Is There Any Advantage To Paying Pmi

Paying PMI comes with one major benefit: the ability to buy a home without waiting to save up for a 20 percent down payment. Home prices are continuing to climb, hitting an all-time high of more than $329,000 for an existing property as of April 2021, according to the National Association of Realtors. A 20 percent down payment at that price would be more than $65,000, which can seem like an impossible figure for many first-time homebuyers.

Instead of waiting while saving, paying PMI allows you to stop renting sooner. Homeownership is generally an effective long-term wealth building tool, so owning your own property as soon as possible allows you to start building equity sooner, and your net worth will expand as home prices rise. If home prices in your area rise at a percentage thats higher than what youre paying for PMI, then your monthly premiums are helping you get a positive ROI on your home purchase.

Who May Want Mortgage Insurance

Anyone with a mortgage balance could benefit from mortgage insurance.

My advice is to purchase life insurance to cover the mortgage in the event one of the homeowners dies prematurely. Dont just buy an amount of life insurance equal to the mortgage amount you probably have other financial bases to cover, Mitchell said.

Shanbrom said MPI can also help people who rely on the main note holder. If that person dies and cant make payments, it could impact the equilibrium of the household and make it hard for those within to go back to work.

Necole Gibbs, licensed independent broker at TNG Insurance and Financial Services, said mortgage insurance is an especially good idea for young couples with children.

If something were to happen to either of the two during the term, the surviving spouse would receive the death benefit and would then be able to pay off the mortgage, Gibbs said.

If youre concerned about losing money through premiums, you could choose a return of premium policy. Those policies, which can be pricey, pay you back your premiums if you outlive your mortgage insurance. Gibbs said these policies get returned as a lump sum at the end of the policys term.

This is a great strategy because if nothing happens to the couple during the term, Gibbs said.

MPI is also an option if you dont want to take a medical exam to buy a regular term life insurance policy. Some insurers dont require an exam for an MPI policy.

Why Do I Have To Pay For Pmi

Although PMI may seem like yet another expense in the home buying process, it is a requirement for many borrowers. In the same way that homeowners insurance can protect you against damage to your home, PMI protects your lender if you default on your mortgage.

If you wish to avoid paying PMI, you may want to consider waiting to purchase a home until you can secure a larger down payment.

Don’t Miss: Can I Throw Away Old Mortgage Papers

How To Pay Lmi

There are two ways you can pay for LMI. Some lenders will allow you to capitalise LMI onto your loan so it can be paid gradually over time with your mortgage repayments. However, this means that interest will accrue on the LMI, costing you more over time.

The alternative is to pay LMI as an upfront cost, which is generally preferred by lenders.

Look Out For Lenders Offering To Discount Or Waive Lmi Costs

In a rising property market, it has become increasingly difficult for many borrowers to build a 20% deposit and maintain it at that level. In response, some lenders have started offering LMI discounts to eligible customers, while others are offering to waive the cost of LMI entirely. For example, at the time of writing, Bank of Melbourne, Bank of Queensland, BankSA and St. George are offering to reduce the cost of LMI to $1 for eligible borrowers on certain loans. Online lender Homestar recently launched a no-LMI home loan that eliminates the cost for eligible customers. Be sure to check with the lender for any eligibility criteria or other terms and conditions that apply to the offer, and remember to check that the loan also represents good value based on the interest rate, fees and loan features.

Recommended Reading: Can You Get A Second Mortgage With Bad Credit

How Much Does Mortgage Insurance Cost

When figuring out MPI premium costs, insurance companies consider:

Your age

Smoking status

Length and amount left on the mortgage

Another cost factor is whether the policy is joint coverage for both spouses. In that case, the company will pay a death benefit when one of the couple dies. Though that coverage will cost more than if you covered only one person, a mortgage insurance policy would probably still cost less than buying two individual term life insurance policies.

Lets take a look at possible costs. If you have $120,000 left on your mortgage, you may find a mortgage insurance policy with bare minimum coverage for $50 a month. Adding riders, such as return of premium and living benefits, can increase monthly premiums to $150 or more on that same $120,000 amount.

Federal Housing Administration Mortgage Insurance

Mortgage insurance works differently with FHA loans. For the majority of borrowers, it will end up being more expensive than PMI.

PMI doesn’t require you to pay an upfront premium unless you choose single-premium or split-premium mortgage insurance. In the case of single-premium mortgage insurance, you will pay no monthly mortgage insurance premiums. In the case of split-premium mortgage insurance, you pay lower monthly mortgage insurance premiums because you’ve paid an upfront premium. However, everyone must pay an upfront premium with FHA mortgage insurance. What is more, that payment does nothing to reduce your monthly premiums.

As of August 2020, the upfront mortgage insurance premium is 1.75% of the loan amount. You can pay this amount at closing or finance it as part of your mortgage. The UFMIP will cost you $1,750 for every $100,000 you borrow. If you finance it, youll pay interest on it, too, making it more expensive over time. The seller is permitted to pay your UFMIP as long as the sellers total contribution toward your closing costs doesnt exceed 6% of the purchase price.

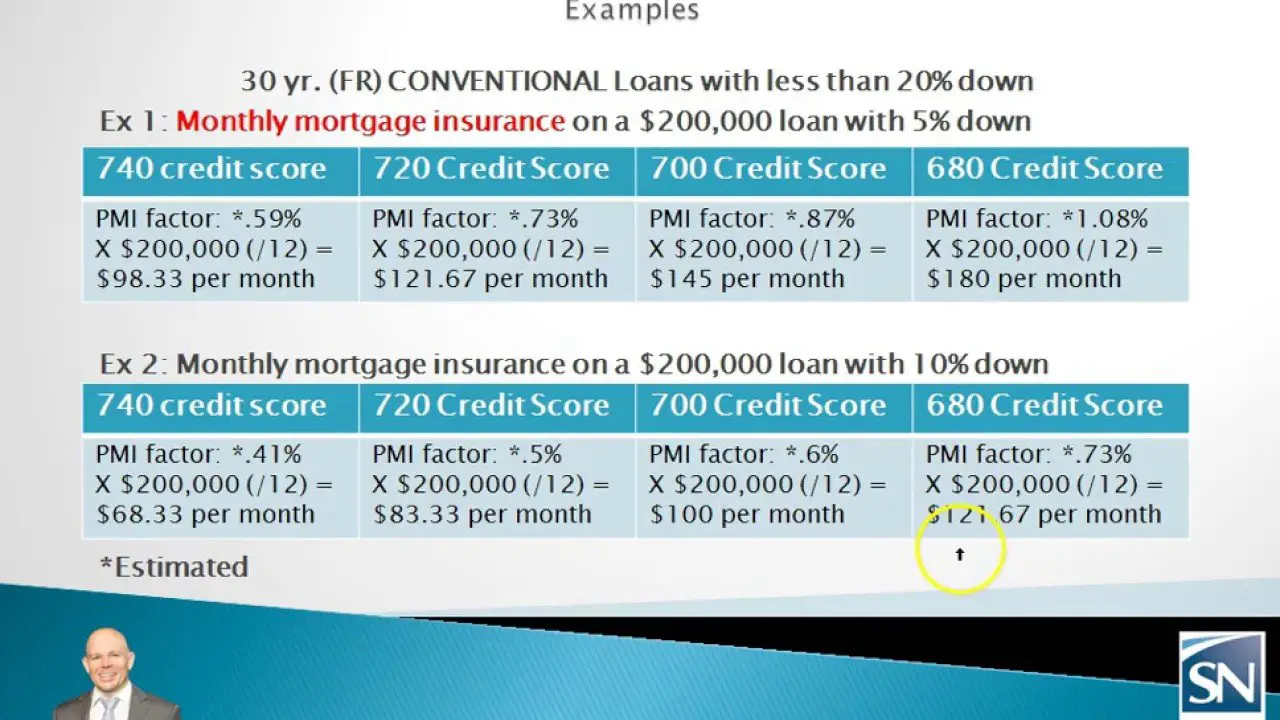

With an FHA mortgage, you’ll also pay a monthly mortgage insurance premium of 0.45% to 1.05% of the loan amount based on your down payment and loan term. As the FHA table below shows, if you have a 30-year loan for $200,000 and you’re paying the FHA’s minimum down payment of 3.5%, your MIP will be 0.85% for the life of the loan. Not being able to cancel your MIPs can be costly.

Also Check: How To Get A Mortgage On A Foreclosure

Are Fha Loans Worth It

Many borrowers choose an FHA loan despite the potentially higher cost of FHA mortgage insurance. One reason is that the FHAs minimum down payment of just 3.5 percent is one of the smallest allowed on any type of loan.

While some conforming, VA and USDA loans also allow borrowers to make a very small down payment, these loans can be more selective than the FHA loan in terms of who can qualify.

Fannie Mae insures one type of loan that has a minimum down payment of 3 percent with PMI. This loan is available only to buyers who haven’t owned a home during the previous three years and homeowners who want to refinance certain types of existing loans.

The VA loan allows borrowers to buy a home without a down payment. This loan is available only to U.S. military servicemembers, veterans and certain other borrowers. The FHA loan also offers low closing costs and easier credit qualifying guidelines, according to the FHA website.

Borrowers who have a moderately low credit score might be able to qualify for an FHA loan with a reasonable interest rate, while that same credit score might trigger a significantly higher interest rate for a non-FHA loan. Though the FHA mortgage insurance might be more expensive, the lower interest rate offsets some of that cost to the borrower.

Borrowers whose credit score is very low might be limited to the FHA loan for that reason alone. Most other types of loans have higher minimum required credit scores.

About the Author

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

Also Check: What Income Can Be Used To Qualify For A Mortgage

How Much Does Mortgage Life Insurance Cost

Youâve won the bidding war for your new home, signed the purchase agreement, and secured a mortgage. But just when you think all the hard work of buying a home is over, you realize that thereâs something else you need: a safety net to protect your family from mortgage debt.

After all, you and your partner wanted the best home the two of you could afford. So even though you both have decent jobs, you have a mortgage that relies on both of your incomes to make the monthly payments. This means that if one of you dies before youâve paid off the mortgage, the surviving partner wonât be able to afford the mortgage. And theyâd have to sell the home.

The bank you got your mortgage from tells you that you can nip your mortgage debt anxiety right in the bud by buying mortgage life insurance â insurance that protects your family against mortgage debt if you pass away.

But how much does mortgage life insurance actually cost? And does it give you the best bang for your buck?

We tell you what you need to know about the cost of mortgage life insurance below.

Cost Versusbenefit Of Private Mortgage Insurance

Todays homeowners are buildingwealth like few times in history.

According to the Federal HousingFinance Agency , home values in the third quarter of 2020 were upmore than 7% from the same period one year prior.

The typical U.S. homeowner isearning $13,000 per year.

Whats more, home value appreciation is nothing new. FHFA says home prices have increased by about 5% per year since 2012. And home values have increased every quarter dating back to 2011.

That means arenter who bought the average home four years ago has gained morethan $40,000 in home equity to date. Some have earned muchmore six figures in some cases.

Whats surprising, then, isadvice saying you should buy a home only when you have a 20% down payment.

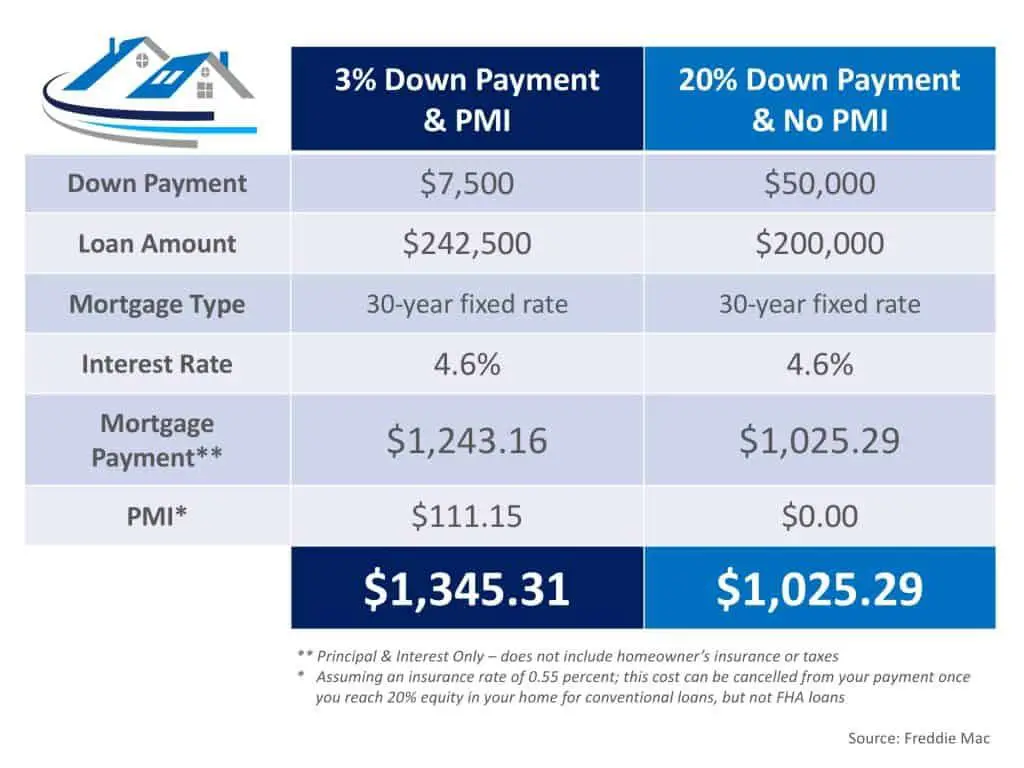

Putting 20% down is less risky thanmaking a small down payment, butits also costly.

Even strong opponents of mortgageinsurance find it hard to argue against this fact: PMI payments, onaverage, yield a huge return on investment.

PMI return oninvestment

Home buyers avoid PMI because theyfeel its a waste of money.

In fact, some forego buying a homealtogetherbecause they dont want to pay PMI premiums.

That could be a mistake. Data fromthe housing market indicates that PMI yields a surprising return on investment.

Imagine you buy a house worth $233,000 with 5%down.

The PMI cost is $135 per monthaccording to mortgage insurance provider MGIC. But its not permanent. It dropsoff after five years due to increasing home value and decreasing loanprincipal.

Read Also: How Can You Have Two Mortgages

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

How To Minimize Mortgage Default Insurance

The only way to minimize your mortgage default insurance is by increasing your down payment as a percentage of your home price. To do this, you either have to increase the amount you put down or purchase a less expensive home. Examining the first option, you may want to consider additional sources for your down payment, such as a gift from a family member or, if you are a first-time homebuyer, a tax-free withdrawal from your RRSP, as part of the RRSP Home Buyers’ Plan.

Note that under the changes to CMHC underwriting on July 1st, 2020, you will not qualify for CMHC coverage if you borrow money for a down payment. If borrowing your down payment puts you over the 20% down payment threshold, however, you won’t need CMHC insurance at all.

Read Also: Can I Have Multiple Mortgages

What You Should Know About Mortgage Insurance As A Homebuyer

Mortgage insurance can be complicated to understand, especially if youre a first-time homebuyer.

So if youre feeling confused about mortgage insurance, just remember these basics:

When Do You Pay Pmi

There are a few ways to handle PMI payments. Some lenders may let you choose a payment method. Others require you to agree to a specific option. The most common PMI payment methods include:

- Monthly premium: Paying a monthly premium is the most common PMI option. In this case, your lender automatically adds PMI to your monthly mortgage payment. You wont have to make a large upfront payment, but your monthly payments will be higher.

- Upfront premium: Rather than paying every month, you may have the option to pay the full cost at once. In this case, your lender arranges for you to pay PMI when you close on the loan. While it’s an additional closing cost, your monthly mortgage payment will be lower.

- Monthly and upfront premiums: Alternatively, your PMI might come in a combination of the two methods above. In this case, your lender arranges for you to pay a portion of your PMI at closing and adds the rest to your monthly mortgage payments.

Don’t Miss: How Do I Qualify For A Mortgage With Bad Credit

Mortgage Insurance Costs Over The Years

People who bought homes in September paid nearly 9% more for mortgage insurance than a year ago, totalling $3,810 based on that months median home prices and an average 1% cost for mortgage insurance, according to Realtor.com. Thats largely because the median home listing price jumped to $381,000, a $31,000 increase during the same period.

Going further back to January 2020, before Covid-19 became a severe global pandemic, home buyers were paying an average $3,000 for mortgage insurance$810 less than homebuyers this September. And for folks in costlier areas, mortgage insurance can be about the same as a new car payment.

Its also crucial to know your mortgage insurance costs ahead of time because it plays a big factor in how much you can borrow to buy a home. This means you might also be limited in how much home you can afford when the cost of housing is skyrocketing, pushing up mortgage insurance costs, like private mortgage insurance .

When the cost of PMI increases, it puts a strain on a borrowers debt-to-income ratio, reducing the amount they can afford to borrow, says Darrin English, a senior community development loan officer at Quontic. An increase of $100 paid in mortgage insurance premium can reduce a borrowers buying power by approximately $20,000.

What Is Mortgage Insurance

Mortgage insurance shouldnt be confused with homeowners insurance. Homeowners insurance is meant to protect you from financial loss if theres an issue or damage on your property. Mortgage insurance, on the other hand, is designed to protect your lender if you cant repay your loan.

Heres the difference in how each type of insurance works:

- Homeowners insurance: Youll purchase this insurance to cover damage and liability on your property. If your home is burglarized, damaged in a storm, or experiences some other issue, your insurance will help cover the costs.

- Mortgage insurance: When you get a mortgage loan, your lender might require you to pay for a mortgage insurance policy. In the event you fall behind on your mortgage, the lender calls on that policy to recoup their losses.

Good to know:

Learn More: How to Buy a House

You May Like: What Is The Mortgage On A 3 Million Dollar Home

First Home Loan Deposit Scheme

If youre an eligible first home buyer, another option is to apply for the Federal Governments First Home Loan Deposit Scheme. Under the scheme, eligible homebuyers chosen to participate can apply for a loan with a deposit as small as 5% and wouldnt need to pay for LMI if the lender approves the loan. The Government essentially guarantees the additional amount needed to reach a 20% deposit.

First home buyers with an annual income of up to $125,000 are eligible. Keep in mind that this scheme is only available to 10,000 first home buyers each year, which up to now has represented a relatively small fraction of the market. Consider checking whether there is availability in the current year, or whether you would need to wait to apply the following year.