Fico Weighs These Five Components To Come Up With Your Score

The often referred to as a FICO score is a proprietary tool created by FICO, the data analytics company formerly known as the Fair Isaac Corporation. FICO is not the only type of credit score available, but it is one of the most common measurements lenders use to determine the risk involved in doing business with a borrower. Here’s a look at what FICO examines to come up with its credit scores.

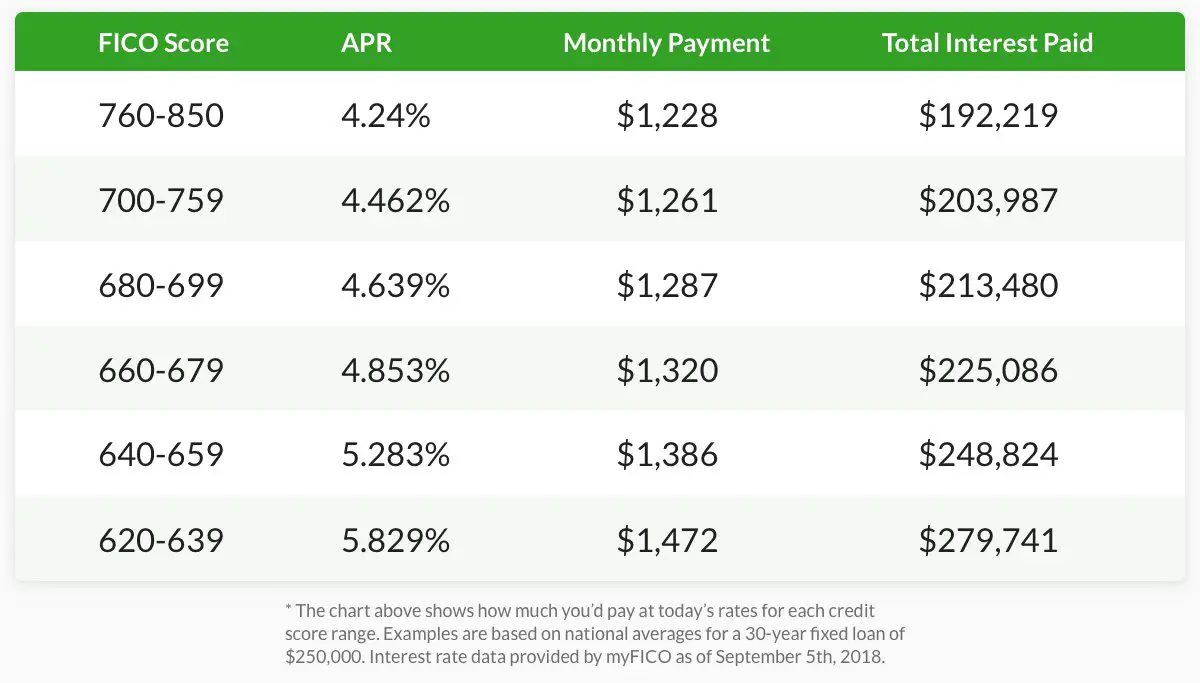

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

First Lets Talk About Credit Scores

Your credit score can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you dont need that score or above to buy a home. Credit scores are maintained by the national credit bureaus and include debt like credit cards, auto loans or student loans.

Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if youre likely to pay your future bills like your mortgage, for example.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

What Is A Fico Score

FICO is the type of credit score used by 90% of the U.S. lending community, including mortgage lenders. FICO scores are determined by your payment history, how much of your available credit youre currently using, how long youve had credit accounts , and how much new credit youve opened and applied for.

When you apply for a mortgage to buy a home, your lender will look at your FICO scores from the three major credit bureaus: Experian, Equifax, and TransUnion.

The information in your credit report contributes to your credit scores. Each of the credit bureaus maintain a credit profile on you that includes a detailed credit history, showing the types of accounts you have held or currently hold, and whether you paid them on time. Your credit report will show credit cards, student loans, car loans, personal loans, and past or current mortgages.

Your payment history is the biggest factor in your credit score. Other elements that influence it are your credit utilization ratio , and the age of your credit .

Below, youll see the minimum FICO credit score needed for popular mortgage loan programs.

Related reading: What Credit Scores Do Mortgage Lenders Use?

Read Also: Requirements For Mortgage Approval

Consider A Rapid Rescore

A rapid rescore is a request to one or more of the credit bureaus to recalculate your credit score within a matter of days. It can be used when a borrower is only a few points shy of qualifying for a loan or a better interest rate.

If you recently paid down significant debt and you want to buy a home, your lender might suggest a rapid rescore to help you qualify. It can take 30-45 days for the bureaus to update your score otherwise, so the rapid rescore option is necessary in some cases.

However, not all lenders offer rapid rescores. The process can cost up to several hundred dollars, depending on the request, and the expense falls entirely on the lender. They are legally forbidden from passing that cost onto borrowers.

But depending on your circumstances, they may decide its your best bet for qualifying for a loan or getting a significantly better interest rate.

If youre not sure where your credit score stands or what your options are, your loan officer can pull your score and come up with a gameplan when you apply.

The Right Time To Apply

Like any credit product, a loan should only be applied for when you are financially prepared to handle all your payments. Since defaulting can result in bad credit and create all sorts of financial problems for you, make sure you have a steady income, a good credit score, and even some security to offer, such as a cosigner or collateral.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

Is My Credit Score Good Enough For A Mortgage

Your , the number that lenders use to estimate the risk of extending you credit or lending you money, is a key factor in determining whether you will be approved for a mortgage. The score isnt a fixed number but fluctuates periodically in response to changes in your credit activity . What number is good enough, and how do scores influence the interest rate you are offered? Read on to find out.

Why A Higher Credit Score Is Key When Selling Your Home

Once you sell your home, you’ll need someplace else to live. If you’re selling and downsizing, you may have enough money from the sale of your home to avoid having to take out another mortgage.

But if you’re buying a similar home or a larger one after selling, you’ll probably need to borrow money to finance it. And the higher your at the time of your mortgage application, the more likely you’ll be to get approved. Furthermore, a higher credit score could be your ticket to a lower mortgage rate when you apply for a home loan.

Recommended Reading: Rocket Mortgage Conventional Loan

Pay Down Your Balances

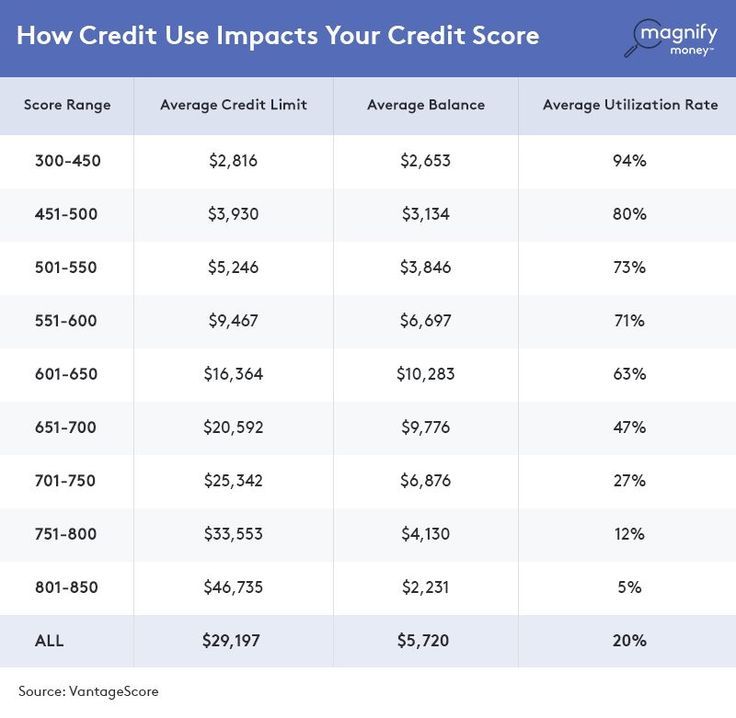

Another way to improve your credit score is to keep your utilization ratio low on your revolving accounts.. This means that you have more credit available than credit that youve used.

Experts recommend having a credit utilization ratio of 30% or less. So, if you have a credit card with a $5,000 limit, youd want your balance to be no more than $1,500. While 30% is the general rule of thumb, keeping the utilization at 10% is ideal and in many cases will provide best overall score outcome.

But the lower your balances are, the better you look to lenders and other creditors. Carrying high balances overtime can make it seem like youre struggling to manage your bills, and lenders may be concerned that youre more likely to default on loans or credit they offer you.

A low balance is easier on your budget, and it gives you a better chance at qualifying for new financial opportunities.

Used Credit Vs Available Credit: ~30%

A key part of your credit score analyzes how much of the total available credit is being used on your credit cards, as well as any other revolving lines of credit. A revolving line of credit is a type of loan that allows you to borrow, repay, and then reuse the credit line up to its available limit.

Also included in this factor is the total line of credit or credit limit. This is the maximum amount you could charge against a particular credit account, say $2,500 on a credit card.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

How Is A Credit Score Calculated On A Joint Mortgage

When two people decide to buy a house together, they have a lot to consider. You and your partner have likely talked about how you’ll combine your finances, share expenses and save for major purchases.

Buying a home is one of the biggest decisions people will make. You’ve probably kept careful track of your credit score and made sure not to do anything that could lower it.

But what about your partner’s credit score? If you and your partner decide on a joint mortgage, both of your credit scores will come into play. This guide will review how credit scores work, how they affect mortgage applications, how to calculate credit score on a joint mortgage and what to do if your partner has bad credit.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

You May Like: Chase Mortgage Recast Fee

What Numbers Do Mortgage Lenders Look At

Lenders use credit scores to determine a borrower’s level of risk.

Three credit bureaus Equifax, Experian, and TransUnion calculate an individual’s credit score. The higher your credit score, the better interest rate you’re likely to get which also means you’ll have a lower monthly mortgage payment. Before you apply for a mortgage, it’s a good idea to check your credit score and review your credit report to make sure everything is correct.

How To Get A Good Credit Score Faqs

How do you get a strong credit score?

The biggest steps you can take toward getting a good credit score are paying your bills on time and reducing your loan and credit card balances. On-time payments and credit utilization are the biggest factors in your credit score.

How can I raise my credit score quickly?

The best way to increase your score quickly is to pay down your balances and make sure to pay all bills on time. If you can pay down a significant portion of your balances, you may be eligible for a rapid rescore , which triggers the credit bureaus to update your file based on your new balances.If you have any collections on your credit report, it may be worth contacting them and asking if they will delete the account after payment is received.

How do I fix my credit score myself?

Although there are services out there that can help you fix your credit score, just know they can be very expensive and may not be able to offer any guarantees. Working on your credit alone may be more time consuming but will save you money, which you can use to pay down debts and help you qualify for a home much sooner.You can request copies of your credit score, pay bills, and dispute inaccurate or outdated information on your own. Making your payments on time and paying down, or paying off, your balances are the best things you can do for your credit score and you can do them without guidance from anyone else.

You May Like: How Does Rocket Mortgage Work

Qualifying For A Lower Mortgage Rate

It may be helpful to improve your credit score before applying for a mortgage so you can qualify for a lower mortgage rate and save tens of thousands of dollars over the life of the mortgage. The money you save on your mortgage is well worth the time and effort to improve your credit score.

If you have a low credit score, review your credit reports to see the items that are affecting your credit score. You can raise your credit score by making timely payments on all your bills, paying down your credit card debt, removing errors from your credit report, and paying off outstanding delinquent balances. In some cases, just a few points can make a big difference in your mortgage rate.

Continue to monitor your credit score in the weeks leading up to your mortgage application to see how your credit score improves.

How Much Interest Will I Pay On A Mortgage

You can use the Experian mortgage calculator to determine how much interest you can expect to pay on a loan for a specific amount, on a loan with a known repayment term and a set interest rate. In general, the amount of interest you pay will depend on the following:

- The total cost of the house: The more expensive the house, the more sizable loan youll need.

- The size of your down payment: The larger your down payment, as a percentage of the total home cost, the less money youll have to borrow in the form of a mortgage.

- The loan term: All else being equal, a longer loan term will mean smaller monthly payments, but more interest paid over the life of the loan.

-

The interest rate: The higher the interest rate, the more youll spend in total interest paymentand your mortgage interest rate is strongly influenced by your . Lenders typically offer their lowest interest rates to applicants with very good to exceptional credit scores. While it may be possible to get a mortgage with a credit score as low as 500, the interest rates associated with that loan will likely be relatively steep.

If your mortgage is a fixed-rate loan, you can calculate the amount youll pay each month with certainty. If you get an adjustable-rate mortgage , youll be charged an introductory interest rate for a specified number of years , and then the interest rate will change annually.

Read Also: 10 Year Treasury Vs Mortgage Rates

How Credit Reports Affect Your Mortgage

Before you start house hunting and getting pre-approved for a home loan, check your credit report and get your FICO scores. Why? Your credit rating may be the single most important piece of financial information you have to obtain a mortgage at the best interest rate.

Checking your credit rating before you purchase will give you time to correct reporting errors and to clean up your ratings if they are in the dumps. One lender tells us that it can take up to 90 days to get erroneous and costly information off your report, although some prospective borrowers say they have a much quicker outcome.

What Impacts Your Fico Score

In general, FICO scores are calculated based on five major factors, each with its own weight. Heres what impacts your FICO Score.

Payment History

Accounting for 35% of your credit score calculation, payment history is the most impactful component of your credit score. This metric includes several factors like the number and severity of late payments and the presence of adverse public records like lawsuits and bankruptcies. To improve your credit scoreor keep it strongmake consistent, on-time payments on all of your accounts.

Amounts Owed

The amounts owed category represents the total outstanding balances on all of your accountsor how much money you owe. As the second most important element of your credit score, it accounts for 30% of the calculation. For that reason, making more than the minimum payment each month and paying down debts quickly can improve your credit score.

Length of Credit History

In general, the longer your credit history, the higher your score. Even though the length of your credit history only accounts for 15% of your score calculation, it can be a frustrating metric to manageespecially if youre building credit for the first time. While you cant go back in time and open credit accounts sooner, you can strengthen this portion of your score by keeping your oldest accounts open and in good standing.

New Credit

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

What’s A Good Credit Score

Credit scores range from about 300 to 850. The higher your score, the less of a risk a lender believes you will be. The interest rate you’re offered will often drop as your score climbs.

Borrowers with a credit score over 670 are offered more financing options. But don’t be discouraged if your scores are on the low side. There’s a mortgage product for nearly everyone.

The average credit score in the U.S. reached a record high of 710 in 2020, according to a report from Experian, and 69% of Americans had a “good” score of at least 670.