When Not To Pay Extra

Paying extra on your mortgage can be helpful but it isnt always the best use of your money.

Whether you should pay extra on your mortgage or not depends on the rest of your financial picture. If you have credit card debt, an expensive car loan, or other high-interest debt, youll want to pay that down before making extra payments on your mortgage, Matthew McEwan, VP of real estate development and property management firm Medallion Capital Group, said.

Additionally, if you are a savvy investor who can tolerate some risk, you may be able to achieve a higher rate of return by investing that money instead, McEwan said.

Want To Make Irregular Payments Do You Need More Advanced Calculation Options

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

Four Alternatives To Paying Extra Mortgage Principal

Before you begin making extra principal payments on your mortgage, its best to consider your overall financial goals. Consider how long you plan on living in the home. Assess any money that you can foresee needing in the future . And determine any current debts you are still paying on.

Assessing your current financial position and your future goals will help identify the ideal use for additional funds or maybe even prove that paying more on your mortgage is advantageous.

So, conversely, what are the alternatives , and what could the benefits be?

You May Like: Reverse Mortgage On Mobile Home

Mistake #: Not Considering All Of Your Options

It can be very tempting if you come into some extra money to put that toward paying your mortgage off ahead of time. However, getting out of debt a little bit earlier may not be the most remunerative choice to make. To illustrate this, lets look at an example.

Lets say youre considering making a one-time payment of $20,000 toward your mortgage principal. Your original loan amount was $200,000, youre 20 years into a 30-year term, and your interest rate is 4%. Paying down $20,000 of the principal in one go could save you roughly $8,300 in interest and allow you to pay it off completely 2.5 years sooner.

That sounds great, but consider an alternative. If you invested that money in an index fund that represents the S& P 500, which averages a rate of return on 9.8%, you could earn $30,900 in interest over those same 10 years. Even a more conservative projection of your rate of return, say 4%, would net you $12,500 in interest.

Everyones financial situation is unique, and its very possible that the notion of being out of debt is so important to you that its worth a less than optimal use of your money. The important thing is to consider all of your options before concluding that paying off your mortgage earlier is the best path for you.

How Much Will You Save By Making Extra Payments

The amount you can save by making extra mortgage payments is one of the first things you need to figure out as that number will enable you to compare it to other options. Lets take a look at how much you could save on interest over the life of a 30-year, $200,000 loan with a 3.5% interest rate if you paid $50, $100 and $250 extra each month.

| Extra Monthly Payments | |

| $43,638 | 9 years, 7 months |

Just paying an extra $50 per month will shave 2 years and 7 months off the loan and will save you over $12,000 in the long run. If you can up your payments by $250, the savings increase to over $40,000 while the loan term gets cut down by almost a third.The savings can be substantial. Use a mortgage calculator to figure out your estimated savings. Then, compare that to the savings or returns you can get by investing the same money elsewhere.

Don’t Miss: Rocket Mortgage Vs Bank

How You And Your Property Affect Mortgage Rates

- That super low advertised mortgage rate sure looks good

- But be sure to check out the fine print

- You probably have to be an A+ borrower

- And you might need to pay discount points too

Also note that the par rate you see advertised on TV and the web often dont take into account any mortgage pricing adjustments or fees that could drive your actual interest up considerably.

Generally, a lender will showcase a mortgage rate that requires perfect credit, a 20% down payment, and is only available on an owner-occupied single-family home, as seen in my fictitious mortgage rate ad illustration above.

If your down payment or credit score isnt that high, or your home equity is low, your mortgage rate may creep higher as well.

Occupancy and property type will also drive rates higher, assuming its a second home, investment property, and/or a multi-unit property. So expect to pay more if thats the case.

If you do put less than 20% down, youll also have to factor in mortgage insurance, which if not explicitly charged, is usually built into the rate.

There are also loan amount restrictionspricing can change depending on if the home loan is conforming or jumbo. Typically, monthly payments are higher on the latter, all else being equal.

In other words, YOU and your property matter as well. A lot!

If youre a risky borrower, at least in the eyes of prospective mortgage lenders, your mortgage rate may not be as low as what you see advertised.

Mortgage Rate Forecast For 2022 And 2023

Wondering if mortgage rates are going up or down in 2022 and the year after? Wonder no longer.

The following table provides 2022 mortgage rate predictions for the 30-year fixed from well-known groups in the industry, along with a 2022 estimate.

Take them with a grain of salt because theyre not necessarily accurate, just forecasts for future rate movement.

| Mortgage Rate Predictions |

Don’t Miss: How Much Does Getting Pre Approval Hurt Credit

Beware Of Mortgage Early Repayment Charges

Mortgages come with rules regarding how much you’re allowed to overpay by each year. But many come with limits, such as a maximum of 10% of the remaining balance each year. Overpay by more than this and you will be charged mortgage early repayment fees. Paying off your mortgage early with a lump sum can also incur this charge.

This is called an early mortgage repayment fee, and could cost you thousands of pounds, so check your overpayment limit with your lender first.

The Best Way To Pay Off Your Mortgage: A Complete Guide

Modified date: Nov. 24, 2021

Having a mortgage is a beautiful thing because it means youre putting equity into a valuable asset. At the same time, nobody likes to have debt looming over themand mortgages come with a lot of debt. So many people wonder how to pay off their mortgage in the most timely manner.

You may be surprised to learn that there are plenty of ways you can do this. Most of them involve finding ways to make extra payments, but there are also some other tips you can use too. For example: Switching your payment frequency and refinancing for a better deal.

Heres my guide to paying your mortgage off faster, no matter what your means.

Whats Ahead:

Also Check: 10 Year Treasury Vs Mortgage Rates

Refinance With A Shorter

A shorter term on the mortgage means it goes away sooner, but at the cost of a much higher monthly payment and perhaps some out of pocket closing costs. Examine the loan closely.

The monthly payment on a 30-year, $200,000 mortgage at 2.5% would be $790 a month.

The monthly payment on a 15-year, $200,000 mortgage at 2.25 % would be $1,310.

Thats another $520 a month to finish paying off your mortgage 15 years sooner.

30 Years vs 15 Years of Payments| 30 Years of Payments |

|---|

| $235,830 |

| *For a $200k mortgage |

The bottom line on this decision is the bottom line: Can you afford the higher monthly payment of a 15-year loan, or are you better off contributing extra each month when you can to a 30-year payment?

Double Up On Regular Payments Whenever Its Feasible

Instead of making an additional annual payment, you can choose to increase the amount of your monthly payments. If possible, double each payment, so youre paying twice the minimum. If youre able to do that every month, youll pay your mortgage off in half the time.

Even if you can only do this a few times throughout the year, each payment will help. Furthermore, you dont have to go full double to reap the benefits of this method.

Laura Adams, better known as Money Girl, says even minimal extra sums will help: Lets say you have a $100,000, 30-year, fixed-rate mortgage at 4.5%. If you add an extra $100 to your payment each month, youd pay it off almost nine years earlier and save over $26,000 in interest.

Don’t Miss: Does Prequalifying For A Mortgage Affect Your Credit

Economic Activity Impacts Mortgage Rates

- Keep an eye on the economy as well to determine mortgage rate direction

- If things are humming along nicely, mortgage rates may rise

- But if theres fear and despair out there, low rates may be the silver lining

- This all has to do with inflation or a lack thereof

Mortgage interest rates are very susceptible to economic activity, just like treasuries and other bonds.

For this reason, jobs reports, Consumer Price Index, Gross Domestic Product, Home Sales, Consumer Confidence, and other data on the economic calendar can move mortgage rates significantly.

As a rule of thumb, bad economic news brings with it lower mortgage rates, and good economic news forces rates higher. Remember, if things arent looking too hot, investors will sell stocks and turn to bonds, and that means lower yields and interest rates.

If the stock market is rising, mortgage rates probably will be too, seeing that both climb on positive economic news.

And dont forget the Fed. When they release Fed Minutes or change the Federal Funds Rate, mortgage rates can swing up or down depending on what their report indicates about the economy.

Generally, a growing economy leads to higher mortgage rates and a slowing economy leads to lower mortgage rates.

Inflation also greatly impacts home loan rates. If inflation fears are strong, interest rates will rise to curb the money supply, but in times when there is little risk of inflation, mortgage rates will most likely fall.

How Does One Payment Matter

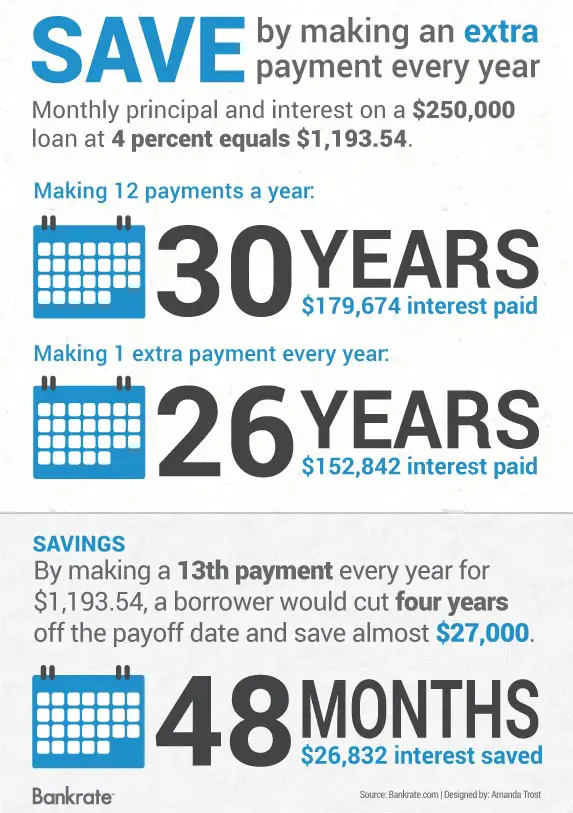

Making an extra payment to your mortgage is something that you should consider because it can save youthousands ofdollars. The fact is that just one payment can make a considerably difference in the total that you payforyour home and what’s more, it can shave years off of that mortgage. Take a look at the followingexample.You can use a mortgage calculator to help you to find out this information specific to your currentloan.

If you currently have a $200,000 mortgage loan and you have secured an interest rate at 6.5 percent, yourmonthlypayment is likely to be $1264 dollars per month if your loan term is 30 years. This is a considerablepaymentand you may not realize that the real facts of what you will be paying on the home you are purchasing.It willcost you far more than $200,000.

Original mortgage amount: $200,000Total interest paid on your loan: $255,088.98How much you will really pay in fullat the end of your term: $455,088.98

This information is provided to you on your amortization statement which is what you will see at the timeof closingthe sale on your home. Your lender must provide this for you before you sign your paperwork, so itshould notbe too much of a surprise to you as to how much you will pay for your home when interest is factoredinto the cost.If you are still unsure, use a mortgage calculator to help you to see what these numbers are for yourparticularsituation.

Don’t Miss: Rocket Mortgage Loan Types

Can You Pay Off Your Mortgage Early

In most cases, homeowners can pay off their mortgage early, provided you follow certain ground rules and make sure the terms of your loan.

The first step is to recognize how your payment works. Early in a 30-year loan, the bulk of the payment goes toward loan interest. As the loan is closer to completion, the bulk goes toward the amount you borrowed, or the principal. But if the principal is lowered through extra early payments, the interest paid also is lowered. Paying down principal in the long run will reduce the total interest paid on the loan.

The more the principal is paid, the more the homeowner builds equity in the home. To easily figure the equity, calculate a fair price you feel the home is worth then subtract the loan balance. If a home could be sold for $300,000 and you have $150,000 left on the loan, you have $150,000 in equity.

When considering paying the mortgage early, be sure you know the answer to a question that many, especially first-time homebuyers, often do not consider: Is there a prepayment penalty on your loan? Many lenders do not have this penalty, but those that do will charge for making early payments. If you have any uncertainty, call your lender to ask specifically about prepayment penalty.

Once that question is answered, be sure to tell your lender if and when you make extra payments that you want that money applied to principal.

Pay Off Credit Card Debt

If youre having a hard time with like many Americans, its more than likely you dont have enough available cash to commit to paying extra on your mortgage. Your credit card rates are going to be significantly higher than your home loan interest rate so it makes sense to tackle credit card debt first. Credit cards typically carry the highest cost to borrow with an average variable interest rate of about 16%.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

Downsides Of Paying Off Your Mortgage Early

Although there are many benefits to paying off your mortgage early, there are still some downsides to consider before making that decision. The first potential issue is that it costs money to refinance. Youll pay similar fees to what you paid for closing costs on your first loan, so if you arent planning to stay in your home for a while, the costs could outweigh the savings.

Your money may be better off used elsewhere, too. Most people know whether they will be able to pay this monthly mortgage payment based on their salary, expenses, and other debts. You need to make sure you can afford to pay off your loan early before you commit to it. Dont stretch yourself too thin if you cant afford to.

You must ask yourself whether or not that money would be better used for something else. Lets say, for example, that paying off your mortgage early means youre not putting as much money into savings for a rainy day. Well, even if your house is paid off, youll still need money to pay for unexpected expenses or emergencies.

Or perhaps you could be using that money for other investments instead. If you have a low interest rate, you may be able to make more off of interest from low-risk investments than you would save by paying off your loan early. In that case, it may be smarter to invest the extra money instead.

Also Check: Does Rocket Mortgage Service Their Own Loans

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.