Can I Use A Mortgage Calculator Based On Income

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

How Does A Mortgage Loan Work

When you get a mortgage, your lender gives you a set amount of money to buy the home. You agree to pay back your loan with interest over a period of several years. You dont fully own the home until the mortgage is paid off.

The interest rate is determined by two things: current market rates and the level of risk the lender takes to lend you money. You cant control current market rates, but you can have some control over how the lender views you as a borrower. The higher your credit score and the fewer red flags you have on your credit report, the more youll look like a responsible lender. In the same sense, the lower your DTI, the more money youll have available to make your mortgage payment. These all show the lender you are less of a risk, which will benefit you by lowering your interest rate.

The amount of money you can borrow will depend on what you can reasonably afford and, most importantly, the fair market value of the home, determined through an appraisal. This is important because the lender cannot lend an amount higher than the appraised value of the home.

What Credit Score Do You Need For A Mortgage

Sean Cooper

â¢10 min read

Article Contents

To qualify for the best available mortgage rates, itâs important to have a strong credit score. A credit score of 680 or above is required to qualify for the best mortgage rates in Canada in 2021. Some mortgage providers allow you to qualify with credit scores between 600 and 680, but these providers may charge higher interest rates.

Want to see your credit score before applying for a mortgage?

Get your free credit score and apply for mortgages with confidence. Use Borrowell to compare mortgage options that you’re likely to qualify for.

You may be wondering why lenders in Canada care so much about your credit score. Mortgages represent a large sum of money for lenders. Just like you wouldnât lend money to a complete stranger, a lender isnât going to lend you a large sum of money without vetting you first. Your credit score is one of the main ways that lenders vet you for your creditworthiness.

A good credit score shows lenders your ability to pay bills on time. The higher your score, the more likely that lenders are willing to work with you. A good credit score can also help you qualify for better mortgage rates, which will help you save more money on your mortgage payments. The interest rate you receive on your mortgage matters, as even a slightly lower interest rate can have a major impact on what you pay in interest.

Don’t Miss: Are Current Mortgage Rates Good

What Do I Need To Do To Get A Mortgage

-

Work out how much deposit you can afford. If you are a first time buyer or needing to move home the UK Governments mortgage guarantee scheme means that with a deposit of 5% you can buy a property worth up to £600,000. These 95% loan to value mortgages are offered by many of the main mortgage lenders. There are also other government schemes including theHelp to Buy scheme

-

Find out how much you could borrow. Use a mortgage calculator to find out whether you can afford a mortgage based on your income and your spending commitments. You can also find out what a mortgage will cost you each month

-

Once youve found a mortgage lender you can ask them to draw up an Agreement in Principle, it doesnt mean you have a mortgage in place but it can help get the homebuying process going

-

Apply for a mortgage – make sure you have all the information and documents you need

What Is A Mortgage Anyway

A mortgage is a loan used for real estate transactions in which the property is collateral for the loan. If you dont make the payments, the bank/lender can seize ownership of the property.

Because mortgages entail a large amount of money and are backed by a physical asset, they allow most people to borrow money at a relatively low-interest rate and spread the payments out over a long period of time . The interest rate can change over the life of the loan, but is fixed for a specific term, typically five years.

No mortgage no home

Lets first make sure you are strong enough to qualify for a mortgage. If you cant do that, then nothing else matters.

Read Also: How To Determine What You Qualify For A Mortgage

Cost Of Mortgage Loan Insurance

The fee you pay for mortgage loan insurance is called a premium. Mortgage loan insurance premiums range from 0.6% to 4.50% of the amount of your mortgage. Your premium depends on the amount of your down payment. The bigger your down payment, the less you pay in mortgage loan insurance premiums.

Find premiums based on the amount of your mortgage:

You can pay your premium by adding it to your mortgage or with a lump sum up front. If you add your premium to your mortgage, you pay interest on your premium. The interest rate is the same rate as youre paying for your mortgage.

Ontario, Manitoba and Quebec apply provincial sales tax to mortgage loan insurance premiums. Your lender cant add the provincial tax on premiums to your mortgage. You must pay this tax when you get your mortgage.

What Documents Will I Need For My Mortgage

Matty Kimura, a Processing Expert at Better Mortgage, gives a rundown of the documents youll need for your mortgage application.

Are you thinking of buying a house? Or maybe youve heard rates are low and you want to refinance your current loan. Either way, youll need a mortgage. To help you prepare, lets go over the types of documents youll be asked for, who will be looking at them, and why they matter.

At Better Mortgage, we have an experienced, non-commissioned support staff dedicated to helping you every step of the way, but coming prepared is the best way to close on a mortgage successfully and without a hitch. To start, well need you to collect some important documents to help us understand your income, debts, and assets. These are the foundation for our underwriting team to make sure you can afford your new mortgage. The docs we need are pretty standard fare across most lenders, but what makes Better Mortgage better is our smart technology, which personalizes document requests based on your situation. We wont ask you for stuff that doesnt make sense, which saves everyone a lot of time and headache.

Read Also: Can I Change Mortgage Companies

What You Need To Know About Mortgages For Your Home

It takes research about the lending process to get the very best loan for your next home. Do you understand what a mortgage brings with it? Well, youll be able to learn a lot from this article so youre able to get yourself a mortgage that you want.

When it comes to getting a good interest rate, shop around. Each individual lender sets their interest rate based on the current market rate however, interest rates can vary from company to company. By shopping around, you can ensure that you will be receiving the lowest interest rate currently available.

If the idea of a mortgage looming over your head for the next few decades does not appeal to you, consider refinancing over a shorter period. Although your monthly payments will be more, youll save a lot in terms of interest over the life of the loan. It also means being mortgage-free much sooner, and owning your home outright!

Know your credit score and keep unsavory mortgage lenders at bay. Some unscrupulous lenders will lie to you about your credit score, claiming it is lower than it actually is. They use this lie to justify charging you a higher interest rate on your mortgage. Knowing your credit score is protection from this fraud.

What Do I Have To Do To Apply For A Mortgage Loan

Toapply for a mortgage loan, you will have to provide a lender with personalfinancial information and information about the house you want to finance.

The first step of applying for a mortgage is to request a Loan Estimate from three or more lenders.

To receive a Loan Estimate, you need to submit only six key pieces of information:

- Your name

- Your Social Security number

- The address of the home you plan to purchase or refinance

- An estimate of the home’s value

- The loan amount you want to borrow

Although you’re not required to provide documents in order to get a Loan Estimate, it’s a good idea to share what you have with the lender. The more information the lender has, the more accurate your Loan Estimate will be.

Tip:

Once you’re ready to choose a loan offer, you need to notify the lender that you are ready to proceed with the loan application. If you don’t notify a lender that you’d like to proceed within 10 business days, the lender may revise the Loan Estimate or close your application as incomplete and you may need to start over. The 10 business days are calculated from when the lender delivers the Loan Estimate to you or places it in the mail, whichever is earlier.

Recommended Reading: Where To Find Lowest Mortgage Rates

Documents You Need To Get A Mortgage

It used to be possible to borrow vast amounts of money to buy a home with almost no documentation. But since borrowers who cant prove their income are more likely to default, the banking industry has become much more careful about who can borrow money which means even very strong buyers have to supply stacks and stacks of documents to prove theyre worthy.

If youre applying for a mortgage, you can expect your lender to ask you for most of the items on this listand perhaps even more if your situation is at all unusual.

1. Tax returns

The lender wants to be reasonably sure that your paycheck is high enough to allow you to meet the mortgage payments every month. They feel more confident if your salary has been relatively stable for the past few years. Thats why most lenders will ask to see tax returns going back at least two years. If your income has jumped recently, the lender may want additional documentation to assure them that it wasnt just a one-time windfall, like a bonus that is unlikely to be repeated.

2. Pay stubs

The tax returns prove what your income was last year and the year before, but your recent pay stubs tell the lender that youre still earning the same amount.

3. Other proof of income

4. Employment letters

5. Proof of funds

6. Photo ID

Thats right the lender wants to make sure you are who you say you are. A copy of your drivers license is usually sufficient.

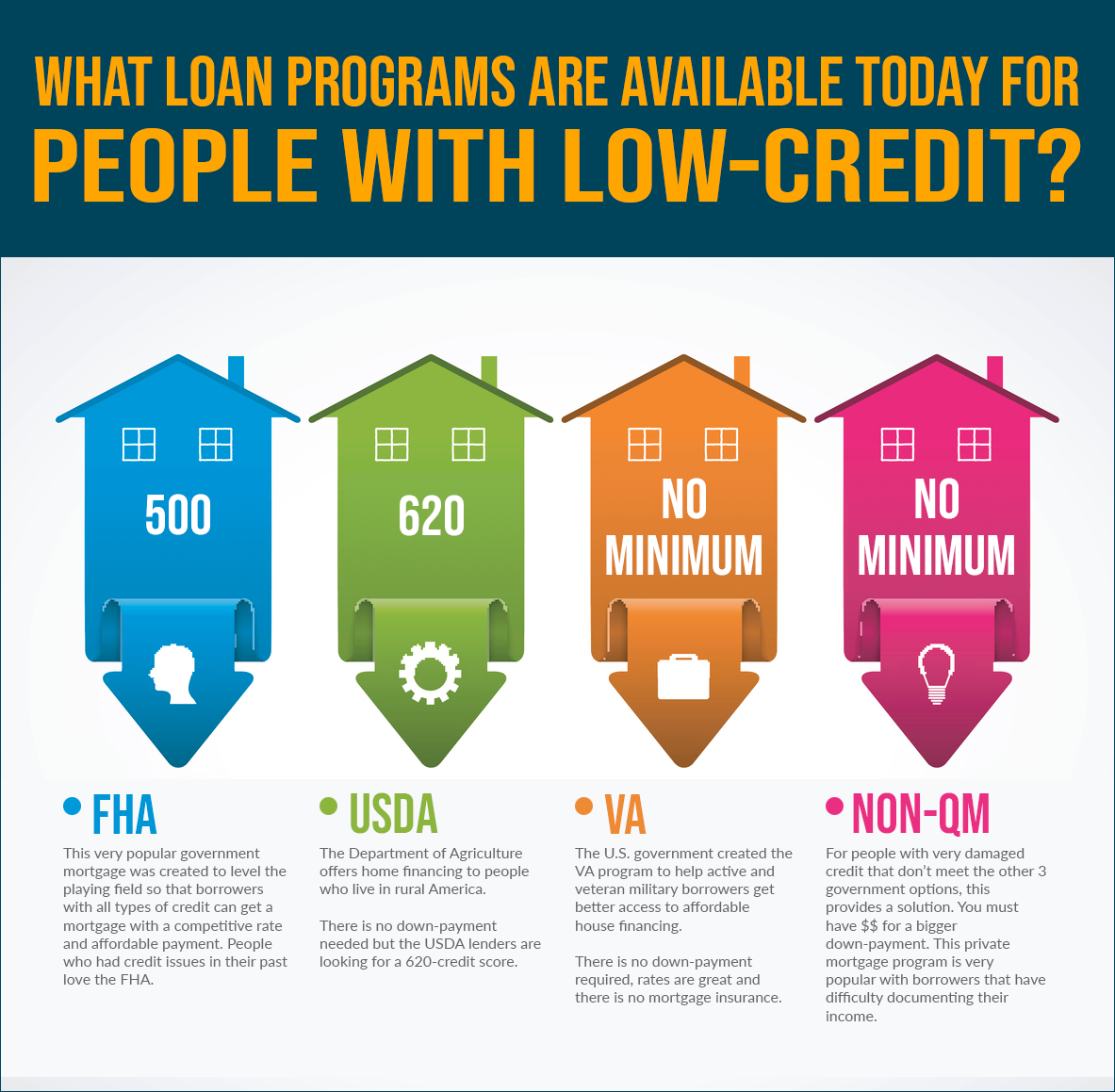

How Do I Get A Mortgage If I Have Bad Credit

Bad credit can limit your ability to get a mortgage. You may have options available to you, but the interest rates youâll qualify for wonât be cheap. If you donât want to put off purchasing a new home, there are immediate steps you can try taking to get a mortgage with bad credit. If youâre willing to wait, you should take time to improve your credit score and qualify for better mortgage options. Here are ways you can get a mortgage with bad credit.

Make a larger down payment

If your credit score isnât great, there are other ways to demonstrate your financial stability to lenders. Making a large down payment of 20% or above provides you with more leverage when working with lenders. It shows that you have a sizeable income and demonstrates your budgeting skills. It will also help you reduce your regular mortgage payments, making them more manageable in the long-run. In short, a larger down payment will often make you a more attractive borrower to mortgage lenders.

Use an alternative mortgage lender

If your credit score falls below 600, you will have a very difficult time getting approved from Canadaâs major banks. Youâll more than likely have to work with an alternative lender.

Alternative lenders are more lenient when it comes to credit. However, youâll usually need to make a heftier down payment of between 20% and 35%. Interest rates also tend to be higher with alternative mortgage lenders.

Get a co-signer or a joint mortgage

Improve your credit score

Also Check: Is Total Mortgage A Good Company

To Verify Your Assets Well Need:

-

At least 2 months of bank statements, including the full transaction history and current balances.

-

If there are any large or recurring payments, or large deposits that fall out of typical use, well need documentation for those transactions. For example, a large deposit into your checking account could be the result of liquidating funds from an investment account. In this case, statements from your investment account that line up with the deposit transaction would suffice. Or if you received a gift toward your down payment from a family member, we will need a letter confirming that it was truly a gift and not a loan.

-

If you are using funds from your retirement account, well need the terms of withdrawal to confirm that you would be able to draw from the account without unexpected penalties.

Once youve provided your initial documentation, an underwriter at Better Mortgage will review your application in its entirety. Based on the information and documents you provide, we may need to reach out to you for further clarification this is to make sure that we fully understand your circumstances. At Better Mortgage, we follow Fannie Maes underwriting guidelines, which is the industry standard. And while underwriting guidelines have tightened up because of the 2008 financial crisis, we make every attempt to limit tedious requests and approve your application.

How To Apply For A Mortgage

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Most people can’t buy a home outright. Rather, they need to finance it with a mortgage. If you’re ready to apply for a mortgage, here’s how to go about it.

Also Check: How To Determine Ltv Mortgage

Be Prepared When You Apply For A Mortgage

Dont let this list scare you! Its designed to give you a general sense of the types of things you may need to apply for a mortgage. Chances are you have many of them on hand or easily accessible already! Plus, this list will enable you to gather what you need for the mortgage application process ahead of time, so things can move along smoothly when you are ready to move forward with pursuing a home loan.

Interested in learning more about preparing to apply for a home loan? Contact the experienced mortgage professionals at Maple Tree Funding today! Our team would be happy to answer any questions you may have on the application process.

Give us a call at or complete our easy online contact form to get started!

Shop Around For The Best Mortgage Rates

With all that out of the way, its time to secure a loan. But dont let your excitement cause you to jump into a contract too soon. Choosing the right mortgage lender and loan offer requires some research and patience to ensure youre getting the best deal.

The mortgage interest rate you agree to will have a major impact on the total cost of your loan. Even a fraction of a percentage point can add up to a significant chunk of change over many years. Say you borrow $200,000 at 4.25% over 30 years. Youd end up paying a total of $154,197 in interest over the life of the loan. If your rate was 3.50% instead, youd pay $123,312 in interest, for a savings of $30,885 over those same 30 years.

In addition to the interest rate, pay attention to closing costs, origination fees, mortgage insurance, discount points and other expenses that can tack on thousands of dollars to your loan. These fees often are rolled into your loan balance, meaning you pay interest on them in addition to the principal.

Once simple way to compare the true cost of a mortgage is by examining the annual percentage rate . This is the total yearly cost of your loan once all fees are factored in, expressed as a percent of the total borrowed. However, one thing to keep in mind is that the APR assumes you will keep the loan for its entire term if you plan to move or refinance within a few years, the APR may be a bit misleading.

Recommended Reading: What Score Do Mortgage Companies Use

Required Income Calculator For A Home Purchase Or A Refinance

Have you found a home that you want to buy? Or plan on refinancing? Or you’re looking at homes around a certain price point. Can you get a loan to buy it? Need to see how much you can qualify for on a refinance?

This mortgage income calculator can give you the answer. This calculator not only takes into account the loan amount and interest rate, but also looks at a whole range of other factors that affect the affordability of a home and your ability to get a mortgage, including your other debts and liabilities that have to be paid each month, as well as costs like taxes and homeowner’s insurance that are part of the monthly mortgage payment.

It also makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan, by using the sliding adjusters below to change your results. Just start filling out the fields indicated below. Or scroll down the page for a detailed explanation of how to use the Mortgage Required Income Calculator.

- FAQ: Great tool to use as loan amount estimates change as you shop for a new home. Or for a refinance when the appraised value forces a change in loan amounts because of loan to value .