Mortgage Lenders Use A Tri

- Unlike most other creditors such as credit card issuers and auto loan lenders

- Mortgage lenders pull all 3 of your credit scores

- Then use the middle score for qualification purposes

- So all 3 need to be in good shape in order to receive the best pricing

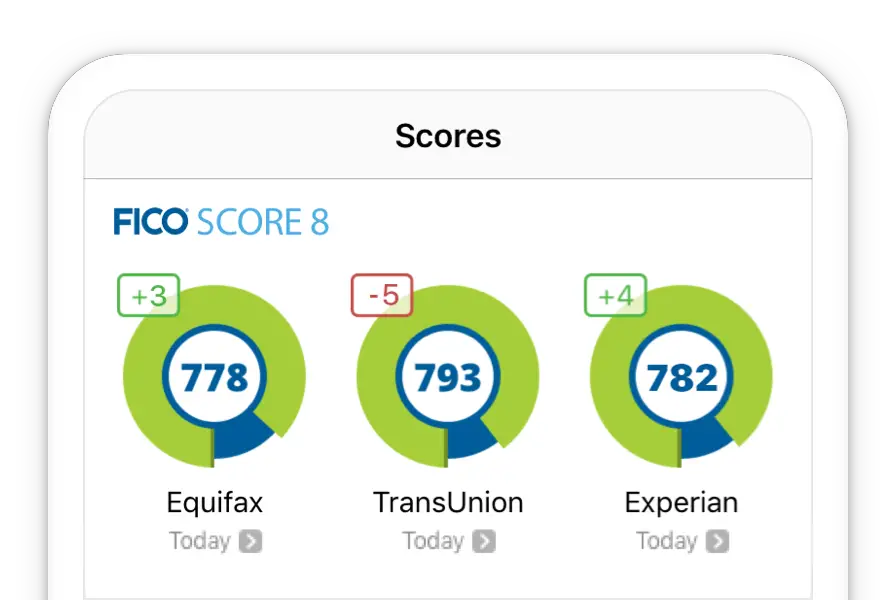

If you want to know where you stand beforehand, be sure to go with a service that allows you to see all 3 credit scores from Equifax, Experian, and TransUnion.

As mentioned, mortgage lenders typically pull a tri-merge credit report, which includes credit scores from all three of those bureaus.

The bureaus each report information a little differently, so knowing just one score wont do you much good.

Aside from the scores, payment history and amounts may differ, so its important to see them all.

As far as lenders are concerned, it basically allows them to triple-check your credit before making the decision to hand over a large sum of money.

They use the mid-score for pricing/qualification, so its imperative that all 3 credit scores are in tip-top shape.

How Your Credit Scores Are Made And Why They Matter

Since there are few numbers that matter as much to your financial wellbeing as your credit score, it helps to know what your scores mean and how they work.

First, know that theres a big difference between a credit report and a credit score.

- Your credit report is a record of your borrowing history Each loan or line of credit youve opened, dates on those accounts, payment history , and so on. Overall, it shows how reliably you manage and pay back your debts

- Your credit score sums up your credit report in a single number It weighs every item on your credit report to come up with an overall score that sums up how responsible of a borrower you are

The big three credit bureaus Equifax, Transunion, and Experian operate in the realm of credit reporting.

Each one keeps a separate record of your borrowing history, based on the information your creditors send them.

The other players in the game FICO and VantageScore are responsible for credit scoring. They determine your score based on whats included in those credit reports.

For example, keeping your credit utilization ratio low can help your credit scores, while repeatedly neglecting to pay your credit card bills on time can hurt them.

Which Credit Score Does Equifax Use

Equifax offers numeric credit scores that range from 280 to 850. 8 The Bureau uses similar criteria to FICO to calculate these scores, but as with Experian, the exact formula is not the same. However, a higher Equifax credit score usually indicates a higher FICO score.

Is Equifax a Vantage or FICO?

VantageScore is the result of a collaboration between three national credit bureaus Equifax, Experian and TransUnion. Both FICO and VantageScore assign higher credit scores to customers who are considered lower -risk borrowers, and both now range from 300 to 850.

Does Equifax use FICO 8?

Although released by FICO more than a decade ago, Score 8 is the version most frequently used by three major credit reporting companies: Equifax, Experian, and TransUnion. The FICO Score 8 model changes from the previous version in several key ways: It pays more attention to high-use credit cards.

You May Like: What Does Gmfs Mortgage Stand For

Ok So Which Of My 3 Fico Scores Do Lenders Use

When your lender pulls your credit, you will get not one but three scores. Thats because there are three main credit bureaus. Which one does the lender use?

The answer is your middle score.

As the name suggests, the middle score is the one in the middle of your three scores. For instance, if your credit report shows 690, 700, and 710, then 700 is your middle score.

If you are applying with someone else, the lender will use the lower of the two middle scores for eligibility purposes.

The following table demonstrates middle scores.

| Bureau |

Why Is My Mortgage Credit Score So Much Lower

There can be a disconnect between the credit scores you obtain for free and the ones your mortgage lender is using.

Typically banks, credit card companies, and other financial providers will show you a free credit score when you use their service. Also, credit monitoring apps can show free credit scores 24/7.

But the scores you receive from those thirdparty providers are meant to be educational. Theyll give you a broad understanding of how good your credit is and can help you track overall trends in your creditworthiness. But they arent always totally accurate.

Thats partly because free sites and your credit card companies offer a generic credit score covering a range of credit products.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back large debts.

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan.

Mortgage lenders, on the other hand, are required to use a unique version of the FICO score almost exclusively.

Since mortgage companies loan money on the scale of $100,000 to $1 million, theyre naturally a little stricter when it comes to credit requirements.

Mortgage lenders will use a tougher credit scoring model because they need to be extra sure borrowers can pay back those large debts.

So theres a good chance your lenders scoring model will turn up a different lower score than the one you get from a free site.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

How Does Your Credit History Affect Getting A Mortgage

Lenders use your credit report to get information on how reliable you have been at paying back debts in the past. When you apply for a mortgage you will have to supply payslips, P60s and bank statements to show how much you earn and what your monthly budget might look like. This shows lenders your current financial situation, but to predict how you might behave in the future they will also look at your credit report.

Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly youve borrowed in the past. Special introductory rates or other attractive mortgage offers might only be available to people whose credit history meets certain criteria.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580,youre in the realm of mortgage eligibility. With a score above 620 you shouldhave no problem getting credit-approved to buy a house.

But remember that credit is only onepiece of the puzzle. A lender also needs to approve your income, employment, savings,and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy ahouse and how much youre approved to borrow get pre-approved by a mortgagelender. This can typically be done online for free, and it will give you averified answer about your home buying prospects.

Popular Articles

Read Also: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Which Credit Scores Do Mortgage Lenders Use

When you apply for a mortgage, lenders will generally request all three of your credit reports and a FICO® Score based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

Fico 8 Mortgage Score

In October 2010, the Fair Isaac Company revealed its new Mortgage Score, based on the FICO 8 credit scoring formula. It is worth noting that FICO is always tinkering with its credit scoring formula, adding more factors, and increasing the sophistication of the measure. While we have a general idea of what is included in a FICO score, the truth is that the actual formula is a closely guarded secret. And, in addition to the more generic FICO score that we are all used to hearing about, FICO offers a number of different scoring products. These scoring products include those that rate depositor behavior for banks, as well as the FICO 8 Mortgage Score.

There are also many other types of credit scores, such as the VantageScore, and those provided by other fintech companies, such as and Credit Sesame.

As you might gather from the name of this score, the Fico 8 Mortgage Score is meant to help lenders figure out what sort of default risk you pose to them. On its web site, FICO describes the power of the FICO Mortgage Score:

The score includes 17 distinct scoring models, increased from the 12 included in the base FICO® 8 Score. This allows for more refined risk assessment of mortgage consumers thats better tuned to reflect mortgage-specific risk performance. Five segments evaluate the future risk among mortgage consumers, including first mortgages.

Modified date: Apr. 22, 2021

Editors note

So I did some research on the following questions:

Read Also: Can You Refinance A Mortgage Without A Job

How The 3 Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

- Equifax

- Transunion

- Experian

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge.

There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

Do Banks Use Fico Or Vantage

Mortgage lenders typically use FICO Scores 5, 2 and 4 when determining whether or not to approve a loan. Additionally, one type of credit score to keep an eye on moving forward is the VantageScore, a score that was developed by the three main credit bureaus and currently serves as a competitor to FICO.

Recommended Reading: Rocket Mortgage Launchpad

Length Of Credit History

of your FICO score calculation. The longer youve had credit accounts reporting to the major credit bureaus, the better.

How to maximize length of credit history

As indicated in the category above, never close open accounts just because they have no balance or you do not actively use them. Those aged and zero balance accounts still have benefit to you because they will continue counting in your length of credit history as older/aged accounts.

Why Does My Lender See A Different Credit Score

Some consumers who see their credit score before seeking loan preapproval are confused and frustrated when a lender comes up with a different number.

It’s important to understand that the educational score you get from FICO, Experian or another credit agency may not quite correlate to the more tailored credit score your lender sees. These specialized credit scores, which are weighted more toward mortgage-related factors, aren’t typically something you can get a look at ahead of time.

The good news is that prospective borrowers with solid credit shouldn’t have much if anything to worry about. But those in the bubble might have to put in a little more work in order to secure home loan financing.

Here are some other things that may be helpful to keep in mind:

Don’t Miss: How Much Is Mortgage On 1 Million

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How Can I Access My Credit Score

Per the Federal Trade Commission, you can pull one free copy of your credit report from each of the three main agencies per year.

You also may have frequent access to your score for free through your bank or credit card issuer.

Keep in mind that the free score you have access to through your bank or credit card company is not your comprehensive report, but it will give you a snapshot of where you are to help you get where you want to go.

Also Check: Chase Mortgage Recast Fee

The Basics: What Is A Fico Score

A FICO® Score is a credit score model from Fair Isaac Corporation that is used by thousands of lenders to help them assess the credit risk of individual consumers. Its a three-digit number ranging from 300 to 850, where higher is better , and has been the industry standard since the products founding in 1989.

Tom Quinn, vice president of Scores at FICO, says that there are numerous versions of FICO credit scores because they are periodically redeveloped to incorporate new analytic tools. Through the updating process, FICO releases new FICO Score versions to the market, at which point lenders determine if theyre going to migrate to a newer version of the FICO® Score or continue using the version they are currently using.

In addition, there are FICO® Score versions tailored to assess the credit risk for specific types of financial products. In addition to the base model, which is designed to predict the general risk of any credit obligation, Quinn points out that there are industry-specific versions focused on auto and bankcard risk.

According to myFICO.com, the industry-specific FICO credit scores leverage all the predictive power of the base FICO® Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking.

And then we have three bureaus, so you multiply everything by three, says Quinn.

Recommended Reading: What Is A Mortgage Deposit

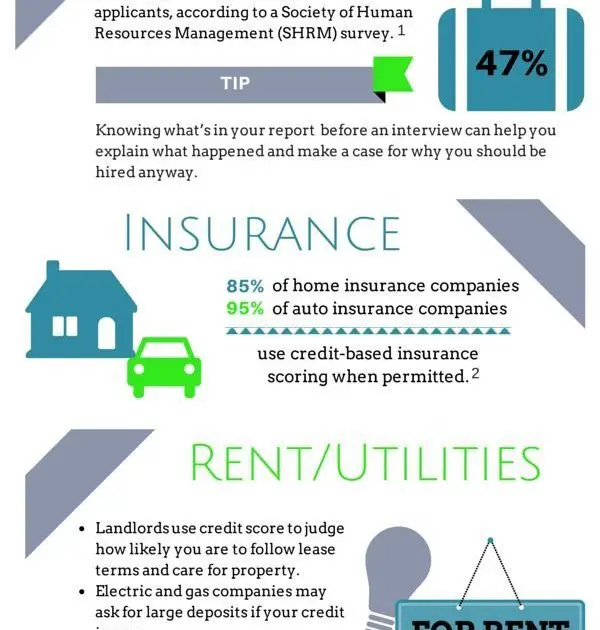

Qualifying For A Mortgage With Nocredit Score

Its possible to qualifyfor a mortgage even with no credit history.

Many individuals havepurchased everything with cash, which is a sign of fiscalresponsibility. Thats why most lenders can help you build a non-traditionalcredit report if you have no credit score or history.

The lender will take historyfrom accounts like rent, utilities, and even cell phone bills tobuild a score for you.

As long as youve managed thesetypes of accounts well in the past, theres a good chance you can get amortgage even with no credit score.

Recommended Reading: Reverse Mortgage For Condominiums

Improve Your Credit Scores Before Applying

The FICO® Score versions used in mortgage lending and the more recently released versions, such as FICO® Score 9 and 10, have the same 300 to 850 range. VantageScore, a competing maker of credit scores, also uses that range for its latest VantageScore 3.0 and 4.0 model credit scores.

For all these scoring models, which use the information from one of your credit reports to determine your score, a higher score is better. As a result, you may notice similar trends in all your scores. This is why making on-time payments can help raise all your credit scores, while missing payments could hurt all your scores.

However, there are also differences between the scoring models. For example, the latest FICO® and VantageScore models ignore paid collection accounts and give less weight to medical collection accounts. But the older FICO® Score models continue to count collection accounts against you after you pay off the balance.

In general, whether you’re looking to buy a home or take out a different type of credit, there are a few things that can help improve all your scores:

- Pay your bills on time.

- Pay down credit card balances.

- Don’t apply for other types of credit in the months leading up to your mortgage application.

In addition to getting your application, you want to get your finances in order as well. Saving up for a larger down payment, increasing your income and paying off debts may all help you qualify for a mortgage with better terms.

Predicting Consumer Credit Behaviors

This development is just one of a large number of efforts to further reduce consumer credit behaviors to numbers that can provide at-a-glance assessments for financial service providers. With technology in the digital age providing the ability to collect a great deal of information about you almost instantly, it is little surprise that more factors, from income estimates to deposit behaviors to what you say about money on social media to where you bought lunch yesterday, are being considered as part of yourconsumer credit risk profile. Indeed, we may be moving toward a system that can provide real-time updates to your credit score.

Also Check: Can You Get A Mortgage To Buy A Foreclosed Home

Recommended Reading: Recasting Mortgage Chase