What Does It Mean To Refinance Your Mortgage

Refinancing your mortgage means you will be obtaining a new loan to replace the loan you currently have on your home. There are many reasons people decide to refinance, including lower interest rates, debt consolidation, home improvements, decreasing monthly housing costs, removing an individual from a property title or accelerating the payoff of your mortgage.

How Much Does It Cost To Refinance Your Mortgage

Your Closing Disclosure tells you exactly what you need to pay at closing. Here are a few of the closing costs you might see when you refinance:

- Application fee: Some lenders charge an application fee due when you apply for your refinance. You must pay your application fee even if the lender rejects your refinance request.

- Appraisal fee: Most lenders require appraisals before refinancing. Most appraisers charge $300 $500 for their services.

- Attorney fees: In some states, an attorney must review and file paperwork for your loan. Attorney fees can vary widely by state.

- Title search and insurance: Your lender may require another title search when you refinance your loan.

Expect to pay 2% 3% of your loan balance in closing costs. You may be able to roll your closing costs into your loan balance, depending on your lenders requirements.

Get approved to refinance.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: What Is The Usual Mortgage Interest Rate

How To Refinance With No Closing Costs

Its possible to avoid closing costs altogether when you refinance. But youll need to understand the benefits and drawbacks of noclosing cost refinance methods because they can wind up costing you more in the long run.

Roll closing costs into your loan

Your lender might allow rolling your closing costs into your mortgage loan if you have enough equity in the home. The benefit of this approach is that you dont pay anything upfront.

On the other hand, rolling these upfront costs into your new mortgage increases your loan balance, meaning youll pay interest on this additional amount. This can result in paying thousands more over the life of the loan.

Be aware, too, that rolling closing costs into the loan is an option only with certain types of mortgages.

For example, a VA loan only allows borrowers to roll the VA funding fee into their loan. Similarly, an FHA refinance can include only the upfront mortgage insurance fee. Other closing costs must be paid upfront.

Ask the lender to pay your closing costs

Another noclosingcost refinance method is to ask for lender credits. This limits your outofpocket costs, but youll pay a higher mortgage rate in exchange.

Lender credits are typically better for homeowners who will keep their new mortgage for only a few years. After that, the higher interest cost can start to outweigh the upfront savings.

If you plan to keep your refinanced loan longterm, rolling closing costs into the mortgage balance might make more sense.

How Does Refinancing Affect Your Tax Situation

With a lower interest rate on your home loan, you will have less interest to deduct on your income tax return. That, of course, may increase your tax payments and decrease the total savings you might obtain from a new, lower-interest mortgage.

Interest paid up front for refinancing must be deducted over the life of the loan, not in the year you refinance unless the loan is for home improvements. This means that if you paid a certain number of points, you would have to spread the tax deduction for those points over the life of the loan. If, however, the refinancing is for home improvements you may be able to deduct the points under certain circumstances.

If you are thinking about refinancing your mortgage, you might want to consider other types of mortgages. For example, you might want to look into a 15-year, fixed-rate mortgage. In this plan, your mortgage payments are somewhat higher than a longer-term loan, but you pay substantially less interest over the life of the loan and build equity more quickly. Of course, this also means you have less interest to deduct on your income tax return.

Recommended Reading: What Score Do Mortgage Companies Use

What Does Refinancing Your Home Mean

When you refinance a home, you are replacing your current mortgage with a new one. Your old mortgage will be paid off, and you will have a new mortgage, either with the same or a different lender.

Learn the steps involved in refinancing a home to give you the best success when you want to refinance your mortgage.

Some Borrowers Are Exempt

Not everyone will have to pay the new fee. If your principal balance is less than $125,000 you are exempt. Borrowers refinancing VA loans and FHA loans also are exempt from this fee. If youre buying a home and taking out a new home loan, youre also exempt.

The only mortgages that are required to pay are those that lenders sell to Fannie Mae and Freddie Mac. But you may not know at the time you apply for a loan whether your lender intends to sell your mortgage to either GSE.

You May Like: Can You Include Renovation Costs In A Mortgage

When Should You Refinance

With interest rates at historic lows, many homeowners are refinancing. Even if you bought or refinanced only a few years ago, doing it again may make sense. Knowing how much youll pay out of pocket will help you decide what to do.

A simple way to get an idea of whether refinancing is good for you is to take your total out-of-pocket closing costs and divide the figure by the amount that you would save each month. That will be approximately how long it would take to pay back your closing costs. Then, take your current monthly mortgage payment and subtract your estimated payment after refinancing. This is how much extra you would have in your budget each month.

For example, consider a case where your total closing costs are around $4,500 and your new mortgage payment is $150 lower each month. This means that it would take around 30 months to break even on the closing costs that you had to pay with the amount you are saving each month. The lower the number of months, the more it makes sense to refinance. This calculation isnt exact, but it can be one factor that you use to help you decide if you should refinance your mortgage.

There are also a few bad reasons to refinance a mortgage. These include trying to lengthen the term of your loan, consolidating debt, or taking equity out of your house to invest. If youre refinancing for one of those reasons, then make sure to double-check your thinking with a financial advisor to make sure that youre making a smart financial move.

How To Get Started With Refinancing A Mortgage

Refinancing can be done with banks, non-bank lenders, and brokers. To get the process started, research the institutions or lenders you are considering working with and nail down their rates, loan costs, closing time frames, and programs available, says Washington.

“A homeowner should shop between a few companies to find one that they are comfortable using,” says Washington. “After that, the homeowner will fill out an application, and submit the necessary paperwork.”

Recommended Reading: How To Get Rid Of Escrow On Mortgage

Questions About Refinancing Your Mortgage

Get the answers you need to make an informed decision

Could refinancing make your home sweet home just a little sweeter? A mortgage refinance is just as big a decision as choosing your first mortgage, and it deserves the same time and attention. Getting answers to these questions can help you make the right choice.

Focus On The Total Cost To Refinance A Mortgage

This is so important and an inside tip on what to ask the Loan Officer.

Far too often people focus on the label and the individual amount rather than the total cost of the loan. For example I constantly hear from potential clients that say they were quoted a no-point loan and a super low rate and I ask them the following question:

What is the total cost of the loan and are they charging any origination fees?

99% of the time the answer is I dont know because many people believe a no-point loan is a no-cost loan and Loan Officers know this.

Second, many no-point loans have origination fees which are basically points however they are not discount points which are different.

I could go on and on about how Loan Officers try to hide the true cost of a loan however the way they do it is not the most important thing. And there is a very simple way to get to the bottom of what fees you are paying. Just ask this one simple question:

What is the total cost of the loan for everything?

Dont get hung up on lender fees, points, origination fees, third-party fees because this is exactly what the Loan Officer wants you to do focus on something so they charge more in other areas.

Recommended Reading: What To Expect When Applying For A Mortgage Loan

Typical Fees Associated In Refinancing A Mortgage

Many homeowners have been refinancing their mortgage to take advantageof the historically low interest rates. Aside from getting a low-interest rate,it makes sense to refinance your mortgage if you want to adjust the length ofyour mortgage term, change from an adjustable-rate mortgage to a fixed-ratemortgage, or if you want to cash out your home equity. However, if this is yourfirst time to do refinancing, you need to be aware of the typical feesassociated with it. Refinancing fees could go between 3 to 6 percent of youroutstanding principal in addition to any prepayment penalties or other costsfor paying off any mortgages you might have.

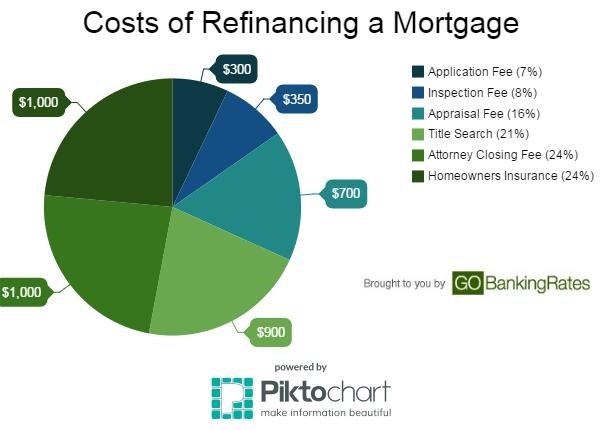

Below is a list of the upfront typical refinancing fees and theirrespective average costs:

Recommended Reading: What Is Payment On 30 Year Mortgage

How Should I Pay My Refinance Closing Costs

Take a close look at your financial situation when deciding the best way to pay your refinance closing costs.

If you have sufficient home equity, it might be worthwhile to add your refinance closing costs to your mortgage balance to avoid an outofpocket expense.

This also makes sense when you dont have much money saved, or if you dont want to deplete your personal savings when refinancing.

However, rolling closing costs into your loan increases the loan balance, your monthly mortgage payment, and your total interest charges. So if you can spare the cash, it might be better to pay your closing costs outofpocket and be done with it.

Pay prepaid items out of pocket if you can

At the very least, you should try to pay your homeowners insurance and property tax reserves outofpocket. Youll receive a check from your current lender for a similar amount a few weeks after closing.

Lenders hold an escrow account for necessary items but refund the balance to you when you refinance or pay off the loan. Because this is such a temporary cash outlay, it doesnt make much sense to add that to your new loan balance and pay it off over many years.

However, if you want to raise some cash without doing a cashout refinance, you could roll taxes and insurance reserves into the new loan and get a sizable check weeks later from your current lender.

Ultimately, your personal finances and specific needs should help guide your decisions.

Don’t Miss: How Much Have I Paid Off My Mortgage

Why Should You Refinance Your Mortgage

One of the most common motivations among Aussie homeowners for refinancing moving from one existing mortgage to another is to access a lower interest rate, especially in todays competitive home loan market. This isnt surprising, given that a lower rate could save you thousands in interest repayments every year. The Australian Competition and Consumer Commission itself has said the average borrower could save $17,000 in interest just by switching to a new loan.

However, refinancing does require some effort to be put in on your own behalf. The level of savings generated through refinancing depends on the size of your mortgage, how many years left on the loan term and how much lower the new interest rate is compared to your current rate.

This needs to be considered alongside the initial costs of refinancing to help you determine whether its worth it. These upfront costs to refinance a mortgage can vary depending on the lender and the type of refinancing.

Generally, there are two main types of home loan refinance:

- External refinance: When you move your loan to another financial lender

- Internal refinance: When you refinance your home loan with your existing lender

Refinancing with your existing lender, for instance, might save you some of the additional fees associated with changing lenders, such as exit, valuation and application fees.

Types Of Cost Of Refinancing

You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Cost of Refinancing

#1 Refinance Through Cash-Out

In cash-out refinance, the borrower can use the equity built up to get cash. It is a new loan for the amount of mortgage. Apart from this, it also includes cash received that would be up to 80% of the loan-to-value ratio Loan-to-value RatioThe loan to value ratio is the value of loan to the total value of a particular asset. Banks or lenders commonly use it to determine the amount of loan already given on a specific asset or the maintained margin before issuing money to safeguard from flexibility in value.read more.

#2 Refinance Through Home Equity Loan

A home equity loan is also known as the second mortgage. It is a separate mortgage. With home equity loans, the borrower can take up to 80% of the loan-to-value ratio.

#3 Rate and Term Refinance

Its a typical mortgage refinance. The main purpose is to take benefits of the revised low-interest rates and new loan term based on new criteria.

#4 Refinance Through Streamline

Government-backed home loans are available for streamline to refinance. The processes of such refinance are usually very quick and easy.

Read Also: What Is Bank Of America’s Mortgage Interest Rate

Choosing A Higher Rate To Save Money

RELEVANT FACTS

Matt is uncertain how long he will own property

Existing rate:5.5%Offer 1 closing costs:$15,000Offer 1 break-even:43 monthsOffer 2 Rate:4.15%Offer 2 closing costs:$0Offer 2 break-even:1 month

Matt’s StoryMatt is a divorced 30-something who owns a home that he originally purchased with his ex-wife. He never got around to refinancing and is paying 5.5 percent on an eight-year-old mortgage. The remaining balance of his $350,000 loan is $303,933.

Refinance OpportunityMatt is considering refinancing to a loan with a 3.5 percent rate. His payment will go down by $622 a month! However, the closing costs for the new loan are over $15,000, and his breakeven point is 43 months. Matt’s not really sure how long he’ll keep his house, and that’s a lot of money to pay upfront if he leaves in just two years, he’ll lose thousands.

Should Matt Refinance?Matt should consider a loan with fewer upfront costs, even if the interest rate is higher. For example, if he chooses a no closing cost refinance with a 4.15 percent interest rate, he breaks even in just one month, lowers his payment by $510 and would save nearly $11,000 over the next three years.

Avoid high upfront refinancing costs if you’re unsure of your time owing the property. Sometimes, the loan with the higher interest rate is the better deal.

Mortgage Refinance Rates Slip Back To Bargain Levels To Close The Week

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders, all opinions are our own.

Check out the mortgage refinancing rates for Nov. 5, 2021, which are mostly down from yesterday.

Based on data compiled by Credible, current mortgage refinance rates fell across three key terms for the third time this week, while 20-year rates remained unchanged.

- 30-year fixed-rate refinance: 3.000%, down from 3.125%, -0.125

- 20-year fixed-rate refinance: 2.750%, unchanged

- 15-year fixed-rate refinance: 2.250%, down from 2.375%, -0.125

- 10-year fixed-rate refinance: 2.125%, down from 2.250%, -0.125

here. Actual rates may vary.

Refinance rates have taken homeowners on a roller coaster ride this week, jumping up and then falling back down each day. Rates closed the week by falling again, meaning homeowners who lock in their rate today can find a bargain whether they choose a longer or shorter term. After rising to 3.125% yesterday, rates for a 30-year refinance fell to 3% today. And rates for a 10-year refinance are at a near-record low of 2.125%. Homeowners who choose this term and can manage a higher monthly payment stand to save significantly on interest over the life of their mortgage loan.

Read Also: A& m Mortgage Merrillville Indiana