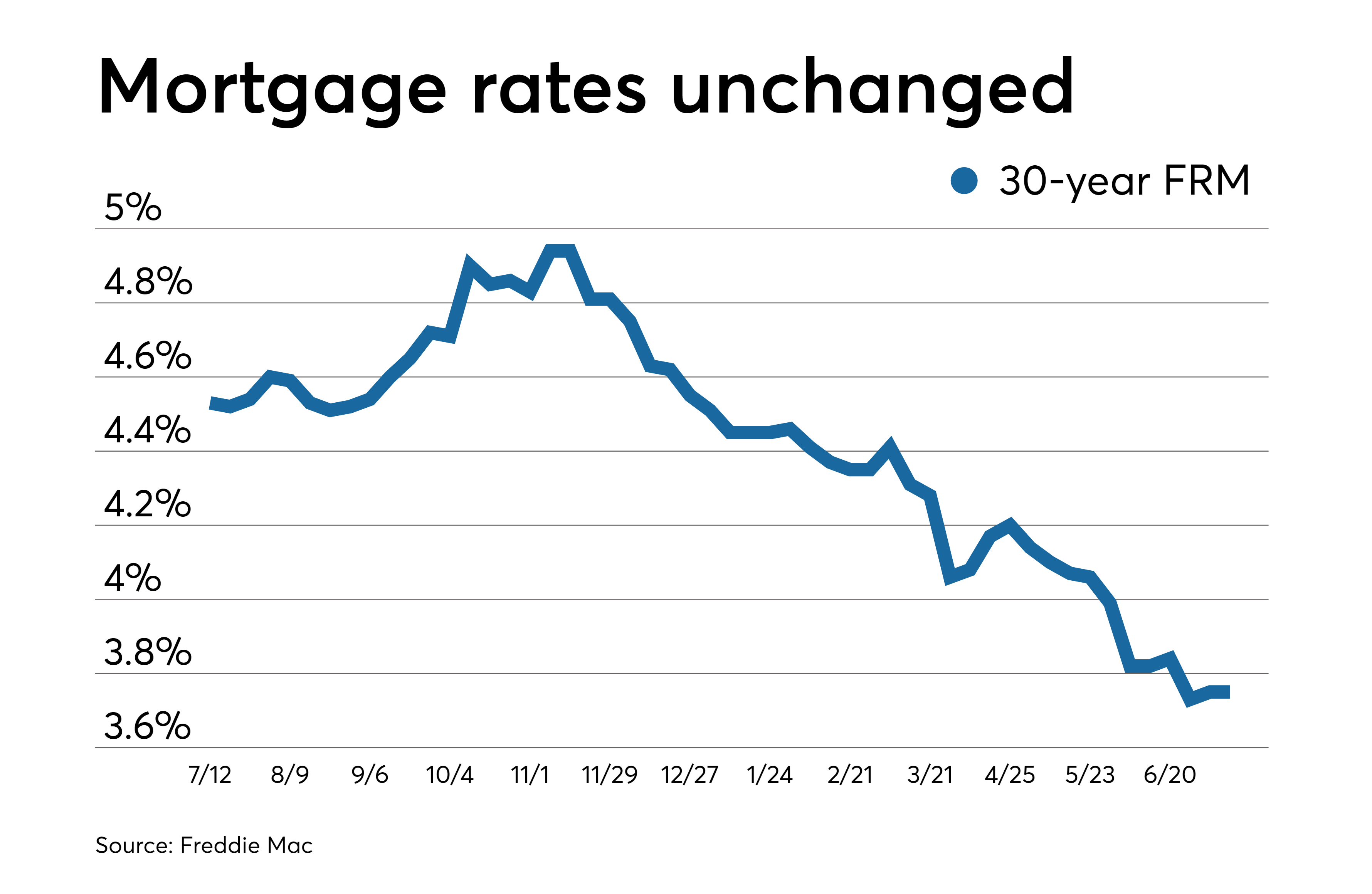

Current 30 Year Mortgage Rate Advances +006%

The average rate for the benchmark 30-year fixed mortgage is 3.30 percent, up 6 basis points from a week ago. This time a month ago, the average rate on a 30-year fixed mortgage was lower, at 3.18 percent.

At the current average rate, youll pay principal and interest of $434.66 for every $100k you borrow. Thats an additional $6.56 per $100,000 compared to last week.

While the 30-year rate is the most popular mortgage term, as with any financial product, the 30-year mortgage has some downsides, including:

What Are The Current Average Mortgage Refinancing Rates

Average mortgage refinancing rates are similar to what youll find for mortgage purchase rates: around 2.9% for a 30-year term. Keep in mind that the average rates may not reflect quotes youll receive from lenders, which depend on individual factors such as your credit score, debt-to-income ratio, and your home equity.

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 3.6% right now.

Read Also: Rocket Mortgage Requirements

Ontarios Housing Market Trend

Ontarios new tagline is A Place to Grow, which is also whats expected for the provinces population. The Ontario Ministry of Finance projects the population of Ontario will increase some 30.2% over the next two decades, bringing the total population to 18.5 million by July 1, 2041.

There are so many incredible aspects to Canadas most populous province, from its lush natural resources to its growing cities. That and solid job growth make the population boom less of a surprise.

As a result of its popularity, home prices in Southern Ontario are expected to continue rising. Prices are particularly prone to inflation in Ontarios Golden Horseshoe region where immigration is high, land is limited by the protected green belt and homes remain in short supply.

That, in turn, implies that Ontario mortgage amounts will grow faster than the national average.

Open Vs Closed Mortgages

You may often notice a significant difference in mortgage rates betweenopen and closed mortgages. Open mortgages allow you to make principal prepayments at any time without any charges or penalties, which makes it very flexible. This flexibility is counterbalanced by open mortgage rates being higher than closed mortgage rates.

Choosing a closed mortgage can let you access much lower mortgage rates at the risk of prepayment penalties if you go over your lenders annual prepayment limit. Things like selling your home or a mortgage refinance can cause you to have to pay significant prepayment penalties. This could be avoided with an open mortgage, but youll have to pay a higher mortgage rate.

Also Check: Will Mortgage Pre Approval Hurt Credit Score

What Are The Current Mortgage Refinance Rates

The interest rate is one of the first things people look at when shopping for a refinanced mortgage, because it is the key factor in determining the total cost of borrowing. External factors can cause rates to change quickly, making it important to keep up with current rates when looking to refinance.

Is It Worth Refinancing

When you refinance your home loan, you pay off your existing mortgage with funds from the new loan, which means you will have a new loan note. If your objective is to save money, then your new refinance rate should be low enough to offset the cost of acquiring the loan. Use a mortgage refinance calculator to determine the refinance interest rate that would make it financially worthwhile.

Refinancing can accomplish more than saving on mortgage interest. Here is a list of common reasons to refinance your home.

- Reduce the total interest paid over the life of the loan

- Reduce the cost of each monthly payment

- Shorten the length of the loan

- Change rate type

- Eliminate mortgage insurance premiums

- Draw cash out to pay off other expenses or higher-interest debts

Recommended Reading: How Does Rocket Mortgage Work

How Do I Lock In A Mortgage Rate

Once youve selected your lender and are moving through the mortgage application process, you and your loan officer can discuss your mortgage rate lock options. Rate locks can last between 30 and 60 days, or even more if your loan doesnt close before your rate lock expires, expect to pay a rate lock extension fee.

How Do I Qualify For Refinancing

Qualifying for a refinance is the same as qualifying for a purchase home loan, as lenders want to make sure you can afford the payments and that you will make them on time per your contract. Although each lender has different requirements, generally all lenders will look at your credit score, debt-to-income ratio , income and home equity.

For conventional mortgages, a credit score between 620 and 720 is preferred. The credit score minimum might also depend on your cash reserves, DTI and the loan-to-value ratio. Also, lenders usually reward high credit scores with the lowest available interest rates.

FHA loans have lower minimums than conventional mortgage refinances, but some lenders might apply a credit overlay, which means they will raise the minimum score to offset risk:

- 500 if your new loan has an LTV of 90% or less

- 580 if your new loan has an LTV of over 90%

There is no credit check for an FHA streamline refinance. There are also no credit score minimums for USDA or VA refinances however, lenders might apply their own standards to these refinances.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

How To Get The Best Refinance Rates

Much like when you shopped for a mortgage when purchasing your home, when you refinance heres how you can find the lowest refinance rate:

- Maintain a good credit score

- Consider a shorter-term loan

- Lower your debt-to-income ratio

- Monitor mortgage rates

A solid credit score isnt a guarantee that youll get your refinance approved or score the lowest rate, but it could make your path easier. Lenders are also more likely to approve you if you dont have excessive monthly debt. You also should keep an eye on mortgage rates for various loan terms. They fluctuate frequently, and loans that need to be paid off sooner tend to charge lower interest rates.

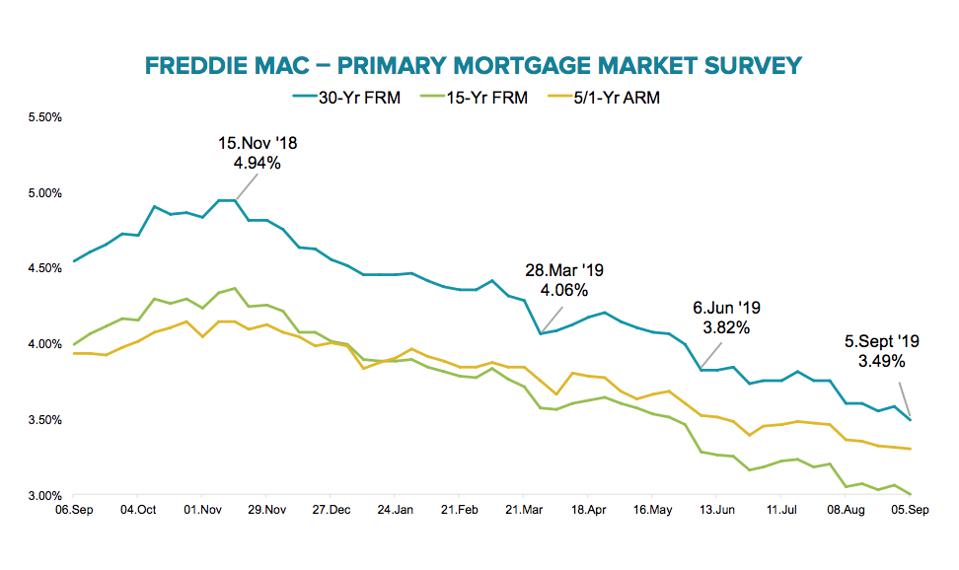

What Are Todays Refinance Rates

On Wednesday, January 05, 2022 according to Bankrates latest survey of the nations largest mortgage lenders, the average 30-year fixed mortgage refinance rate is 3.350% with an APR of 3.450%. The average 15-year fixed mortgage refinance rate is 2.580% with an APR of 2.730%. The average 5/1 adjustable-rate mortgage refinance rate is 2.700% with an APR of 3.990%.

Recommended Reading: Recasting Mortgage Chase

How Do Refinance Rates Work

Mortgage refinance rates vary by lenders based on a whole host of different factors. Some lenders might charge lower rates because they need more business and are able to take on more risk, for example. Likewise, lenders have different qualifications for getting low rates.

If youre considering refinancing to lower your mortgage rate, then youll want to compare interest rates and fees by lender. Many lenders dont disclose fees or even rates online so you might have to contact them and ask for a list of their fees and what their rates are.

In order to get an even more accurate description of how much the loan will cost you, you can apply for multiple loans and receive loan estimates based on your credit score, loan-to-value , debt-to-income ratio and other financial details.

What Is A Mortgage Refinance

Mortgage refinancing is when you replace one home loan with another in order to access a lower interest rate, adjust the loan term or consolidate debt. Refinancing requires homeowners to complete a new loan application and may involve an appraisal and inspection of the home. Lenders also rely heavily on an applicants credit score and debt-to-income ratio when deciding whether to extend a new loan.

In addition to the qualification process, refinancing costs can be substantial, totaling up to 6% of the original loans outstanding principal. So its important to consider whether a refi is the right move for you.

Read Also: Does Prequalification For Mortgage Affect Credit Score

How Often Can I Apply To Refinance My Mortgage

While you should only ever refinance your home with good reason, there are no rules that limit how often you can refinance. Lenders, however, will typically set a limit. Keep in mind that your credit report will be pulled each time you refinance, and when this happens too frequently it can negatively affect your credit score. Since your credit score is also a factor in a lenders decision to approve your refinancing, a lower score would also lower your chances of approval.

Why Consider Refinancing

Refinancing a mortgage is when you end your current mortgage and start a new one. You can do this with your current mortgage provider or a new one. If you’re refinancing your mortgage while you’re in the middle of an exiting mortgage term, you’re likely to be hit with a prepayment penalty – more on that below.

There are two main reasons youâd consider doing a refinance: To lower your existing mortgage rate, or to access the equity youâve built in your home as cash.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

What Is A Mortgage Rate

A mortgage rate is a percentage of the total loan amount paid by the borrower to the lender for the term of the loan. Fixed mortgage rates stay the same for the term of the mortgage, while variable mortgage rates fluctuate with a benchmark interest rate that is updated publicly to reflect the cost of borrowing money in different markets.

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

Recommended Reading: Rocket Mortgage Payment Options

When It Makes Sense To Refinance

Refinancing makes the most sense when you still have a significant amount of time left in your mortgage term. Since there are costs associated with a refi, you want to make sure you have enough time for the money spent to be worth it.

Refinancing is also best when interest rates are historically low so that you can take advantage of the best rates and pay less overall. Borrowers who think they could find lower rates or better terms should look into refinancing.

For example, if switching to a 30-year term from a 15-year fixed-rate loan would help you get a handle on your monthly payments, it may be worth it even if you pay more overall in interest.

There are a ton of different reasons to refinance, so ultimately the answer of when to refinance will be up to your goals and needs. If you need to refinance quickly after closing on your home because you realize your payments are too high or your employment situation has changed, while it may not make the most sense to someone else to refinance that quickly, it could get you out of a sticky financial situation. And that means its the right time for you.

In general, though, youll want to make sure that the rates are low enough to make sense, that youve done your due diligence in searching for a lender, that the new terms and conditions will fit your needs and that the new loan helps you to achieve your final goals.

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

Read Also: How To Get Preapproved For A Mortgage With Bad Credit

Amerisave Mortgage Corporation: Best For Refinancing

AmeriSave Mortgage Corporation is an online mortgage lender, available in every state except New York, offering an array of loan products. Along with conventional loans and refinancing, the lender also offers government loans, and is one of Bankrates best FHA lenders in 2021.

Strengths: Like other online mortgage lenders, AmeriSave Mortgage Corporation has some of the most competitive rates out there, and about half of consumers have had their loans closed in 25 days. The lender also doesnt charge a separate origination fee.

Weaknesses: Youll still need to pay a flat $500 fee.

> > Read Bankrate’s full AmeriSave Mortgage Corporation review

What If I Refinance The Mortgage On A Second Property

Refinancing a second property will be similar to refinancing a primary residence in many ways, except lenders may require you to have more equity in the property than if you were refinancing a home you lived in. Furthermore, rates on a mortgage refinance for a rental property may prove to be higher than if you refinanced the home you live in. This is because the lender knows that your first mortgage will be paid before the one on a second property in the event you default on your payments.

The same goes if you choose to refinance the mortgage on an investment property that you dont rent out. Rates will likely be higher than if you were simply refinancing the mortgage on your main residence.

Jessica Vomiero

About the Author

Jessica is the former Associate Editor for LowestRates.ca. Before joining the team, Jessica worked as a National Online Journalist with Globalnews.ca and previously spearheaded the launch of the Business Section at one of Canada’s largest technology websites, MobileSyrup.

Read Also: What Does Gmfs Mortgage Stand For

How To Compare Mortgage Rates

While online tools, , allow you to compare current average mortgage rates by answering a few questions, you’ll still want to compare official Loan Estimates from at least three different lenders to ensure you are getting the best mortgage rate with the lowest monthly payment.

After applying for a mortgage, the lender will provide a Loan Estimate with details about the loan. Pay specific attention to which lender has the lowest mortgage rate, APR, and projected principal and interest payment. Then review the Origination Charges located on the Loan Estimate under Loan Costs to see how much the lender is charging in fees . The higher the fees and APR, the more the lender is charging to procure the loan. The remaining costs are generally applicable to all lenders, as they are determined by services and policies the borrower chooses, in addition to local taxes and government charges.

What Is A Discount Point

Discount points are optional fees paid at closing that lower your interest rate. Essentially, discount points let you make a tradeoff between your closing cost fees and your monthly payment. By paying discount points, you pay more in fees upfront but receive a lower interest rate, which lowers your monthly payment so you pay less over time. Any discount points purchased will be listed on the Loan Estimate.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Does The Federal Reserve Decide Mortgage Rates

Although the Federal Reserve doesnt directly decide mortgage rates, it influences them when it changes short-term interest rates. Financial institutions like banks use these rates to borrow from each other, and these costs are usually passed onto borrowers. What this means is that if the Federal Reserve raises or lowers the short-term rates to guide the economy, lenders may do the same to their mortgage rates.