Know Your Local Housing Market And Plan Accordingly

The real estate market is in an unpredictable place. Home sales went largely on pause during the global COVID-19 pandemic, a struggling stock market caused many in-contract sales to fall through and changes in the short-term rental market might mean former rentals go on the market as homes for sale.

On the one hand, mortgage rates were trending down at the time this was written . They might stay low, keeping monthly payments quite affordable. If thats the case, you could afford to put in a larger offer than youd expected. On the other hand, real estate in your area could come back with a vengeance and drive prices up.

If your maximum spend on a home is $250,000, but desirable homes in your area have been selling for 5% above the asking price, its time to recalibrate. Anticipate going over by 5% and crunch some new numbers. With a maximum budget of $250,000, that will translate to looking for homes with an asking price thats $12,500 or 5% of your actual budget lower than your max.

The bottom line is that the performance of recent sales in your market are the best indicator for how your own purchase will go. If other homes are selling for under the asking price, you should feel empowered to offer under asking on the home of your dreams.

The Traditional Model: 35%/45% Of Pretax Income

In an article on how the mortgage crash of the late 2000s changed the rules for first-time home buyers, the New York Times reported:

If youre determined to be truly conservative, dont spend more than about 35% of your pretax income on mortgage, property tax, and home insurance payments. Bank of America, which adheres to the guidelines that Fannie Mae and Freddie Mac set, will let your total debt hit 45% of your pretax income, but no more.

Lets remember that even in the post-crisis lending world, mortgage lenders want to approve creditworthy borrowers for the largest mortgage possible. I wouldnt call 35% of your pretax income on mortgage, property tax, and home insurance payments conservative. Id call it average.

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

Don’t Miss: Does Prequalification For Mortgage Affect Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How much house can I afford?

$583,522

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

This DTI is in the affordable range. Youll have a comfortable cushion to cover things like food, entertainment and vacations.

*DTI is the main way lenders decide how much you can spend on a mortgage.

Good Centsmyths Lies And Bad Advice You’ve Been Told About Real Estate And The Value Of Your Home

If you dont truly understand what you can safely afford, he says, you may end up with a mortgage that will financially drain you. Many home buyers, he explains, get so excited about a house that they dont think about how they might struggle to pay for it if they lose their job or come down with a major illness.

For that reason, he says to be conservative.

Being conservative means you save up for a 20 percent down payment, being conservative means you take a straightforward 15 or 30-year loan, and it means that you calculate these basic numbers and know that youre under the 28/36 rule very comfortably, Sethi says.

If you dont have enough savings for a 20 percent down payment, then you need to keep saving, Sethi says. If you are struggling to save, he advises creating a sub-savings account.

A sub-savings account is an automated account that directly deposits small amounts from your paycheck into a savings account, so you dont even have to think about it, he says.

A lot of people say Hey, Im cut to the bone, I cant really save, he says. Well, it turns out when you automate this money you never even see it. It actually adds up pretty quick.

And dont underestimate the power of the side hustle, he says.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

Rule : Consider Your Total Housing Payment Not Just The Mortgage

Most agree that your housing budget should encompass not only your mortgage payment , but also property taxes and all housing-related insurancehomeowners insurance and PMI. To find homeowners insurance, we recommend visiting . Theyre what we call an insurance aggregator, which means they compile all the best rates from around the online marketplace and present you with the best ones.

As for just how big a percentage of your income that housing budget should be? It all depends on whom you ask.

How Much House Can I Afford

When trying to answer the question of, How much should my loan be? youre going to factor items such as your household income, monthly debt, and how much of a down payment you can afford.

However, life can also bring about unexpected events and expenses. To help figure out how much you can afford and to safeguard against those unexpected expenses, you need to have a stockpile of savings enough for three months worth of bills on hand.

You should also:

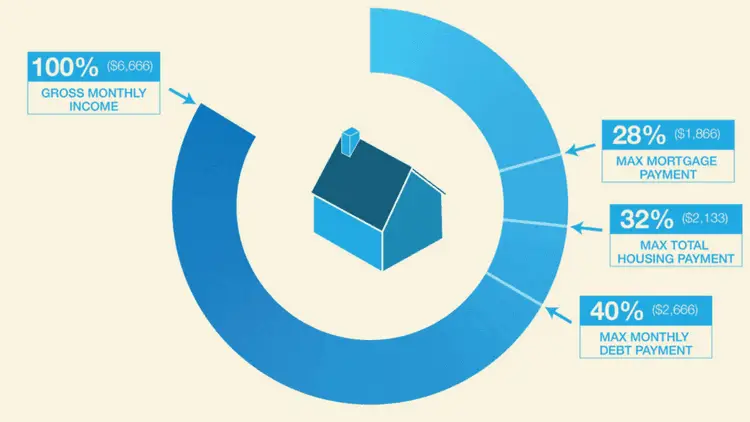

- Use the 28/36 rule: Dont let your estimated monthly housing costs eclipse 28% of your monthly gross income.

- Determine your down payment budget: This money tends to come from peoples savings and the equity theyve built up in the homes they currently own.

- Withdrawing from your retirement plan to have a down payment on your home isnt a great move, but sometimes homebuyers dont have other options.

- Calculate an affordable home purchase price: To figure out your max purchase price, add together your down payment and the amount of money youre borrowing, but dont be afraid to modify.

- Know your local housing market: If your max budget is $250,000 but homes in the housing market you are looking at are going for well above your max price, it would be wise to reconsider the area youre buying in.

Also Check: Can I Get A Reverse Mortgage On A Condo

Improve Your Credit Score

Your credit score is directly tied to the interest rate you receive on a loanthe higher your score, the lower the rate, the lower your payment.

One of the quickest ways to improve your credit score is to pay down your credit card debt. Try to get your total balances below 15% of your credit limits.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Read Also: Reverse Mortgage Mobile Home

How Does Credit Affect Mortgage Affordability

A crucial factor in calculating your monthly mortgage payment is the loan’s interest rate. To help determine what your interest rate would be, lenders review your credit report and credit score in addition to other factors.

In general, borrowers with higher credit scores can secure lower interest rates because they’re able to show that they’ve managed their debts well in the past. In the lender’s eyes, this positive payment history lessens the risk that the borrower will default on their monthly mortgage payments.

On the flip side, a low credit score could result in a higher interest rate or even the outright denial of an application. The minimum credit score for a mortgage loan can vary based on the lender and the type of loan you’re applying for.

Finding The Right Mortgage

Before even getting a mortgage you must first have the finances to qualify for the loan. Lenders will check your:

- Gross income

- If you have financial dependents

Lenderswill also base their decision on things like:

- Property value

- Initial deposit

You must also put down an initial deposit on your mortgage. The larger the initial deposit, the lower your monthly payments will be and the faster you will be able to pay off your mortgage.

Traditional wisdom holds that you should try to put down at least 10% of the value of the property as an initial deposit. So for example, if the house you are looking at is £200,000, then you should try to put down at least £20,000 for the initial deposit.

If a lender rejects your application for a mortgage, then it means they do not think you will be able to make your payments.

At this point, the best option is probably to lower your expectations and find more modest loan terms. It might be frustrating to truncate your expectations but its better than becoming financially overwhelmed.

Also Check: Reverse Mortgage On Condo

Whats Behind The Numbers

NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage. It uses five numbers – home price, down payment, loan term, interest rate and your total debt payments – to deliver an estimate of the salary you need to buy your home. After those first five inputs, you can answer optional questions to refine your result.

Example Of Mortgage Payment Percentage

Based on the 28 percent and 36 percent models, heres a budgeting example assuming the borrower has a monthly income of $5,000.

- $5,000 x 0.28 = $1,400

- $5,000 x 0.36 = $1,800

Going by the 28 percent rule, the borrower should be able to reasonably afford a $1,400 mortgage payment. However, factoring in the 36 percent rule, the borrower would also only have room to devote $800 to their remaining debt obligations. Applied to your own financial situation, this may or may not be feasible for you.

Recommended Reading: Rocket Mortgage Conventional Loan

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

How To Get More House For Your Money

There are a couple of ways to reduce parts of your mortgage payment and get more house for your money.

PMI is generally required when your down payment is less than 20 percent of the home value. You can avoid a PMIand reduce your mortgage paymentby saving more for a down payment before signing on the dotted line.

Another factor in your payment is your Higher scores can often mean lower interest ratesimproving your credit score before you get a mortgage can significantly reduce the amount you pay over time.

Read Also: Recast Mortgage Chase

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

You May Like: Rocket Mortgage Requirements

What To Do Before You Buy

Whatever you can afford, you want to get the best mortgage ratesand you want to be in the best position to make an offer on your house. Make these steps part of your preparation:

- Check your credit score. Your can have a direct affect on the interest rate you’ll pay. Check your score, and do what you can to improve it. You can get a free credit report at AnnualCreditReport.com.

- Get pre-approved. Go to a lender and get pre-approved for a loan before you make an offer on a house. It will put you in a much stronger bargaining position.

The Conservative Model: 25% Of After

On the flip side, debt-hating Dave Ramsey wants your housing payment to be no more than 25% of your take-home income.

Your mortgage payment should not be more than 25% of your take-home pay and you should get a 15-year or less, fixed-rate mortgage Now, you can probably qualify for a much larger loan than what 25% of your take-home pay would give you. But its really not wise to spend more on a house because then you will be what I call house poor. Too much of your income would be going out in payments, and it will put a strain on the rest of your budget so you wouldnt be saving and paying cash for furniture, cars, and education.

Notice that Ramsey says 25% of your take-home income while lenders are saying 35% of your pretax income. Thats a huge difference! Ramsey also recommends 15-year mortgages in a world where most buyers take 30-year mortgages. This is what Id call conservative.

Read Also: Rocket Mortgage Loan Types

Finding The Right Lender

One place to start is with , a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

In the market for a house sometime soon? Use our resources to target your searchand know well in advance what you can afford:

What Is The 28/36 Rule Of Thumb For Mortgages

When mortgage lenders are trying to determine how much theyll let you borrow, your debt-to-income ratio is a standard barometer. The 28/36 rule is a common rule of thumb for DTI.

The 28/36 rule simply states that a mortgage borrower/household should not use more than 28% of their gross monthly income toward housing expenses and no more than 36% of gross monthly income for all debt service, including housing, Marc Edelstein, a senior loan officer at Ross Mortgage Corporation in Detroit, told The Balance via email.

It’s important to understand what housing expenses entail because they include more than just the raw number that makes up your monthly mortgage payment. Your housing expenses could include the principal and interest you pay on your mortgage, homeowners insurance, housing association fees, and more.

Also Check: Can You Do A Reverse Mortgage On A Mobile Home