Maintain A Strong Credit Score

You’ll need a minimum score of 620 to qualify for a conventional mortgage, but some lenders require higher scores. And if you want to snag a competitive interest rate on your mortgage, aim to get your score into the mid-700s or higher.

If you’re serious about buying a home in the near term, check your , and if it’s not as strong as you’d like it to be, work on boosting it. You can do so by paying off existing credit card balances and correcting errors on your credit report.

Temporary Rental In Connection With Own Habitation In The Near Future

A third form of intermediate rent is for house buyers who will not immediately live there. For example when buying an apartment for when you are older.

The purchased apartment can then be rented out temporarily. When you want to use the apartment yourself, there is an option to cancel the rent due to urgent personal use.

With all three forms of intermediate rental it is very important that this is described very well with an extra clause in the rental agreement. This is in order to demonstrate later that the tenants were well aware of the situation and the intention of the rental.

Buying a house to use for rental

In this blog we have hopefully shown you that it is not so easy to buy a house and use it for rental immediately. As soon as there is a mortgage, fairly strict rules apply.

Do you still want to buy a house and use it for rental? Discuss your plans in advance with your bank so that you are not faced with any surprises. Check out our separate blog about buying and renting a house for more information on this theme. Here we will tell you, for example, what you should pay attention to when buying an investment home, and how you can finance it.

Do you have any questions about renting?

Do you have any questions about renting out a house? Check out our frequently asked questions for landlords. Or contact our customer service.

We are here for you to answer all your questions.

- To let

Houses Are In Fact Money Pits

Next up is the undeniable fact that homes are costly to maintain. Houses require periodic painting, landscaping, roofing, HVAC maintenance, and a host of other things. Theyre also full of expensive appliances that break at the most inconvenient times. To illustrate that point, my friend had to replace his stove and refrigerator the first year he lived in his house.

Why do you think your landlord is so slow to return your call about the leaky sink?

She wants to get as many years out of that sink as possible.

When we own our homes, we make repairs and renovations based on emotions, not resale value, making owning a home far more expensive than renting.

You May Like: How To Get Out Of Mortgage Insurance

How To List A Room For Rent

Once youve prepared the space and figured out what type of roommate you are looking for, its time to craft an ad and get it out there. Consider that your tenant may not look in the normal places for your ad.

Try a college campus housing agency or college newspaper, or a senior citizen center for a single person looking for a room. Since you wont be attracting a family, for example, you can focus on more of a niche marketing approach than a wide net.

Spread the word with friends and family as well, because networking can often yield good results. As always, a good tenant screening is invaluable and will eliminate a lot of trouble for you down the road. You can conduct the screening on your own or use a professional service for a reasonable fee.

One thing to ask for in a room rental/roommate situation is to get references for previous roommates if the applicant is willing. Its much different to find out what a person is like to live with from a former living partner than to ask the landlord, who probably wont know what that person is like in the day-to-day.

Basic Types Of Expenses For Tax Deductions On Rental Property In Canada

The CRA specifies not only the expenses that can be deducted from your rental income but also when, specifically the tax year, in which they can be deducted. As you will realize shortly, some expenses are only acceptable as a deduction in the year you incur them while others are deductible in future years.

Read Also: How Do Mortgage Appraisals Work

Youll Build Equity In Your Home

As long as your property doesnt depreciate, you will build equity in your home over time.

With each mortgage payment, youre saving a few hundred dollars or more in your home equity that, someday, you could liquidate in a sale or refinancing event.

All else being equal, if you could live in the identical home for $1,000 monthly rent or a $1,000 mortgage payment , owning the home seems to make financial sense because youre holding onto $600 a month before factoring in maintenance and other costs.

Thats definitely a good thing, but I dont think its enough of a benefit to entice people to become homeowners prematurely.

There are simply too many other factors to consider, but I think the two biggest are:

- If you dont live in your house long enough, much or all of your equity will be erased by realtor commissions and closing costs on a new home.

- Home equity isnt liquid. If you need cash, youll be forced to sell your home or refinance .

Yes, paying a mortgage and building home equity helps you build wealth. But it only works if you stay in one house for a very long time and you dont borrow against it.

I Own An Investment Property That I Purchased In The Middle Of Last Year My Tax Returns Dont Show An Accurate Reflection Of The Income I Wouldve Made If Id Owned The Full Year Is That Going To Impact How Much Rental Income Can Be Used Toward Qualifying For A Home Loan

If your rental property was acquired during or after the most recent tax filing year or was out of service for an extended period of time, it is possible to use more income than what is reported on your tax returns.

Work directly with your mortgage advisor to explain your specific scenario. We can help you determine how much income can be used toward qualifying. You should prepare to provide documentation, such as a settlement statement to prove when the home was acquired, a current lease agreement to show what its being rented for, and/or documentation to explain why the rental property was out of service for a specific amount of time.

These are just a few of the questions you might have about rental income and qualifying for a home loan. Our experienced mortgage advisors are ready to answer any additional questions you may have.

Fill out the form below to learn more!

Don’t Miss: What Is A Mortgage Inspection

Live In Your Own Rental Building And Call It A Primary Residence

In this article:

Owning a rental property and living in it can be a great way to reduce your monthly mortgage payment.

- When you purchase a 2-unit, 3-unit, or 4-unit home, its your right as a homeowner to live in any of the homes available units.

- Qualifying for a loan will vary depending on the mortgage you use to finance it. In general, mortgage lenders allow just 75% of a homes total rental income to be claimed on a mortgage application because rental homes do become vacant. This means that for every thousand dollars in rent collected, $750 can be used on your loan application.

- The mortgage approval process when you buy a rental property as a primary residence is similar to when you buy any other home. Your lender will require proof of income and assets evidence of employment and, a credit score which meets program minimums. Making a down payment is also required for nearly all loans.

My Retired Parents Want To Rent An Apartment And Have Asked Me To Be Their Lease Guarantor Should I Do It Could It Impact My Ability To Get A Mortgage

Qualifying for a New York City rental is tough, and its even more challenging for retirees who are no longer earning a paycheck and need to meet a landlords income qualifications through other means. So if youre thinking about being a guarantor for your parents, heres what you should know.

Find Your Next Place

First, you have to meet stringent financial requirements to qualify as a guarantor in NYC. Your income must be at least 80 times their monthly rent, your credit has to be solid, and you might also have to reside in the tri-state area.

The idea is that you can handle your financial obligations and pay their rent should they default, Cristina Chiarizia, director of closings at Maxwell Kates, previously told Brick.

Being a lease guarantor shouldnt have a big impact on your credit scorebut it will show up on your credit report. And your credit could be impacted negatively if your parents default on their rent, and you arent able to pay it either.

Another consideration is if you plan to apply for a mortgage in the near future. Thats because just like any other loan or debt, it might create an obstacle to getting a mortgage, says Melissa Cohn, regional vice president and mortgage banker at William Raveis Mortgage. For example, if youre guaranteeing an apartment that costs $5,000 a month, that monthly rent will be considered your debt, making a direct impact on your approval, she says.

Read Also: How Do I Find A Good Mortgage Broker

You Cant Control Taxes Or Your Neighbors

When you buy a home, you make a long-term commitment to your neighborhood, for better or worse.

If you live in a city, or town, with a great economy and school system, chances are your home value will increase . And if your salary isnt soaring as high as those of the new people flocking to your town, you may find yourself unable to afford to stay there.

Ive seen this happen to both my parents and my in-laws, and its not pretty.

On the flip side, if your neighborhood deteriorates, youre the one not just living there, but owning property. If you rent, you can move at the end of the lease and let your landlord figure out how to deal with the depreciating property.

The Joys Of Being A Landlord

Being a live-in landlord means living near your renters. That can be good and bad such as if theyre having a loud party and you have to go tell them to quiet it down. And, of course, theres maintenance, which can require being handy if you want to save money and do the work yourself.

Riley Adams, a licensed CPA in Louisiana who has a personal finance blog aimed at helping young professionals find financial independence, says he spends four to eight hours per month maintaining or repairing the two-unit house that he and his wife own in New Orleans, and another four to eight hours each month to upkeep a short-term rental behind the house.

The couple lives in one part of the house, and long-term tenants live in the other half. Adams part of the house has a separate side entrance. A separate unit behind the house earns them income as a short-term rental on AirBnB.

Between the money earned from our tenants and the short-term guests who stay with us, we completely cover our monthly mortgage and associated housing expenses, Adams says. This allows us to live in the space for free and house hack.

They used a traditional 30-year mortgage to buy the property, and included the expected rental income in their income total used to qualify for the loan, he says.

They keep busy during busy tourist times in New Orleans of November through May, he says, and both he and his wife are flipping the unit between guests.

Read Also: How Mortgage Pre Approval Works

Knowing How Much You Can Afford Is Essential

Sometimes its too late before we ask that very important question how much rent can I afford? The whole process of the apartment search is overwhelming: using apartment finders to locate one that looks decent, calling and making appointments to tour, and applying and finally being accepted. Sometimes the details of that question of how much can I afford is just not adequately considered.

We made this question easier to answer with our How Much Rent Can I Afford? Calculator. Especially when you are moving to a new area, its hard to know just how much you can spend each month on your apartment without leaving yourself with only oatmeal for breakfast and beans and rice for dinner.

Once you finish your calculations, plug in the results of our How Much Rent Can I Afford Calculator right into your RentLingo apartment search. You can search for apartments based solely on your budget. RentLingos apartment reviews and ratings so that you can narrow your search to the best apartments possible that will fit your budget. Dont forget to factor in things like utilities, renters insurance and transportation costs. Also, each listing is complete with its own apartment guide that includes available amenities, apartment pictures and videos, location details, and contact information. Good luck with finding your next apartment!

Evaluate The Terms Of Your Contract

Evaluating your mortgage contract should be your first priority after you have decided to begin renting your property. Carefully review this document in order to determine whether or not your lender has incorporated any stipulations related to renting out your property, such as a statement that the property will be owner-occupied. If there are no specific restrictions written into your contract you should be able to rent out your home as you see fit. Your lender may still require specific documentation that will ensure that your mortgage is not put into jeopardy.

Recommended Reading: Can You Get Extra Money On Your Mortgage For Furniture

I Work In Another State Can I Deduct Rent For My Apartment

My permanent residence is Florida, where I claim homestead, own a home and have a mortgage, pay taxes, etc.

However, I work in Georgia. I rent a small apartment for $500/month so I am able to work there.

Can I deduct this on business expenses as well as traveling back and forth?

You Will Receive Permission More Quickly With Temporary Emigration

Are you going to emigrate temporarily? Even then, banks usually give permission to rent out a home with a “landlord’s diplomatic clause” included in the rental agreement.

Renting out a house remotely is the solution for people who temporarily emigrate. Some advantages are for example:

- Your house does not deteriorate because people are residing in the house.

- You have fewer costs, because you can pay the mortgage and/or other expenses with the rent.

- It is safer, because having people in your home means there will likely be less opportunity for break-ins or squatters.

- You keep your own home in the Netherlands, so you can simply live in your own home when you return.

Renting out your house yourself from abroad is not that practical. Communicating with tenants from abroad is difficult and there is not much you can do if there are defects in the home.

That is why many landlords engage a company for the management of real estate. A company that has contact with the tenants and takes care of the maintenance of the house.

In collaboration with a rental company you will experience the benefits, but not the burdens of home rental.

You May Like: How To Determine Ltv Mortgage

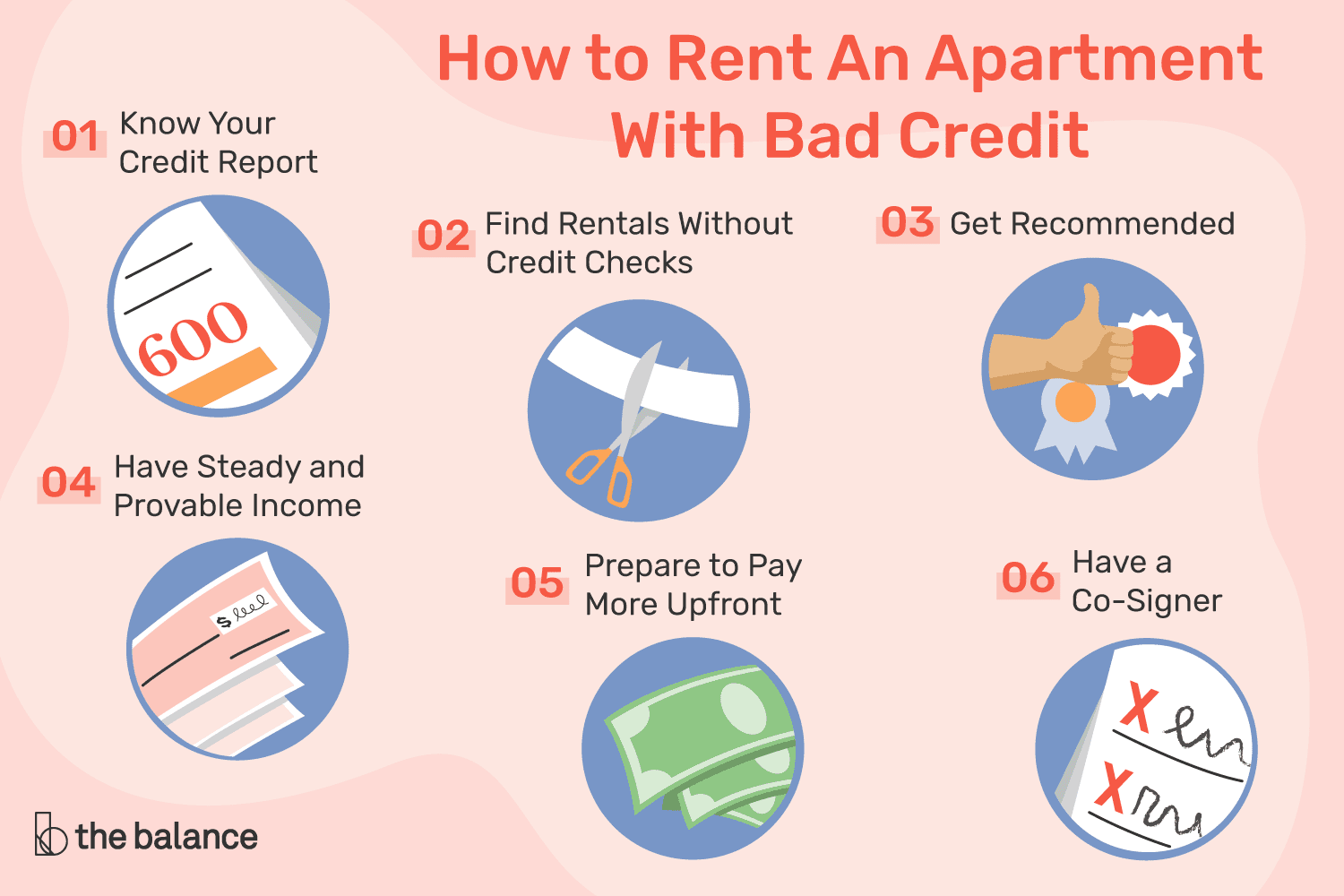

With A Bad Credit Score How Can I Rent An Apartment

A low credit score does not always rule out the possibility of renting an apartment. Landlords are more concerned with finding a tenant they can trust to pay the rent on time and respect the property than with a specific credit score.

While a higher credit score may help you stand out, the most important thing is to portray a clear picture of the type of renter you are. Anything you can do to demonstrate that you will look after the property and pay your bills on time will help you.

Use the tactics below to strengthen your application and demonstrate that youll be a dependable renter. One or more of these strategies may be enough to persuade a landlord that you are a qualified renter.

Is It Worth Buying A House

If youre still weighing up your options, ask yourself these questions:

- Where do you see yourself in two years time? If you want a flexible lifestyle to work in different places and travel for extended periods then it might be a good idea to wait to buy.

- What makes you happy in life? Do you prize security over everything, or do you dislike being tied down?

- Are you likely to inherit property later in life? If so, can home ownership wait while you put money into a pension, savings or invest?

- Do you want to buy a home just because you think property prices will go up? If the answer is yes, its probably not a good idea to buy because there are no guarantees that prices will rise.

- Will you be able to afford the maintenance costs if something needs repairing?

- How much disposable income would you have after paying mortgage repayments and other bills? Make sure you feel comfortable.

- If not, investing or paying into a pension while renting might be the best bet idea until you have moved up the career ladder or saved a bigger deposit.

- Do you know about the government schemes to help people buy properties? Make sure you know the support thats available to you which we outline here.

Find out more: Is now a good time to buy a house?

Read Also: How To Negotiate The Best Mortgage Rate