Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

On the day this was written, Freddie Macs weekly average rate for a 30year, fixedrate mortgage was 2.99%. But the daily equivalent on Mortgage News Dailys website was 3.13%. So theres clearly a lot of variance across the market.

Home Equity Lines Of Credit

A HELOC is a secured form of credit. The lender uses your home as a guarantee that youll pay back the money you borrow. Most major financial institutions offer a HELOC combined with a mortgage under their own brand name. Its also sometimes called a readvanceable mortgage.

HELOCs are revolving credit. You can borrow money, pay it back, and borrow it again, up to a maximum credit limit. It combines a HELOC and a fixed-term mortgage.

You usually have no fixed repayment amounts for a home equity line of credit. Your lender generally only requires you to pay interest on the money you use.

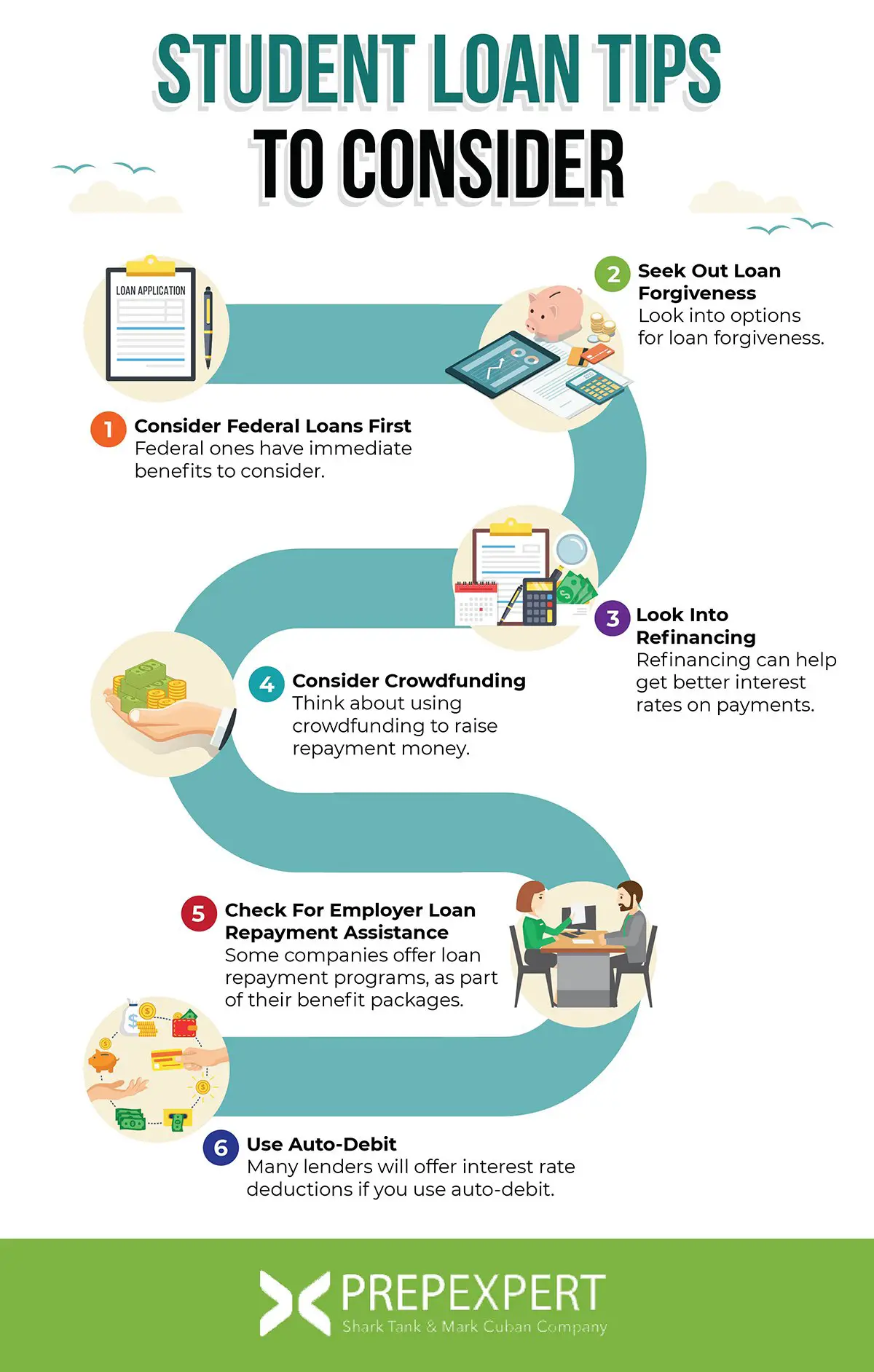

Consider Paying For Interest Point Reductions Up Front

When you pay points at your mortgage closing, youre essentially paying a fee in exchange for a lower interest rate. Your lender may also refer to these as discount points, mortgage points, or prepaid interest.

One point is generally 1% of the loan amount. The amount each point reduces your interest rate depends on the lender.

Paying points makes the most sense when you know youll be in the home for a longer period of time. It takes time for the reduced interest rate and lower monthly payment to recoup the money you pay up front for points.

Don’t Miss: Reverse Mortgage Mobile Home

How Is Apr Calculated

-

Add the fees to the loan amount.

-

At the loan’s interest rate, figure what the monthly payment would be if you include fees in the loan amount rather than pay them upfront.

-

Convert that “would-be” payment into an interest rate.

The result is the annual percentage rate. Here’s an example:

You get a $200,000 mortgage with an interest rate of 4%, and you pay $6,000 in upfront fees. The monthly principal and interest payment is $954.83. But if you added the fees to the loan amount, the monthly principal and interest would be $983.48. When you convert that “would-be” payment into a monthly and then annual rate, it comes out to 4.25%. The loan has an APR of 4.25%.

Shop Around To Find Your Best Interest Rate

Mortgage lenders personalize your interest rates based on your credit history and other details about your financial life. So you wont know for sure what your rate options look like until you apply and get preapproved.

The first rate youre quoted may not be your best interest rate. Be sure to apply with several lenders so you can compare Loan Estimates and find your best deal.

You May Like: Chase Recast Calculator

Make Upgrades Easy To Find

Your lender will order an appraisal to make sure that your home’s value matches up with your new loan. One of the factors that influences the value of your property is the type of upgrades youve added to your home since you bought it. Certain upgrades might be a bit difficult for an appraiser to spot on their own.

Be present for your appraisal and give your appraiser a list of all permanent upgrades youve made to your property. Include receipts from contractors, as well as estimates and permits if applicable. Dont be afraid to walk through your home with your appraiser and point out all the additions youve made. This will help increase the overall value of your property.

Respond To Lender Inquiries Quickly

Most refinances take 30 45 days. You can ensure that your refinance goes through quickly and smoothly by responding to any inquiries from your lender as soon as possible. Your lender might ask for additional documentation supporting your credit, work or financial history during underwriting. Try to send these documents to the lender within a few days of their request and include your contact information in case they have any more inquiries.

When your lender finishes underwriting your loan and reviewing your appraisal, theyll send you a document called a Closing Disclosure. Your Closing Disclosure includes the final terms of your loan, your closing costs, your interest rate and more. Your lender must give you at least 3 days to review your Disclosure after you receive it. Be sure to acknowledge that you have your Closing Disclosure as soon as you get it.

Also Check: What Does Rocket Mortgage Do

Check Your Credit Report Before The Mortgage Lender Does

You need to convince mortgage lenders that you’ve got the financial discipline required to pay back your mortgage. One way they investigate this is by searching your credit report to find out if you’ve a good repayment history.

Your credit report lists details from any accounts you’ve had open over the past six years, including:

The three credit reference agencies in the UK are Experian, Equifax and TransUnion. It used to be that checking your credit report would cost you, but these days you can do it for FREE. See how to access your Experian, Equifax and TransUnion credit reports in our Check your credit report for free guide.

It is worth checking that each of them is up to scratch, as you don’t know which one your future mortgage lender will check.

Can I get a mortgage with a bad credit score?

Having a poor credit history might not automaticallyrule out your chances of getting a mortgage, but it certainly runs the risk of scuppering them. To give yourself the best chance possible of acceptance, take the time before you apply for a mortgage to get your credit report into good shape.

For tips and help on how to bolster your credit report, see our guide.

Quick questions

Start To Shop Around Early

Just how soon can you renew a mortgage? Sure, you may be a few months away from your mortgage maturity date, but they say the early bird gets the worm! This phrase rings especially true with the mortgage renewal process.

While your current lender will likely send you that renewal slip some time in the last 30 days of your mortgage term, you can usually start negotiating as early as 120 days before your maturity date. To ensure youâre ready, find the maturity date on your mortgage contract and count 120 days back on a calendar.

If you canât negotiate a better offer with your current lender, this gives you time to start considering switching providers. You may not be able to switch your mortgage over until your actual renewal date arrives, but this gives a mortgage broker time to give you mortgage renewal advice and find the best product. It also allows time to get the paperwork ready, so youâre not left scrambling at the last minute.

Don’t Miss: Does Rocket Mortgage Sell Their Loans

Find The Right Real Estate Agent

Most home buyers work with a real estate agent, especially first-time buyers. As your advocate throughout the home-buying process, they will help you in so many ways, including finding properties and negotiating a fair price.

When you’re ready to find a real estate agent:

- Look for an agent who is familiar with first-time buyers.

- Make sure they work in the area where you’re purchasing your property.

- Check the number of past sales they’ve had in your price range.

And make sure you ask about fees. As a buyer, you do not have to pay a real estate agent. The seller will pay the agent a commission that’s usually equal to 3% to 6% of the value of the home you purchase. For more information, check out our guide to finding the best real estate agent.

Check Your Bank Statements

As a part of verifying your assets, mortgage lenders ask to take a look at your bank statements. And if youre a tip earner, your bank statements will probably have plenty of cash deposits.

For folks with salaried jobs and regular paychecks, lots of weird cash deposits are a red flag. Cash coming in that cant be traced can indicate unreported or illegal sources of income, under-the-table loans, or other shady business. So mortgage underwriters look very carefully at cash deposits.

But of course, you are a smart tip earner. And you know that lenders will trust your bank statements more than your personal ad hoc spreadsheet. If youve been carefully depositing tip money instead of spending it willy-nilly, you may well be making multiple, legitimate cash deposits every week.

So heres our advice. In the months leading up to your mortgage, keep a detailed record of where each of your cash deposits came from. Print out your shift schedule, and keep it somewhere safe.

When you deposit tips into your bank account, make a note for yourself about how much you earned per shift, and which deposits go with which dates. You dont need anything fancy for this. But when a mortgage underwriter asks about the cash deposits, youll be ready to provide documentation.

Great Reads

Don’t Miss: Does Getting Pre Approved Hurt Your Credit

Explore Mortgage Loan Types And Shop Around For Rates

Loans with favorable terms keep borrowing costs and payments low. There are different types of mortgage loans for first-time buyers, including:

- Government-backed loan: The FHA loan, VA loan, or USDA loan has lower down payment requirements. Check out this first-time home buyer’s guide to FHA loans to learn more.

- Conventional mortgage: This loan type isn’t guaranteed by the government and can be harder to qualify for.

Also, decide on your loan term and whether you want a fixed-rate mortgage or an adjustable-rate mortgage. ARMs only have a fixed payment for a limited time, after which rates adjust and could rise. Sometimes first-time buyers take the risk of an ARM if it provides a low starting rate.

Shop around with several lenders and compare loan offerings and rate quotes to find the most affordable loan. If you still need more help, look into these types of first-time home-buyer loans.

Carefully Manage Your Available Credit

This is all about how much credit you have available to spend on credit cards and overdrafts. It’s the difference between your combined debit balances on your cards and bank accounts and your combined credit limits/overdraft limit.

You need to strike a balance between not having too much as lenders may think you could rack up more debt by spending it all and not getting too close to your limits, which makes it seem you’re at the edge of your finances. Here’s what credit agency Experian says:

This is an art, not a science, and all lenders’ views of how much credit you ‘should’ have differ. Try to average around 25% of your available credit, but if you need to use more then definitely keep it below 50% in all cases. Of course, if you can pay off debt, you should do so.

You May Like: How Does Rocket Mortgage Work

Hammer Out A Deal At Auction

Auction properties can be cheaper than market values. There are properties out there for under £20,000, but auctions don’t always equal bargains. Research and renovations are usually needed.

If you’re considering bidding, go to a couple of auctions first to get a feel for the process. Visit properties several times. You must get a survey to reveal any horrors – there could well be hidden defects that meant the seller had to go to auction.

Always enlist a solicitor to inspect the auction pack. If you buy a property with major legal issues that need sorting, it may not be the bargain you thought it would be.

Plus do confirm the previous tenants have handed over the keys and the property is unoccupied. If the repossessed property was previously owned by a buy-to-let landlord, it’s possible that the property may be resold with a tenant in situ.

Remember that the contract comes into force on the fall of the auctioneer’s hammer, so you cannot pull out without huge cost after the auction.

You need finance in place before bidding

Unless you’re lucky enough to be a cash buyer, you’ll need to get finance in place before bidding. Call your broker and get a ‘mortgage promise’, which lets you know the maximum amount you can borrow.

This isn’t a formal mortgage though – most lenders will not give this until you have found a specific property and they’ve sent a valuer round. If the mortgage company disagrees with your valuation, they may not approve the deal.

Get The Offset Advantage

You have probably heard that it is a good idea to get a loan with a mortgage offset account, but you may not realise just how powerful and profitable it is.

Short version: an offset account lets you use every dollar you have twice both for its intended purposes and to cut your mortgage interest bill.

Any money held in an offset account reduces your loan balance. So, it is the savviest place for funds you need to keep safe, as they will save you more money against the loan than you would earn in interest by having it sitting in the bank.

We are talking any savings for holidays, a new kitchen, school fees whatever you have stashed. You should also aim to hold emergency funds equal to six months salary in the offset account if you can afford it.

Just what do you stand to save by adopting this strategy?

On a $400,000 loan at an average 5 per cent interest rate, having $30,000 in an offset account at all times would slash your interest bill by $66,000 and the time in debt by almost 2.5 years. For free.

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Take A Targeted Rather Than Shotgun Approach To Mortgage Applications

Remember that whenever you apply for a loan, including a mortgage, the hard inquiry the lenders make shows up on your credit report and temporarily lowers your score. Applying for several mortgages in a two week period only counts as one inquiry, but if you drag it out and canvas as many lenders over a longer period, youll end up doing damage to your score, which could result in a lower rate than you were hoping for.

Standard Or Collateral Charge

When choosing a loan product, make sure to ask if it comes with a standard or collateral charge. A first or second mortgage with a collateral charge means that you may be able to take out a home equity line of credit later on, however, it makes it tougher to move your mortgage when it comes up for renewal.

Because of that, your lender is less likely to offer you its best mortgage rates upon renewal. Make sure you know what youre signing up for before signing on the dotted line.

Read Also: Rocket Mortgage Vs Bank

Save 100s On Gas And Electricity

As soon as you move into your new place you’ll need to start paying for energy. It can be cheaper to switch rather than sticking with the previous owners’ energy supplier. Those on energy providers’ standard tariffs can save £100s a year by switching.

You can still compare, even if you don’t have previous bills from your new house. Just tell our Cheap Energy Club some info about the new house and whether you’re a high, medium or low user. It’ll show the cheapest tariff for you.

This won’t be 100% accurate as it makes some assumptions, but it will give you good options, likely to be far cheaper than the default standard tariff you’ll be put on when you moved in.

Finally, don’t forget to take meter readings when you move in.

Ask For A Better Mortgage Rate

With those little mortgage renewal slips, lenders make it too easy for you to answer the should I renew my mortgage now? question, by providing a quick and easy way to renew. They know youâre busy and that youâll pay for this convenience. On average, mortgage providers only offer their existing customers a discount off their posted rate on a renewal slip. But this isnât the lowest possible rate, even from your current lender. On top of that, there are usually lower rates available from other lenders.

Negotiating mortgage renewal for a better rate becomes even more important in a rising rate environment. Hereâs a chart outlining how much you could save by asking for a better rate on a $300,000 mortgage with a 20-year amortization.

| Current Rate | |

| +$358.04 | +$56.57 |

Letâs say your mortgage matures next month and that you had previously agreed to a five-year fixed rate at 2.74%. Your current lender may offer you a discount of 0.25% off the posted rate for a new rate of 4.89%.

That would mean monthly payments of $1,953.60. However, shopping around could mean securing a much better rate for the next five years. Maybe youâll secure a five-year fixed rate at 2.94%. If you were to qualify at that rate, your monthly payments would be a much more manageable $1,652.13, saving you $301.47 per month.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home