Improve Your Credit Score

If you have debt, a mortgage lender may still approve your application if you have a very good or excellent credit score.

Payment history is the most important factor in your credit score, so make sure you’re paying all your bills on time. You can also request a credit report from one of the three credit bureaus to check for any errors. If you find you’ve been penalized unfairly, dispute an error with the bureau.

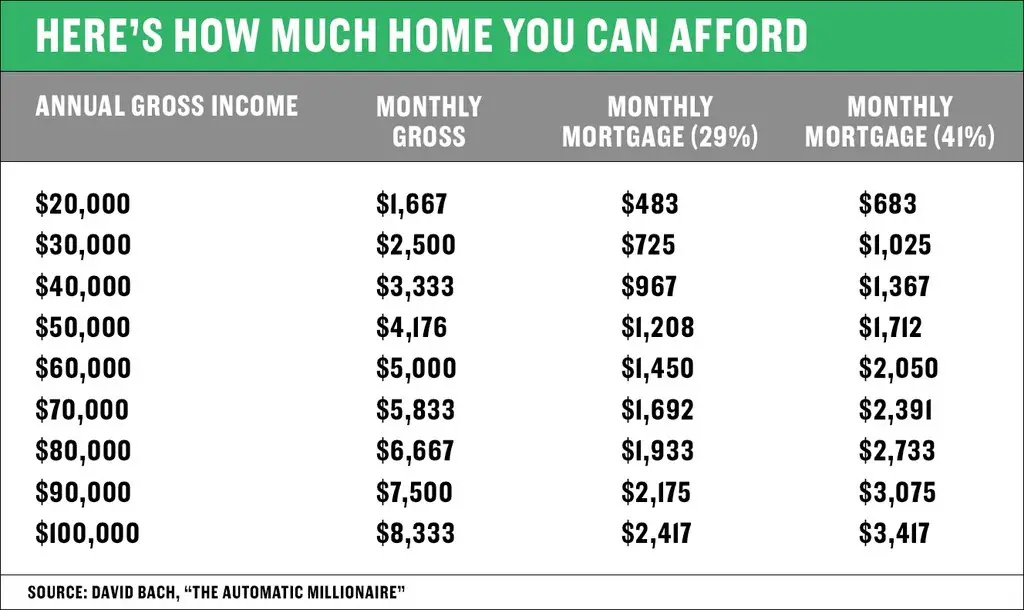

How Much Of Your Debt Should Be Taken Up By Your Mortgage

Mortgage lenders use guidelines to determine the maximum percentage of your debt and income that can be taken up by your mortgage payment. Lenders use two primary ratios to evaluate your ability to pay your mortgage loan: a housing ratio and a total debt ratio.

Other Mortgage Qualification Factors

In addition to your debt service ratios, down payment, and cash for closing costs, mortgage lenders will also consider your credit history and your income when qualifying you for a mortgage. All of these factors are equally important. For example, even if you have good credit, a sizeable down payment, and no debts, but an unstable income, you might have difficulty getting approved for a mortgage.

Keep in mind that the mortgage affordability calculator can only provide an estimate of how much you’ll be approved for, and assumes youre an ideal candidate for a mortgage. To get the most accurate picture of what you qualify for, speak to a mortgage broker about getting a mortgage pre-approval.

Recommended Reading: What’s The Interest Rate On A 15 Year Mortgage

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

How To Interpret The Results

The calculator shows two sets of results:

Most lenders require borrowers to keep housing costs to 28% or less of their pretax income. Your total debt payments cant usually be more than 36% of your pretax income.

Some mortgage programs – FHA, for example – qualify borrowers with housing costs up to 31% of their pretax income, and allow total debts up to 43% of pretax income.

Use our Debt-to-income Calculator to find your DTI ratio and learn more about debts role in your home purchase.

Recommended Reading: Who Benefits From A Reverse Mortgage

Using Our Mortgage Calculator

Our mortgage calculator can help you determine how much you might be able to borrow based on your salary. Just input your annual income and guaranteed overtime together with that of the second applicant, if youre applying for a joint mortgage and youll be shown the minimum and maximum you may be offered. Remember though that income isnt the only factor lenders will take into account when determining how much youll be able to borrow, so this should purely be used as a guide.

Once you have an idea of the maximum amount youll be able to borrow, you can start to compare different mortgages Our mortgage charts allow you to search for a mortgage based on your circumstances, giving an overview of the products available and helping you narrow down the options. You may want to speak to an independent broker for a more personalised look at the products available, too.

Many Americans Spend More Than They Should On Housing These Guidelines Can Help You Avoid That Trap

Buying a new home is a big decision that involves a whole lot of smaller ones. Many people focus on the number of bedrooms or the quality of the kitchen appliances as they contemplate where they want to live.

But new homebuyers shouldnt let considerations like those persuade them to buy a home thats more expensive than they can comfortably afford.

With home prices on the rise in many parts of the U.S., keeping things affordable is getting harder to do. In May the median listing price for a home rose 6 percent from the previous year, to $315,000, a record high, according to a report by Realtor.com. Meanwhile, the number of homes priced above $750,000 rose 11 percent from a year ago.

Buyers say that those high prices are forcing them to spend more than they planned. One-third of buyers report that they spent more than they expected to on their home, and nearly one-third put down a higher down payment than they anticipated, according to a by CoreLogic, a real estate data analytics firm.

Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget. Yet the average married couple with children between the ages of 6 and 17 spends 32 percent of their budget on housing, and single people spend almost 36 percent, according to data from the Bureau of Labor Statistics.

To make sure you dont spend more than you should, here’s some advice on getting a mortgage you can afford.

You May Like: What Is The Hiro Mortgage Program

How Much House Can I Afford Calculator

Maximum Mortgage Payment

How Much House You Can AffordBased on a interest rate on a -year fixed mortgage.

Now that you know what you can afford, get your mortgage here or try our full mortgage calculator.

As you can see from our calculator, how much house you can afford really depends on the relationship between your income and mortgage.

To figure out how much mortgage you can afford with your income, different lenders use different guidelinesbut most lenders dish out mortgages that are way too expensive and keep borrowers in debt for decades!

We want to help you buy a home thats a blessing, not a burden. And the only way to do that is to calculate your home-buying budget the smart wayand stick to it!

Thats what our calculator does for you. How does it work? Well show youget ready for some math!

Example Of Mortgage Payment Percentage

Based on the 28 percent and 36 percent models, heres a budgeting example assuming the borrower has a monthly income of $5,000.

- $5,000 x 0.28 = $1,400

- $5,000 x 0.36 = $1,800

Going by the 28 percent rule, the borrower should be able to reasonably afford a $1,400 mortgage payment. However, factoring in the 36 percent rule, the borrower would also only have room to devote $800 to their remaining debt obligations. Applied to your own financial situation, this may or may not be feasible for you.

Also Check: What Is Negotiable On A Mortgage Loan

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter you and your partners income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you dont know them.

With these numbers, youll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

Finding The Right Mortgage

Before even getting a mortgage you must first have the finances to qualify for the loan. Lenders will check your:

- Gross income

- If you have financial dependents

Lenderswill also base their decision on things like:

- Property value

- Initial deposit

You must also put down an initial deposit on your mortgage. The larger the initial deposit, the lower your monthly payments will be and the faster you will be able to pay off your mortgage.

Traditional wisdom holds that you should try to put down at least 10% of the value of the property as an initial deposit. So for example, if the house you are looking at is £200,000, then you should try to put down at least £20,000 for the initial deposit.

If a lender rejects your application for a mortgage, then it means they do not think you will be able to make your payments.

At this point, the best option is probably to lower your expectations and find more modest loan terms. It might be frustrating to truncate your expectations but its better than becoming financially overwhelmed.

Read Also: How To Figure Mortgage Payment

Save For A Down Payment

The down payment you put on a home increases your buying power. If you can afford a 20 percent down payment, you put yourself in a good position. You can avoid PMI and lenders do not view you as high risk. If you cannot afford a 20 percent down payment, there are other options.

You can find loans that require no down payment, such as the USDA or VA loans. These loans, however, require specific circumstances. Only veterans of the military or their spouses are eligible for VA loans. Borrowers who purchase a home in a rural area and have low income may qualify for a USDA loan. The other loan programs available require the following down payments:

- Fannie Mae has a 3 percent down payment program

- FHA only requires 3.5 percent down

In exchange for a lower down payment, however, you usually pay some type of mortgage insurance. Fannie Mae loans require PMI. You can estimate the amount you would owe as 1 percent of the loan amount per year.

A $200,000 loan would require $2,000 per year in PMI premiums. This amounts to an additional $167 per month. You can cancel this insurance once you owe less than 80% of the value of the home. However, this could take many years.

FHA loans require mortgage insurance for the life of the loan regardless of how much you put down. Today, the FHA charges 0.85 percent of the loan amount in mortgage insurance. On the same $200,000 loan, you pay $142 per month.

Figure In The Closing Costs And Prepaid Expenses

Purchasing a home requires more than a down payment and a loan. There are closing costs and prepaid expenses too. Borrowers may pay up to 5 percent of the loan amount in closing costs. On a $150,000 loan, this equals $7,500. This may take away from the money you saved for a down payment.

Lenders offer different programs and charge different fees, though. Apply with several lenders when you shop for a mortgage to find the best deal. Some lenders charge points up front or have higher interest rates, while others have a higher threshold for risk and can charge less. Comparing the loan estimate from each lender can help you find the right deal.

However, closing fees and down payments are not the only cash you may need. You may also owe prepaid expenses. This is usually the mortgage interest on your loan charged during the month after your closing. Most mortgages do not require the first payment until the following month.

The interest you pay is per diem . You would owe 17 days of interest. Here is an example for a $150,000 loan at 4% interest:

$150,000 x 0.04 = $6000

For more information on how much it really costs to purchase a home, visit our article “How Much Money Do You Need to Buy a House?“

Recommended Reading: Do Mortgage Companies Verify Tax Returns With The Irs

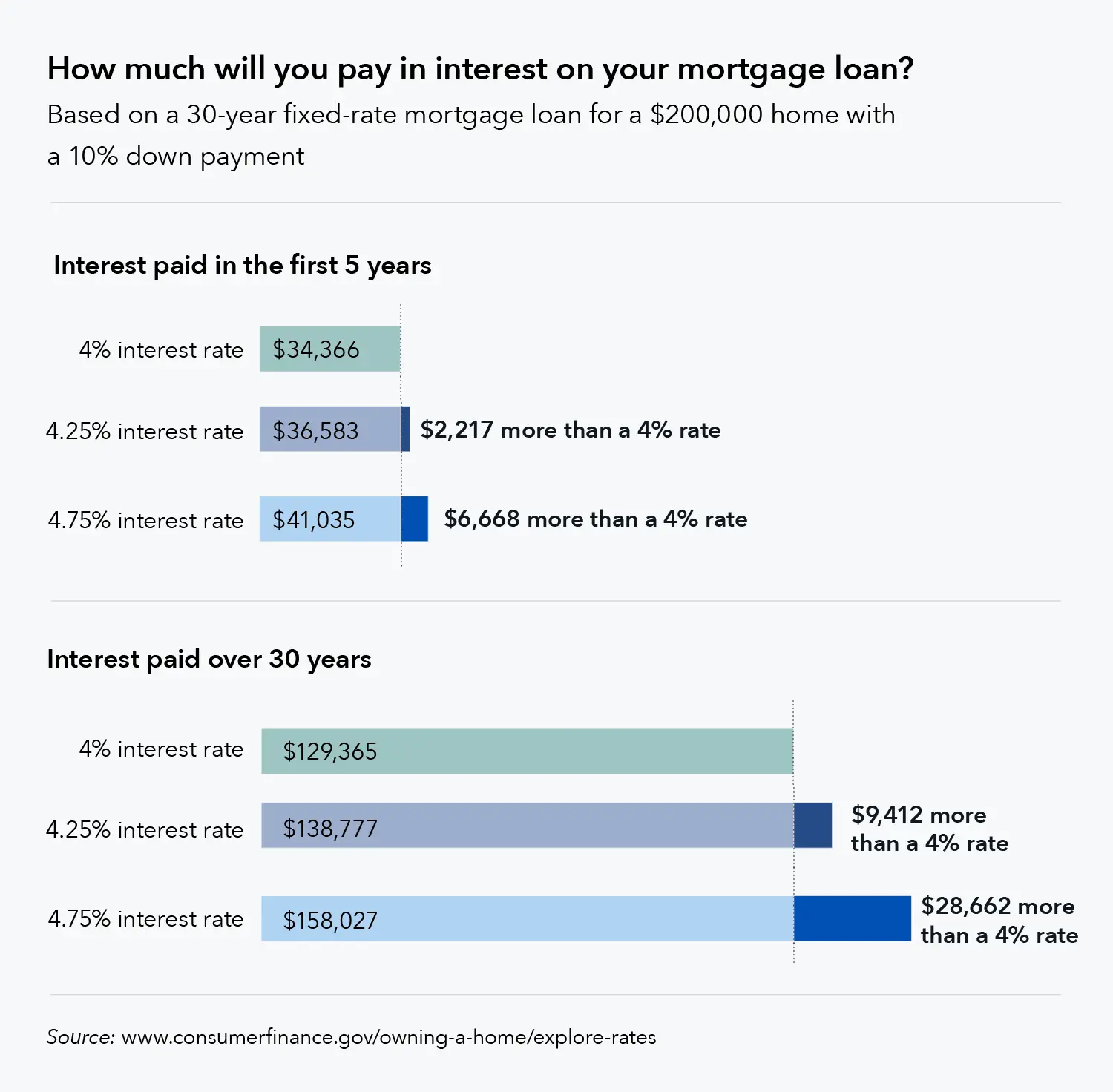

How Are Mortgage Repayments Calculated

To calculate a mortgages monthly repayment, youll need to know the value of the home youre buying, your deposit, the interest rate and the length of term.

For example:

- Deposit – £50,000

- Mortgage amount – £200,000

- Mortgage term 30 years

- Mortgage rate 2%

If the mortgage rate in this example was fixed for the length of the 30-year term, youd pay 360 monthly instalments of £739.24. This pays off the £200,000 loan in full, along with a total interest amount of £66,126.

Its important to remember that, as you begin to pay off your mortgage, the interest owed begins to fall in line with the outstanding amount on your mortgage thats owed. This means youll slowly be charged less in interest as the years go on. During a fixed term however, youll be charged a fixed, regular amount.

| Year of mortgage |

2021 comparethe.com. All rights reserved. comparethe.com is a trading name of Compare The Market Limited. Registered in England No. 10636682. Registered Office: Pegasus House, Bakewell Road, Orton Southgate, Peterborough, PE2 6YS. Compare The Market Limited is authorised and regulated by the Financial Conduct Authority for insurance distribution and is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. Energy and Digital products are not regulated by the FCA.

Meerkat Movies: Participating cinemas. Tues or Weds. 2 standard tickets only, cheapest free.

What Should I Do If The Lender Refuses To Give Me A Big Enough Mortgage

If various lenders reject your application, its a sign that they dont think you can afford such a big mortgage. Should this be the case, its best to scale down your aspirations rather than desperately search for the one lender that will say yes.

This may be frustrating, but its in your best interest to ensure that youre not financially overstretched because you dont want to have your home repossessed in the future.

Related guides

Read Also: What Will My Total Mortgage Payment Be

Can I Include Overtime Payments When Calculating How Much I Can Borrow For A Mortgage

This depends on both how regular your overtime is and the attitude of the lender concerned. Some lenders will not consider any additional income you may receive through overtime, while others may accept all or 50% of this income. Any earnings from overtime to be included as part of your mortgage application will need to be regular or guaranteed and be evidenced.

If however overtime is something you only get occasionally then the lender may not take it into account at all. This is where a mortgage broker can help they will know which lenders are more likely to accept overtime as part of their income calculations.

How Income Multiples Affect Your Borrowing Chances

Banks and building societies will usually lend up to four-and-a-half times the total annual income of you and anyone else you’re buying with. For example, if your total household income is £60,000 a year, you might be offered up to £270,000.

However, some mortgage lenders do offer larger amounts to people in certain professions or those with higher earnings.

For example, some ‘professional’ mortgages will let borrowers with specific jobs borrow five or five-and-a-half times their salary. Alternatively, if you have a household income of more than £80,000, you might find some banks will offer you a higher multiple.

In some cases, the income multiple you’ll be eligible for can also depend on the loan-to-value ratio you’re borrowing at. So if you’re applying for a 75% mortgage, you might be able to borrow more than if you’re applying for a 90% deal.

Following the coronavirus outbreak, some mortgage lenders have begun to impose stricter rules on how much you can borrow. For example, Barclays will now only offer loans up to four-and-a-half times annual salary, compared to the five-and-a-half times salary available to some customers before the pandemic.

Also Check: Should I Have A Mortgage

Where Does The 30% Rule For Rent Come From

The 30% rule of thumb for rent traces its roots to the 1930s, specifically the National Housing Act of 1937. This act created the public housing program for low-income families and established guidelines for maximum rents for them.

Over the years, the original maximum rent threshold gradually increased from 20% of income to 25%, then to 30% in 1981. This amount remains the standard for most public housing programs and is generally used as the yardstick to determine how much you should spend on rent at most income levels.

Interestingly, the 30% rule applies to rent, but there’s a different number that’s used for mortgage payments. Mortgage lenders typically look for borrowers whose combined monthly housing and debt payments don’t exceed 43% of their income.

The 30% rule is rent-specific and doesn’t include other necessary housing costs, such as utilities or renter’s insurance.

Realize That Other Expenses May Come Up

Even if your mortgage doesn’t stretch your budget, an unexpected job loss or other event could cause you to struggle to make your mortgage payments. The more affordable a home is in the first place, the better chance youll have of recovering.

Building up an emergency fund is easier if you limit your mortgage payment to 25 percent of your take-home pay. The more cash you have on hand, and the lower your monthly obligations, the better chance youll have of staying afloat if difficult times strike.

Also Check: Can I Rent An Apartment If I Have A Mortgage

How Much Can I Borrow If Im Self

This will vary between lenders. When using our calculator, aim to get as close to what you think your monthly salary would be.

Some lenders will expect to see at least three years worth of accounts. If youve got an accountant, then your accountant should be able to provide you with the necessary paperwork. If not, youll need to provide a solid record of your accounts yourself.

If youre self-employed, it could be helpful to use a mortgage broker. A broker will be familiar with what evidence lenders need in terms of business accounts, tax returns and the number of tax years youll need documentation for.

Brokers are also likely to have insights into what kind of calculations mortgage providers make, when considering the maximum mortgage theyll lend, and who is more willing to lend to self-employed people. Some lenders calculate the amount you can borrow based on several years income. Others base it on your previous year of trading.

Get more information about mortgages and the self-employed.