How Much Does A $300000 Mortgage Cost And How Can I Get One

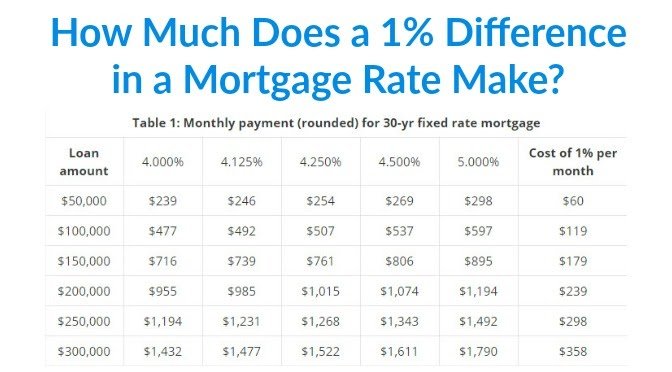

The total cost of a $300,000 mortgage depends on several factors, including your interest rate, down payment amount, and loan term.

The median home price has been over $300,000 for the past five years, according to Federal Reserve data. If youre looking for a $300,000 mortgage, how much buying power that amount will give you depends on several factors, including where youre buying, your credit and the interest rate you receive.

Heres how to get a $300,000 mortgage and what to know about what your monthly mortgage payment could look like.

Mortgage Calculator With Taxes And Insurance

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.

What Happens If You Dont Have 20 Down Payment

If your down payment is less than 20% and you have a conventional loan, your lender will require private mortgage insurance , an added insurance policy that protects the lender if you cant pay your mortgage for some reason. Other types of loans might require you to buy mortgage insurance as well.

Also Check: Chase Recast Mortgage

Use This Fha Mortgage Calculator To Get An Estimate

An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price. The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium and annual premiums paid monthly.

This FHA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that youre buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lenders fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $175,000 base loan amount with a 30-year term at an interest rate of 4.125% with a down-payment of 3.5% would result in an estimated principal and interest monthly payment of $862.98 over the full term of the loan with an Annual Percentage Rate of 5.190%.1

Should I Put 20% Down On A $300k House

When does 20% make sense as the down payment for a $300,000 house? The brief answer is: When you can afford it.

Putting down 20% on a home purchase earns you real advantages because:

For example, suppose a lender wants a minimum credit score of 700. You might get away with a score a few points below that if youre putting 20% down.

Be patient and consider your options

Of course, relatively few firsttime home buyers can scrape together 20 percent. And if you cant, its not a big deal.

Monthly payments and home price inflation can help push up home equity to the 20% level. So next time you move or refinance, you may get all those privileges.

There are even arguments against putting down 20% on a new home. Read Before Making A 20% Mortgage Down Payment, Read This before you decide whats right for you.

If youre buying real estate mainly as an investment, there can be good reasons to keep your down payment small.

Don’t Miss: How 10 Year Treasury Affect Mortgage Rates

How Does An Appraisal Affect A Mortgage Loan

An appraisal directly affects the amount of mortgage loan you can get because your lender gives you a home loan based on the appraisals estimate of the fair market value of the home. It keeps the lender from lending you too much money and keeps you from borrowing more than you need for a particular home.

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income. So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

The amount a borrower agrees to repay, as set forth in the loan contract.

You May Like: Chase Mortgage Recast Fee

Why Is Adopting A Loan Repayment Strategy Important

As you can see from some of the earlier examples, even small changes to your repayments can save you thousands of dollars in the long run. A saving of just 0.25% on your home loan will make a giant dent in the total interest paid over 30 years or switching to bi-weekly or fortnightly payments can decrease the amount of time it will take to pay off your loan.

Small adjustments can lead to major changes, so testing different options in the mortgage repayment calculator is worth the effort. And while its still best to speak to a professional, which you can do for free here, this calculator is an ideal starting point. You can also try testing our Borrowing Power Calculator to have an idea of how much you can afford to borrow.

How To Get A $300000 Mortgage

Applying for a mortgage can be quite simple especially when using a rate-shopping tool like Credible.

When filling your mortgage application out, youll want to have some financial details on hand, including your income, estimated credit score, homebuying budget, and info regarding your assets and savings.

Heres a step-by-step guide on how the mortgage process usually goes:

Also Check: Recasting Mortgage Chase

Apply For A 300000 Mortgage

To find out more about our range of £300,000 mortgages simply make an application with our approved mortgage experts found here on the website. Rates are available from across the market either on a fixed rate or variable rate deal. Mortgages and lenders to suit most credit types and applicants including buy to let property.

Explore this product

The Cost Of A $300000 Mortgage Including Repayments Total Interest And Amortization So That You Can Borrow With Confidence

- 5 year fixed rate from 2.64%

- Prepay up to 25% annually

- All provinces & territories

If youre ready to apply for a mortgage, you might wonder how the amortization period and interest rate you choose has an impact on the total cost of your mortgage. Heres a breakdown of what your monthly payments might be, in interest and over the life of a $300,000 mortgage.

Don’t Miss: Reverse Mortgage Mobile Home

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Which Mortgage Calculators Can You Use

There are online mortgage calculators you can use on our website. And while calculating your costs ahead of applying for a £300,000 mortgage can help you to avoid nasty surprises , bear in mind that these calculators wont provide you with an accurate cost, only a rough idea of what you may be eligible for.

For a more accurate calculation on how much a £300,000 mortgage could cost you, speak to a specialist.

Also Check: Mortgage Recast Calculator Chase

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Getting A Mortgage On A 300k House

This isnt the same as simply taking out a £300,000 mortgage as you likely wont need to borrow the full amount of the property youre buying is on the market for £300k.

The deposit requirements must also be factored in. Since most lenders ask for 10% deposit for a residential property, you would only need to borrow £270,000 from a mortgage lender. It may also be possible to buy a home of this value with a £285,000 mortgage as some providers accept 5% deposit.

Don’t Miss: Are Discount Points Worth It

What House Can I Afford On 50k A Year

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That’s because salary isn’t the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Add All Fixed Costs And Variables To Get Your Monthly Amount

Figuring out whether you can afford to buy a home requires a lot more than finding a home in a certain price range. Unless you have a very generous and wealthy relative who’s willing to give you the full price of your home and let you pay it back without interest, you can’t just divide the cost of your home by the number of months you plan to pay it back and get your loan payment. Interest can add tens of thousands of dollars to the total cost you repay, and in the early years of your loan, the majority of your payment will be interest.

Many other variables can influence your monthly mortgage payment, including the length of your loan, your local property tax rate and whether you have to pay private mortgage insurance. Here is a complete list of items that can influence how much your monthly mortgage payments will be:

Also Check: How Does Rocket Mortgage Work

Mortgage Legal Issues In California

One benefit of buying a property in California is its buyers protections. The state was at the forefront of abandoning the caveat emptor rule, also known as buyer beware, in real estate transactions. This means that sellers are required to disclose any issues or defects with the property on an extensive transfer disclosure statement that both the seller and real estate broker are required to sign. California, unlike many other states, has these rules backed by law. Its not an optional disclosure, its mandatory.

The state also runs the Department of Consumer Affairs Bureau of Real Estate. This entity was created to protect public interest and increase consumer awareness in real estate transactions. You can visit its website to read information on the homebuying process, loan modification or foreclosure prevention, verify a real estate license, find answers to frequently asked questions and find who to call for complaints.

When a judicial foreclosure occurs , the process is much slower as the court is involved. The benefit to this process is that the homeowner has the right of redemption. This right allows the homeowner to buy the property back up to one year after the auction. However, with a judicial foreclosure, a lender can get a deficiency judgement which allows the lender to pursue the full mortgage amount from the borrower.

What Are The Parts Of A Mortgage Payment

A mortgage payment includes principal and interest, and sometimes additional costs are rolled into the loan.

- Principal balance This is the amount you originally borrowed a portion of your mortgage payment is applied directly to your outstanding loan balance. As you pay down your loan over years, the amount of your payment that goes toward the principal increases.

- Interest This is the amount a lender charges you for borrowing money. Your interest rate and loan term determine how much youll pay over the life of the loan. In the early years of your mortgage, a larger portion of your payment will go toward paying interest.

- Escrow costs If you choose to use an escrow accountor your lender requires it, your property taxes and insurance premiums will be included in your mortgage payment.

Don’t Miss: Chase Recast

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Recommended Reading: Reverse Mortgage On Condo

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Whats The Minimum Amount You Can Put Down

The mortgage you can get largely depends on your personal circumstances.

Weve already mentioned some of the restrictions on certain loans. But lets take a deeper dive into the requirements for low and zerodown mortgages.

VA loans

To get a zerodown VA loan , you need a Certificate of Eligibility. And the VA has strict rules about those.

Veterans, activeduty service members, members of the National Guard, and reservists typically qualify along with some surviving spouses.

Youll need an acceptable credit history as well. Some mortgage lenders are happy with a credit score of 580, but many want 620660 or higher. Shop around if your scores low.

USDA loans

USDA mortgages are backed by the U.S. Department of Agriculture as part of its rural development program. Like the VA loan program, USDA allows a 0% down payment .

Youll have to buy in an eligible rural area to qualify. However, your occupation doesnt have to be connected to agriculture in any way.

You must also have an income thats low or moderate for the area where youre buying. Not sure whether yours is? Use this lookup tool to check whether your qualify.

According to Experian: While the USDA doesnt have a set credit score requirement, most lenders offering USDAguaranteed mortgages require a score of at least 640. This is the minimum credit score youll need to be eligible for automatic approval through the USDAs automated underwriting system.

Conforming loans

FHA loans

Read Also: Does Prequalifying For A Mortgage Affect Your Credit