S To Get A Second Mortgage

The steps for getting a second mortgage are much the same as getting a first mortgage when you buy a housethe key difference with second mortgages is that you already own the property.

Borrowers who want a HELOC or home equity loan should follow five basic steps:

Its also important to note that different lenders have different fees they charge throughout the loan process. Some lenders have application fees they charge upfront, while others have appraisal or title fees that dont get paid until the loan closing. In some cases, you even can finance these closing costs. Just know those costs will be tacked on to the balance of your loan when you closeand youll be paying interest on those fees throughout the life of the loan.

Qualifying For A Second Home Mortgage

Before you apply for a second home mortgage, review your credit score, assets and income, just like a lender will.

To buy a second home, youll likely need extra money in reserve that could cover your mortgage payments in case you have a temporary loss of income. Well-qualified individuals likely need at least two months of reserves, while less-qualified applicants may need at least six months of reserves. One month of reserve funds should be enough to cover the monthly mortgage payment on both homes.

Debt-to-income requirements for a second home mortgage may depend on your credit score and the size of your down payment. Generally speaking, the more you put down and the higher your credit score, the more likely your lender will allow a higher DTI.

Some homeowners might choose to offset their expenses by renting out their vacation homes when they’re not using them. Doing this could violate your mortgage terms because you are using the property as an investment instead of a true second home, resulting in higher risk to the lender.

To qualify as a vacation or second home, typically, the property must:

- Be lived in by the owner for some part of the year

- Be a one-unit home that can be used year-round

- Belong only to the buyer

- Not be rented, or run by a management firm

What Is A Home Equity Loan

A home equity loan is usually a fixed-rate loan distributed in one lump sum, with terms that range from 5 to 30 years. You pay it back in fixed monthly installments. This might be a good loan if you anticipate a large one-time expense such as a wedding, the purchase of a second home, or debt consolidation. A fixed rate and predictable monthly payment can help you budget as you work toward your financial goals.

Don’t Miss: How Do I Qualify For A Zero Down Mortgage

Second Home Financing Options

For many home purchasers, an FHA-insured loan is a prime choice because these loans require a down payment of just 3.5%, and lenders offer the loans even for borrowers with lower credit scores, down to 580 or even lower in some cases. However, second home buyers are not allowed to use FHA loans for their purchase these loans are limited only to homes that are the borrowers’ principal residence.

Second Mortgages Help With Bad Credit

If you have bad credit, then borrowing money to consolidate or pay off debt can be challenging. Those with poor credit scores often think obtain a second mortgage is impossible, but ironically, this is likely one of the best tools to help them repair that credit.

Gaining access to your equity can allow you to pay off all of those overdue bills, immediately, and give you piece of mind to get your finances back in order.

A simpler, single payment setup, can also make it easier to have a single target to hit monthly.

Most traditional banks, and even many brokers and alternative lenders, do not offer second mortgages for bad credit borrowers. Its important to speak with a mortgage professional not tied down by these burdensome restrictions, because second mortgages are possible even with a poor credit score. Canada is filled with lenders to work with, and you need someone who will help you find them.

Don’t Miss: What’s The Average Mortgage Payment

Keep An Eye On Your Credit Score

As in many other parts of the financial world, your credit score makes a big difference. In many cases, second mortgages are considered low risk for lenders. After all, if someone has successfully been managing a first mortgage, it stands to reason that they will do okay with a second mortgage.

On the other hand, some people are only barely managing their first mortgage. In that case, they might not be able to handle the added burden of a second mortgage.

Your credit score is one of the things that will make the biggest difference as far as whether you are approved for a second mortgage. At the very least, you should know what your credit score is. If it is low or high, that will tell you a lot about how good your chances are not being approved.

Hopefully, you have enough time to improve your credit score before needing to apply for a second mortgage. If so, you may be able to make significant gains in short order. However, this requires that you be efficient with your strategy.

If you find any old debts that are past due, pay them off. That is a fast way to bump up your credit score. On the other hand, if your credit score doesnt have anything like that, then you will just have to continue paying back any debts that you have.

That will also build up your credit, but more slowly. In some cases, if you can pay back an entire debt, then that can increase your credit score.

You Can Use Your Equity Foranything

One of the most attractive benefits of buying a home is the potential to use the equity you have built up over time. Why let it sit there? Let that money youve earned start working for you!

You can use the funds however youd like, but many people choose to use a second mortgage for home improvements, other investments, a childs college education, an emergency fund, and more.

One popular usage of a second mortgage is to make an investment, like buying a rental property. Instead of saving up 20% for a down payment, you can tap into the equity of your existing home. The bonus of using a second mortgage for investment purposes is that the entire interest on that loan now becomes a tax deduction.

Also Check: How To Apply For A House Mortgage

Pros Of A Second Mortgage:

When considering a second mortgage individuals will ask, why take out a second mortgage? and what are the pros and cons of second mortgage?. Consider the following:

- You dont have to discharge your current low rate first mortgage and suffer penalties and fees.

- Since there are many providers, both institutional and private , it is easier to arrange, especially when you compare a second mortgage vs a HELOC.

- Most second mortgages are interest-only payments and one-year terms.

- Up to 80% of your appraised home value can be used to arrange a second mortgage, minus the amount left to pay on the primary mortgage.

There Are Two Common Uses Of Second Mortgages

The most common usage of a second mortgage is to pay off high-interest consumer debt or to use the funds for home renovations or upgrades. With the average , you could save a lot of money by leveraging a second mortgage.

If you have a credit card balance of $30,000, for instance, your minimum monthly payment will be around $600 a month . If your credit card interest rate is 15% APR, this will cost you about $4,500 in interest in just your first year, before you even touch the principal amount you owe.

So many people are adding a second mortgage, paying off the credit card with that, and then enjoying a much reduced interest rate because a second mortgage is secured by an asset: your home.

Also Check: What Score Do Mortgage Companies Use

What Is A Second Mortgage Exactly

A second mortgage is when you sacrifice your own home equity in exchange for a faster way to pay off other debts, complete home improvement projects, or buy something you couldnt otherwise afford.

But its debt. You must pay it back. And since a second mortgage is secured by your home, youll lose your house if you dont pay it back. Thats some scary stuff.

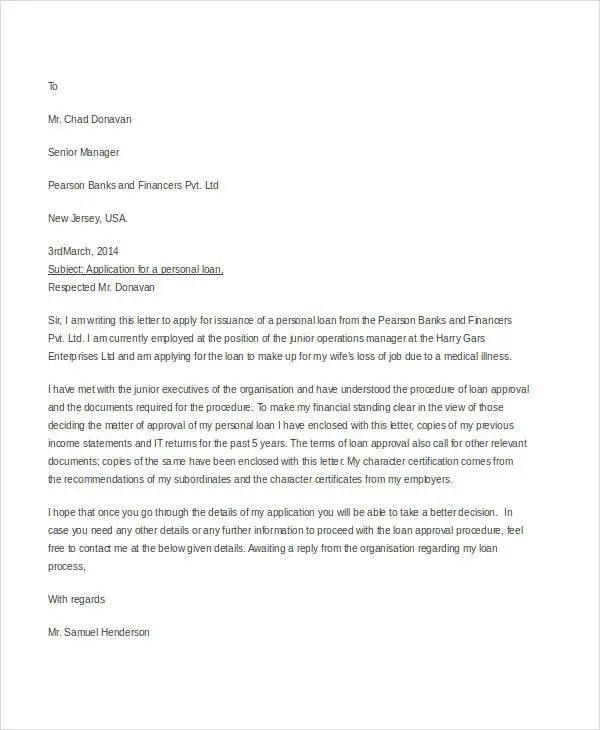

How To Apply For A Second Mortgage

The application process for a second mortgage is similar to that of your first mortgage, with a few key differences. For instance, youll have to provide details of your existing loan in addition to your personal and financial details. If youre taking out a second mortgage on a commercial property, you may also have to provide some business details as well. Specific eligibility requirements will differ between lenders, so be sure to compare your options and find a loan that youll be eligible for.

While second mortgages can be beneficial in some circumstances, they do come with some inherent risks. Make sure youre aware of all the traps and pitfalls before you decide whether a second home loan is right for you.

Read Also: Can You Write Off Points On A Mortgage

Tips For Getting A Second Mortgage

Shop around, and get quotes from at least three different sources. Be sure to include the following in your search:

Get prepared for the process by getting your documents ready. That will make the process much easier and less stressful.

Interest Rates And Fees If You Refinance Your Home

The interest rate on the refinanced part of your mortgage may be different from the interest rate on your original mortgage. You may also have to pay a new mortgage loan insurance premium.

You may have to pay administrative fees which include:

- appraisal fees

Your lender may have to change the terms of your original mortgage agreement.

Also Check: How Often Do You Pay Your Mortgage

How To Get A High

When you apply for a mortgage, you will need to pass a mortgage stress test based on a benchmark set by the Bank of Canada. This test will check your eligibility and financial health should interest rates go up during your loan cycle.

High-ratio mortgages will also require your capacity to pay for closing costs such as appraisal fees, inspection fees, legal fees, real estate commissions, taxes, and insurance.

Lenders will look at criteria including:

· Your credit history

· Income/job

· Your amortization/payment based on the value of the property

You will also need to qualify for mortgage insurance through the Canada Guaranty, CMHC, or Genworth.

Consider waiting to save for a 20% down payment for your mortgage. If this is not possible, you may want to buy a cheaper home to bring down your loan amount.

Compare mortgage rates with a mortgage broker to find the lowest possible rates. An experienced and reputable mortgage broker can help you pre-qualify for a mortgage so that you know how much you can borrow to buy your house.

What is mortgage insurance?

From the point of view of banks and other lenders, a high-ratio mortgage carries a higher risk of default. A homeowner who buys a house beyond the value of their savings and with less equity can more easily default on the loan.

It is due to this reason that high-ratio mortgages require mortgage insurance. It protects the interests of the lender should any borrower become unable to meet their mortgage payments.

Which Lenders Offer Second Mortgages

Since a lender in second position takes on more risk, not all lenders offer this type of mortgage it will depend on the individual lenders risk tolerance. Here is a list of the lenders who will offer a mortgage in second position. Note that each lender will have their own unique terms and conditions.

| Product |

|---|

Don’t Miss: What Is A 5 1 Arm Mortgage

Benefits Of A Second Mortgage

People choose to take out a second mortgage for a wide range of reasons. Here are a few of the benefits that people look at getting from a second mortgage:

- Access equity. A second mortgage allows you to access the equity in your home which can help free up your cash flow.

- Debt consolidation. Accessing the equity in your home means you can work towards paying down and consolidating your debts.

- Alternative to refinancing. A second mortgage also provides an alternative to refinancing, which may involve break costs, exit fees and other legal fees.

- Home renovations or repairs. Accessing home equity can also allow you to make much-needed home renovations or repairs, which can also increase the value of your property.

- Going guarantor. If you are going guarantor on a loan for a family member or friend, then you can use a second mortgage over your property as additional security for the bank or lender.

Why Second Mortgages Are Risky

Before you take on a second mortgage, its important to consider the drawbacks of getting one. Ultimately, youll have to pay back the funds you borrow. Since your home acts as your collateral , your lender can force you into foreclosure and take your house if you fail to pay off your second mortgage.

Second mortgages are subordinate to primary mortgages, so if you default on your loans, the debt from your first mortgage gets paid off before the second mortgage lender receives anything. For that reason, home equity loans and HELOCs are considered to be riskier than traditional home loans. Therefore, they typically have higher interest rates.

In addition to the higher mortgage rates, there are additional fees that youll owe if you want a second mortgage. Closing costs for second mortgages can be as much as 3% to 6% of your loan balance. If youre planning to refinance, having a second mortgage can make the whole process trickier to navigate.

Home equity loan payments are generally easier to manage because you can set up your budget knowing that youll pay x amount of money every month for that second home loan. Since the amount you owe for a HELOC will vary, however, you might not be able to pay your bill if its significantly more expensive than it previously was. And if you need a second mortgage to pay off existing debt, that extra loan could hurt your credit score and you could be stuck making payments to your lenders for years.

Don’t Miss: What Information Do You Need To Prequalify For A Mortgage

Qualifying For A Second Mortgage

The qualification requirements for a second mortgage vary depending on what type of junior lien you’re seeking and the lender you choose.

But there’s one qualification requirement that’s a constant: For any stand-alone second mortgage, you’ll need to have accrued sufficient home equity to borrow against. The amount you can borrow with a second mortgage usually tops out at 85% of your equity.

The amount you can borrow with a second mortgage usually tops out at 85% of your equity.

A of 620 is the typical minimum for a second mortgage. Lenders may ask for a higher score, especially if you’re trying to borrow a large amount. A higher credit score can also help you get a lower rate.

Just as with a primary mortgage, your debt-to-income ratio how much of your monthly earnings goes toward monthly debt payments should be less than 43% for a second mortgage. Lenders can require a lower DTI if they choose, however.

What Happens If I Want To Move House And Have A Second Charge Mortgage

If you want to sell your home, theres a couple of options. If your first and second charge mortgages are portable, youll be able to switch them to your new home while staying with your current lenders.

Another option is to repay both mortgages when you sell your property and take out a new, single mortgage on the new property. Whether you could do this would depend on the conditions of both mortgages and any early repayment charges youd need to make. Talk to your mortgage advisor about the best option for you.

You May Like: How Much Is The Mortgage On A $300 000 House

How To Get A Second Mortgage

Many lenders offer second mortgages, so you can choose a second lender if you dont want to use the same bank, credit union or online lender that approved you for your first home loan. Comparing lenders is a good idea if you want the best mortgage rates and terms.

Applying for a second mortgage isnt that different from applying for a primary home loan. Youll go through an underwriting process and your lender will look at your credit and your financial track record. If your credit score is in good shape and you meet your lenders requirements, you might qualify for a loan worth as much as 85% of your home equity.

Second Mortgage Vs Cash

A second mortgage and a cash-out refinance are both common strategies to borrow money using your home as collateral but there are some key differences.

A cash-out refinance replaces your original mortgage with a new, bigger mortgage, allowing you to receive the difference in cash. Its also a popular method for debt consolidation and financing home improvement projects, and it doesnt require you to take out an additional loan the way a second mortgage does.

With a cash-out refinance, you can change the interest rate and terms of your mortgage and the rates are often lower than a home equity loan or HELOC. A cash-out refinance also tends to be easier to qualify for than a second mortgage, as the lender would be first in line to be paid back in the event of a default. But youd have to pay more in closing costs since its considered a new mortgage.

Don’t Miss: What Is The Biggest Mortgage I Can Get