What Happens At The End Of A Term

At the end of each term, you have the option to renew or refinance your mortgage.

- Renewing your mortgageinvolves signing for another term with your existing lender. Your monthly payment and mortgage interest rate may change.

- Refinancing your mortgageinvolves signing a new term agreement, possibly with a different rate or lender. Refinancing allows you to take advantage of lower mortgage rates or better options not offered by your current lender. You can also borrow more money by using your home equity and receiving it in cash.

Your mortgage lender might not reassess your credit score or debt service ratios if youre renewing at the same lender. If youre switching to a new lender, youll need to be reassessed and you may need to pass the mortgage stress test.

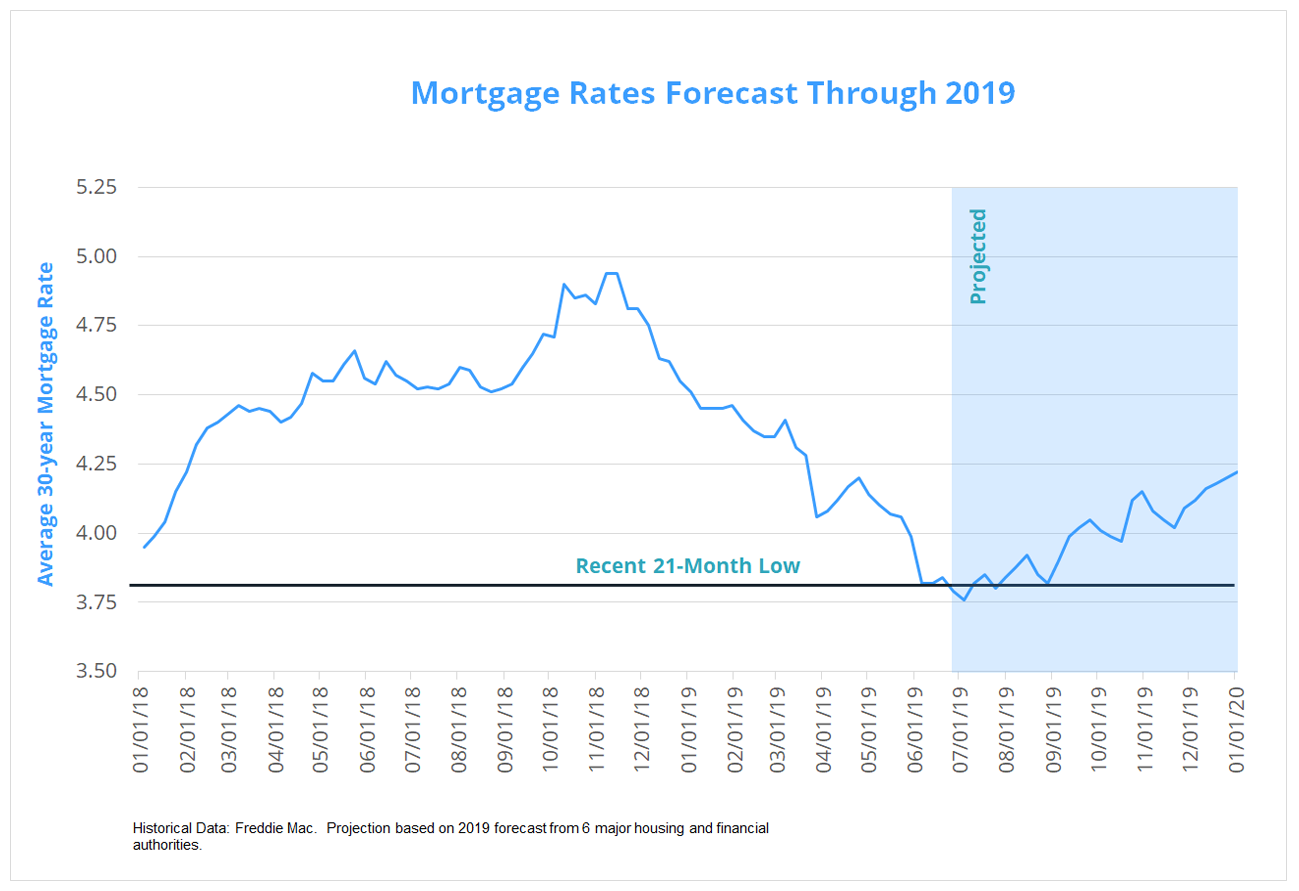

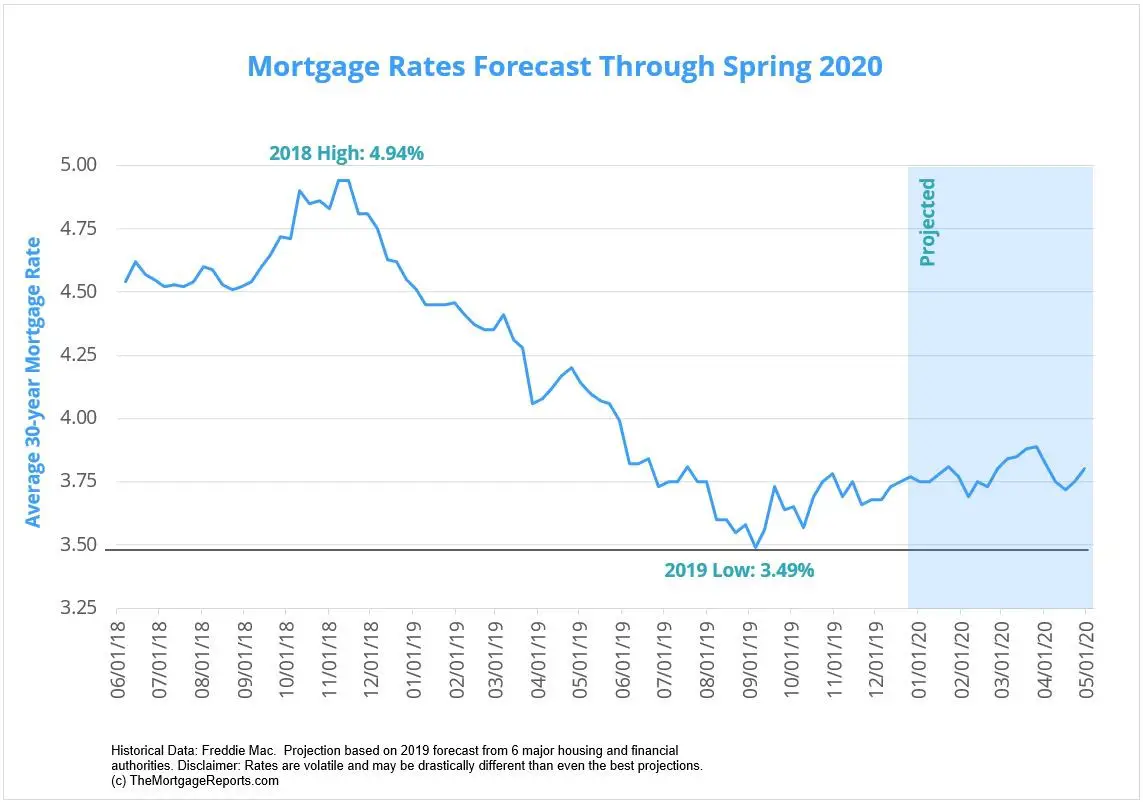

Calgary Mortgage Rate Forecast

The best rates in Calgary are often slightly better compared to mortgage rates in other parts of the province thanks to the number of lenders and brokers in the city, and the liquidity of its real estate market .

Due to the COVID-19 crisis, mortgage rates in Calgary, like all other parts of the country, have been near record-lows. Thats true even though many people are still unemployed and unable to take advantage of such rates.

Mortgage activity should start to recover by the end of 2021 as the economy fully re-opens, rates remain low and people regain employment. But much depends on the level of oil prices, given the correlation with business investment in the region.

Rick Sharga Executive Vice President Realtytrac

30year mortgage rates forecast: 3.75%

15year mortgage rates forecast: 3.25%

I think its likely well see mortgage rates increase in 2022, says Rick Sharga, executive vice president at RealtyTrac.

He explains, The biggest question is whether todays high inflation is transitory, as the Biden Administration claims, or will be more pervasive. Higher inflation almost always results in higher mortgage interest rates. If the Federal Reserve Bank decides it needs to do something more forceful to slow down the rate of inflation, it will probably raise the Fed Funds rate, which creates a higher rate environment overall.

If the Federal Reserve Bank decides it needs to do something more forceful to slow down the rate of inflation, it will probably raise the Fed Funds rate, which creates a higher rate environment overall.

Consider that the spread between the yields on 10year Treasuries and 30year fixedrate mortgages is below its historic level of about 2 points, so mortgage rates could move up a few basis points if that relationship were to simply revert to historically normal levels next year, he adds.

Don’t Miss: What Is The Going Mortgage Interest Rate

Track Rates Over A Few Months

A mortgage forecast is a collection of data from a period of time, usually a few months or a week. There are often forecasts for the year in January, but because the market is subject to change, it can be difficult to predict the lending climate.

So, in order to find an ideal rate, it is best to track 30-year mortgage rate forecasts over a period of time to determine if you should lock in your rate now or wait until later. Your First Bank mortgage advisor can provide informed advice on this issue as well, as they follow the fluctuations of mortgage rates and are trained to predict market behavior.

How Does The Federal Reserve Affect Mortgage Interest Rates

The Federal Reserve does influence mortgage rates, but the two arent directly linked. The Fed sets the federal funds rate, which is the rate at which banks borrow and lend money to each other, usually on an overnight basis. Each time the Fed meets, it issues a press release highlighting committee members views on the economy. If their position is generally positive, mortgage rates tend to rise. When their outlook is negative, mortgage rates tend to fall.

Recommended Reading: How Many Times Can I Apply For A Mortgage

How Interest Rates Affect The Housing Market

Mortgage loans come in two primary formsfixed rate and adjustable ratewith some hybrid combinations and multiple derivatives of each. A basic understanding of interest rates and the economic influences that determine the future course of interest rates can help you make financially sound mortgage decisions. Such decisions include making the choice between a fixed-rate mortgage or adjustable-rate mortgage or deciding whether to refinance out of an adjustable-rate mortgage.

National Association Of Realtors Forecast

The leading organization for real estate professionals predicts the 30-year fixed-rate mortgage will climb slightly throughout 2022, reaching 3.5% in the second quarter and averaging 3.6% for the year, according to Nadia Evangelou, senior economist and director of forecasting for the NAR.

She pointed to several factors behind the associations outlook.

First, recently pushed up its inflation estimates for this year, indicating that inflation will be around longer. The grace period for higher inflation seems to be coming to an end, as the Fed will likely raise interest rates by the middle of next year, Evangelou said. When the Fed increases its interest rates, banks do, too. And when that happens, mortgage rates go up for borrowers.

When the Fed increases its interest rates, banks do, too. And when that happens, mortgage rates go up for borrowers.

Nadia Evangelou, senior economist and director of forecasting for the NAR.

Additionally, the Fed recently announced that it will likely begin decreasing its purchases of long-term Treasuries and mortgage-backed securities starting this November. This strategy will also contribute to increased rates in 2022, Evangelou added.

Sixty basis points is the equivalent of 0.60%.

Rates could rise more slowly if poor job growth is observed next year. But if the Feds tapering starts earlier, mortgage rates could rise even faster in the coming months, Evangelou explained.

Also Check: What Are The Chances Of Getting A Mortgage

Overview Of 2022 Mortgage Rates Forecast

We interviewed eight mortgage, housing, and finance professionals to get their mortgage rate forecasts for 2022.

Average interest rate predictions put 30-year fixed rates at 3.88% and 15-year fixed rates at 3.27% in 2022.

| Industry Expert | |

| Al Lord | 3.75% |

| Stephen Adamo | 4% |

| Lyle Solomon | 4% |

| 3.88% | 3.27% |

Put in perspective, its important to remember that mortgage interest rates have remained relatively affordable. And for the foreseeable future, they shouldnt stray too far from alltime lows.

Ponder that, 40 years ago, mortgage interest rates were close to 17%. With that in mind, an increase to even 4% by the end of 2022 doesnt seem too scary.

What Credit Score Do I Need To Get A Mortgage

The minimum depends on the type of loan youre looking for. For conventional loans, the minimum FICO score is usually 620, although some lenders may have higher minimums.

For loans backed by the Federal Housing Administration , the minimum credit score is 500. However, applicants with credit scores below 580 must come up with a larger down payment .

Read Also: What Is Escrow Means Mortgage

Logan Mohtashami Lead Analyst At Housingwire

We shouldnt expect skyrocketing rates in the coming weeks, according to Mohtashami. He says that rates have stayed in a very low range for 2021, and that should still be the case for the rest of the year. As long as other economies around the world are still struggling, that puts a limit on how high rates can go in the U.S.

Borrowers may still have time to lock-in a great rate, but buying a home doesnt look like it will be getting any easier. This housing market is the most unhealthy housing market post 2010, he says. Not because theres a bubble or a credit boom or anything like that, its just that the shortage of homes is facilitating forced bidding. The number of homes for sale has increased somewhat from recent lows, but inventory still isnt fully meeting the demand. We may see a seasonal dip in housing inventory this winter which will not make it any easier for buyers in the coming months.

Dreaming Of A White Christmas

The warning signs about increasing inflation havent subsided in recent weeks, leaving many industry insiders pessimistic about the mortgage rate environment, even if recent jobs reports look promising, wider economic data appear bullish, and the recently passed infrastructure bill appears to be a step in the right direction.

With inflation elevated and the Federal Reserve holding true to its promise to begin tapering bond purchases, mortgage rates will continue moving higher by the end of the year, says Greg McBride, Bankrates chief financial analyst.

He foresees the 30-year fixed rate clocking in as high as 3.5 percent, on average, compared to an average rate of up to 2.7 percent for a 15-year mortgage, by the end of the month.

Nadia Evangelou, the senior economist and director of forecasting for the National Association of Realtors, is firmly in McBrides camp.

Inflation has risen to its highest point since 1990. If it remains elevated for a longer period, that will drift up mortgage rates even higher, she says. Meanwhile, the Fed will slowly reduce its monthly bond purchases. This strategy is expected to move up bond yields, as the supply of these bonds will increase in the broader economy and bond prices will drop. Following the trend of the 10-year Treasury yield, mortgage rates will go up as well.

Read Also: How To Market Yourself As A Mortgage Loan Officer

How Is The Bank Of England Base Rate Set

The Bank of Englands monetary policy committee sets and announces UK interest rate decisions eight times a year roughly once every six weeks.

In a series of meetings, the nine members of the MPC debate and vote on what monetary policy action to take.

At its last meeting on 23 September, the MPC voted unanimously to keep the base rate at 0.1% until the economic outlook in Britain was more certain. The next interest rate decision in the UK will be on 4 November.

The Bank of England interest rate decision and the minutes of the meetings, are published at midday on a Thursday. These are scrutinised for clues that might suggest rate cuts or rises are on the way.

You can find details of the MPCs decision dates on the Bank of England website.

Bank Of Canada Maintains Rate But Lowers Qe Program

The Bank of Canada held its 5th meeting of the year on July 14th, 2021. Highlights from the meeting include:

- the Target Overnight Rate will remain at 0.25%.

- CPI inflation reached 3.6% in May, but is believed to be due to mainly base-year effects and transitory bottlenecks.

- The Bank of Canada’s Quantitative Easing program has decreased down to $2 billion a week from $3 billion a week, the 2nd drop in a row.

- The Bank of Canada expects a rate hike as early as the second half of 2022

While CPI inflation has reached the top of the Bank of Canada’s inflation-control range, they believe that the inflation will be transitory and that “extraordinary monetary policy support” is still necessary for Canada’s economic recovery. As a result, the BoC still believes that a rate hike will be necessary only in H2 2022.

Read Also: How To Calculate Principal And Interest For Mortgage

What Are Todays Mortgage Rates

Low mortgage rates are still available. You can get a rate quote within minutes with just a few simple steps to start.

1Todays mortgage rates based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

Popular Articles

Resources

What This Means For Borrowers

Now that weve discussed likely interest rate trends for the rest of the year, its important that we also share what this means for borrowers and what you can do with this information.

First, if youve thought about refinancing your mortgage, consider doing so sooner rather than later. If experts are correct and mortgage rates rise in June, and throughout the next year, then there isnt likely to be a cheaper time to refinance.

Next, if youve been planning to buy a home and have your finances in order, it may also be worth buying soon, before rates have a chance to increase. By purchasing a home today rather than six months from now, you could potentially be saving yourself tens of thousands of dollars in interest.

But what if youre not quite ready to buy yet?

It can be easy to feel that youre missing out by not buying while rates are low. And yes, waiting to buy might mean a higher interest rate. But ultimately, its better to wait until youre financially ready for a mortgage than to lock in a low interest rate before youre really ready.

And remember, the current market rate isnt the only thing that affects your mortgage rate. Your , debt-to-income ratio, and down payment will all factor into the rate youre able to get.

Read Also: Can You Sell Your House Without Paying Off The Mortgage

What That Forecast Got Correct

I look at that year-ago prediction in two ways. The forecasters were wrong in their aggregated prediction that mortgage rates would stay about the same. But they were right about something more important: that rates, when averaged for the year, wouldn’t be higher in 2021 than in 2020.

That prediction wasn’t exactly bold, but it wasn’t intuitive, either. Mortgage rates were low in 2020, with little room to go down and a lot of room to go up. The COVID-19 recession looked like it was ending, and vaccines were on the way. An economic recovery would tend to push mortgage rates higher.

But mortgage rates didn’t move much in 2021 until they turned upward in late September. The forecast is for them to assume an upward trend throughout 2022.

Is A Variable Rate Better

If youre comparing a variable rate and a fixed rate at the same point in time, a variable rate will almost always be lower than a fixed rate. Just as how a longer term mortgage will have a higher rate when compared to a shorter term mortgage, borrowers will pay a premium for locking-in a fixed rate.

Historically, variable rates have performed better than fixed rates, as found in a 2001 study by theIndividual Finance and Insurance Decisions Centre. Thats because interest rates have generally fallen over the past few decades, meaning that borrowers with a variable mortgage rate would have benefited from falling interest rates.

In todays low interest rate environment, its not certain if interest rates can continue to decrease further. While the focus can be on the direction of the change, you should also pay attention to how large the interest rate changes can be.

Since variable rates are often already priced at a discount to fixed rates, variable rates would be a better choice if interest rates dont move at all. Variable rates might still be a better choice if interest rates only increase slightly and later on in your mortgage term.

A fixed mortgage rate would be better if you think interest rates will significantly rise in the near future. Many borrowers also place value on the peace of mind that a fixed mortgage rate gives. The slightly higher mortgage rate might be worthwhile in exchange for not having to worry about interest rate fluctuations.

Also Check: Which Mortgage Lenders Use Transunion

The Federal Reserve And Mortgage Rates

Currently, the Federal Reserve is purchasing $40 billion per month in mortgage-backed securities as part of its Covid stimulus program.

This is one of the single biggest factors keeping mortgage rates as low as they are.

When the Fed slows or tapers its purchasing of MBS, mortgage rates are almost certain to increase by a wider margin than weve seen this year.

And that could be coming in the not-too-distant future.

In a speech on August 27, Fed Chair Jerome Powell indicated that asset purchase tapering could begin before the end of the year depending on how the Delta variant plays out economically.

Asset purchase tapering could begin before the end of the year depending on how the Delta variant plays out economically.

We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, said Powell. My view is that the substantial further progress test has been met for inflation. There has also been clear progress toward maximum employment.

He continued on to say that in light of these positive trends, he and other Fed members believe it may be appropriate to start reducing the pace of asset purchases this year.

But and its a big but the Fed still isnt clear on what the overall economic impact of the Delta variant will look like. And because of that, its not ready to make any firm plans to start withdrawing support in 2021.