The 30% Rule Ignores Your Full Financial Picture

Lets do some back-of-the-napkin calculations. Say youre making $30,000 per year and have no household debt. According to the 30% rule, youd be able to spend $750 per month on rent, which would leave roughly $1,300 a month for savings and expenses , after taxes.

Quick calculations: $30,000 / 12 months = $2,500 x .3 = $750 per month on rent and $1,300 a month left over for other payments and savings.

Sounds great until you start subtracting student loan payments and retirement savings . All of this could subtract another 15-20%, without accounting for food, entertainment, transportation, child care, additional debt or other savings.

Other Mortgage Qualification Factors

In addition to your debt service ratios, down payment, and cash for closing costs, mortgage lenders will also consider your credit history and your income when qualifying you for a mortgage. All of these factors are equally important. For example, even if you have good credit, a sizeable down payment, and no debts, but an unstable income, you might have difficulty getting approved for a mortgage.

Keep in mind that the mortgage affordability calculator can only provide an estimate of how much you’ll be approved for, and assumes youre an ideal candidate for a mortgage. To get the most accurate picture of what you qualify for, speak to a mortgage broker about getting a mortgage pre-approval.

How Much Mortgage Can I Qualify For

Lenders have apre-qualification processthat takes your finances into account to determine how much they are willing to lend you. Once the lender has completed a preliminary review, they generally provide a pre-qualification letter that states how much mortgage you qualify for. Get pre-qualified by a lender toconfirm your affordability.

Also Check: What Is The Highest Interest Rate On Mortgage

How To Use The Home Affordability Calculator

After entering in basic information about your annual income, monthly debts, savings and location, this online tool calculates a few different estimates you can use to begin your home search, such as:

- An estimate of how much home you can afford: Youll be presented with a range of home prices that are recommended based on your financial circumstances. By dragging the slider across the range, you can see the home prices youd be able to afford comfortably, the prices that would stretch your budget and those that would involve more risk.

- An estimated monthly payment: As you move the slider along the range, youll notice that the monthly payment changes based on the home price youve selected. Click on the breakdown below the monthly payment read out to get an estimate of how much youd pay in principal and interest, property taxes, homeowners insurance and private mortgage insurance .

- A breakdown of your monthly budget: Based on the information youve provided and the home price youve chosen, youll see an estimated analysis of your monthly budget on the right side of the screen. This budget will include the amount youd spend on your monthly mortgage and current debts as well as the amount of money youll have left over for other living expenses.

Since these online tools only provide estimates based on the information you enter, its useful to learn more about how home affordability is determined. In the sections below, youll find everything you need to know.

How Much Of Your Income Should You Spend On A Mortgage In The Uk

TL DR: You should try to spend no more than 35% of your gross income on your mortgage. A more conservative recommendation is no more than 25% of your gross income.

If you are currently in the market for a house you will first need to figure out exactly how much you can afford.

There are a lot of costs that go into buying a house and even a scrupulous planner can get overwhelmed by costs if they dont plan properly.

Inorder to figure out how much you can afford to spend on a house, youwill need to figure out:

- Your gross income

- Net cash flow

- How long of a mortgage you want

All of these factors go into determining how much you should be paying each month on your mortgage.

Before we go into specific recommendations for mortgage payments, were going to cover the major types of mortgages and how monthly mortgage payments are calculated.

Read Also: Is Rocket Mortgage And Quicken Loans The Same

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Second: Save At Least Your Annual Salary Before Taking Any Action

Keep saving until you have saved an amount equal to your annual income. This should cover your down payment and the other expenses associated with buying a house. If you purchase a home that is 4 times your annual income, 1 times your income is 25% of the value of the home, accounting for a 20% down payment and other home-buying expenses. Consider saving this amount first before taking any action.

Paying a 20% down payment is the ideal option in most cases, because you can avoid private mortgage insurance and save money in the long run. If you have trouble paying for a 20% down payment but still want the big house you’ve always dreamed of, you could benefit from selecting a nonconforming loan, like an FHA loan.

Note: You don’t have to borrow the full amount a mortgage lender will give you. “Just because a bank tells you that you can borrow $300,000 doesn’t mean that you should,” cautions Zhao. “And always compare all mortgage options available to you, because there might be a better option.”

Read Viewpoints on Fidelity.com: How to pick a mortgage: 5 considerations

Read Also: What Would My Mortgage Be On A 300 000 House

Take Advantage Of Lower Interest Rates

Besides buying a smaller home that has no wasted rooms, the next best thing is to get a mortgage with as low of an interest rate as possible.

Mortgage rates have actually been coming down since the late 1980s as the economy became more productive thanks to technology. Interest rates are closely coordinated around the world now and the Federal Reserve is more efficient in controlling inflation.

Below is a 10-year chart of average mortgage rates. As you can see, mortgage rates are at all-time lows.

The best way to get a low mortgage rate is to shop around online. And the best place to get multiple real quotes, all in one place is with Credible.

Credible is an online lending marketplace where qualified and vetted lenders compete for your business. All youve got to do is input your information and you should get real quotes to compare within three minutes.

How Do Lenders Determine How Much Mortgage I Qualify For

Before you figure out how much house you can afford, its useful to know how lenders calculate whether you qualify for a mortgage. Mortgage lenders determine your qualification based on your credit score and debt-to-income ratio .

Your DTI enables lenders to evaluate your qualifications by weighing your income against your recurring debts. Based on this number, lenders will decide how much additional debt youll be able to manage when it comes to your mortgage.

To see if youll qualify for a mortgage, you can begin by calculating your DTI:

Once you have calculated your DTI, you can evaluate whether its low enough to get approved for a mortgage. The lower your DTI, the more likely youll get approval.

If your total monthly debt is $650 , and your monthly income is $4,500 before taxes, your DTI would be 14%. A DTI of 14% is quite low, so youd be likely to obtain a mortgage.

Very rarely will mortgage lenders give a loan to an individual whose DTI is above 43%. After calculating your DTI ratio, if you find that its over 43%, youll need to work on lowering it.

Read Also: What Credit Score Do You Need For A Conventional Mortgage

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property that costs between two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

How To Calculate Mortgage Affordability

First, lets define mortgage affordability. Though its sometimes used in reference to the cost of living in a particular city relative to the average income in that area, you should think about it as the amount a bank or financial institution will allow you to borrow based on your income, debt and living expenses.

Your mortgage affordability is based on:

- Your annual income before tax

- Your monthly debt payments, which includes credit cards, loans and car payments

- Housing costs such as property taxes, heat and half of your condo/HOA fees . For the latter, only half the amount is used, because condo fees can cover things like property maintenance, insurance and some utilities, which are not used in debt-service calculations for other types of properties.

According to the Canadian Mortgage and Housing Corporation, a mortgage is affordable when your gross debt service ratiowhich accounts for your housing costsdoesnt exceed 39%. To be considered affordable, your total debt service ratiowhich accounts for housing costs as well as other debt obligationsmust not surpass 44%.

Don’t Miss: How To Get Assistance With Mortgage Payments

Save A Bigger Down Payment To Make Your Home More Affordable

Remember, your down payment amount makes a big impact on how much home you can afford. The more cash you put down, the less money youll need to finance. That means lower mortgage payments each month and a faster timeline to pay off your home loan! Just imagine a home with zero payments!

Now, were always going to tell you that the best way to buy a home is with 100% cash. But if saving up to pay in cash isnt reasonable for your timeline, youll probably wind up getting a mortgage.

If thats you, at the very least, save up a down payment thats 10% of the home price. But a better idea is to put down 20% or more. That way you wont have to pay private mortgage insurance .

PMI protects the mortgage company in case you dont make your payments and they have to take back the house . PMI is a yearly fee that usually costs 1% of the total loan value and isyou guessed ityet another expense thats added to your monthly payment.

Lets backtrack for a second: PMI may change how much house you thought you could afford, so be sure to include it in your calculations if your down payment will be less than 20%. Or you can adjust your home price range so you can put down at least 20% in cash.

Trust us. Its worth taking the extra time to save for a big down payment. Otherwise, youll be suffocating under a budget-crushing mortgage and paying thousands more in interest and fees.

What Percentage Of Your Income Can You Afford For Mortgage Payments

Modified date: May. 31, 2021

These questions often come up among first-time home buyers:

- What percentage of my monthly income can I afford to spend on my mortgage payment?

- Does that percentage include property taxes, private mortgage insurance , or homeowners insurance?

Today we tackle these questions to help make your home buying experience a little easier.

Whats Ahead:

Don’t Miss: How To Negotiate The Best Mortgage Rate

What Salary Do You Need To Buy A $400k House

Now lets take what weve learned and put it into action with an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment.

With a 15-year mortgage at a 3% interest rate, your monthly payment could be around $2,200 . To manage that payment, youd need to be earning at least $8,800 as your monthly take-home pay .

So, to buy a $400,000 home, youd need to be earning a take-home salary of more than $105,000 per year . Keep in mind, youd actually need more than that after you add the cost of property tax and home insurance into your mortgage.

If that doesnt sound like you, dont worry. Try saving a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

Use A Mortgage Calculator

Another popular way prospective homebuyers determine how much mortgage they can afford is by using a mortgage calculator. There are plenty of these types of calculators available online including one from mortgagecalculator.org.

Mortgage calculators factor in such costs a home’s sale price, homeowners’ insurance, HOA fees, loan terms , interest rate, and down payment, in order to provide an estimate of your approximate monthly mortgage payment.

“Online calculators will give a potential homebuyer an idea on the principal and interest payment,” Ray Rodriguez, regional sales manager in Metro New York for TD Bank, tells Parents.“They may also help determine a down payment. They can be useful, but do not address other costssuch as taxes and insurance.”

You May Like: What’s Taking Out A Second Mortgage

How To Determine The Percentage Of Income For Mortgage

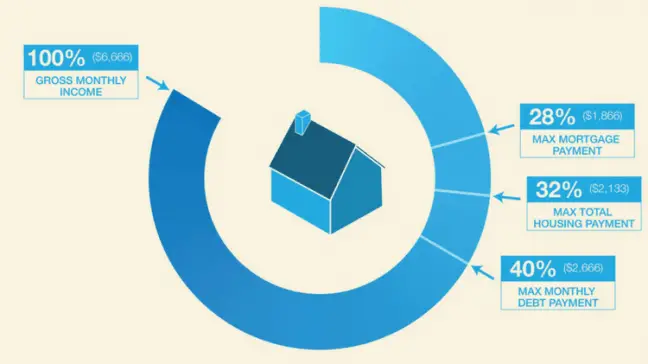

When you purchase a home, its vital to know what percentage of your income will be saved for your mortgage . Housing ratios and debt-to-income ratios are ways of calculating the percentage of gross income for mortgage payments and who qualifies for mortgage loans. Debt to income ratios work using the 28/36 rule , which well explain in detail later in this post.

What is the housing ratio? Simply put, the housing expense ratio is a ratio that compares your pre-tax income to housing expenses on the real-estate market. Lenders use this calculation when they decide who will qualify to borrow for a loan.Understanding what percentage of your monthly income should go to your mortgage payments can help you budget and live comfortably. Nobody wants to be house poor, struggling to make ends meet in order to make mortgage payments.

If youre wondering what is another term for housing ratio ? Its sometimes referred to as the front-end ratio as it is a partial component of a borrowers total debt-to-income. Therefore, it should be considered early in the underwriting process for a mortgage loan.

Dont worry, well be explaining front-end ratios, back end ratios, gross income, net income, and mortgage percentage payments as you read on. We will follow this up with some essential guidelines for obtaining an affordable mortgage.

But first, lets answer a fundamental question:

The Traditional Model: 35%/45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time home buyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. I wouldnt call 35% of your pretax income on mortgage, property tax, and home insurance payments conservative. Id call it average.

Don’t Miss: What Is A Good Ltv For Mortgage

Learn More About Specific Loan Type Rates

The lower the interest rate on your mortgage, the less expensive your monthly payments will probably be. If you’re searching for a home and want to get a mortgage, it pays to compare mortgage rates for several loan types.

Purchase Rates

Were firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.