You Don’t Live In The Home

You can deduct the interest on a home mortgage only for:

- your main home — that is, the home where you ordinarily live most of the time, and

- a home that you choose to treat as your second home.

If you have a second home and rent it out part of the year, you also must use it as a home during the year for it to be a qualified home. You must use this second home more than 14 days or more than 10% of the number of days during the year that the home is rented at a fair rental, whichever is longer. If you do not use the home long enough, it is considered rental property and not a second home.

Your Mortgage Is Too Large

There is a limit on the size of a home mortgage for which interest is deductible. If you purchased your home before December 15, 2017, you may deduct mortgage interest payments on up to $1 million in loans to buy, build, or improve a main home and a second home. If you purchased your home after December 15, 2017, new limits imposed by the TCJA apply: You may deduct the interest on only $750,000 of home acquisition debt: a reduction of $250,000 from prior law. The $750,000 loan limit is scheduled to end in 2025. After then, the $1 million limit will return.

Mortgage Points And Arm Loans

Mortgage points on an adjustable-rate mortgage work like points for a fixed-rate mortgage, but most ARMs adjust at five years or seven years, so its even more important to know the breakeven point before buying points.

Factor in the likelihood that youll eventually refinance that adjustable rate because you may not have the loan long enough to benefit from the lower rate you secured by paying points, says McBride.

Also Check: What Salary Is Required For A Mortgage

Heres Whats Not Deductible

The following costs arent considered interest, so you cant include them in your mortgage interest deduction:

- Most ground rent: Ground rent, or rent paid specifically on the land the property is on, can only be claimed as mortgage interest under very specific and unusual circumstances.

- Reverse mortgage interest: The IRS considers interest that accrues on a reverse mortgage to be home equity debt, which is not deductible.

- Rent payments for a home you purchase: Rent payments you make when you rent with an option to buy, for example, are not considered interest, so theyre not deductible as interest.

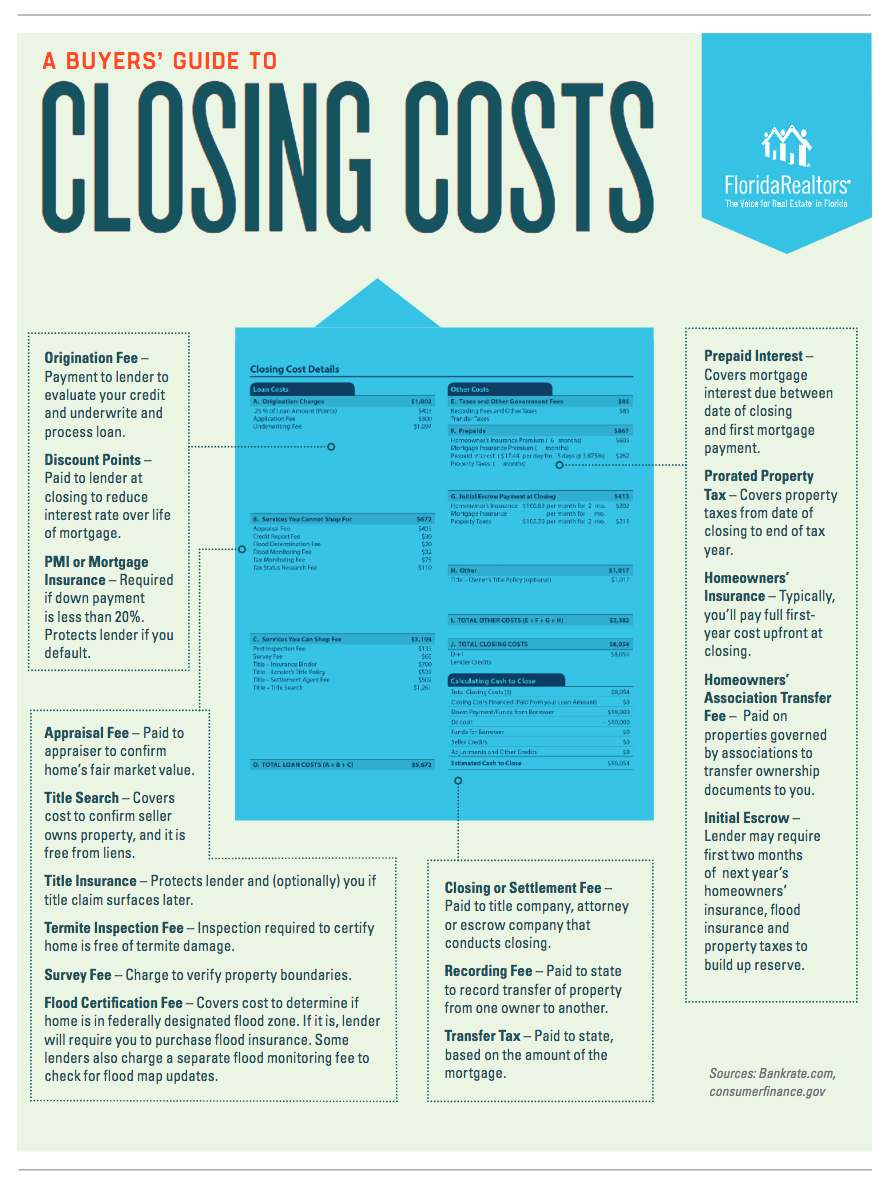

- Charges for services: Charges for closing services the lender provides in the process of financing your home purchase, such as appraisals and notary work, arent deductible.

- Loan placement fees: You cant deduct placement fees the seller pays to arrange your financing.

Learn More: How Much Down Payment Do You Need to Buy a House

Real Estate Tax Deduction

Real estate taxes are another major expense for homeowners but they can also be another important tax deduction. If you pay your real estate taxes with your mortgage payment, you deduct the real estate taxes your escrow company actually pays on your behalf, not the amount you pay into the escrow account.

Read Also: How To Determine What You Qualify For A Mortgage

I Amortized Points Paid On Refinancing Over The Term Of The Mortgage May I Change And Write Off The Remaining Points This Year And Discontinue Amortiziing In The Future

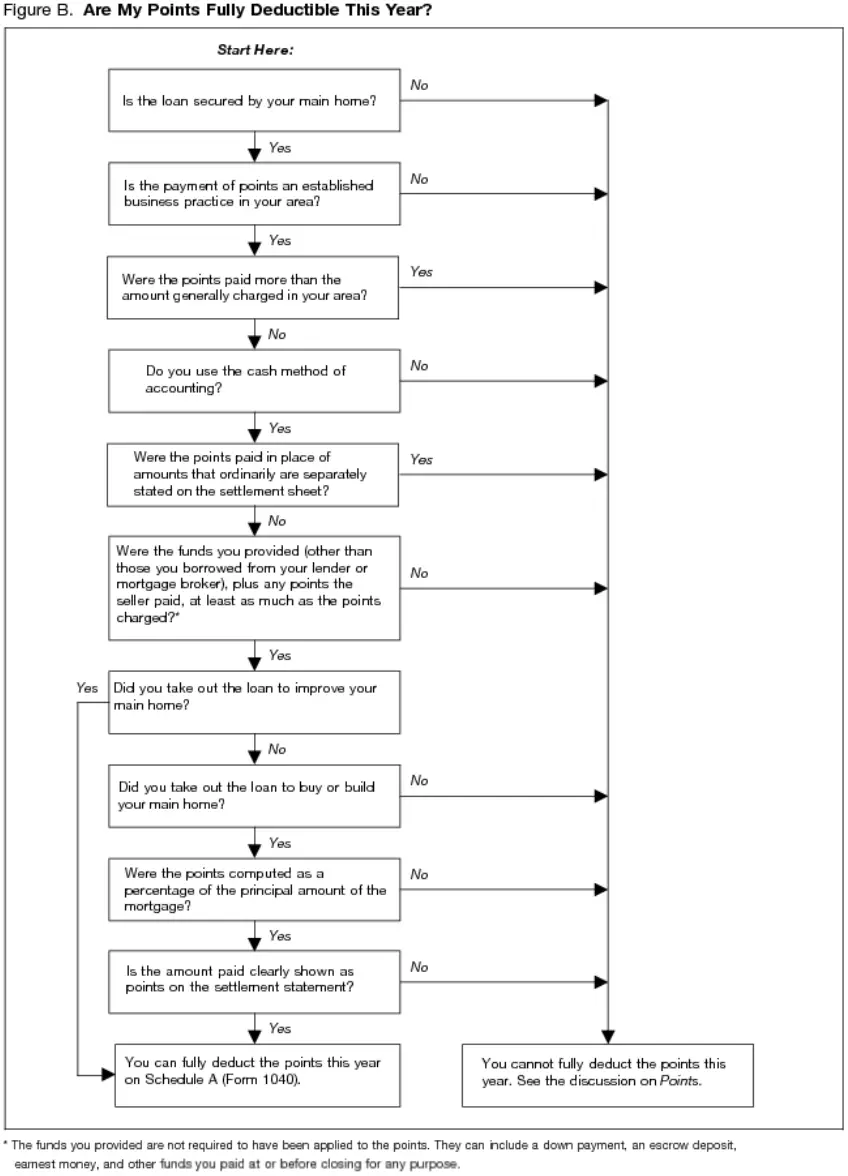

If you meet specific criteria, you can either deduct all your points in the year you paid them, or deduct them in equal increments over the life of the loan.

Please see the TurboTax FAQ “Can I deduct mortgage points?” below for guidance. Pay particular attention to the bulleted section, and the “If you refinanced with the same lender” section to see what applies to your particular situation.

Can I Deduct Closing Costs For Mortgage Refinance Off My Taxes

Your mortgage is a debt, but if you play your cards right you can use it to generate some tax advantages. One of those advantages is deducting your mortgage interest, including points. Whether it’s a new mortgage or you’re refinancing, knowing when and how to deduct points is key to saving on your tax bill.

Recommended Reading: Is Citizens Bank Good For Mortgages

Deducting Interest From A Heloc Or Home Equity Loan

Equity is the current value of your home minus how much you have left on your mortgage. If your home is worth $300,000 and youâve made $50,000 in payments against the mortgage principal, you have $50,000 in equity.

You can receive part of the equity as cash without selling your home, by using it as collateral for a home equity line of credit or a home equity loan.

Whether you take out a HELOC or a home equity loan, the interest may be deductible just like ordinary mortgage interest. As with mortgage interest, the HELOC or home equity loan debt must be secured by a qualified home âif you default on the HELOC or home equity loan, your home could go into foreclosure, meaning you could lose the home.

Rental Expenses You Can Deduct

You can deduct any reasonable expenses you incur to earn rental income. The two basic types of expenses are current expenses and capital expenses.

For more information on what we consider a current or capital expense, go to Current expenses or capital expenses.

Some expenses you incur are not deductible. For more information, go to Rental expenses you cannot deduct.

If you are modifying a building to accommodate persons with disabilities, buying an older building, or encounter other situations, go to Capital expenses Special situations.

The following is a list of expenses that are deductible:

You May Like: Does Chase Allow Mortgage Recast

Closing Costs On A Rental Property

You cannot deduct settlement fees and other closing costs on a primary or secondary home. However, different rules apply for rental properties. The IRS sees the money you earn from renting out a home or condo as taxable income.

You have a lot more leeway when deducting closing costs and other upkeep expenses for a refinance on a rental property. Some expenses you can claim as deductions on a rental property include:

- Attorneys fees

Heres What You Can Deduct

Heres what youre allowed to deduct as part of the IRS mortgage interest deduction:

- Late mortgage payment fees: You can deduct late loan payment fees as long as theyre not for specific services rendered in connection with your loan.

- Mortgage prepayment penalty: Some lenders charge a penalty if you repay your loan early. You might be able to claim this fee in a mortgage interest deduction.

- Mortgage interest in connection with a home sale: You can deduct the interest you paid up to and including the day before you close.

- Mortgage insurance premiums: Mortgage insurance premiums are deductible if your insurance contract was issued after 2006. If your adjusted gross income is $100,000 or more, the deduction you could get is significantly reduced or you might not be able to deduct at all.

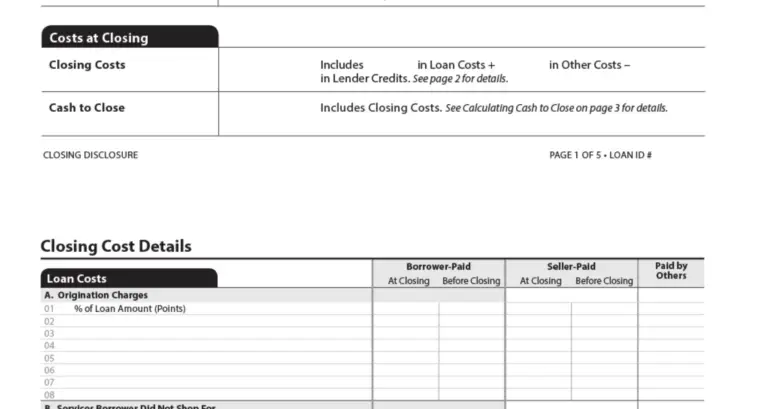

- Points: You deduct points you pay at closing for your primary home in the year you pay them. You deduct most points paid on loans for second homes and some eligible refinance loans over the life of the loan.

Find Out:

Recommended Reading: Can I Use My Partner’s Income For A Mortgage

Are Mortgage Processing Fees Deductible

The mortgage interest deduction reduces the tax burden for many homeowners. You can write off the interest of up to $1 million of home mortgage debt and an additional $100,000 of home equity debt. Other than your home mortgage interest, the IRS severely limits your ability to write off other mortgage fees. As such, you cannot claim a mortgage processing fee for a personal residence loan as a write off, although it may have value when you sell. These rules also apply to your California income taxes, since they generally follow federal law.

Heloc Interest Tax Deduction

With a HELOC, you can spend the equity, pay it back, and spend it again, as often as you need to during the years-long draw period. Youâll be charged interest on the amount you withdraw.

If you use the HELOC as home acquisition debt â that is, for buying, building, or renovating your home â that interest will be tax-deductible.

Read Also: What Do I Need To Become A Mortgage Broker

What Closing Costs Can I Deduct On My Taxes

You can write off some closing costs at tax time. Mortgage closing costs typically range between 2% and 6% of your loan amount. When youre determining what to claim on taxes, it helps to know the IRS rules. Because each persons tax situation may be different, you may want to consult a tax professional for specific guidance.

Tax-deductible closing costs can be written off in three ways:

How To Claim The Mortgage Interest Deduction

Youll need to take the following steps.

1. Look in your mailbox for Form 1098. Your mortgage lender sends you a Form 1098 in January or early February. It details how much you paid in mortgage interest and points during the tax year. Your lender sends a copy of that 1098 to the IRS, which will try to match it up to what you report on your tax return.

You will get a 1098 if you paid $600 or more of mortgage interest during the year to the lender. You may also be able to get year-to-date mortgage interest information from your lenders monthly bank statements.

2. Keep good records. The good news is that you may be able to deduct mortgage interest in the situations below under certain circumstances:

- You were a co-op apartment owner.

- You rented out part of your home.

- The home was a timeshare.

- Part of the house was under construction during the year.

- You used part of the mortgage proceeds to pay down debt, invest in a business or do something unrelated to buying a house.

- Your home was destroyed during the year.

- You were divorced or separated and you or your ex has to pay the mortgage on a home you both own .

- You and someone who is not your spouse were liable for and paid mortgage interest on your house

The bad news is that the rules get more complex. Check IRS Publication 936 for the details, or consult a qualified tax pro. Be sure to keep records of the square footage involved, as well as what income and expenses are attributable to certain parts of the house.

Read Also: What Is Tip In Mortgage

How To Deduct Mortgage Points On Your Tax Return

OVERVIEW

If you ever decide to take the plunge and buy a home, your mortgage will likely be the largest debt you’ll ever take on. And as part of owning a home, you may be faced with fees in terms of mortgage points. However, paying mortgage points can sometimes make good financial sense, and you can often deduct points on your taxes.

The Bottom Line: Utilize Your Mortgage Tax Deduction

When it comes to mortgage interest deduction, there are many questions to be asked, especially as a first-time homeowner. Although at first glance it can seem overwhelming, being able to utilize a mortgage tax deduction can be very beneficial. We encourage you to take the opportunity to speak with a financial planner or tax professional for any further questions related to mortgage interest deduction.

You May Like: How Much Is The Mortgage On A $300 000 House

You Can Deduct The Full Amount Of Points When Selling Or Refinancing

- Assuming you were deducting mortgage points ratably

- You might be able to deduct the full, remaining amount

- When you prepay, sell or refinance

- But certain restrictions apply

If the mortgage ends early due to a prepayment, refinancing, or foreclosure, you can deduct the remaining amount of the points in the year the mortgage expires.

But if you refinance your home loan with the same lender, the remaining points must be deducted over the life of the new loan.

If you dont itemize your deductions in the year the loan is taken out, you can spread the mortgage points over the life of the loan and deduct in the future when you do itemize deductions.

Keep in mind that you can also deduct any mortgage points paid by the seller of the home, assuming you meet all the requirements listed above.

Note that certain closing costs such as appraisal fees, title and escrow fees, homeowners insurance, and notary fees are not interest, and are therefore not tax deductible.

As always, any tax related questions should be reviewed by a tax professional to ensure their accuracy as guidelines do change often.

Mortgage Interest Deduction Limit

Signed in 2017, the Tax Cuts and Jobs Act changed individual income tax by lowering the mortgage deduction limit and putting a limit on what you can deduct from your home equity loan debt.

Before the TCJA, the mortgage interest deduction limit was $1 million. Today, the limit is $750,000. That means this tax year, single filers and married couples filing jointly can deduct the interest on up to $750,000 for a mortgage if single, a joint filer or head of household, while married taxpayers filing separately can deduct up to $375,000 each.

However, there are a few exceptions:

- Any mortgage taken out before October 13, 1987 is considered grandfathered debt and is not limited. All of the interest you pay is fully deductible.

- Any home purchased after October 13, 1987 and before December 16, 2017 is still eligible for the $1 million limit .

- Any home that was sold before April 1, 2018 is eligible for the $1 million limit only if there was a binding contract entered before December 15, 2017 to close before January 1, 2018 and the home was purchased before April 1, 2018.

You May Like: How To Understand Mortgage Payments

Mortgage Interest Deduction For Prepaid Interest Points

There are also special rules regarding when you can apply your deduction for prepaid interest points. You may be able to deduct more of your points in the year you bought them. But, generally speaking, you cant deduct the full cost of prepaid points in the year you paid them. Instead, you can deduct a portion of the points each year over the life of the loan.

To determine the amount you can deduct each year, use the following equation:

x Number of mortgage payments made each year

As an example, lets say you bought a house with a 30-year mortgage term and paid $3,400 in points upfront. Here are the steps you would need to complete:

1. Multiple the full term of the loan by 12 to determine what the loan term is in months:

30 x 12 = 360

2. Divide the cost of the points paid by the full term of the loan :

$3,400 ÷ 360 = $9.44

3. Multiply the result by the number of mortgage payments made in the tax year:

$9.44 x 12 = $113.33 deduction each year.

Buy Down Points On Refis

The IRS’ applies different rules on buy down points when you are refinancing your mortgage. Instead of being able to write off your points when you pay them, you have to amortize them over the life of your loan. For example, if you pay $2,500 to buy down a 30-year refinance, you will be unable to claim a $2,500 deduction. You will, instead, write it off over 30 years by claiming a $83.33 discount every year. If you pay that mortgage off early, though, you will be able to claim the remainder of the buy down poinfs in a lump sum then.

Read Also: How To Sell A Mobile Home With A Mortgage

What Is The Mortgage Interest Deduction

The mortgage interest deduction is a tax incentive for homeowners. This itemized deduction allows homeowners to count interest they pay on a loan related to building, purchasing or improving their primary home against their taxable income, lowering the amount of taxes they owe. This deduction can also be taken on loans for second homes, as long as it stays within the limits.

Mortgage Interest Deduction Calculator

When it comes to calculating your mortgage interest deduction, you can easily do so in the comfort of your home. Youll need to divide the maximum debt limit by your remaining mortgage balance, then multiply that result by the interest paid to figure out your deduction. Many people revert to financial experts in cases like these, just to make sure their calculations are accurate and there are zero issues with the IRS.

Lets consider an example: Your mortgage is $1 million, and since the deduction limit is $725,000, youll divide $750,000 by $1 million to get 0.75. Youll pay $60,000 in interest for the year, and that multiplied by 0.75 will show that you can ultimately deduct $45,000.

Don’t Miss: What Score Do Mortgage Companies Use

Mortgage Discount Points Vs Apr

While buying discount points on your mortgage is effectively prepaying interest, an annual percentage rate is a way to facilitate the comparison of loans among different rate and point combinations. It incorporates not just the interest rate, but also the points you pay and then any fees that the lender charges for providing the credit. Check out a quick explanation from Greg McBride, CFA, Bankrate chief financial analyst: