Do I Qualify For A Mortgage

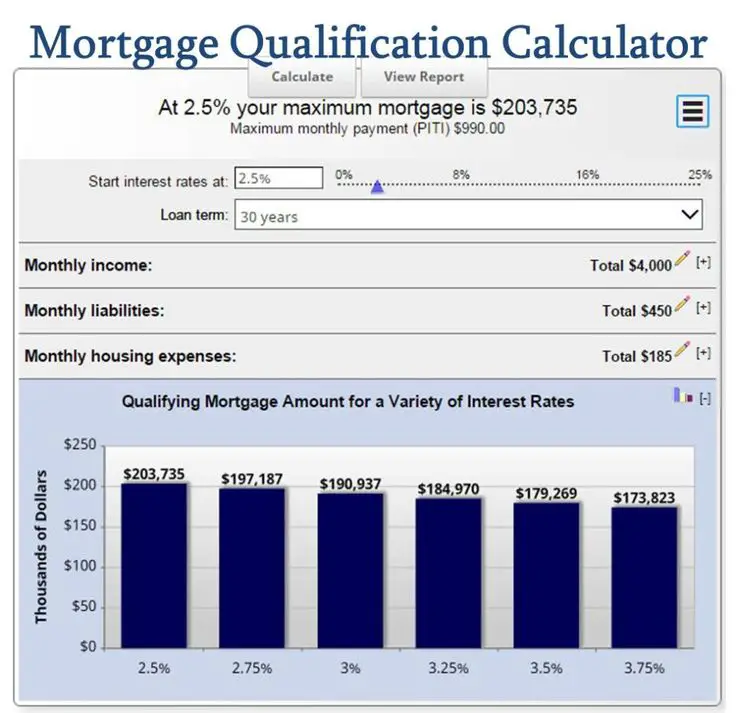

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

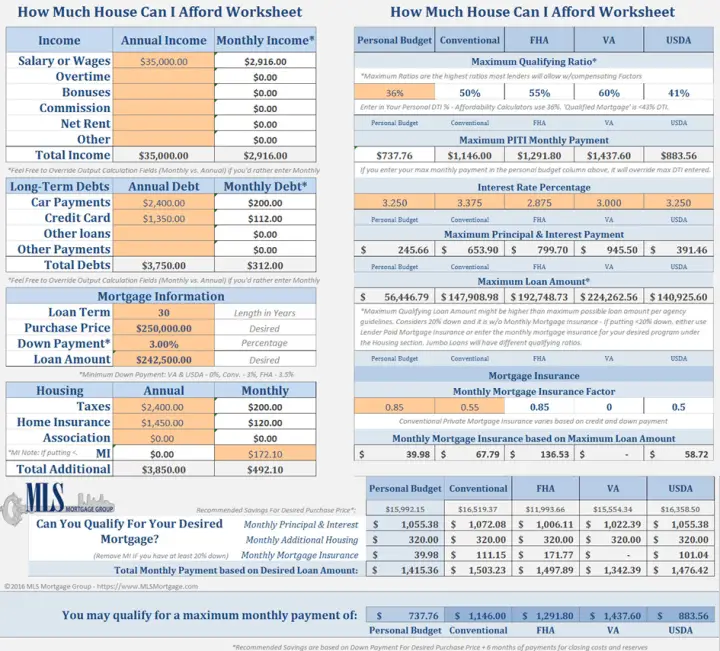

View Affordability From Two Perspectives:

- Your overall monthly payments which included household expenses, mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

Be Conscious Of Changes In Employment

If you lose your job, how will you pay your mortgage? When you apply for a mortgage, your lender ideally will want to see a 2-year work history before they grant approval. If you choose to take the largest loan you qualify for, will you be able to make those higher monthly payments during a period of unemployment?

Also Check: Reverse Mortgage On Mobile Home

The Math Behind Your Down Payment

In my case, I was selling my condo to finance the purchase of my new home, so I calculated how much I would have for a down payment based on an estimate of my current homes value.

First, I tallied the costs associated with moving, including real estate agent commissions, legal fees, moving-day expenses, a home inspection and land transfer taxes . To calculate closing costs, the rule of thumb is to budget for 4% of your homes purchase price. A $500,000 home, for instance, would require $20,000.

I decided not to touch my investments or savings to cover these costs, so I subtracted them from the potential profit of the sale. That left me with a down payment of over 20%, which means I didnt have to pay mortgage default insurance.

Lets bring the math to life using the example of a 25-year mortgage for a $500,000 home, assuming a 5-year term and 3% fixed interest rate.

| Scenario 1 | |

|---|---|

| $100,000 | $200,000 |

Because I was able to make a larger down payment, I knew that would lower my monthly mortgage payments as well as the amount of interest I would pay over time. My own calculations suggested I would save at least $50,000 in interest.

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

Recommended Reading: Reverse Mortgage Mobile Home

Save More For A Down Payment

If you dont already have the requisite percentage saved up for homes in your price range, check out our tips on how to save more for a down payment.

One option available to first-time buyers is to borrow up to $35,000, tax-free, from a Registered Retirement Savings Plan. If youre buying a home with a partner or spouse, each of you can withdraw that sum from your own RRSPs under the Home Buyers Plan, for a total of $70,000.

Miscalculating The Hidden Costs Of Homeownership

If you had sticker shock from seeing your new monthly principal and interest payment, wait until you add up the other costs of owning a home. As a new homeowner, there are many other potential expenses to budget for, like property taxes, mortgage insurance, homeowners insurance, hazard insurance, repairs, maintenance and utilities and more.

How this affects you: One Bankrate survey found that the average homeowner pays $2,000 annually for maintenance. Not having enough cushion in your monthly budget or a healthy rainy day fund can quickly put you in the red if youre not prepared.

What to do instead: Your real estate agent or lender can help you crunch numbers on taxes, mortgage insurance and utility bills. Shop around for insurance coverage to compare quotes. Finally, aim to set aside at least 1 percent to 3 percent of the homes purchase price annually for repairs and maintenance expenses.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partnerâs income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you donât know them.

With these numbers, youâll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

How Much House Can I Afford Based On My Salary

To calculate how much house you can afford, use the 25% rulenever spend more than 25% of your monthly take-home pay on monthly mortgage payments.

That 25% limit includes principal, interest, property taxes, home insurance, private mortgage insurance and dont forget to consider homeowners association fees. Whoathose are a lot of variables!

But dont worry, our full-version mortgage calculator makes it super easy to calculate those numbers so you can preview what your monthly mortgage payment might be.

Don’t Miss: Will Mortgage Pre Approval Hurt Credit Score

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Save A Bigger Down Payment To Make Your Home More Affordable

Remember, your down payment amount makes a big impact on how much home you can afford. The more cash you put down, the less money youll need to finance. That means lower mortgage payments each month and a faster timeline to pay off your home loan! Just imagine a home with zero payments!

Now, were always going to tell you that the best way to buy a home is with 100% cash. But if saving up to pay in cash isnt reasonable for your timeline, youll probably wind up getting a mortgage.

If thats you, at the very least, save up a down payment thats 10% of the home price. But a better idea is to put down 20% or more. That way you wont have to pay private mortgage insurance .

PMI protects the mortgage company in case you dont make your payments and they have to take back the house . PMI is a yearly fee that usually costs 1% of the total loan value and isyou guessed ityet another expense thats added to your monthly payment.

Lets backtrack for a second: PMI may change how much house you thought you could afford, so be sure to include it in your calculations if your down payment will be less than 20%. Or you can adjust your home price range so you can put down at least 20% in cash.

Trust us. Its worth taking the extra time to save for a big down payment. Otherwise, youll be suffocating under a budget-crushing mortgage and paying thousands more in interest and fees.

Read Also: Rocket Mortgage Loan Types

Why Its Smart To Follow The 28/36% Rule

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as well as things like student loans, car expenses and credit card payments. The 28/36 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

Example: To calculate how much 28 percent of your income is, simply multiply your monthly income by 28. If your monthly income is $6,000, for example, your equation should look like this: 6,000 x 28 = 168,000. Now, divide that total by 100. 168,000 ÷ 100 = 1,680.

Depending on where you live and how much you earn, your annual income could be more than enough to cover a mortgage or it could fall short. Knowing what you can afford can help you take financially sound next steps. The last thing you want to do is jump into a 30-year home loan thats too expensive for your budget, even if you can find a lender willing to underwrite the mortgage.

Likely Rate: 3222%edit Rate

Loan details

Down payment & closing costsNerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed and the card’s rates, fees, rewards and other features.

Income and debts

Annual household incomeYour income before taxes. Include your co-borrowers income if youre buying a home together.

Minimum monthly debtThis only includes the minimum amount you’re required to pay each month towards things like child care, car loans, credit card debt, student loans and alimony. If you pay more than the minimum, that’s great! But don’t include the extra amount you pay.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a . As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

For more on the types of mortgage loans, see .

You May Like: Chase Mortgage Recast Fee

Tips For Buying An Affordable Home

- Set aside funds for home maintenance and emergencies. Unexpected expenses are par for the course for homeowners, so youll want to make sure you can cover them without taking on debt. Whether its a broken appliance or a pipe that springs a leak, home repairs always seem to happen at inconvenient times and wind up costing more than youd expect. State Farm recommends setting aside 1 percent to 4 percent of your homes value for emergency repairs each year.

- Plan for income changes. If you or your partner or co-borrower wants to switch up the employment situation after moving, youll want to make sure to factor that into your budget. You dont want to wind up taking out a mortgage that you can no longer afford.

- Shop around to save on homeowners insurance. Comparing mortgage offers isnt the only way to save. Youll also want to solicit quotes from multiple insurers to make sure youre getting the best deal.

- Stay within your means. A lender might be willing to offer you a larger mortgage than youre comfortable with or able to pay. Dont buy a house just because the bank tells you you can afford it only commit to monthly payments that actually fit into your overall budget.

| Loan Type |

|---|

Why Your Debttoincome Ratio Is Key

While many factors impact the amount you can borrow, your debttoincome ratio is essential to the equation.

DTI compares your monthly gross household income to the monthly payments you owe on all your debts including housing expenses. The standard maximum DTI for most mortgage lenders is 41 percent.

To achieve a 41 percent DTI with a $50,000 annual income , you couldnt exceed $1,700 a month in housing and other debt payments.

The less you spend on existing debt payments, the more home you can afford and viceversa.

Say $400 of your monthly debt payments go to a car loan, a student loan, and minimum payments on your credit card debt. In this case, you would have $1,300 to spend on housing.

With a $10,000 down payment and 4% interest rate, you could probably buy a home for a maximum price of around $200,000 and still have a $1,300 monthly payment.

If you had no existing monthly debts, you could spend $1,700 a month on your mortgage payment and still keep a 41 percent DTI.

In this case, your home buying budget would increase to about $300,000 even with the same $10,000 down and 4% interest rate.

Thats an additional $100K in home buying power all because of a reduction in your existing monthly expenses not an increase in your annual salary.

Frontend vs backend ratios

As you shop around between mortgage lenders, you may come across the terms frontend ratio and backend ratio.

Don’t Miss: Reverse Mortgage On Condo

To Calculate Your Total Debt Service Ratio:

Now, on top of your housing costs listed above, lets assume your non-housing related debts come in at $800 per month . Your TDS ratio would fall within the limit, at 41%.

When it came to buying my own place, I was well within these numbers, but how much I could end up spending on a new mortgage still made me squeamish. Already in my 40s, shouldnt I be paying off my mortgage instead of adding to it?

Thats not reality, says Calla. As difficult as it might be, she says its important to not compare yourself to others. Make the decisions that best suit your lifestyle and goals.

How Many Times Can You Use A Va Loan

Getting a VA loan isnt a one-time deal. After using a VA mortgage to purchase a home, you can get another VA loan if:

-

You sell the house and pay off the VA loan.

-

You sell the house, and a qualified veteran buyer agrees to assume the VA loan.

-

You repay the VA loan in full and keep the house. For one time only, you can get another VA loan to purchase an additional home as your primary residence.

Also Check: Rocket Mortgage Requirements

A $100k Salary Puts You In A Good Position To Buy A Home

One of the first questions you ask when you want to buy a home is how much house can I afford?

With a $100,000 salary, you have a shot at a great homebuying budget.

But to qualify for the lowest mortgage rates and therefore the biggest loan amount you also need a strong credit score, low debts, and a decent down payment.

With all these factors and $100K of income per year, most doors in the mortgage world will be open to you.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How much house can I afford?

$583,522

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

Read Also: Reverse Mortgage For Condominiums