What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Considerations Before Committing To A Mortgage

WOW: Look at those figures above! The amount of interest you will pay your bank over the period of the loan is outrageous, particularly when we consider what we have done to bail out the banks in our recent history. I know, you have no choice, you need a mortgage but, save what you can, while you can. Use a bigger deposit if you can, repay your mortgage early to save thousands on interest payments. Think about your financial future, when do you really want to pay of that mortgage, the answer should be as soon as possible.

Affordability: Be sure you can really afford to make the Mortgage repayments. Only you really know if you can afford a Mortgage or not and committing to a mortgage which you will struggle to repay will only cause you financial hardship and pain in the future. Remember,

Mortgages: READ THE SMALL PRINT: Your home may be repossessed if you do not keep up your Mortgage repayments .

Shop around: It always pays to shop around and see what deals are available. Most banks and building societies run promotions at various points of the year. Never assume that one lender is better than the other, look for the good deals as they could save you a lot of money.

Borrow Little, Repay Quickly: The best Mortgage is one repaid quickly. A quick repayment means less interest paid and less stress about your debt.

Monthly Payments On A $200000 Mortgage

What is each mortgage payment made up of?

- Principal payment. This goes towards the amount you borrowed from the lender . As you gradually pay off the amount you borrowed, you will be paying interest on a smaller loan amount, so your interest payments will slowly reduce.

- Interest payment. This is the cost to borrow from the lender. The higher your principal and the higher your interest rate, the more interest youll need to repay.

$948.42$1,931.21

Monthly payments by interest rate

| Interest |

|---|

Read Also: How To Get Preapproved For A Mortgage With Bad Credit

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

Should I Use The Mortgage Calculator Or Request An Agreement In Principle

Our mortgage calculator and Agreement in Principle both give you an indication of how much you may be able to borrow towards the purchase of a property, monthly repayments and potential interest rates. You can use both tools to help if you’re house-hunting or looking to remortgage.

We ask for a little more information as part of an Agreement in Principle application, but it does provide you with a more formal document that you can use with estate agents and sellers to show that you may be in a financial position to purchase a property. Therefore, it makes sense to have an Agreement in Principle when you are viewing properties with a potential intention to buy.

Read Also: Chase Recast Calculator

How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

How Much Is The Monthly Interest On A 200000 Mortgage

Below you can see how a repayment mortgage compares with an interest-only mortgage, based on monthly payments and a term of 25 years.

The lower column illustrates how much monthly interest you would pay on a £200k mortgage at various interest rates.

| Interest Rate | |

|---|---|

| £666 | £834 |

For more accurate figures, or if you want to see if a repayment mortgage might be right for you, drop us a line. Well connect you with an expert who can help you see if this is the best fit for you.

Don’t Miss: Will Mortgage Pre Approval Hurt Credit Score

How To Get A $200000 Mortgage

Getting a mortgage isnt as hard as you think. As long as you prepare and break the process down into small, manageable steps, its really quite simple. And were here to help you break those steps down.

If youre ready to get started, you can use Credible to request an instant streamlined pre-approval today.

Credible makes getting a pre-approval letter easy

- Streamlined pre-approval: It only takes 3 minutes to see if you qualify for a streamlined pre-approval letter, without affecting your credit.

- Figure out your homebuying budget: No more second-guessing how much you can afford well tell you the amount youre prequalified for instantly.

- Compare your mortgage options: You can check out rates from multiple lenders to make sure youre getting a great deal on that $200,000 mortgage.

Here are the steps to follow to get a mortgage:

Find a great agent today

Keep Reading:

What Are The Repayments On A 200000 Mortgage

The answer, of course, is not the same for everybody, which is why bespoke advice is crucial.

For a start, every lender is different, along with every borrowers and circumstances there are many factors that can affect your monthly repayments.

Two main factors will have a bearing on how much the repayments cost: the term of the mortgage and the interest rate that the lender gives you.

This table shows how your monthly repayments can vary, based on the term and the interest rate.

| £200,000 Mortgage Repayments |

|---|

Recommended Reading: Does Prequalification For Mortgage Affect Credit Score

Can I Get An Interest

Yes, theres a fair amount of choice on the market, but lenders will want to see a viable repayment strategy before stumping up the cash.

A repayment strategy is essentially a written plan that shows how youll be able to pay the full balance of the mortgage at the end of the term.

In an interest-only mortgage, your monthly payments only meet the interest on the loan, the capital is due at the end of the term in one large lump sum.

The criteria for an interest-only residential mortgage are a little different. Youll probably be asked for a larger deposit. Most lenders will only offer 75% loan-to-value , though a smaller number will offer 80%, and a handful will go up to 85% if the circumstances are right.

Why Should I Use A Mortgage Repayment Calculator

A home loan is the biggest expense most people will ever have. Thats why its important to use a mortgage repayment calculator to work out how much your potential home loan repayments could be before applying for a loan, so you know how much you can afford to borrow.

A home loan repayment calculator can help you compare the costs of taking out a home loan and give you an idea of what your monthly repayments could be. Having an understanding of what your monthly repayments could be can help you to work out whether the loan is something you can afford, and what the total cost of the loan will be over the full loan term.

Recommended Reading: Reverse Mortgage On Condo

Can I Get A 200000 Buy

Its very likely. Its worth bearing in mind that the rules for BTL mortgages are a little different and usually stricter.

For a start, lenders will very often expect a higher deposit 25% is not uncommon, though some may accept 15%, provided you fit other criteria.

Minimum income requirements are another common factor, with some lenders insisting that you make at least £25k a year.

That said, some lenders will look at rental income forecasts instead, insisting that your projected rental payments cover 125%-130% of the £200,000 mortgages monthly payments.

Another hurdle comes from the fact that many of them wont offer a BTL mortgage to a first-time buyer , though some of the more specialist providers may consider this .

Many people opt to take their buy-to-let mortgage on an interest-only basis. The section below will help you get an idea of the monthly payments on a £200k, interest-only mortgage.

How Can A Mortgage Broker Help Me Get A 250k Mortgage

Your best chance of being able to borrow the maximum you can afford is to use a mortgage broker. Your broker will give you independent advice on the best deal for you and will help you with every stage of your application. An independent mortgage broker also has access to more deals than youll find on the high street or online, so youll know you really are getting the best deal you can achieve at this time.

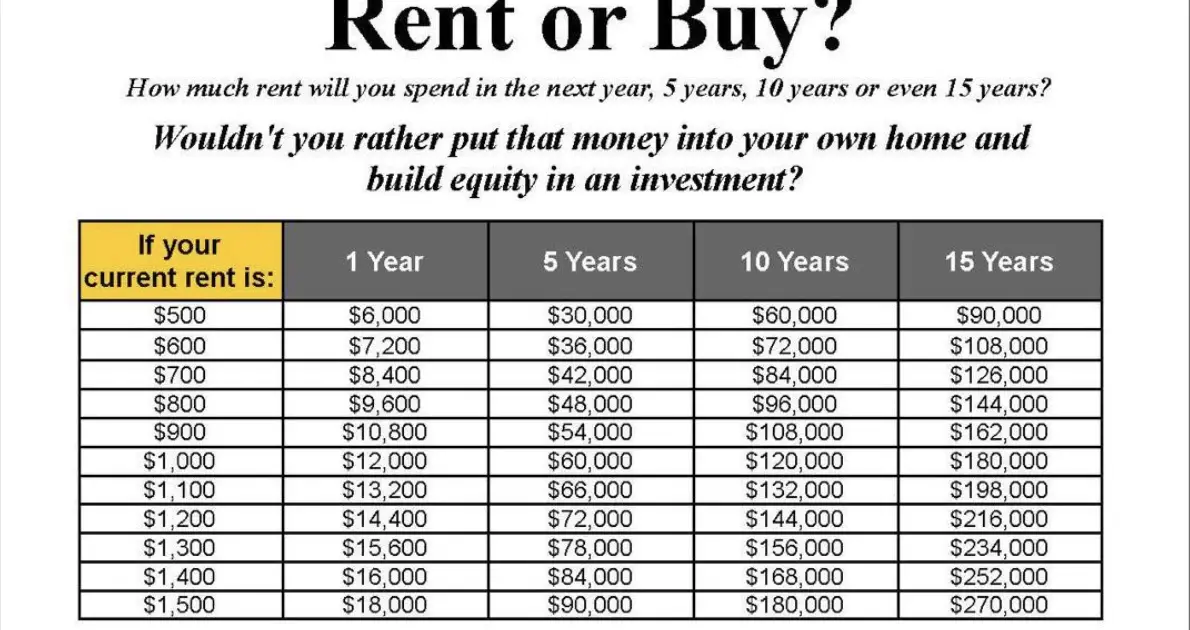

Did you find this article helpful? Then you might also find our article on renting vs buying informative, too!

Let us match you to your perfect mortgage adviser

Read Also: Reverse Mortgage On Mobile Home

Monthly Carrying Costs When Buying A Home

When you take out a mortgage to buy a home, you know how much your monthly mortgage payment will be. However, that’s not the only monthly cost associated with owning a home – and the extra ones can add up fast. Depending on where your new home is located, and which utilities it’s hooked up to, the additional monthly costs will vary from home-to-home. Here are some of the most common costs you could have to pay each month as a homeowner.

This table shows your estimated monthly carrying costs for a $350,000 home with a $300,000 mortgage at 3.24% amortized over 25 years.

| Mortgage Payment |

|---|

Disclaimer: Financial institutions pay us for connecting them with customers, including by paying for advertisements, clicks, or when someone applies for/is approved for a product. Terms and conditions apply between you and the provider of the product – please be sure to review them. Product information and details vary for Quebec. The content provided on our site is for information only it is not meant to be relied on or used in lieu of advice from a professional. Partners/Advertisers are not responsible for the accuracy of information on our site. For complete and current information on any product, please visit the providerâs website. However, not all products we list are tied to compensation for us. Our industry-leading education centres and calculators are available 24/7, free of charge, and with no obligation to purchase. To learn more, visit our About us page.

Does Bad Credit Affect How Much Deposit I Need For A 200000 Mortgage

Unfortunately yes, though it doesnt have to be a deal-breaker.

A history of bad credit means that lenders will look upon you as a higher risk. The worse your credit history, the greater the risk, which often means a larger deposit and less favourable rates.

Of course, every lender is different and will treat each issue differently. As a result, each will offer different rates and ask for different deposit sizes for a bad credit mortgage.

Some issues are generally seen as lower risk by most lenders. For example, if you have a low credit score and a few late payments on your record, some lenders may be happy to offer you a higher loan-to-value ratio and better rate.

But if you have something more serious, such as a recent bankruptcy or repossession, many of them will be much more cautious requesting a higher deposit or higher rate of interest on your loan.

Other providers adopt a case-by-case approach when it comes to lending. You may have to submit a written document regarding the circumstances of your adverse in order for the lender to make a full assessment, and your application may have to go through an additional underwriting evaluation.

See our table below to see how your credit rating could affect your mortgage:

| Risk Profile – Low |

|---|

| £200,000 | £100,000 |

The above is for demonstrative purposes only and you should consult your broker or lender for the most up-to-date information and rates.

Don’t Miss: How Does Rocket Mortgage Work

How Does The Mortgage Repayment Calculator Work

Your Mortgages mortgage calculator considers a variety of factors to determine how much your regular repayments will be over the loan term.

While there are many factors that can influence this calculation such as changes in interest rates, a decision to refinance, or using a redraw facility, the calculator will still be able to give you an estimate of how much your regular repayments could be and the total interest paid over the life of the loan.

By changing the interest rate, loan term, and repayment frequency fields, you can compare how these differences can impact your repayments.

Disclaimer: The results yielded by the calculator assume no changes in interest rates over the loan term. This means whatever interest rate you use will be applied for the whole loan term.

Monthly Payments For A $200000 Mortgage

Monthly mortgage payments always contain two things: principal and interest. In some cases, they might include other costs as well.

- Principal: Principal is money that goes directly toward whittling down your balance.

- Interest: This is what you pay to actually borrow the money. The amount youll pay is reflected in your interest rate.

- Escrow costs: If you opt to use an escrow account , youll also have your property taxes, mortgage insurance, and homeowners insurance rolled into your monthly mortgage payment, too.

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance.

But these can vary greatly depending on your insurance policy, loan type, down payment size, and more.

Credible is here to help with your pre-approval. Answer a few quick questions below to get started.

Heres a more detailed look at what the total monthly payment would look like for that same $200,000 mortgage:

| Interest rate |

|---|

Check out: 20- vs 30-Year Mortgage: Is an Unusual Option Right for You?

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

How Much Will My Mortgage Cost

The cost of your mortgage will depend on several different factors, including how much you are borrowing, your mortgage term, and the rate of interest youre paying. For example, the longer the mortgage term you choose, the cheaper your monthly payments will be, but the more youll end up paying back overall. If you choose a shorter term, your monthly payments will be higher, but youll reduce the total amount of interest you pay back.

Mortgages often come with arrangement fees, which can also have an impact on how much your monthly mortgage payments cost if youve chosen to add these to the amount you are borrowing.

If youre not sure which mortgage deal is likely to be most cost-effective for you based on your individual circumstances, seek professional advice from one of our advisers who can run you through all the available options.