do not know what a rate class is you should. You can learn what a rate class is on this page.

The best mortgage protection life insurance companies are:

The worst mortgage protection life insurance companies are:

- Mutual of Omaha

State Farm, USAA, Americo or Mutual of Omaha, Even though these companies say they have a particular mortgage protection series product, they are all still just term policies, and they are expensive term policies compared to the competition.

If Homeowners Insurance Doesnt Cover Mortgage Payments What Will

Youll want to get a mortgage protection insurance policy if youre worried about needing help paying your mortgage one day. These policies are mainly designed to cover homeowners in the event that they become disabled or temporarily unemployed and as a result are unable to make their mortgage payments. Coverage may provide reimbursement for a designated fraction of your mortgage or for the full amount for a set amount of time, depending on your policy.

Mortgage protection insurance offers the following coverage benefits:

- Disability: Mortgage protection insurance basically acts as a disability policy with extra benefits. Coverage will protect you by paying some or all of your mortgage for a specific amount of time, should you become injured or ill and unable to work as a result.

- Unemployment: If you get laid off and are temporarily unemployed, coverage can be set up to pay part or all of your mortgage while you are out of work.

- Death benefits: Mortgage protection insurance can also act a bit like a life insurance policy, in that it can be set up to pay off the remainder of your mortgage straight to the lender if you die. Certain policies also have features built in that allow for your designated beneficiary to collect the full amount of your original mortgage. Your beneficiary could then pay off any remaining balance on your mortgage, and treat the leftovers as a gift.

TrustedChoice.com Article | Reviewed byPaul Martin

©2023, Consumer Agent Portal, LLC. All rights reserved.

Don’t Miss: When Can You Get A Mortgage After Chapter 7

How Does Supplemental Unemployment Insurance Work

Supplemental unemployment insurance is an optional insurance product. You can purchase on your own if youre employed or an employer can buy it for you.

This type of job loss insurance is meant to supplement state/federal unemployment insurance benefits. It helps you retain a part of your original salary.

As with state/federal unemployment insurance, you can collect only from a job loss insurance company if you were let go without fault by your employer. If you were fired, quit or retired, this insurance isnt available to you.

Supplemental unemployment insurance can provide cash payouts that, when combined with state/federal unemployment insurance payouts, equal a maximum of half your weekly pre-tax income paid by your last employer. The job loss insurance company payout depends on the policy and insurer.

Heres an example:

- You live in Illinois and your yearly pre-tax salary was $80,000 .

- Illinois weekly unemployment insurance benefit amount is 47% of your average weekly earnings over your two highest-earning quarters. The maximum weekly benefit is $484.

- In this scenario, your supplemental unemployment insurance weekly benefit can reach $285 — which, when coupled with $484, would total $769. Thats approximately half of your original $1,538 weekly earnings.

Every supplemental employment insurance policy and insurer has different rules and benefits. Make sure to read the fine print before getting this form of job loss insurance.