How Much Do I Need To Earn To Get A Buy

Some Buy to Let mortgage providers will require you to earn a minimum of £25,000 per year in order to apply for a Buy to Let mortgage.

That being said, some lenders will also take the amount of potential rental income youre likely to achieve into consideration.

As a general rule of thumb, most lenders will expect you to charge 25% 45% more than your mortgage repayment in rent as this provides sufficient income to pay your mortgage as well as any unexpected bills or repairs that may need doing.

$650000 House At 400%

| $1,733 |

Mortgage Tips

- Get a free copy of your to make sure there are no errors which might negatively affect your credit score.

- Shop around. Make sure to get multiple mortgage quotes. Over 30 years, a difference of 0.25% in APR might end up being over $10,000 in extra payments!

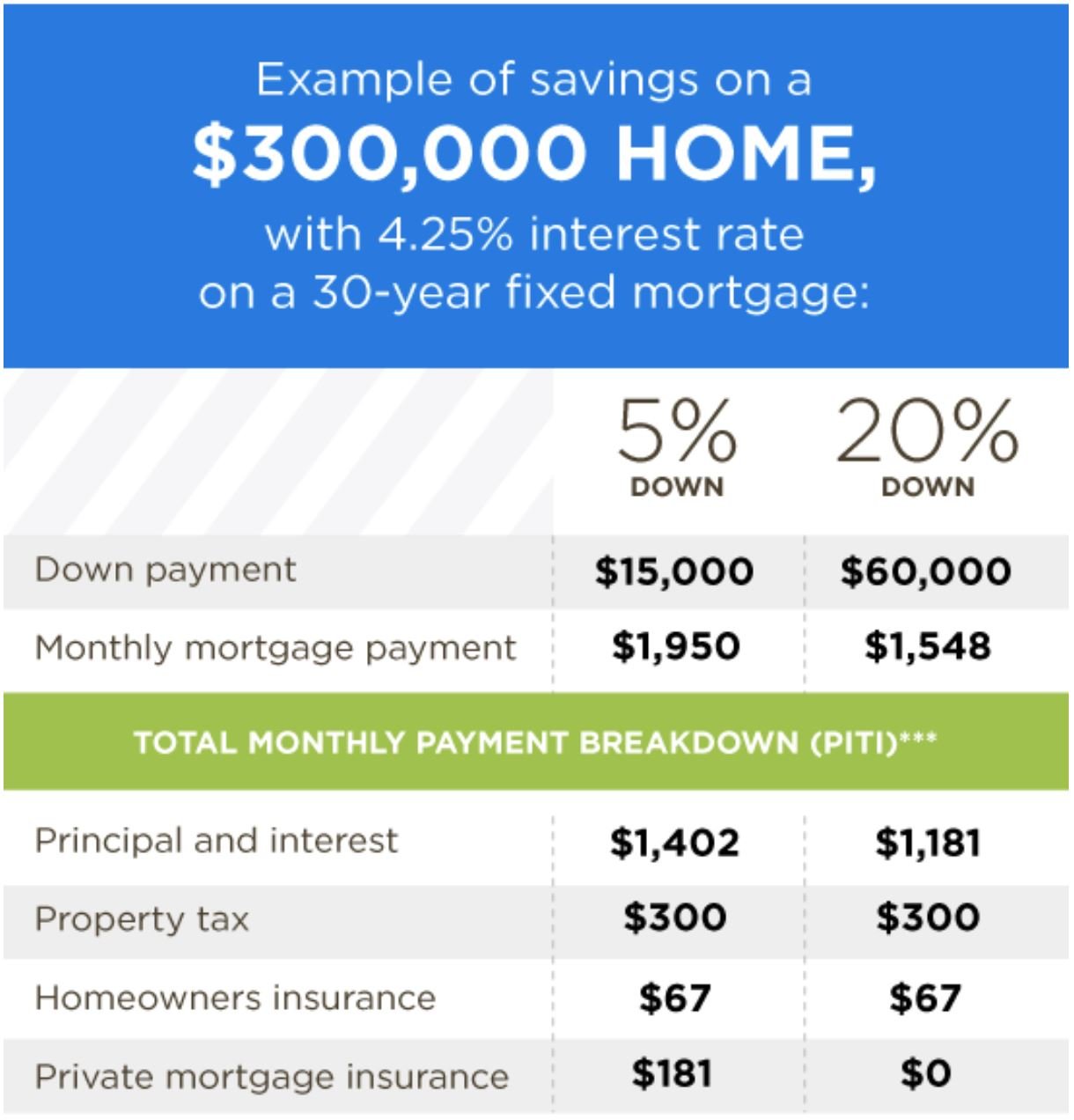

- Bigger down payments are better. You can often qualify for a mortgage with as little as 3.5% down. But, unless your down payment is at least 20%, you will likely have to pay Private Mortgage Insurance . This can add significant cost to the price of the mortgage.

Can I afford a $650,000 house?

Traditionally, the “28% rule” means a person should not spend more than 28% of their pre-tax income on total housing costs.

Let’s assume that taxes and insurance are 2% of the house price annually. Here’s how much you’d have to make to afford a house that costs $650,000 with a 4.00% loan:

| % Down |

|---|

How Much Mortgage Can I Afford

The general rule of thumb for mortgage eligibility is that you can borrow around four times your annual household gross income, and no more than 32% of your gross income should go for housing and mortgage expenses. However, there are more factors involved in calculating your mortgage affordability amount and consequently, the real calculation is more complicated. Your monthly non-housing expenses, such as food and utilities, and also your monthly debt payments are involved as they reduce the amount of income you have for your mortgage payments. A quick way to check is to use amortgage payment calculatorto see how much payments are required every month.

For example, say you have an annual household income of $140,000 and have saved $70,000 for a down payment. Your monthly non-housing expenses are $2,000, youre paying off your student debt at around $300 monthly and your car loan costs you $400 per month. Thats $2,700 from your monthly income to start with. Your mortgage affordability, the amount you can afford to spend on a home, works out at $658,000.

You can find out how much you can afford by using ourmortgage affordability calculator.

Try out the mortgage stress test using ourstress-test calculator.

Recommended Reading: Can You Write Off Points On A Mortgage

Scotland Stamp Duty Rates

The equivalent of stamp duty in Scotland is the Land and Buildings Transaction Tax, or LBTT. Itâs calculated in âbandsâ, which means you pay different rates on different âportionsâ of the property price.

| Property price | |

|---|---|

| £0 â £145,000 | 0% |

| £145,001 â £250,000 | 3% |

| £250,001 â £325,000 | 5% |

| £325,001 â £750,000 | 10% |

Hereâs an example for a property worth £300,000:

- Youâll pay 0% on the first £145,000 = £0

- Then 2% on the next £105,000 = £2,100

- Finally, 5% on the last £50,000 = £2,500

Total LBTT = £4,600

Down Payment Assistance Programs

Some provincial and municipal governments offer financial assistance to first-time home buyers. This can be in the form of transfer tax rebates, income tax credits, or direct cash payments. Some programs include down payment assistance, which may be in the form of an interest-free loan that will cover the down payment for a new home purchase.

For example, New Brunswicks Home Ownership Program provides an interest-free loan of up to $75,000 for first-time homebuyers with an income under $30,000.Manitobas Rural Homeownership Programprovides a forgivable loan of up to 25% of the purchase price of select rural properties.provides an interest-free loan of up to 5% of the purchase price of a home to cover the minimum down payment.

Federally, theFirst-Time Home Buyer Incentivehelps provide interest-free financing through a shared equity mortgage, of up to 10% the purchase price of a newly constructed home, or 5% for existing homes.

Also Check: Does Discover Bank Do Mortgages

Wales Stamp Duty Rates

The equivalent of stamp duty in Wales is the Land Transaction Tax, or LTT. Itâs calculated in âbandsâ, which means you pay different rates on different âportionsâ of the property price.

| Property price | |

|---|---|

| £0 â £180,000 | 0% |

| £180,001 â £250,000 | 3.5% |

| £250,001 â £400,000 | 5% |

| £400,001 â £750,000 | 7.5% |

Hereâs an example for a property worth £300,000:

- Youâll pay 0% on the first £180,000 = £0

- Then 3.5% on the next £70,000 = £2,450

- Finally, 5% on the last £50,000 = £2,500

Total LBTT = £4,950

Other Ontario Closing Costs

There are a number of other Ontario closing costs to consider when purchasing a home.

Legal fees: There are many legal aspects to consider when purchasing a home. With that in mind, its important to hire an experienced real estate lawyer to review all of your paperwork and help you finalize your transaction.

Home Inspections: Its wise to use an home inspector before purchasing a home, to make sure the home youre about to buy is in good condition.

Also Check: How Do Mortgage Appraisals Work

Can I Add Stamp Duty To My Mortgage

If youâve forgotten to factor the costs of stamp duty, you could use some of your deposit to pay, if you can afford to.

You might be able to borrow more on your mortgage to cover the costs of stamp duty, but youâll have to reduce your deposit so that the deposit and mortgage add up to the purchase price.

Usually, itâs not a good idea to increase your mortgage this way, and better to pay stamp duty from the savings you have, if possible. Thatâs because adding stamp duty to your mortgage means youâd need to borrow more money on your mortgage. And that has two effects:

It could raise your mortgage interest rate. Thatâs to do with your loan to value . LTV is a percentage showing how much of the property value youâre borrowing. The lower your LTV , the lower interest rates you get.

Adding your stamp duty to your mortgage would increase your loan to value ratio, so you might have to pay more interest on your mortgage â which could increase your monthly mortgage payments.

It could mean you end up paying far more stamp duty in the long term. Your mortgage term is usually around 25 years. If you add stamp duty to your mortgage, it means youâll have to pay back interest on that amount over all those years â and that could add up to thousands.

Get advice from your mortgage broker before you make a decision â they can help you figure out all the numbers and see which option is right for you.

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

- Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

- Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

- Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

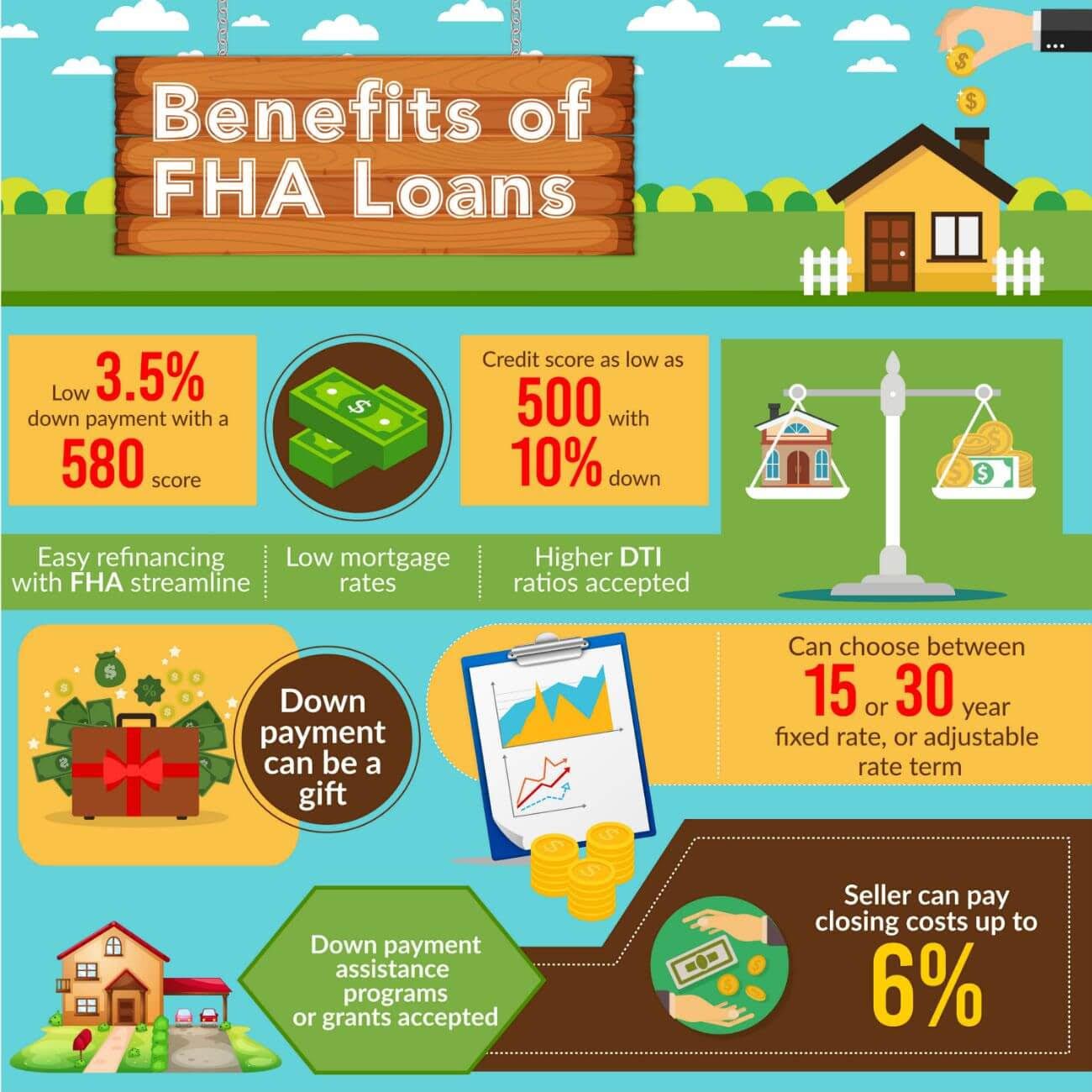

- Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

- Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

Recommended Reading: Is A Hecm The Same As A Reverse Mortgage

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

How Much Income Is Needed For A 200k Mortgage

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

Also Check: Why Is Mortgage Cheaper Than Rent

Land Transfer Tax In Ontario

Ontarios land transfer tax is calculated as a percentage of the propertys value, using the purchase price as an estimate. The LTT is a marginal tax with rates varying from 0.5% to 2.0% of a homes value depending on its purchase price. For detailed information on rates and calculations see our Ontario land transfer tax page.

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

You May Like: What Is The Current Interest Rate On An Fha Mortgage

Income To Afford A 15 Million Dollar House

As they say, go big or go home.

So, forget the1.5million dollar home. Drive right by the 5 million dollar house, and dont even bother calling to ask about the ten million dollar house you saw on TV.

Head right over to the 15 million dollar home and give it a test drive.

Sure, it is true that most lenders wont offer loans that will cover 15 million dollars. Youll have to get a jumbo loan, but what the heck, you dont mind paying a bit more when it comes to closing costs or your monthly mortgage payment.

Youre living large, so go for it.

To buy this baby youre going to need to make $3.5 million dollars per year and your monthly mortgage payment will be $81,854 dollars each and every month.

The truth is when youre buying a home you want to make sure it is one you can afford. Dont let the lenders or real estate agents talk you into a more expensive home than you need.

Take the time to check out many properties and make a budget before you go. Make sure the purchase price is in your budget and stick to it.

Thats how you can get the home of your dreams and not have it turn into a nightmare down the road.

To Sum it All Up:

Real estate is expensive and you might be surprised just how much you need to make a year to get a mortgage lender to loan you the money you need for a 30-year fixed-rate mortgage. For a $650k house, you will need to make at least $119,000 dollars per year to really be able to afford it.

See Your Credit Scores From All 3 Bureaus

Do you know what’s on your credit report?

Learn what your score means.

FHA.com is a privately-owned website that is not affiliated with the U.S. government. Remember, the FHA does not make home loans. They insure the FHA loans that we can assist you in getting. FHA.com is a private corporation and does not make loans.

Also Check: How Many Times Annual Salary For Mortgage

How Much Income Do I Need For A 650k Mortgage

You need to make $199,956 a year to afford a 650k mortgage. We base the income you need on a 650k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $16,663.

You may want to be a little more conservative or a little more aggressive. Youre be able to change this in our how much house can I afford calculator.

What Is Home Equity

Home equity is the difference between the value of your home and how much you owe on your mortgage.

For example, if your home is worth $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

Your home equity goes up in two ways:

- as you pay down your mortgage

- if the value of your home increases

Be aware that you could lose your home if youre unable to repay a home equity loan.

Read Also: Does Pre Approval For Mortgage Affect Credit

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

Don’t Miss: Can Your Mortgage Go Up

How Much Do I Need To Earn As An Older Borrower

Some mortgage providers cap the maximum age a borrower can be at application or at the end of the mortgage term which can be frustrating if you are an older borrower.

The reason for this is lenders are concerned that you wont be able to meet the mortgage repayments once you enter retirement.

However, there are lenders who will consider older borrowers, if they can prove that their income will be sufficient enough throughout the duration of the mortgage.

Mortgage providers may ask for proof of your income which could be from employment, savings, a pension or benefits.

To find out how much you will need to earn as an older borrower, speak to an expert.

The advisors we work with can talk you through the process and highlight which lenders may be willing to approve your mortgage depending on your income and other variables.

Alternatively, for more information on lending in later life, visit our section on here.

How Much Do I Need For A Deposit

If you have started saving you can start to look at buying once you have at least 5% of the purchase price.

If you have between 5% and 20% of the purchase price, you may need to pay whats called Lenders Mortgage Insurance, which enables us to lend you a larger percentage of the purchase price. This can be included either in your upfront costs or in your loan repayments so that its spread out over the term of the loan.

The estimates below do not take into account the money you need for upfront costs.

Don’t Miss: How Much Should You Pay For Mortgage

How Much Would A $650k Mortgage Cost

So you are thinking about getting a $650k mortgage but want to know what exactly it will cost you.

There are many aspects to consider when applying for a $650,000 mortgage. This includes the down payment, monthly payments, interest rate, and mortgage length.

A 15-year $650k mortgage could save you a considerable amount of money compared to a 30-year mortgage when taking interest into account.

Below you will find how much you could expect to pay each month with various interest rates. On top of that, you will also find the different down payment options explained in detail so you can choose the best way to go about getting a $650,000 mortgage.

This post may contain affiliate links. For more information, see our disclosure policy.