Calculate Your Monthly Payment By Hand

You can calculate your monthly mortgage payment, not including taxes and insurance, using the following equation:

M = P /

P = principal loan amount

i = monthly interest rate

n = number of months required to repay the loan

Once you calculate M , you can add in the monthly property tax and homeowners insurance premium, if you have them. These are fixed costs that aren’t determined by how much you borrow from the bank, so they can easily be added to the monthly cost.

What Factors Determine How Much Your Repayments Are

There are four main factors that go into working your monthly home loan repayments, namely:

- The amount you borrow, otherwise known as the loan principal.

- Your interest rate, or the percentage of the loan principal you must pay back each year on top of any principal payments.

- The length of your loan. Generally, the longer the loan term, the lower your monthly repayments will be but the more interest youâll pay in the long run.

- Any ongoing fees and charges. This could include account fees, such as service and administration fees, as well as lenders mortgage insurance .

Why Use A Mortgage Repayment Calculator

Understanding roughly how much your monthly repayments will be is a crucial step in budgeting for a new mortgage. Taking out a mortgage at the upper end of your affordability may at first seem like a good idea but depending on the type of mortgage you decide to go for, mortgage rate increases could see you saddled with repayments that you cant afford. Instead, its best to opt for mortgage repayments that you can comfortably afford even if this means borrowing slightly less.

You May Like: How To Find Mortgage Payment

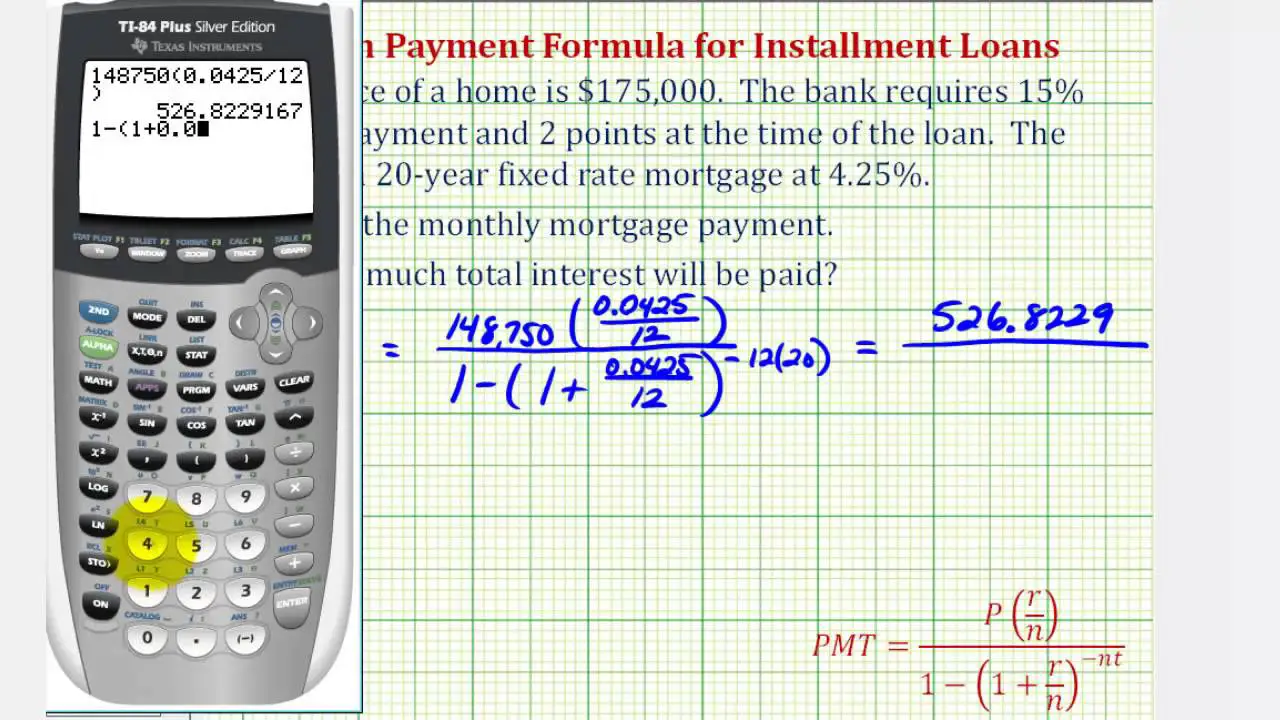

Formula For Calculating A Mortgage Payment

The mortgage payment calculation looks like this: M = P /

The variables are as follows:

-

M = monthly mortgage payment

-

P = the principal amount

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Comparing A $2000 Monthly Payment Frequency

| Payment Frequency | |

|---|---|

| $500 | $26,000 |

Monthly, semi-monthly, bi-weekly, and weekly all add up to the same amount paid per year, at $24,000 per year. For accelerated payments, youre paying an extra $2,000 per year, equivalent to an extra monthly mortgage payment. This extra mortgage payment will pay down your mortgage principal faster, meaning that youll be able to pay off your mortgage quicker.

This mortgage calculator allows you to choose between monthly and bi-weekly mortgage payments. Selecting between them lets you easily compare how it can affect your mortgage payment, and the amortization schedule below the Canada mortgage calculator will also reflect the payment frequency.

Also Check: What Is The Mortgage Rate For Bank Of America

How Are Mortgage Repayments Calculated

You essentially have two different things that you need to pay off when it comes to your mortgage – the sum you have borrowed, referred to as the capital, and the interest charged on that loan.

With a repayment mortgage, your monthly payment is made up of two different parts. Part of the monthly payment will go towards reducing the size of your outstanding debt, while the rest will go towards covering the interest charged on that debt.

Let’s look at an example. Say you’ve borrowed £200,000 for 25 years, at an interest rate of 3%.

Over the lifetime of the mortgage, you’ll be charged £84,478 in interest, meaning you need to pay back £284,478 over 300 months .

Your monthly repayment will be £284,478/300 = £948.

- Find out more: mortgage repayment calculator

What Happens If I Miss A Mortgage Repayment

If you miss a mortgage repayment, a mark will be left on your . This will dent your chances of being able to borrow in the future. That mark will remain for six years.

Falling behind on your mortgage repayments can also lead to serious problems with your mortgage lender, potentially even having the property repossessed.

If you are having money issues then its really important that you speak to your mortgage lender as early as possible as they may be able to help you by switching part of the loan to an interest-only basis, reduce your payments for a short period, or extend the mortgage loan so your repayments are more manageable.

If you are having money worries, its a good idea to speak to a debt charity.

Read Also: How Much Is The Mortgage On A $300 000 House

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how big your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a one million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

How To Calculate Your Monthly Mortgage Payment

You can calculate your monthly mortgage payments using the following formula:

M = P /

In order to find your monthly payment amount “M,” you need to plug in the following three numbers from your loan:

- P = Principal amount

- I = Interest rate on the mortgage

- N = Number of periods

A good way to remember the inputs for this formula is the acronym PIN, which you need to “unlock” your monthly payment amount. If you know your principal, interest rate and number of periods, you can calculate both the monthly mortgage payment and the total cost of the loan. Note that the formula only gives you the monthly costs of principal and interest, so you’ll need to add other expenses like taxes and insurance afterward.

Also keep in mind that most lender quotes provide rates and term information in annual terms. Since the goal of this formula is to calculate the monthly payment amount, the interest rate “I” and the number of periods “N” must be converted into a monthly format. This means that you must convert your variables through the following steps:

Example

N = 30 years X 12 months = 360

You May Like: Is Citizens Bank Good For Mortgages

How Do I Work Out How Much Interest Ill Pay On A Home Loan

Here is a simple formula to work out what interest you will pay on yourhome loan:

- Step one: Divide your interest rate by the number of payments youll make in 12 months.

- Step two: Multiply the answer by the balance of your loan. Remember if you are paying off your Principal and interest then your loan balance will reduce with each payment you make.

- Step three: This gives you the amount of interest you pay per month.

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

You May Like: What Are Current Mortgage Rates In Oregon

Extend Your Repayment Term

One of the simplest ways to reduce your monthly mortgage payments is by extending the duration of your mortgage term. Even though this way the overall cost of the mortgage over the entire tenure increases, your monthly financial pressure will be eased and you can feel more comfortable about your financial situation.

What Happens When Interest Rates Change

If you take out a variable rate home loan and the interest rate on your loan goes up or down, the amount of your mortgage repayments will go up or down also.

For instance, if you have a $500,000 principal and interest loan and your loan term is 30 years and your interest rate is 4%, your monthly repayments would be $2,387.08, excluding any fees.

If interest rates moved up to 4.5%, your repayments would go up to $2,533.43 a month, excluding fees. If interest rates went down to 3.5%, your repayments would go down to $2,245.22, excluding any fees.

Don’t Miss: How To Recruit Mortgage Loan Officers

How Much Interest Do You Pay

Your mortgage payment is important, but you also need to know how much of it gets applied to interest each month. A portion of each monthly payment goes toward your interest cost, and the remainder pays down your loan balance. Note that you might also have taxes and insurance included in your monthly payment, but those are separate from your loan calculations.

An amortization table can show youmonth-by-monthexactly what happens with each payment. You can create amortization tables by hand, or use a free online calculator and spreadsheet to do the job for you. Take a look at how much total interest you pay over the life of your loan. With that information, you can decide whether you want to save money by:

- Borrowing less

- Paying extra each month

- Finding a lower interest rate

- Choosing a shorter-term loan to speed up your debt repayment

Shorter-term loans like 15-year mortgages often have lower rates than 30-year loans. Although you would have a bigger monthly payment with a 15-year mortgage, you would spend less on interest.

How Much Money Can You Save By Overpaying

You can save significant sums of money by overpaying your mortgage. Here are a few examples, with all figures rounded to the nearest pound.

Say you had a £200,000 repayment mortgage with 20 years left to go with an interest rate of 3%. Your normal monthly payment would be £1,109.

If you increased this by £100 to £1,209, youd reduce the mortgage term to 17 years and 10 months, and so pay it off two years and two months quicker. Youd also reduce the total amount of interest you paid from £66,206 to £58,403, saving £7,803.

If you had the same mortgage and made a lump sum overpayment of £20,000 and kept your monthly payments the same, youd reduce your mortgage term by two years and seven months.

Youd also reduce the total amount of interest you pay from £66,206 to £51,165, saving £15,041.

If you did both these things made a £20,000 lump sum payment and overpaid by £100 a month youd reduce your term by four years and five months and save £20,797 in interest.

Read Also: What Does The Bank Need For A Mortgage

Your Estimated Monthly Payments Would Be

£—–

Based on borrowing at an interest rate of over

This is an estimated payment calculation based on the details input plus:

- Interest being calculated on a daily basis.

- No fees being added to the loan amount

- The same interest rate input being used for the duration of the term.

Leeds Building Society mortgages are available to UK residents only. Mortgage applicants must be 18 years or over. Mortgages are subject to eligibility, status and financial standing.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Get Approved For A Higher Mortgage

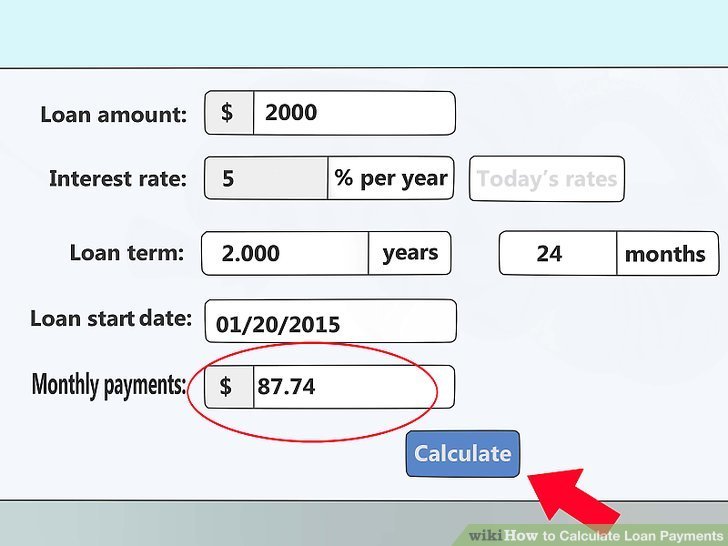

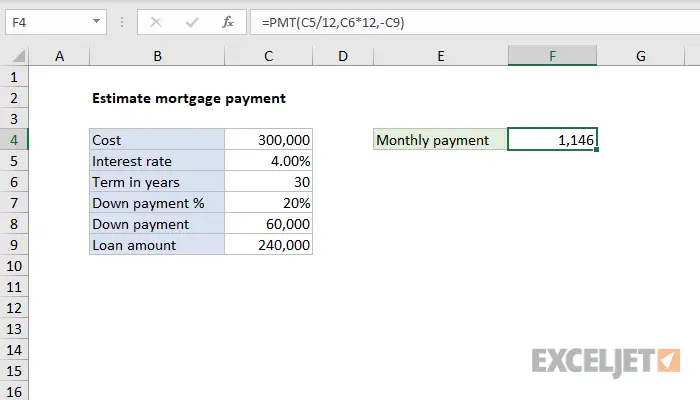

How To Calculate Mortgage Payments In Excel

Like me, you might have used an online mortgage calculator to predict your payments.

But how do those tools come up with your payment amount? Well, armed with Excel, you can easily calculate that magical number

You can download the spreadsheet from the link at the bottom of this post.

But I encourage you to read on for a step-by-step guide to calculating your mortgage payments using your favorite spreadsheet tool!

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed, which could result in a bill or a refund come tax season.

You can typically find your property tax rate on your local government’s website.

Don’t Miss: How To Get A 2nd Mortgage

What Mortgages Does Cmhc Insurance Not Cover

TheCMHC has eligibility requirementsthat limit the type of mortgages that can be insured.

CMHC insurance will not cover homes with a cost of $1 million or more.

Mortgages with an amortization period greater than 25 years are also not eligible for CMHC insurance.

You can still get CMHC insurance for mortgages with a down payment larger than 20%.

How Do I Work Out Monthly Mortgage Payments

Q Could you tell me the formula for calculating repayment mortgage monthly amounts?

A If you had asked how to calculate monthly mortgage payments for an interest-only mortgage, I’d have said: “Easy, all you have to do is multiply the mortgage amount by the percentage interest rate and divide by twelve.”

Sadly, the formula for calculating the monthly payments for a repayment mortgage is not that simple, as you will discover if you go to www.mortgagesexposed or any of the other sites I found by typing “formula for calculating repayment mortgage” into Google.

However, if you simply want to calculate what a potential mortgage repayment would be without getting involved in the mathematics of it, I suggest you go to the Guardian’s very own handy calculator

Recommended Reading: When To Get Prequalified For A Mortgage

Can I Reduce My Mortgage Repayments

You may be able to extend your mortgage term in order to lower your monthly mortgage repayments.

For example, if your mortgage is currently on a 25-year term and you move it to a 30-year term, your monthly repayments will fall as you are taking longer in order to clear the capital youve borrowed.

While this will reduce your monthly outgoings, it will increase the overall amount you repay. Because you are taking longer to clear the capital youve borrowed, youll also be charged interest for longer, meaning a larger total repayment.

Let’s look at an example. If you borrowed £200,000 over 25 years at an interest rate of 3%, you’d repay £948 and repay £284,478 in total.

Extending your term to 30 years will reduce your monthly repayments to £843, but you’ll repay 303,495 – an extra £19,000.

You may also be able to switch part or all of your mortgage debt onto an interest-only mortgage. Lenders may offer this as an option if you are experiencing some financial difficulties to help you avoid falling into arrears.

Remember, while this will mean lower monthly payments, you will still need to find a way to repay the capital you borrowed at the end of your mortgage term.

How Lenders Decide

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back. Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

Recommended Reading: What Is A Mortgage Modification Agreement

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.